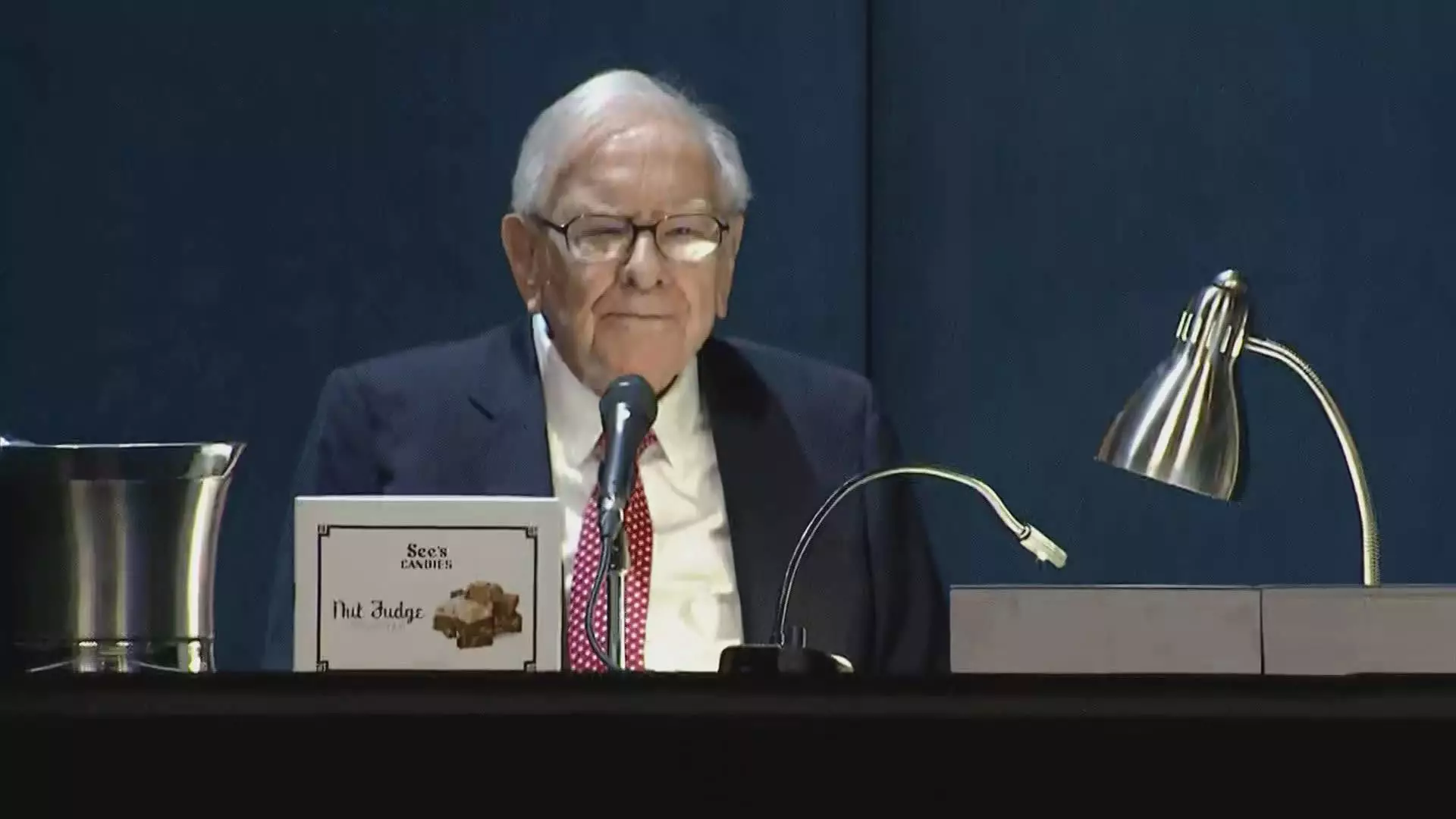

Berkshire Hathaway's Future: Analyzing Apple Stock After CEO Change

Table of Contents

Warren Buffett's succession plan at Berkshire Hathaway and the subsequent leadership changes are sparking significant debate about the future of the conglomerate's massive Apple stock holdings. This article delves into the potential impact of this CEO transition on Berkshire Hathaway's investment strategy and the long-term prospects of its Apple investment. We will analyze the implications for both Berkshire Hathaway and individual investors considering Apple stock.

The Significance of Apple in Berkshire Hathaway's Portfolio

Apple's position within Berkshire Hathaway's portfolio is nothing short of monumental. It represents a cornerstone of their investment strategy, a significant driver of returns, and a reflection of Warren Buffett's long-term vision. Understanding this relationship is vital for comprehending Berkshire Hathaway's future.

-

Apple's Portfolio Weight: Apple stock consistently constitutes a significant percentage of Berkshire Hathaway's overall portfolio, often exceeding 40%, making it by far their largest holding. This substantial weighting underscores Apple's importance to Berkshire's overall performance.

-

Historical Returns: Berkshire Hathaway's investment in Apple has yielded substantial returns over the years. The stock's consistent growth has significantly contributed to Berkshire's impressive track record, solidifying Apple's role as a key driver of shareholder value. Specific financial data showcasing these returns can be found in Berkshire's annual reports.

