Amundi Dow Jones Industrial Average UCITS ETF: A NAV Deep Dive

Table of Contents

Deconstructing the Amundi Dow Jones Industrial Average UCITS ETF NAV

The Amundi Dow Jones Industrial Average UCITS ETF's NAV represents the total value of its underlying assets per share. Understanding its components is crucial for informed investment.

- Portfolio Composition: The ETF's primary holdings consist of the 30 constituent stocks of the Dow Jones Industrial Average. Each stock's weighting within the ETF mirrors its weighting in the index, offering broad exposure to leading US companies.

- Asset Allocation: The ETF's highly concentrated asset allocation strategy focuses solely on large-cap US equities, making it a straightforward and easily understood investment vehicle. This simplification can be both an advantage and a limitation, depending on your overall portfolio diversification.

- Weighting: The weighting of each stock within the ETF's portfolio dynamically adjusts to reflect changes in the composition and market capitalization of the Dow Jones Industrial Average. This ensures that the ETF accurately tracks the index's performance.

- Currency Risk: As the ETF tracks a US index, investors outside the US might face currency risk. Fluctuations in exchange rates between their local currency and the US dollar will affect the NAV in their local currency terms.

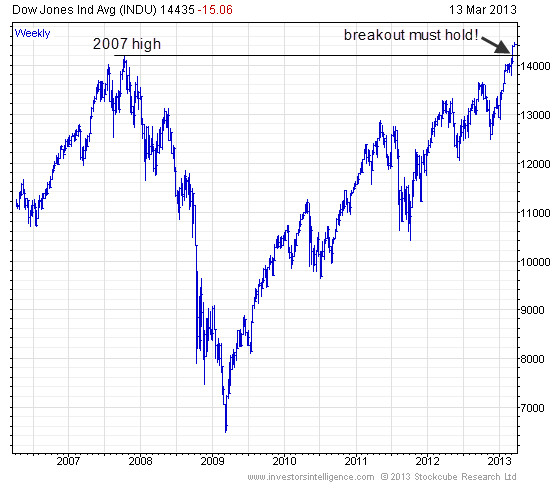

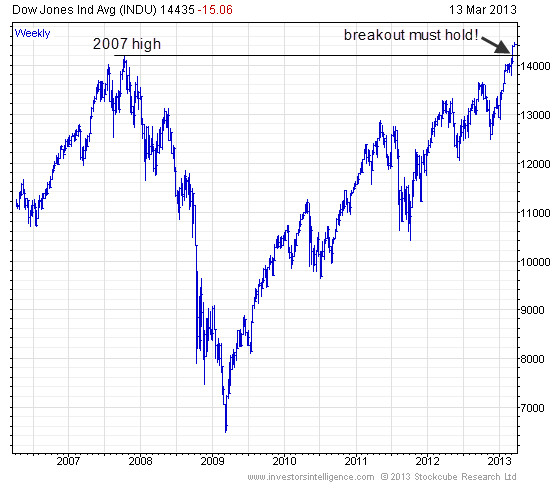

Impact of Market Fluctuations on NAV

Daily market movements directly influence the ETF's NAV. The Dow Jones Industrial Average's performance acts as a primary driver of the ETF's NAV, reflecting the collective performance of its 30 constituent companies.

- Market Volatility: Periods of high market volatility will lead to more significant daily fluctuations in the ETF's NAV. Understanding this volatility is crucial for managing investment risk.

- Price Fluctuations: Changes in the prices of the underlying 30 stocks cause corresponding changes in the ETF's NAV, reflecting its close tracking of the Dow Jones Industrial Average.

- Index Tracking: The ETF's primary goal is to track the Dow Jones Industrial Average's performance as closely as possible. Therefore, the NAV will generally mirror the index's movement, albeit with minor deviations due to management fees and expenses.

- Daily NAV: The daily NAV is calculated at the end of each trading day, reflecting the closing prices of the underlying stocks.

Accessing and Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is readily accessible from various sources:

- Amundi's Website: Amundi, the ETF provider, typically publishes the daily NAV on its website.

- Financial Data Providers: Major financial data providers like Bloomberg, Refinitiv, and Yahoo Finance offer detailed NAV information, often including historical data and charts. (Note: Remember to verify the reliability and accuracy of the data source.)

- Brokerage Platforms: Most online brokerage platforms display the current NAV along with other ETF information.

The NAV is usually reported daily, providing a clear picture of the ETF's value at the close of each trading day. By comparing the historical NAV with past market performance, investors can gain insights into the ETF's price movements and its correlation with the Dow Jones Industrial Average.

Comparing NAV to Market Price: Understanding Premium and Discount

The market price of the ETF may deviate slightly from its NAV. This difference creates a premium (market price exceeding NAV) or a discount (market price below NAV).

- Market Price vs. NAV: The market price reflects the price at which the ETF is currently traded on the exchange, while the NAV represents the intrinsic value of the underlying assets.

- Premium and Discount: Premiums and discounts are typically small and often fluctuate based on factors such as trading volume, supply and demand, and the overall market sentiment.

- Factors Influencing Premium/Discount: High trading volume often reduces the difference between the market price and the NAV, while low trading volume can lead to greater deviations.

- Bid-Ask Spread: The bid-ask spread, the difference between the highest bid and the lowest ask price, also contributes to the difference between market price and NAV.

Using NAV for Investment Strategies with the Amundi Dow Jones Industrial Average UCITS ETF

Investors can employ the NAV data in several investment strategies:

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of the NAV, can mitigate the risk associated with market timing.

- Value Investing: While not a direct application, observing the relationship between NAV and market price can provide insights for a value investing approach – potentially buying when a discount exists.

- Investment Timing: While using NAV alone for perfect market timing is unrealistic, monitoring trends in NAV in conjunction with broader market analysis can inform investment decisions.

Conclusion: The Importance of Understanding NAV in Amundi Dow Jones Industrial Average UCITS ETF Investing

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for making informed investment decisions. By monitoring the daily NAV, comparing it to the market price, and understanding the factors influencing its fluctuations, investors can optimize their investment strategies. Regularly tracking the NAV allows investors to evaluate the performance of their investment, manage risk effectively, and potentially improve their chances of investment success. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and how to effectively use its NAV for your investment strategy, leading to better portfolio management and more informed decisions.

Featured Posts

-

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yuhqq Hdha Alinjaz

May 24, 2025

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yuhqq Hdha Alinjaz

May 24, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Reaksiyonlar

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Reaksiyonlar

May 24, 2025 -

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025 -

Brachniy Bum Na Kharkovschine Analiz Svadebnoy Statistiki

May 24, 2025

Brachniy Bum Na Kharkovschine Analiz Svadebnoy Statistiki

May 24, 2025 -

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni And Mobil Klasik

May 24, 2025

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni And Mobil Klasik

May 24, 2025

Latest Posts

-

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025 -

Tik Tok Tourism Backlash Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 24, 2025

Tik Tok Tourism Backlash Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025 -

Legal Action Amsterdam Residents Sue City For Tik Tok Influenced Overcrowding At Snack Bar

May 24, 2025

Legal Action Amsterdam Residents Sue City For Tik Tok Influenced Overcrowding At Snack Bar

May 24, 2025 -

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025