Aritzia's Response To Trump Tariffs: No Planned Price Increases

Table of Contents

Aritzia's Initial Reaction to the Tariffs

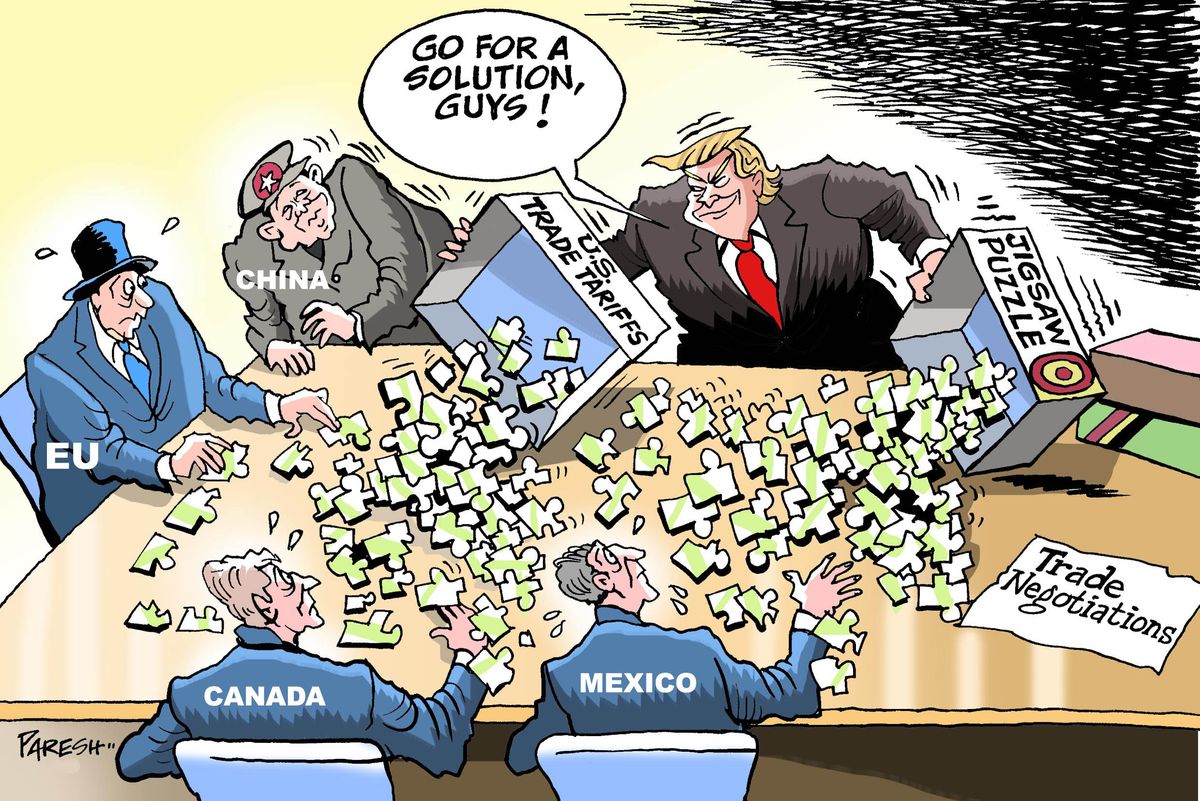

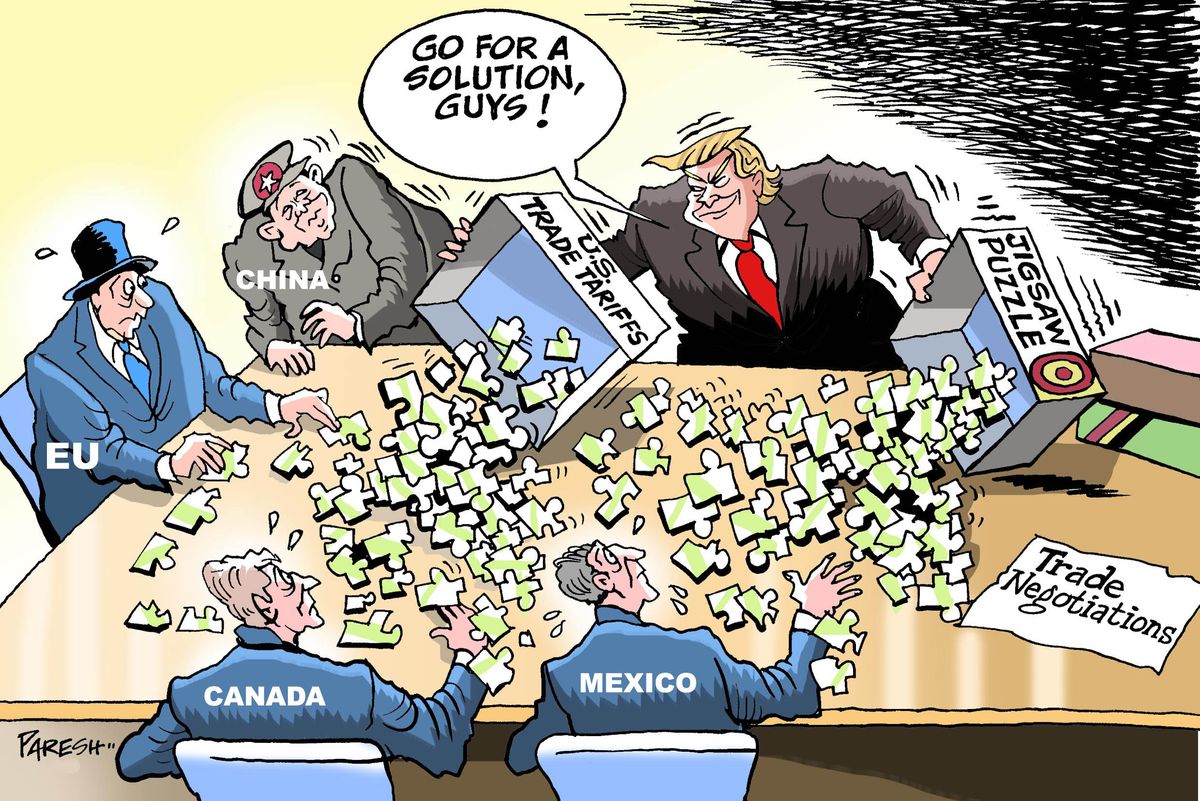

The Trump administration's tariffs on imported goods, particularly textiles and apparel, sent shockwaves through the fashion industry. Increased import costs threatened to significantly impact profit margins for retailers like Aritzia, who relied on global supply chains for manufacturing and sourcing. Aritzia, like many other companies, faced immediate challenges:

- Increased manufacturing costs: The tariffs directly added to the cost of producing garments, impacting the company's bottom line.

- Potential supply chain disruptions: The uncertainty surrounding the tariffs created potential disruptions to Aritzia's carefully established supply chain, leading to delays and logistical complexities.

- Pressure to maintain competitiveness: Competitors might choose to pass on increased costs to consumers, potentially creating a price disadvantage for Aritzia if it remained steadfast in its pricing strategy.

The "No Price Increase" Strategy – A Bold Move

Faced with these significant challenges, Aritzia made a bold decision: it would absorb the increased costs associated with the Trump tariffs and maintain its existing price points. This strategy presented both risks and benefits:

- Maintaining brand loyalty: By absorbing the costs, Aritzia aimed to maintain its strong brand loyalty and avoid alienating its customer base with unexpected price hikes. This decision demonstrated a commitment to its customers during a time of economic uncertainty.

- Potential impact on profit margins: This strategy undoubtedly impacted Aritzia's profit margins in the short term. The company had to find ways to offset the increased manufacturing costs without sacrificing its pricing structure.

