Apple Stock: Weighing Wedbush's Bullish Prediction Against Price Target Reduction

Table of Contents

Wedbush's Bullish Prediction for Apple Stock

Wedbush Securities' positive outlook on Apple stock rests on several key factors related to Apple’s growth potential. Their bullish forecast centers around strong iPhone sales, continued growth in Apple's Services segment, and expansion into new markets. The firm highlights several compelling reasons for their optimism.

-

Strong iPhone 15 Pre-orders: Early indications suggest robust pre-orders for the iPhone 15, pointing towards strong sales figures in the coming quarters. This is a significant driver of Apple's overall revenue and profitability. The improved features and potential for increased market share significantly bolster the Wedbush prediction.

-

Growth in Apple Services: Apple's services segment, including Apple Music, iCloud, Apple TV+, and other subscription services, continues to demonstrate impressive growth. This recurring revenue stream provides stability and predictability, mitigating some of the risks associated with hardware sales cycles.

-

Expansion in Wearables and Other Hardware Categories: Beyond the iPhone, Apple is seeing success with its wearables (Apple Watch, AirPods), and other hardware categories. This diversification reduces reliance on a single product and enhances overall revenue streams, supporting the bullish Apple stock prediction.

-

Potential for Increased Market Share: Wedbush anticipates Apple capturing an even larger share of the smartphone market, particularly in high-growth regions. This expansion fuels their positive Apple stock prediction, further emphasizing the long-term growth potential.

Wedbush hasn't publicly released a specific price target recently, making it crucial to always consult their latest reports for the most up-to-date information. However, their bullish sentiment strongly suggests a significant upside potential for Apple stock.

Counterarguments and Price Target Reductions

Despite the bullish sentiment from Wedbush, several other analysts have reduced their Apple price targets, raising concerns about the company's future performance. These counterarguments stem from a variety of factors.

-

Global Economic Slowdown Impacting Consumer Spending: A global economic slowdown could dampen consumer demand for high-priced electronics, impacting iPhone sales and overall Apple revenue. This macroeconomic factor is a significant headwind for many tech companies, including Apple.

-

Increased Competition from Android Manufacturers: Android manufacturers continue to innovate and offer competitive alternatives to Apple's products, posing a challenge to Apple's market share dominance. This increased competition introduces risk into the Apple stock outlook.

-

Potential for Supply Chain Disruptions: Geopolitical instability and global supply chain issues could disrupt Apple's production and delivery timelines, potentially impacting sales and profitability.

-

Concerns about Apple's Valuation Relative to its Growth Prospects: Some analysts believe Apple's current valuation is high relative to its projected growth, suggesting a potential overvaluation in the market.

These counterarguments highlight significant risks that investors need to consider when evaluating their Apple investment strategy. The discrepancies between different price targets emphasize the need for careful analysis and a diversified investment approach.

Analyzing the Discrepancy and Investor Strategies

The discrepancy between Wedbush's optimistic view and the more cautious predictions from other analysts highlights the inherent uncertainty in the stock market. This divergence underscores the importance of thorough due diligence and risk management for any Apple stock investment strategy. How should investors react?

-

Analyze the Differences: Carefully examine the reasoning behind the differing predictions. Are the differing predictions based on distinct underlying assumptions? Identifying the core differences in forecasting methodologies is crucial for informed decision-making.

-

Buy, Sell, or Hold?: The optimal strategy – buy, sell, or hold – depends entirely on your personal risk tolerance, investment horizon, and broader portfolio diversification. Consult a financial advisor to determine the most suitable approach for your unique circumstances.

-

Risk Management: Diversification is key. Don't put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk. Dollar-cost averaging is another effective strategy to reduce the impact of market volatility.

-

Long-Term vs. Short-Term Investment Horizons: A long-term investment horizon allows for weathering short-term market fluctuations, while a short-term focus requires a more cautious approach and a greater emphasis on risk mitigation within your Apple investment strategy.

Potential Investment Strategies:

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations.

- Diversification: Spread your investments across various stocks and asset classes to reduce overall risk.

- Long-term investment horizon: Hold your Apple stock for an extended period, allowing time to recover from short-term market downturns.

- Consider your risk tolerance: Align your investment strategy with your comfort level concerning potential losses.

