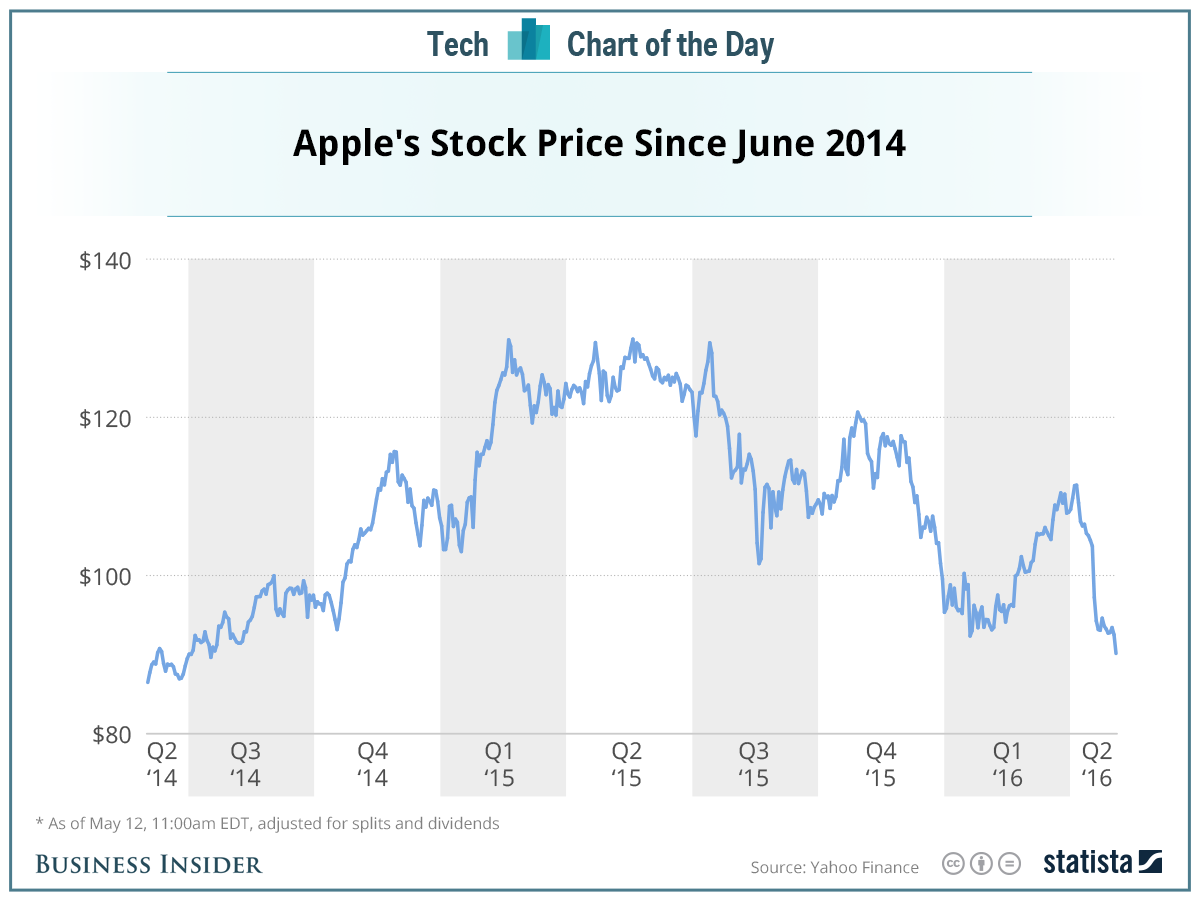

Apple's Stock Price: Concerns Before Q2 Financial Report

Table of Contents

Weakening iPhone Demand

The iPhone remains Apple's flagship product, contributing significantly to its overall revenue. However, concerns are mounting regarding weakening iPhone demand, a key factor influencing the Apple stock forecast.

Saturation in Mature Markets

The iPhone market, while still incredibly lucrative, is showing signs of saturation in key regions. Growth is slowing, impacting the Apple stock price. This slowdown can be attributed to several factors:

- Lower upgrade rates compared to previous years: Consumers are holding onto their iPhones for longer periods, reducing the frequency of upgrades.

- Increased competition from Android manufacturers offering comparable features at lower price points: Android competitors are increasingly challenging Apple's dominance with devices offering similar functionality at more affordable prices. This puts downward pressure on Apple's iPhone pricing strategy and consequently, its stock price.

- Economic slowdown impacting consumer spending on discretionary items like smartphones: Global economic uncertainty and inflation are causing consumers to cut back on discretionary spending, impacting demand for high-priced electronics like iPhones. This is a major factor influencing the tech stock market as a whole.

Supply Chain Issues

While less prevalent than in previous years, lingering supply chain disruptions could still impact iPhone production and availability, affecting the Apple stock price.

- Potential delays in component delivery could lead to lower-than-expected sales figures: Any delays in securing crucial components can directly impact iPhone production, resulting in lower sales figures than projected.

- Geopolitical instability continues to pose risks to global supply chains: Ongoing geopolitical tensions and uncertainties can create disruptions in the supply chain, potentially impacting the availability and cost of components.