- Competitive advantage over brands that raised prices: While impacting profit margins, this strategy offered a competitive advantage over other brands that chose to raise prices. It positioned Aritzia as a more affordable and consumer-friendly option during a period of economic uncertainty and rising prices for clothing.

Aritzia's Business Model and its Role in the Decision

Aritzia's ability to absorb the cost increases without raising prices can be attributed to several factors related to its business model and overall financial health:

- Strong brand reputation and customer base: Aritzia's strong brand recognition and loyal customer base provided a level of resilience and demand that allowed it to absorb the short-term hit to profit margins.

- Efficient supply chain management: Aritzia's efficient and well-managed supply chain, already optimized for cost-effectiveness, likely played a significant role in mitigating the impact of the tariffs.

- Cost-control measures implemented: The company likely implemented further cost-control measures to offset the increased costs associated with the tariffs. This could have involved renegotiating contracts, streamlining operations, or finding more cost-effective manufacturing partners.

Long-Term Implications for Aritzia and the Fashion Industry

Aritzia's decision to avoid price increases during the Trump tariff era had several long-term implications:

- Setting a precedent for other retailers: Aritzia's actions could have influenced other retailers to consider similar strategies, emphasizing customer loyalty over immediate profit maximization.

- Impact on consumer spending habits: Aritzia's willingness to absorb costs might have positively influenced consumer spending habits, potentially leading to increased sales in the long run.

- Potential future tariff implications for Aritzia: While Aritzia successfully navigated these specific tariffs, future trade policies and tariffs could present similar challenges, requiring ongoing adaptation and strategic planning.

Conclusion: Aritzia's Strategic Response to Tariff Pressures: A Case Study

Aritzia's decision to absorb the increased costs associated with the Trump tariffs, rather than passing them onto consumers, was a strategic move that prioritized brand loyalty and customer relationships. This decision highlights Aritzia's strong business model, efficient supply chain, and overall financial health. While impacting short-term profits, the long-term implications for Aritzia's brand image and competitive positioning are likely to be positive. Aritzia's tariff strategy serves as a valuable case study for other retailers facing similar economic challenges. What are your thoughts on Aritzia's response to the tariffs and its impact on Aritzia's price point? Share your opinions on Aritzia's response to trade policies and continue following the brand's performance in the evolving global market.