-

Strategic Rationale: Buffett's rationale for this significant investment stemmed from his belief in Apple's strong brand loyalty, its robust ecosystem, and its long-term growth potential in a rapidly evolving technological landscape. He often praised Apple's innovative products and the company’s strong customer base.

Impact of the CEO Change on Berkshire Hathaway's Investment Decisions

The shift in leadership at Berkshire Hathaway naturally raises questions about the future of its substantial Apple holdings. Will the new leadership maintain Buffett's investment philosophy, or will we see significant adjustments to the portfolio?

-

Shifting Investment Styles: The investment styles of the new CEO and other key figures within Berkshire Hathaway's leadership team will play a crucial role. While they might uphold many of Buffett's principles, variations in risk tolerance, investment horizons, and sector preferences could lead to shifts in portfolio allocation.

-

Maintaining or Adjusting the Apple Position: The likelihood of maintaining or adjusting the Apple stock position is a key area of speculation. Will the new leadership maintain the substantial Apple stake, or might they consider partial divestment to diversify the portfolio or pursue other investment opportunities?

-

Diversification Strategy: The new leadership might choose to diversify away from the technology sector to mitigate risk, or they might even increase their holdings in Apple if they see continued strong growth potential. This decision will have a significant ripple effect throughout the market.

Analyzing Apple's Future Prospects Independent of Berkshire Hathaway

Regardless of Berkshire Hathaway's decisions, Apple's intrinsic value and future prospects remain a critical factor. Understanding Apple's position within the broader tech market and its future growth trajectory is vital for both Berkshire Hathaway and individual investors.

-

Innovation and Product Pipeline: Apple's continued innovation is a primary driver of its stock price. Analyzing their product pipeline, technological advancements, and the overall success of new product launches is crucial for assessing future performance.

-

Competitive Landscape: The competitive landscape is ever-changing. The threat of competition from other tech giants and the emergence of disruptive technologies could significantly impact Apple's market share and future growth.

-

Macroeconomic Factors: Global macroeconomic factors like inflation and interest rates play a significant role in influencing investor sentiment and stock valuations. Understanding these influences is vital for accurately assessing Apple's future performance.

The Role of Diversification in Berkshire Hathaway's Future

Portfolio diversification is paramount for mitigating risk. Berkshire Hathaway's significant concentration in Apple stock presents both opportunities and challenges.

-

Benefits of Diversification: Diversification across various sectors and asset classes significantly reduces the impact of any single investment's underperformance on the overall portfolio. This is a fundamental principle of sound investment management.

-

Risks of Over-Reliance: Over-reliance on a single stock, even one as successful as Apple, exposes Berkshire Hathaway to considerable risk. A downturn in Apple's performance would significantly impact the overall portfolio.

-

Diversification Strategies: Berkshire Hathaway might explore various diversification strategies, including increasing investments in other sectors, exploring different asset classes, or potentially reducing its holdings in Apple to rebalance its portfolio.

Conclusion

The CEO transition at Berkshire Hathaway raises important questions about the future of its significant Apple stock holdings. While Apple remains a strong performer, the new leadership's investment philosophy and the overall need for portfolio diversification will shape the future of this crucial investment. Analyzing Apple's independent prospects is crucial for both Berkshire Hathaway and individual investors.

Call to Action: Stay informed about the evolving relationship between Berkshire Hathaway and Apple stock. Continue to research and analyze the implications of this CEO change on your investment strategy in both Berkshire Hathaway and Apple Inc. Understanding the interplay between these two giants will be crucial for navigating the complexities of the stock market and maximizing returns.

Featured Posts

-

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

Why Investors Shouldnt Panic Over High Stock Market Valuations A Bof A Analysis

May 24, 2025

Why Investors Shouldnt Panic Over High Stock Market Valuations A Bof A Analysis

May 24, 2025 -

Transformatsiyata Na Konchita Vurst Ot Evroviziya Do Dnes

May 24, 2025

Transformatsiyata Na Konchita Vurst Ot Evroviziya Do Dnes

May 24, 2025 -

Property Investment Success Nicki Chapmans 700 000 Country Home

May 24, 2025

Property Investment Success Nicki Chapmans 700 000 Country Home

May 24, 2025 -

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025

Latest Posts

-

Free Speech And Ai Examining The Case Of Character Ai

May 24, 2025

Free Speech And Ai Examining The Case Of Character Ai

May 24, 2025 -

Jony Ives Ai Company Potential Acquisition By Open Ai

May 24, 2025

Jony Ives Ai Company Potential Acquisition By Open Ai

May 24, 2025 -

Palestine Blocked Microsoft Email Restrictions Spark Employee Outrage

May 24, 2025

Palestine Blocked Microsoft Email Restrictions Spark Employee Outrage

May 24, 2025 -

The Legal Status Of Character Ai Chatbot Conversations

May 24, 2025

The Legal Status Of Character Ai Chatbot Conversations

May 24, 2025 -

Is Open Ai Acquiring Jony Ives Ai Startup The Latest News

May 24, 2025

Is Open Ai Acquiring Jony Ives Ai Startup The Latest News

May 24, 2025