BBAI Stock: Analyst Downgrade Weighs On Future Growth Prospects

Table of Contents

The Analyst Downgrade: Details and Implications

Specifics of the Downgrade:

A prominent analyst firm, [Insert Analyst Firm Name Here], recently downgraded BBAI stock from a [Previous Rating, e.g., Buy] rating to a [New Rating, e.g., Sell] rating. The rationale behind this significant BBAI stock rating change cited several key concerns:

- Increased Competition: The analyst report highlighted the growing competition within the [Industry Sector] sector, suggesting BBAI is facing increasing pressure on market share from established players and new entrants.

- Market Saturation: Concerns were raised about the potential for market saturation in BBAI's key product lines, limiting future revenue growth opportunities.

- Slower-than-Expected Revenue Growth: The analyst firm pointed to BBAI's recent financial reports, noting slower-than-anticipated revenue growth and reduced profit margins compared to projections.

- Weakening Financial Performance: The downgrade was partly influenced by BBAI's recent financial performance, indicating a decline in key metrics, such as [mention specific metrics like EPS, revenue growth percentage, etc.]. This fueled the BBAI stock price drop.

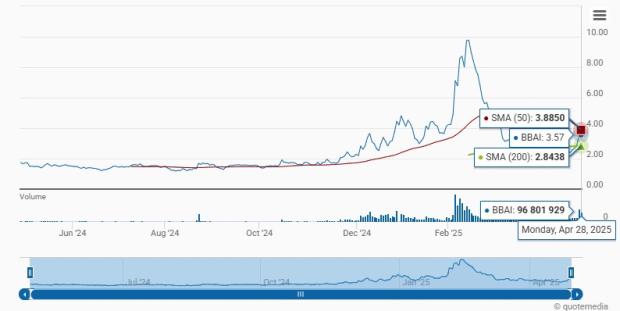

Impact on BBAI Stock Price:

The BBAI stock price experienced a sharp decline immediately following the release of the analyst downgrade. The stock price fell by [Percentage]% on [Date], with trading volume significantly increasing, reflecting heightened investor activity. This market volatility underscored the sensitivity of BBAI's valuation to analyst sentiment. The BBAI stock price drop was exacerbated by [mention any other market factors influencing the drop, like overall market downturns].

Investor Sentiment and Market Reaction:

The analyst downgrade triggered a wave of negative investor sentiment. News outlets and financial blogs reported extensively on the event, with many expressing concerns about BBAI's future prospects. Social media discussions also reflected a prevailing sense of uncertainty and pessimism surrounding the BBAI stock news. Short selling activity increased, indicating a significant portion of investors believe the BBAI stock price will continue to fall.

Analyzing BBAI's Growth Prospects in Light of the Downgrade

Challenges Facing BBAI:

BBAI faces several significant challenges that hinder its future growth prospects:

- Intense Competition: The company operates in a highly competitive market, with established players constantly innovating and launching new products.

- Regulatory Hurdles: Navigating complex regulatory environments, particularly in [mention specific regions/markets], poses a substantial challenge to BBAI's expansion plans.

- Technological Disruption: Rapid technological advancements could render some of BBAI's existing products obsolete, requiring significant investments in R&D to maintain market relevance.

- Supply Chain Disruptions: The ongoing global supply chain disruptions pose a considerable challenge to BBAI's ability to produce and deliver its products efficiently.

Potential Opportunities for BBAI:

Despite the challenges, BBAI still possesses opportunities for future growth:

- New Product Launches: The introduction of innovative products can revitalize BBAI's market position and capture new customer segments.

- Strategic Partnerships: Collaborating with other companies in the industry can unlock new market access and technological advancements.

- International Expansion: Expanding into new geographical markets presents a substantial opportunity for revenue growth and diversification.

- Focus on Cost Optimization: Implementing effective cost reduction strategies can improve profitability and enhance financial stability.

Financial Performance and Key Metrics:

BBAI's recent financial performance has been mixed. While [mention positive aspects like revenue increase in certain segments], concerns remain about [mention negative aspects like declining profit margins or increased debt]. A detailed analysis of the BBAI financials, including key metrics such as revenue growth, earnings per share (EPS), and debt-to-equity ratio, is crucial for evaluating its financial health and future outlook. A comparison with industry benchmarks is also essential to understand BBAI's relative performance.

Assessing the Risk and Reward of Investing in BBAI Stock Post-Downgrade

Investing in BBAI stock post-downgrade presents a complex risk-reward scenario. The risk factors include the potential for further price declines due to persistent competition, regulatory hurdles, and technological disruption. However, potential rewards exist if BBAI successfully addresses these challenges, capitalizes on new opportunities, and demonstrates improved financial performance. The current BBAI stock valuation reflects a significant degree of uncertainty, making a thorough risk assessment paramount before making any investment decisions. The potential return on investment (ROI) is highly dependent on future performance and market conditions.

Conclusion: BBAI Stock Outlook and Investment Decisions

The analyst downgrade has undeniably cast a shadow on BBAI's short-term growth prospects. The company faces significant challenges, but also possesses certain opportunities. A careful assessment of BBAI's financial performance, competitive landscape, and future strategy is necessary. Conduct thorough due diligence before making any investment decisions related to BBAI stock. Stay informed about future developments impacting BBAI stock price and growth prospects. Continuously monitoring BBAI stock analysis from reputable sources is crucial for informed investment decisions. This comprehensive BBAI stock investment analysis should inform your strategy but remember that market conditions are dynamic and subject to change.

Featured Posts

-

Fast Moving Storms And Their Destructive Winds A Comprehensive Guide

May 20, 2025

Fast Moving Storms And Their Destructive Winds A Comprehensive Guide

May 20, 2025 -

Chinas Pressure On Manilas Missile System Fails

May 20, 2025

Chinas Pressure On Manilas Missile System Fails

May 20, 2025 -

Le Nouveau Visage De La Gastronomie Biarrote Chefs Et Adresses

May 20, 2025

Le Nouveau Visage De La Gastronomie Biarrote Chefs Et Adresses

May 20, 2025 -

Big Bear Ai Stock Buy Sell Or Hold A Detailed Look

May 20, 2025

Big Bear Ai Stock Buy Sell Or Hold A Detailed Look

May 20, 2025 -

500 000 Bribery Scheme Lands Retired Navy Admiral 30 Year Prison Sentence

May 20, 2025

500 000 Bribery Scheme Lands Retired Navy Admiral 30 Year Prison Sentence

May 20, 2025

Latest Posts

-

Efimeries Giatron Stin Patra Savvatokyriako 12 13 Aprilioy

May 20, 2025

Efimeries Giatron Stin Patra Savvatokyriako 12 13 Aprilioy

May 20, 2025 -

Efimereyontes Giatroi Patras 12 And 13 Aprilioy Odigos Eyresis

May 20, 2025

Efimereyontes Giatroi Patras 12 And 13 Aprilioy Odigos Eyresis

May 20, 2025 -

Pasxa Kai Protomagia Sto Oropedio Evdomos Programma Ekdromis

May 20, 2025

Pasxa Kai Protomagia Sto Oropedio Evdomos Programma Ekdromis

May 20, 2025 -

Oropedio Evdomos O Apolytos Proorismos Gia Protomagia

May 20, 2025

Oropedio Evdomos O Apolytos Proorismos Gia Protomagia

May 20, 2025 -

Champions League I Kroyz Azoyl Kai O Giakoymakis Paleyoyn Gia Ton Teliko

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Paleyoyn Gia Ton Teliko

May 20, 2025