Auto Tariff Relief Speculation Lifts European Markets; LVMH Experiences Significant Drop

Table of Contents

Auto Tariff Relief Speculation Fuels European Market Growth

The European auto industry has long felt the pinch of auto tariffs, impacting production, sales, and overall profitability. These tariffs have created trade barriers, increasing the cost of imported vehicles and parts, and hindering competitiveness. However, recent speculation regarding potential relief or even a significant reduction of these tariffs has injected a wave of optimism into the market. This speculation stems from ongoing trade negotiations and hints from influential political figures.

This positive investor sentiment is manifesting in several ways:

- Increased Investment: We're seeing a surge in investment in European auto manufacturers, as investors anticipate increased profitability following tariff reductions.

- Rising Stock Prices: Automotive stocks have experienced significant gains, with many showing double-digit percentage increases in recent weeks. This reflects the market's expectation of future growth.

- Improved Consumer Confidence: The prospect of lower prices and increased availability of vehicles is boosting consumer confidence in the sector.

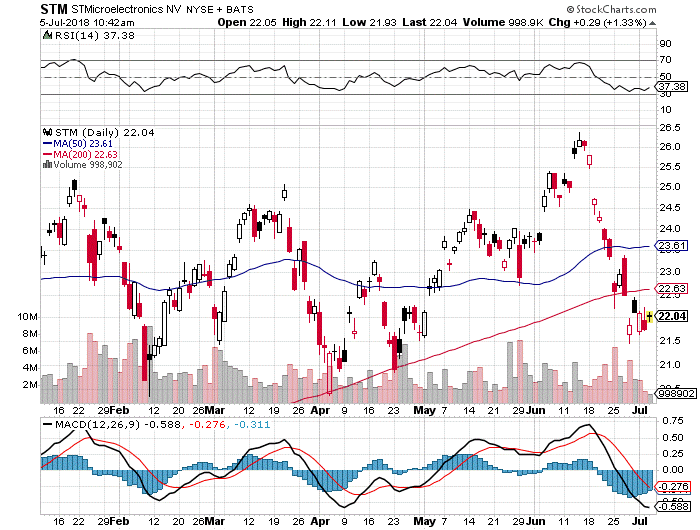

For example, preliminary data suggests a 15% increase in the market capitalization of leading automotive companies in the past month, accompanied by a significant jump in trading volume, further underscoring the market's excitement around potential tariff relief. These figures clearly demonstrate the strong correlation between speculation of automotive trade negotiations and the performance of automotive stocks.

LVMH's Decline: A Contrasting Trend Amidst Market Optimism

While European markets, particularly those tied to the auto industry, are experiencing a boom fueled by auto tariff relief speculation, LVMH, a leading luxury goods conglomerate, has seen a significant and unexpected drop in its stock price. This divergence from the overall positive market trend demands closer scrutiny. Several factors unrelated to auto tariff speculation may be contributing to LVMH's downturn:

- Luxury Goods Market Slowdown: Concerns about a potential slowdown in the global luxury goods market, particularly in key Asian markets, could be impacting investor confidence in LVMH.

- Company-Specific News: Negative news or announcements concerning LVMH's performance or strategic decisions could be affecting investor sentiment.

- Geopolitical Factors: Broader geopolitical uncertainty and potential economic slowdowns in key regions could also be contributing factors.

This sharp contrast between LVMH's performance and the overall positive trend in European markets highlights the complex and often unpredictable nature of market volatility. Understanding the reasons behind LVMH's decline requires a careful examination of factors specific to the luxury goods market and the company itself.

Analyzing the Interplay Between Auto Tariffs and Luxury Goods

At first glance, the link between auto tariff relief speculation and the luxury goods sector might seem tenuous. However, indirect connections exist. A healthier automotive industry could stimulate broader economic growth, potentially creating a positive ripple effect across other sectors, including luxury goods. Conversely, a global economic downturn, even if initially confined to the automotive sector due to continued high tariffs, could negatively impact consumer spending on luxury items.

The contrasting performance of these two sectors reflects more than just sector-specific factors; it also points towards broader shifts in investor sentiment and the inherent complexity of market correlations in a globalized economy. The current global economic climate, characterized by ongoing trade disputes and inflationary pressures, undoubtedly plays a significant role in shaping investor behavior and influencing the performance of diverse market sectors.

Expert Opinions and Market Forecasts

Leading financial analysts offer divergent views on the future of auto tariffs and their impact on the European and global markets. Some predict that tariff relief will lead to sustained growth in the automotive sector, further bolstering European markets. Others remain cautious, citing concerns about the broader global economic outlook and the potential for unforeseen economic shocks. Regarding LVMH and the luxury goods sector, forecasts vary widely, with some predicting a continued slowdown while others see a potential recovery driven by increasing consumer spending in certain markets. This range of opinions underlines the uncertainty inherent in making long-term market predictions.

Conclusion: Understanding the Implications of Auto Tariff Relief Speculation

The impact of auto tariff relief speculation on European markets is clear: positive investor sentiment has led to significant gains in automotive stocks and increased investment in the sector. However, LVMH's performance highlights the nuanced and often unpredictable nature of market dynamics, illustrating how sector-specific factors can overshadow broader market trends. The interplay between different sectors and global economic trends is crucial to understanding market movements.

To navigate this complex landscape, it is vital to monitor auto tariff relief developments closely, stay updated on European market trends, and track LVMH stock performance alongside broader economic indicators. By actively following these developments, investors and market observers can better understand and respond to the evolving dynamics of the European and global markets.

Featured Posts

-

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025 -

Listen Now Joy Crookes Latest Single Carmen

May 24, 2025

Listen Now Joy Crookes Latest Single Carmen

May 24, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025 -

La Minaccia Dei Dazi Conseguenze Per Le Borse E Contromisure Ue

May 24, 2025

La Minaccia Dei Dazi Conseguenze Per Le Borse E Contromisure Ue

May 24, 2025 -

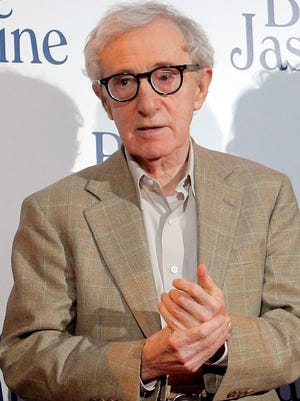

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025 -

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025 -

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025