Betting On Uber's Driverless Future: ETFs That Could Pay Off

Table of Contents

Understanding the Autonomous Vehicle Market and its Potential

The autonomous vehicle market is poised for explosive growth. Analysts predict a massive expansion in the coming decade, driven by increasing demand for robotaxis, autonomous delivery services, and other applications of self-driving technology. This transformative technology is expected to reshape urban landscapes and revolutionize logistics.

- Market size projections: Some estimates project the global autonomous vehicle market to reach hundreds of billions of dollars within the next 5-10 years, representing a significant investment opportunity.

- Key players: Beyond Uber, major players like Waymo (Google's self-driving car project), Tesla, Cruise (General Motors' autonomous vehicle subsidiary), and several other tech giants and startups are heavily invested in this space, fueling competition and innovation.

- Societal and economic impacts: Widespread adoption of self-driving cars promises to improve road safety, reduce traffic congestion, increase accessibility for the elderly and disabled, and create new economic opportunities in manufacturing, software development, and related industries.

However, significant technological hurdles remain. These include:

- Safety regulations: Robust and reliable safety regulations are crucial before widespread autonomous vehicle deployment becomes a reality. Thorough testing and public trust are paramount.

- Infrastructure needs: Existing infrastructure may need upgrades to support the seamless operation of autonomous vehicles, including improved mapping and communication networks.

- Public acceptance: Overcoming public concerns about safety and job displacement is critical for the successful integration of autonomous vehicles into society.

Identifying ETFs with Exposure to Autonomous Vehicle Technology

Several ETFs provide exposure to the autonomous vehicle sector, offering investors a way to participate in this potentially high-growth market. It's crucial to remember that investing in ETFs carries inherent risk, and no investment guarantees a profit.