Mac and iPad Sales Slowdown

Beyond the iPhone, Apple also faces challenges with its Mac and iPad product lines. A slowdown in sales growth in these sectors is adding to the concerns surrounding the Apple stock price.

Post-Pandemic Normalization

The pandemic fueled a surge in demand for Macs and iPads, as people worked and studied from home. This surge is unlikely to be sustained. A return to pre-pandemic buying patterns is expected, potentially leading to a significant decrease in sales.

- Reduced demand for home office equipment as people return to physical workplaces: With many returning to offices, the need for home office equipment, including laptops and tablets, has diminished.

- Increased competition in the tablet and laptop markets: Apple faces stiff competition from other brands offering similar devices at competitive price points.

Pricing Concerns

The premium pricing of Apple products, while a source of high profit margins, might deter budget-conscious consumers in the current economic climate.

- Inflationary pressures are impacting consumer purchasing power: Rising inflation reduces consumer purchasing power, making expensive electronics less accessible.

- Alternative, more affordable options are available in the market: Consumers have more affordable options available from competing brands, influencing their purchasing decisions.

Services Revenue Growth Slowing

Apple's services sector, including Apple Music, iCloud, and the App Store, has been a significant driver of revenue growth. However, even this area is facing headwinds.

Competition in the Streaming Market

Apple faces increasing competition from established players in the streaming services market. Retaining subscribers and attracting new ones is crucial for maintaining revenue growth and a positive Apple stock forecast.

- Increased competition from Netflix, Disney+, and other streaming services: The streaming market is becoming increasingly crowded, making it harder for Apple to stand out.

- Pricing pressure could impact subscription rates and overall revenue: Competitive pricing pressures might necessitate price adjustments, potentially impacting subscription rates and overall revenue.

App Store Scrutiny

Ongoing regulatory scrutiny of Apple's App Store practices poses a significant risk. The potential for fines and changes to App Store policies could significantly impact future revenue streams and consequently, the Apple stock price.

- Antitrust concerns and potential fines could significantly impact profits: Ongoing antitrust investigations could result in substantial fines, negatively affecting Apple's profitability.

- Changes to App Store policies could limit future revenue generation: Regulatory changes could limit Apple's control over the App Store, impacting its revenue generation capabilities.

Overall Economic Uncertainty

Global economic uncertainty, including inflation, rising interest rates, and the potential for recessions, casts a shadow over the overall tech sector, including Apple's prospects. This macro-economic environment significantly influences investor sentiment and the Apple stock price.

- Investor sentiment can be highly influenced by macroeconomic factors: Investor confidence is directly linked to broader economic conditions.

- A downturn in the global economy could significantly impact Apple's sales and profits: A global economic downturn would likely reduce consumer spending and adversely affect Apple's performance.

Conclusion

The upcoming Apple Q2 financial report is crucial for determining the trajectory of the Apple stock price. While Apple remains a dominant player in the tech industry, concerns around weakening iPhone demand, slowing sales of Macs and iPads, and increasing competition in the services sector are significant factors to consider. Investors need to carefully analyze the Q2 results and assess the long-term implications for the company's growth prospects before making any decisions regarding their Apple stock portfolio. Stay informed and monitor the Apple stock price closely following the release of the Q2 financial report. Understanding the factors influencing the Apple stock price is key to making informed investment decisions. Don't miss the crucial insights from the Apple Q2 earnings report to better understand the future direction of your Apple stock investments.

Featured Posts

-

Hawaii Keiki Celebrate Memorial Day With Lei Making Art Contest

May 24, 2025

Hawaii Keiki Celebrate Memorial Day With Lei Making Art Contest

May 24, 2025 -

Analiz Svadebnoy Statistiki Kharkovskoy Oblasti 600 Brakov Za Mesyats

May 24, 2025

Analiz Svadebnoy Statistiki Kharkovskoy Oblasti 600 Brakov Za Mesyats

May 24, 2025 -

Classic Cars And Art Porsche Indonesia Classic Art Week 2025

May 24, 2025

Classic Cars And Art Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

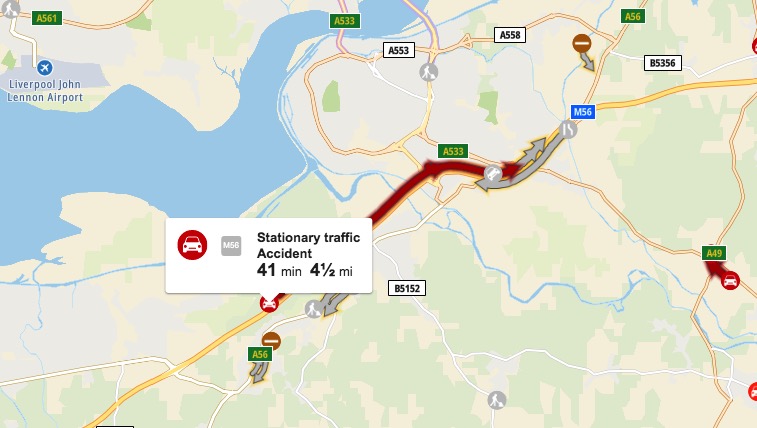

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025 -

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025