Are High Stock Market Valuations A Concern? BofA Says No. Here's Why.

Table of Contents

BofA's Arguments Against Overvaluation Concerns

BofA's optimistic outlook on high stock market valuations rests on several key pillars. Their analysis suggests that while valuations appear elevated compared to historical averages, several significant factors mitigate these concerns.

Strong Corporate Earnings and Profitability

BofA's analysis highlights robust corporate earnings and profit margins as a primary justification for their less-worried stance on high stock market valuations. Their research indicates that many companies are exceeding earnings expectations, driven by strong revenue growth and improved efficiency.

- S&P 500 earnings growth exceeding expectations: Recent reports show the S&P 500 consistently surpassing analysts' projected earnings growth, suggesting a strong underlying foundation for current valuations.

- Strong revenue growth in technology and consumer staples sectors: Key sectors like technology and consumer staples are demonstrating significant revenue growth, fueling overall market performance and contributing to higher stock prices. This sustained growth helps justify higher stock market valuations.

- Increased efficiency and cost-cutting measures boosting profit margins: Companies are implementing innovative strategies to enhance efficiency and reduce costs, leading to improved profit margins and bolstering investor confidence. This translates to higher valuations as investors anticipate continued profitability.

Low Interest Rates and Abundant Liquidity

Low interest rates play a crucial role in BofA's assessment of high stock market valuations. The prolonged period of low interest rates, fueled by quantitative easing and other monetary policies, has made equities a more attractive investment compared to fixed-income securities.

- Low interest rates make equities a more attractive investment: With bond yields remaining low, investors are shifting their capital towards higher-yielding assets, like stocks, leading to increased demand and higher stock prices. This increased demand contributes to the current high stock market valuations.

- Increased liquidity fuels demand for stocks: Abundant liquidity in the market, resulting from central bank policies, provides ample funds for investment, further driving up stock prices and contributing to high stock market valuations.

- Impact of Federal Reserve policies on market valuations: The Federal Reserve's actions, particularly concerning interest rate adjustments and quantitative easing, significantly influence market liquidity and investor sentiment, directly impacting stock market valuations.

Long-Term Growth Potential and Innovation

BofA emphasizes the long-term growth potential of the global economy and the transformative role of technological innovation in supporting higher stock market valuations. Their analysis identifies numerous sectors poised for substantial growth.

- Growth potential in emerging technologies like AI and renewable energy: Investments in artificial intelligence, renewable energy, and other emerging technologies are expected to drive significant economic growth in the coming years, justifying higher valuations for companies involved in these sectors.

- Positive long-term outlook for the global economy: BofA's projections suggest a positive long-term outlook for the global economy, supporting their view that current high stock market valuations are sustainable. This long-term perspective is a key factor in their optimistic outlook.

- Innovation driving increased productivity and efficiency: Technological advancements and innovation are boosting productivity and efficiency across various sectors, contributing to stronger corporate earnings and further justifying the higher stock market valuations.

Addressing Potential Risks and Counterarguments

While BofA presents a bullish outlook, they acknowledge potential risks and counterarguments to their perspective on high stock market valuations.

- Analysis of inflation's potential impact on stock valuations: BofA acknowledges the potential for inflation to erode corporate earnings and negatively impact stock valuations. Their analysis incorporates potential inflationary pressures into their projections.

- Assessing geopolitical risks and their influence on market sentiment: Geopolitical uncertainties and global events can significantly affect investor sentiment and market stability, impacting stock market valuations. BofA incorporates these risks into their overall assessment.

- BofA's projections for potential market corrections: BofA acknowledges the possibility of market corrections and incorporates scenarios of moderate pullbacks into their outlook. They are not entirely dismissing the possibility of a downturn.

Conclusion

BofA's analysis suggests that while high stock market valuations may appear concerning at first glance, several factors mitigate these concerns. Strong corporate earnings, low interest rates, and the potential for long-term growth, particularly driven by technological innovation, all contribute to their optimistic outlook. While acknowledging potential risks such as inflation and geopolitical uncertainties, BofA maintains a relatively bullish stance. However, it’s crucial to remember that this is just one perspective.

While BofA presents a compelling case regarding high stock market valuations, it's crucial to conduct your own thorough research and analysis before making any investment decisions. Consider consulting a financial advisor to discuss your specific situation and tolerance for risk regarding high stock market valuations and develop a suitable investment strategy.