Conclusion

The outlook for Apple stock remains complex, with conflicting signals from prominent analysts. While Wedbush maintains a strong bullish stance, fueled by strong iPhone sales and Apple Services growth, other firms have expressed concerns, leading to reduced price targets, partly due to macroeconomic headwinds and increased competition. Investors must carefully weigh these competing viewpoints, considering both the potential upside and the inherent risks involved. Understanding the nuances of Apple stock's current situation is crucial for informed investment decisions. Conduct thorough research, consider your risk tolerance, and develop a well-defined investment strategy to effectively navigate the complexities of the Apple stock market. Continue researching Apple stock predictions and make informed choices about your investments.

Featured Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025 -

New Ferrari Flagship Facility Launch Bangkok Post Coverage

May 24, 2025

New Ferrari Flagship Facility Launch Bangkok Post Coverage

May 24, 2025 -

A Look At Nicki Chapmans Country Escape Her Chiswick Garden

May 24, 2025

A Look At Nicki Chapmans Country Escape Her Chiswick Garden

May 24, 2025 -

European Shares Rise On Trump Tariff Hint Lvmh Slumps

May 24, 2025

European Shares Rise On Trump Tariff Hint Lvmh Slumps

May 24, 2025 -

Can Bardella Unite Frances Opposition Election Analysis

May 24, 2025

Can Bardella Unite Frances Opposition Election Analysis

May 24, 2025

Latest Posts

-

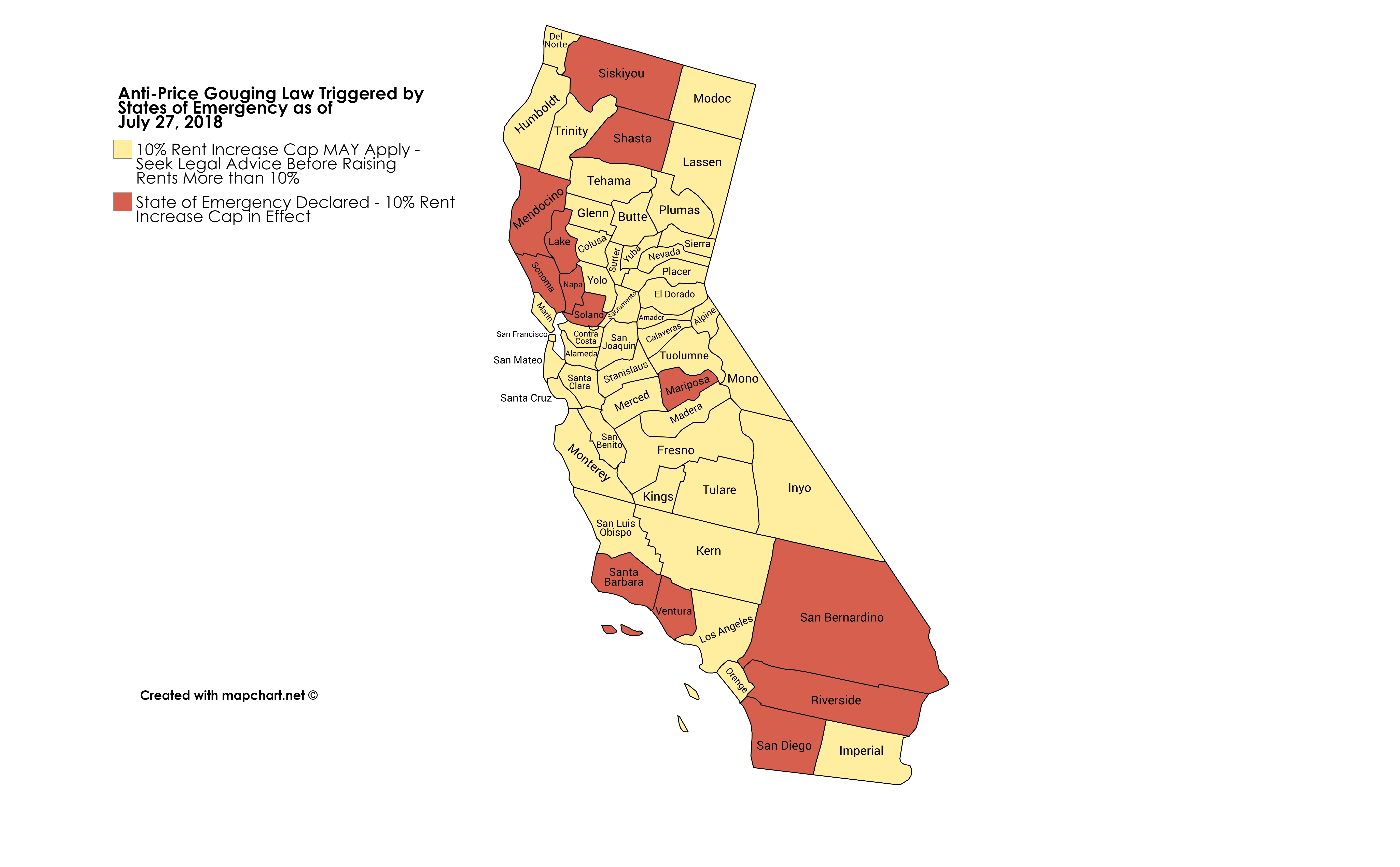

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

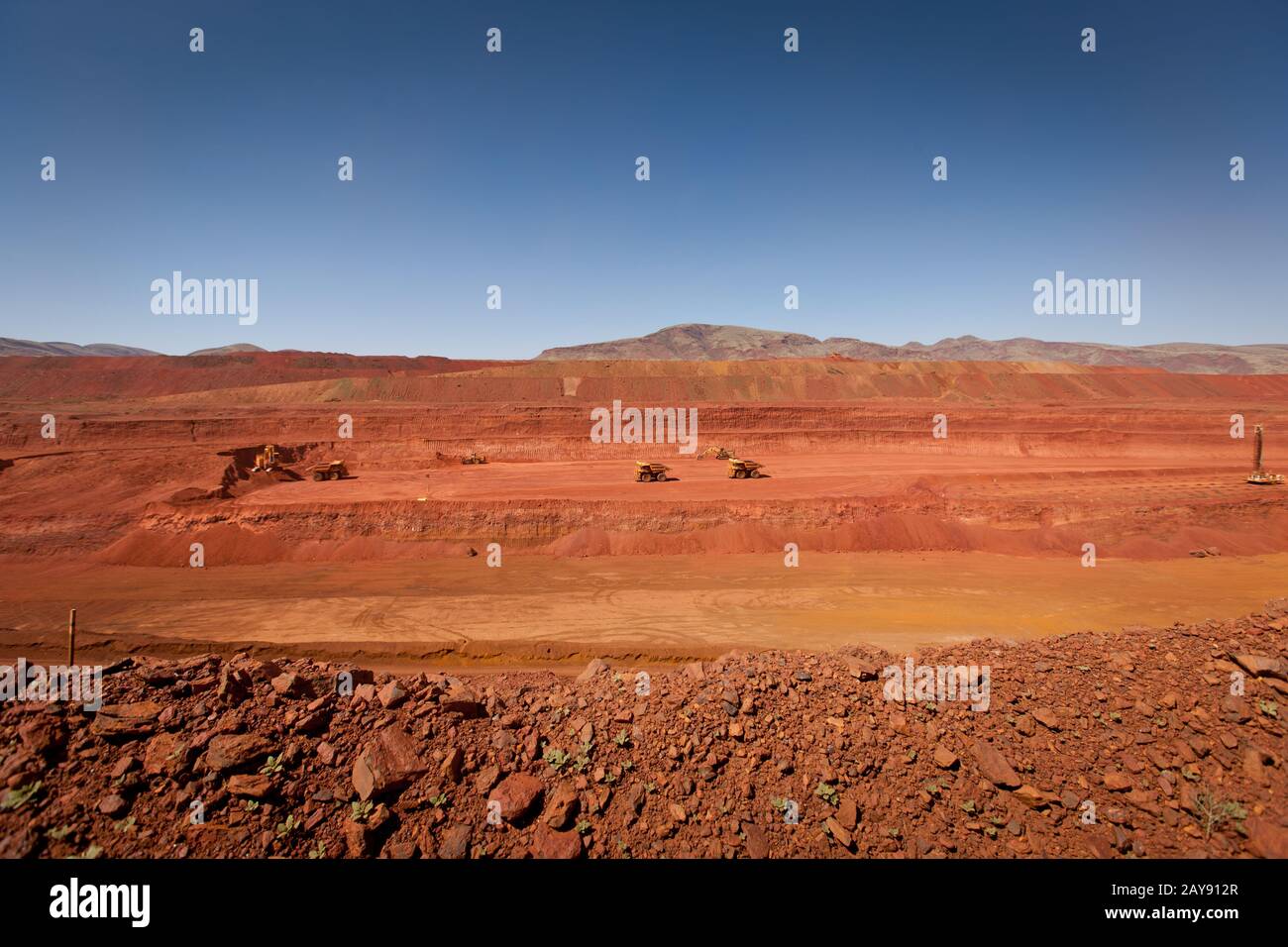

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025