Bank Of Canada's Rate Pause: Expert Analysis From FP Video

Table of Contents

Reasons Behind the Bank of Canada's Rate Pause

The Bank of Canada's decision to pause its interest rate hikes is multifaceted, influenced by a complex interplay of economic factors. Let's examine the key drivers:

Inflationary Pressures

While inflation has begun to cool, it remains stubbornly above the Bank of Canada's target of 2%. Several factors contribute to this persistent inflationary pressure:

- Elevated Energy Prices: Global energy markets continue to experience volatility, impacting prices at the pump and contributing to overall inflation.

- Supply Chain Disruptions: Although easing, lingering supply chain bottlenecks continue to add to the cost of goods.

- Robust Wage Growth: Strong wage growth, while positive for workers, can fuel inflationary pressures if it outpaces productivity gains.

Current inflation data shows a rate of [Insert current inflation rate here]%, significantly higher than the Bank of Canada's target. Core inflation, which excludes more volatile components, stands at [Insert core inflation rate here]%, indicating underlying inflationary pressures persist. This situation necessitates a cautious approach to interest rate adjustments.

Economic Growth Concerns

The Canadian economy is facing a confluence of challenges. While employment rates remain relatively strong, there are growing concerns about the potential for a slowdown or even a recession:

- GDP Growth Slowdown: Recent GDP growth figures indicate a moderation in economic expansion [Insert recent GDP growth data here].

- Increased Interest Rate Sensitivity: Higher interest rates impact consumer spending and business investment, potentially dampening economic growth.

- Global Economic Uncertainty: Geopolitical events and global economic slowdown contribute to uncertainty and risk aversion.

These factors suggest a need for the Bank of Canada to tread carefully, avoiding aggressive rate hikes that could trigger a sharper economic contraction.

Housing Market Sensitivity

The Canadian housing market is highly sensitive to interest rate changes. Rising interest rates have already cooled the market, but further increases could trigger a more significant downturn:

- Housing Price Corrections: We've seen some correction in housing prices in certain markets [Insert data on housing price trends here].

- Mortgage Rate Increases: Higher interest rates lead to increased mortgage payments, impacting affordability and potentially leading to a decline in home sales.

- Impact on Consumer Spending: Housing-related expenditures form a significant part of consumer spending. A housing market slowdown reduces this spending, affecting overall economic activity.

Expert Opinions from the FP Video

The Financial Post video offers valuable insights from leading economists and analysts on the Bank of Canada's rate pause. Let's explore the key takeaways:

Key Takeaways from the Financial Post Analysis

The FP video presents a range of perspectives, but a common thread is the cautious optimism surrounding the pause:

- Data-Dependent Approach: Experts emphasize the Bank of Canada's data-dependent approach, suggesting future rate decisions will hinge on incoming economic data.

- Inflation as the Key Factor: The video highlights inflation as the most crucial factor influencing future monetary policy decisions.

- Potential for Future Hikes: While a pause is warranted now, some experts foresee the possibility of further rate hikes depending on inflation's trajectory. [Insert relevant quote from FP video here].

Alternative Views and Potential Scenarios

The FP video also acknowledges alternative scenarios and differing perspectives:

- Faster Inflation Reduction: Some analysts believe inflation could fall faster than anticipated, potentially opening the door for rate cuts sooner.

- Prolonged High Inflation: Other experts warn that inflation could remain stubbornly high, requiring more aggressive interest rate action in the future.

- Recessionary Risks: Concerns regarding the potential for a recession are also discussed, impacting the Bank of Canada’s approach to future rate adjustments.

Implications for Investors and Consumers

The Bank of Canada's rate pause has significant implications for both investors and consumers:

Investment Strategies in a Pause Environment

Investors need to adapt their strategies to navigate this period of uncertainty:

- Diversification: Diversifying investment portfolios across different asset classes is crucial to manage risk.

- Defensive Positioning: Some investors might choose a more defensive approach, focusing on less volatile investments.

- Opportunities in Fixed Income: The pause presents potential opportunities in the fixed income market, with potentially higher yields on bonds.

Impact on Consumer Spending and Borrowing

The rate pause will influence consumer behavior in several ways:

- Easing Borrowing Costs: The pause might offer some relief to borrowers, albeit temporarily.

- Increased Consumer Confidence: A pause could potentially boost consumer confidence, leading to increased spending.

- Managing Household Debt: Consumers should carefully manage their household debt levels, given the potential for future rate increases.

Conclusion: Understanding the Bank of Canada Rate Pause

The Bank of Canada's decision to pause interest rate hikes is a complex one, driven by a delicate balancing act between controlling inflation and supporting economic growth. Expert opinions, as highlighted in the Financial Post video, suggest a cautious approach, with future decisions heavily reliant on incoming economic data. This pause offers some respite for consumers and investors but does not signal an end to the volatility in interest rates. The implications for both investors and consumers are substantial, necessitating careful consideration of investment strategies and debt management.

To deepen your understanding of the Bank of Canada's monetary policy and its implications for the Canadian economy, we strongly encourage you to watch the full Financial Post video [Insert link to FP video here]. Learn more about the Bank of Canada's interest rate decision and its impact on your financial future.

Featured Posts

-

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 22, 2025

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 22, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 22, 2025

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 22, 2025 -

Identifying Emerging Business Opportunities A Nationwide Map

Apr 22, 2025

Identifying Emerging Business Opportunities A Nationwide Map

Apr 22, 2025 -

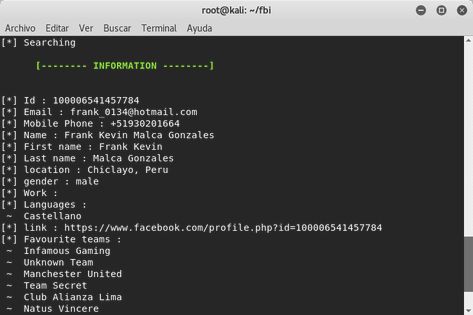

Exec Office365 Breach Millions Made From Inbox Hacks Fbi Says

Apr 22, 2025

Exec Office365 Breach Millions Made From Inbox Hacks Fbi Says

Apr 22, 2025 -

Hegseths Military Plans Revealed In Signal Group Chats

Apr 22, 2025

Hegseths Military Plans Revealed In Signal Group Chats

Apr 22, 2025

Latest Posts

-

Foerklaringar Kring Jessica Simpsons Pastaenden Om Orm Sperma

May 12, 2025

Foerklaringar Kring Jessica Simpsons Pastaenden Om Orm Sperma

May 12, 2025 -

I Tzesika Simpson Apokalyptei To Mystiko Tis Fonis Tis

May 12, 2025

I Tzesika Simpson Apokalyptei To Mystiko Tis Fonis Tis

May 12, 2025 -

Jessica Simpson And Snake Sperm The Story Behind The Headlines

May 12, 2025

Jessica Simpson And Snake Sperm The Story Behind The Headlines

May 12, 2025 -

Jessica Simpson Hennes Kontroversiella Orm Sperma Upplevelse

May 12, 2025

Jessica Simpson Hennes Kontroversiella Orm Sperma Upplevelse

May 12, 2025 -

Jessica Simpson New Music And Reality Tv Comeback Rumors

May 12, 2025

Jessica Simpson New Music And Reality Tv Comeback Rumors

May 12, 2025