Featured Posts

-

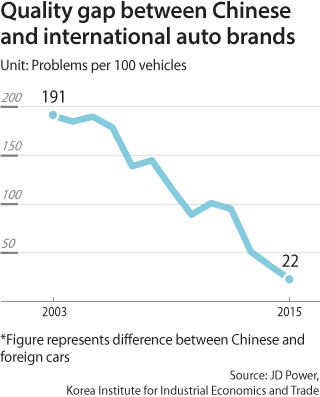

The Rise Of Chinese Automakers A Look At The Future Of Cars

Apr 26, 2025

The Rise Of Chinese Automakers A Look At The Future Of Cars

Apr 26, 2025 -

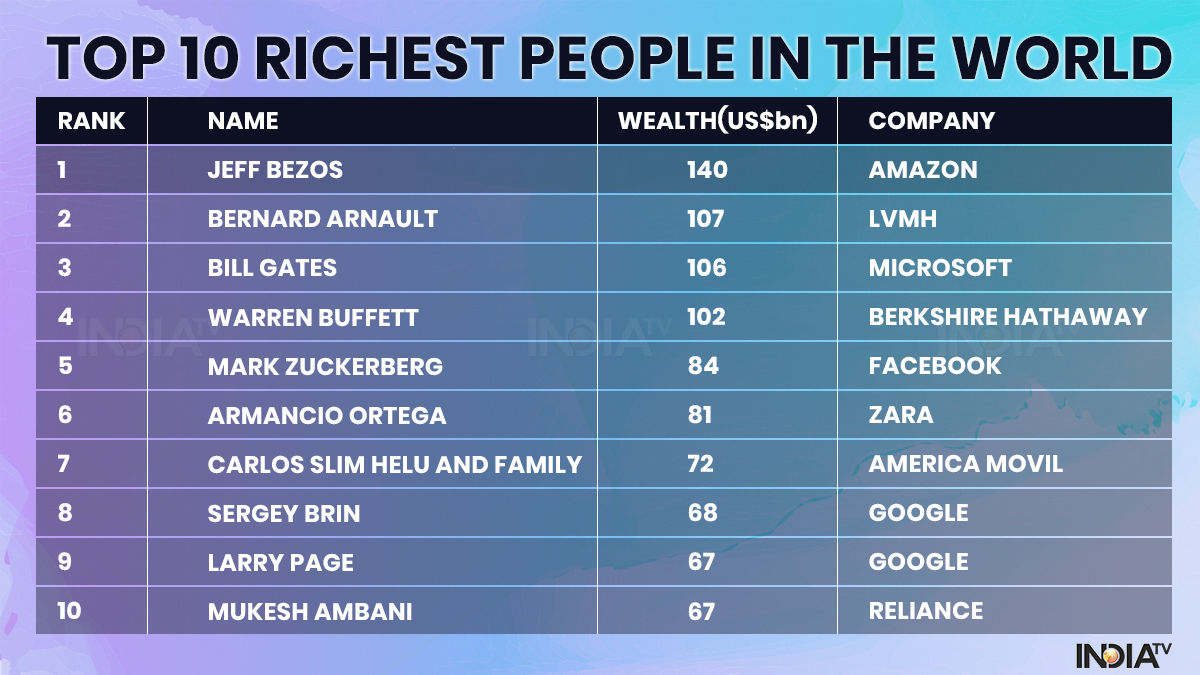

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025 -

American Battleground A Fight For Economic Justice

Apr 26, 2025

American Battleground A Fight For Economic Justice

Apr 26, 2025 -

Creating Ethical And Inclusive Ai A Conversation With Microsofts Design Chief

Apr 26, 2025

Creating Ethical And Inclusive Ai A Conversation With Microsofts Design Chief

Apr 26, 2025 -

Navigating The Geopolitical Landscape Of Ai The Us Eu Standoff

Apr 26, 2025

Navigating The Geopolitical Landscape Of Ai The Us Eu Standoff

Apr 26, 2025

Latest Posts

-

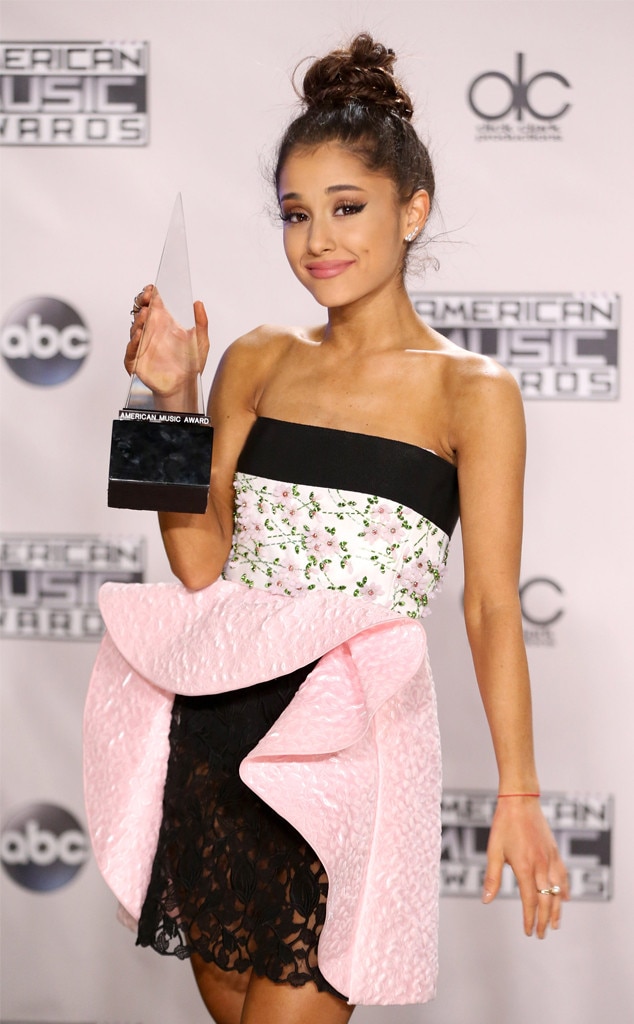

Celebrity Style Ariana Grandes Hair And Tattoo Transformation And The Role Of Professionals

Apr 27, 2025

Celebrity Style Ariana Grandes Hair And Tattoo Transformation And The Role Of Professionals

Apr 27, 2025 -

Professional Hair And Tattoo Artists Inspired By Ariana Grandes Transformation

Apr 27, 2025

Professional Hair And Tattoo Artists Inspired By Ariana Grandes Transformation

Apr 27, 2025 -

Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Help

Apr 27, 2025

Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Help

Apr 27, 2025 -

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025 -

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025