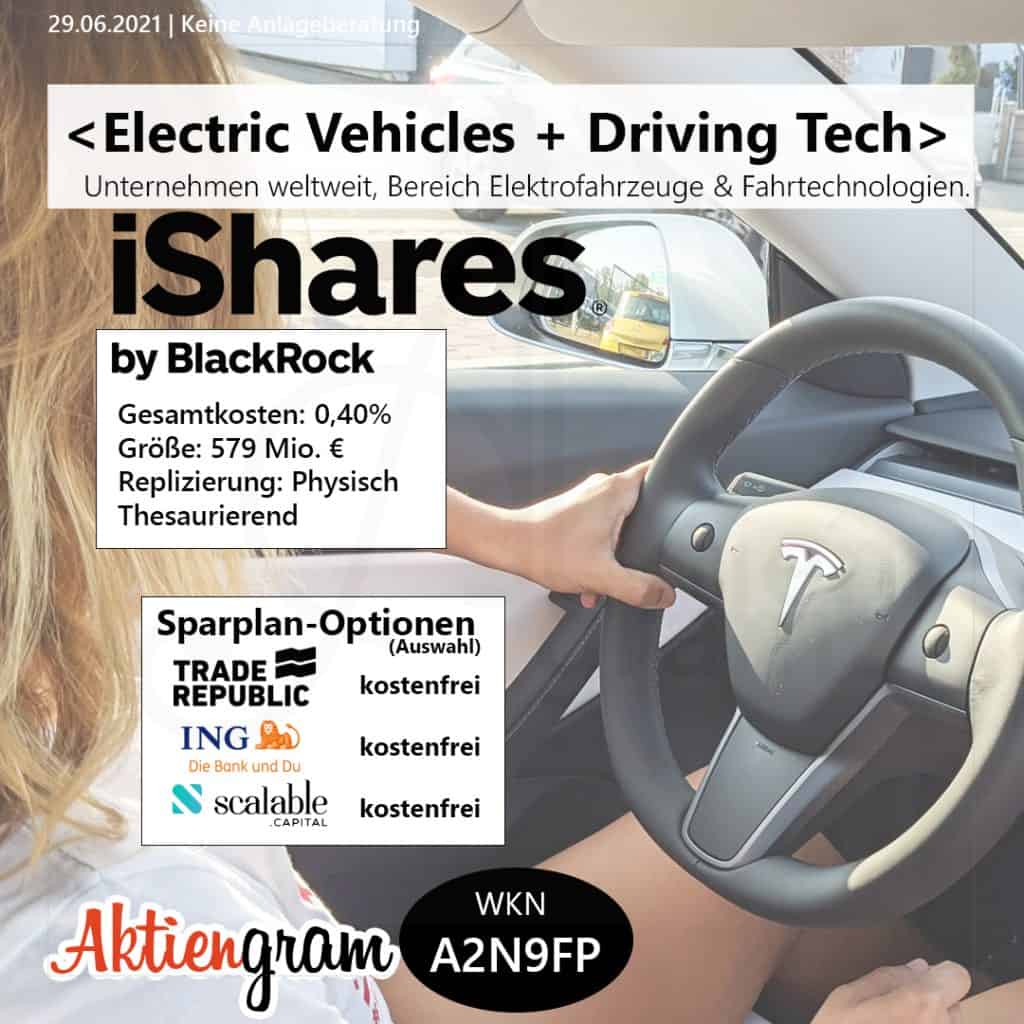

- Technology-focused ETFs: Many technology ETFs hold shares of companies involved in the development of autonomous vehicle technology, such as sensor manufacturers, software developers, and artificial intelligence companies. Examples may include but are not limited to (please verify current holdings before investing): [Insert relevant ETF ticker symbols here - e.g., Technology Select Sector SPDR Fund (XLK), Invesco QQQ Trust (QQQ)].

- Transportation sector ETFs: Broader transportation sector ETFs may include companies involved in related industries like mapping services (e.g., TomTom), high-precision GPS technology, and other supporting infrastructure. [Insert relevant ETF ticker symbols here - e.g., iShares U.S. Transportation ETF (IYT)].

- Company-specific ETFs: While less common, some ETFs may track the performance of Uber or other major players in the autonomous vehicle race directly. You'll need to conduct thorough research to find ETFs that align with your specific investment objectives and risk tolerance.

Diversification and Risk Management: It’s crucial to diversify your investments across multiple ETFs and asset classes to mitigate risk. Never invest more than you can afford to lose.

Analyzing ETF Holdings and Risk Assessment

Before investing in any ETF, carefully analyze its holdings to assess its exposure to the autonomous vehicle market.

- Checking ETF portfolios: Examine the ETF's portfolio to identify companies directly involved in self-driving technology development. Look for companies specializing in areas like lidar, radar, computer vision, and autonomous driving software.

- Understanding the risks: Investing in emerging technologies like autonomous vehicles carries significant risk. Technological challenges, regulatory hurdles, and competition could impact the success of these companies and the ETFs that hold their shares.

- Expense ratios and performance: Consider the ETF's expense ratio (the annual fee charged to manage the fund) and its historical performance, but remember past performance is not indicative of future results.

Investing Strategies for the Driverless Future

For investors looking to capitalize on the autonomous vehicle revolution, a well-defined investment strategy is essential.

- Dollar-cost averaging: Regularly investing a fixed amount of money over time, regardless of market fluctuations, can help mitigate risk.

- Diversification: Spreading your investments across multiple ETFs and asset classes reduces the impact of losses in any single investment.

- Long-term horizon: Given the long-term nature of this emerging technology, a long-term investment horizon (5-10 years or more) is generally recommended.

- Staying informed: Keep abreast of industry news, regulatory developments, and technological advancements to make informed investment decisions.

Conclusion

Investing in the autonomous vehicle sector through ETFs offers a potentially high-reward, high-risk opportunity. By carefully selecting ETFs and employing sound investment strategies, investors can gain exposure to companies shaping the future of transportation, including companies like Uber. Remember to conduct thorough research and consider your own risk tolerance before investing.

Call to Action: Start exploring the world of ETFs and position yourself for potential gains by learning more about how you can benefit from betting on Uber's driverless future and the broader autonomous vehicle market. Don't miss out on this potentially transformative investment opportunity. Remember to consult with a financial advisor before making any investment decisions. Your journey to profiting from the autonomous vehicle revolution starts with careful research and planning.

Featured Posts

-

Angelo Stiller To Liverpool German Media Offers Update Affecting Arne Slot

May 17, 2025

Angelo Stiller To Liverpool German Media Offers Update Affecting Arne Slot

May 17, 2025 -

Apple Tv Subscription 3 Month Discount For 3 Act Now

May 17, 2025

Apple Tv Subscription 3 Month Discount For 3 Act Now

May 17, 2025 -

Will The Knicks Problems Persist Even After Brunsons Return

May 17, 2025

Will The Knicks Problems Persist Even After Brunsons Return

May 17, 2025 -

Analyzing Etf Investments In Ubers Autonomous Driving Technology

May 17, 2025

Analyzing Etf Investments In Ubers Autonomous Driving Technology

May 17, 2025 -

186 Milyon Dolar Novak Djokovic In Gelir Kaynaklari Ve Basarisi

May 17, 2025

186 Milyon Dolar Novak Djokovic In Gelir Kaynaklari Ve Basarisi

May 17, 2025