Featured Posts

-

Sheins London Ipo Fallout From Us Tariffs

May 05, 2025

Sheins London Ipo Fallout From Us Tariffs

May 05, 2025 -

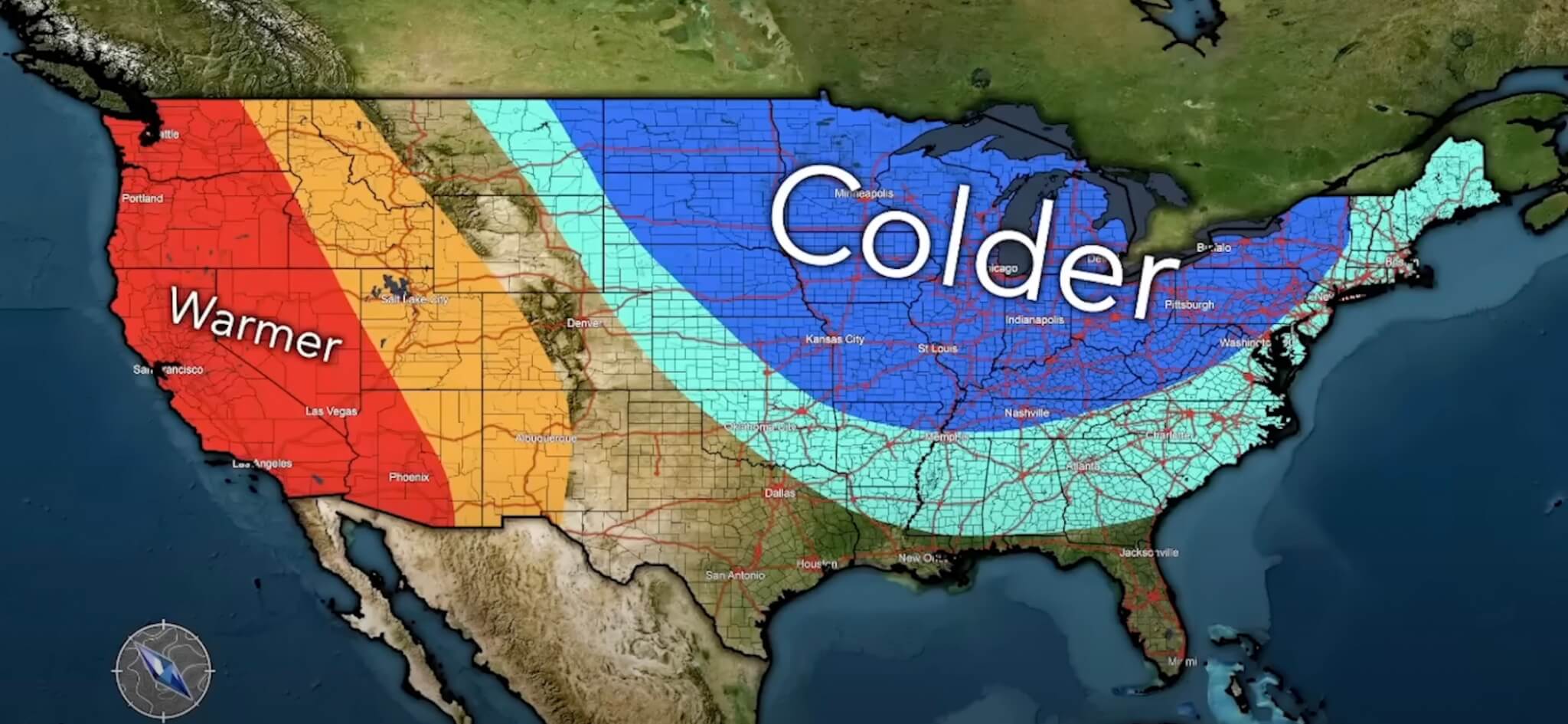

Winter Storm Watch Snow Forecast For New York New Jersey And Connecticut

May 05, 2025

Winter Storm Watch Snow Forecast For New York New Jersey And Connecticut

May 05, 2025 -

Australian Election Albaneses Labor Party Ahead As Voting Commences

May 05, 2025

Australian Election Albaneses Labor Party Ahead As Voting Commences

May 05, 2025 -

Deutschland Beim Esc Wiener Duo Abor And Tynna Im Fokus

May 05, 2025

Deutschland Beim Esc Wiener Duo Abor And Tynna Im Fokus

May 05, 2025 -

Me T Department Predicts High Tide And Scorching Temperatures In West Bengal For Holi

May 05, 2025

Me T Department Predicts High Tide And Scorching Temperatures In West Bengal For Holi

May 05, 2025

Latest Posts

-

One Last Fight Ufc Champ Returns From Hiatus On May 3rd

May 05, 2025

One Last Fight Ufc Champ Returns From Hiatus On May 3rd

May 05, 2025 -

Ufc Des Moines Predictions Preview And Betting Tips

May 05, 2025

Ufc Des Moines Predictions Preview And Betting Tips

May 05, 2025 -

Former Ufc Champions May 3rd Fight A Year In The Making

May 05, 2025

Former Ufc Champions May 3rd Fight A Year In The Making

May 05, 2025 -

Des Moines Ufc Predictions And Fight Analysis

May 05, 2025

Des Moines Ufc Predictions And Fight Analysis

May 05, 2025 -

Ufc Des Moines Fight Night Predictions Who Will Win

May 05, 2025

Ufc Des Moines Fight Night Predictions Who Will Win

May 05, 2025