BigBear.ai (BBAI): Growth Uncertainty Prompts Analyst Downgrade

Table of Contents

Reasons Behind the BBAI Stock Downgrade

The recent analyst downgrade of BBAI stock stems from a confluence of factors that raise concerns about the company's near-term growth trajectory. These concerns primarily center around revenue growth, contract award challenges, and integration difficulties.

Revenue Growth Concerns

Analysts have expressed concerns about BigBear.ai's slower-than-anticipated revenue growth. While the company has shown promise in the AI and defense sectors, the projected figures haven't met initial expectations.

- Q3 2023 Revenue: [Insert actual or projected Q3 2023 revenue figures here]. This represents a [percentage]% increase/decrease compared to the same period last year.

- Projected Revenue for 2024: [Insert projected revenue figures for 2024 here]. This projection falls short of previous analyst forecasts by [percentage]%.

This slower growth is attributed partly to increased competition within the burgeoning AI market, with established tech giants and new entrants vying for similar contracts. Furthermore, the cyclical nature of government spending on defense projects adds another layer of uncertainty.

Contract Award Challenges

Securing new contracts is crucial for BigBear.ai's growth, and recent challenges in this area have contributed to the downgrade. The competitive bidding process, particularly within the government sector, is notoriously rigorous.

- Increased competition: The AI and defense sectors are becoming increasingly competitive, with both established players and new entrants vying for limited government contracts.

- Government budget constraints: Budgetary limitations within government agencies can lead to delays or cancellations of projects, impacting contract awards.

- Contract delays: The process of securing government contracts often involves lengthy negotiations and bureaucratic hurdles, leading to potential delays in revenue generation.

These challenges highlight the inherent risks associated with relying heavily on government contracts for revenue generation.

Integration Challenges

BigBear.ai's growth strategy involves strategic acquisitions and the integration of new technologies. However, integrating diverse technologies and teams presents operational challenges.

- Technology compatibility: Merging different technological platforms and systems can be complex and time-consuming, potentially leading to delays and cost overruns.

- Team integration: Harmonizing different corporate cultures and integrating teams from acquired companies can pose significant human resource management challenges.

- Operational efficiency: Integration issues can negatively impact operational efficiency, potentially hindering productivity and profitability in the short term.

These integration challenges underscore the risks involved in rapid expansion and acquisition-driven growth strategies.

Impact on BBAI Stock Price and Investor Sentiment

The analyst downgrade had an immediate and noticeable impact on BBAI's stock price. [Insert data on stock price changes following the downgrade, including percentage changes and relevant chart/graph]. This decline reflects a shift in investor sentiment, with many investors reacting to the news by selling off their shares. The overall effect on investor confidence in BigBear.ai's long-term prospects remains to be seen, but the initial reaction suggests a cautious outlook.

Future Outlook for BigBear.ai (BBAI)

BigBear.ai needs to demonstrate a robust strategic response to address the concerns raised by the analyst downgrade. This might involve refining its revenue projection, improving its bidding strategies for government contracts, and streamlining its technology integration processes. Potential catalysts for future growth include successful contract wins, particularly large-scale government projects, and the successful integration of its acquired technologies into a cohesive and efficient platform. While risks remain, particularly concerning the competitive landscape and government spending cycles, BigBear.ai retains long-term potential given its expertise in AI and the growing demand for AI-powered solutions in defense and other sectors. Any positive news regarding new contract awards or successful technology integrations could significantly offset the negative sentiment generated by the downgrade.

Conclusion: Assessing the Risks and Rewards of Investing in BBAI

The analyst downgrade of BigBear.ai (BBAI) stock highlights the inherent growth uncertainty within the AI and defense contracting sectors. While the company possesses considerable potential, challenges related to revenue growth, contract awards, and technology integration must be addressed. The immediate impact was a decline in stock price and investor sentiment, reflecting concerns about the company's near-term prospects. However, potential catalysts for future growth remain. Investors should carefully weigh the risks and rewards before making investment decisions. Conduct thorough due diligence, considering the current growth uncertainty and analyzing the company's strategic response to the challenges outlined in this analysis. For further insights and relevant financial information, consider accessing resources such as [link to relevant financial news website or SEC filings]. Before investing in BBAI stock or any other AI investment opportunities, remember to carefully consider your risk tolerance and investment goals. Conduct your own thorough BBAI stock analysis to make an informed decision.

Featured Posts

-

Americas Factory Jobs Trumps Promises And The Economic Landscape

May 20, 2025

Americas Factory Jobs Trumps Promises And The Economic Landscape

May 20, 2025 -

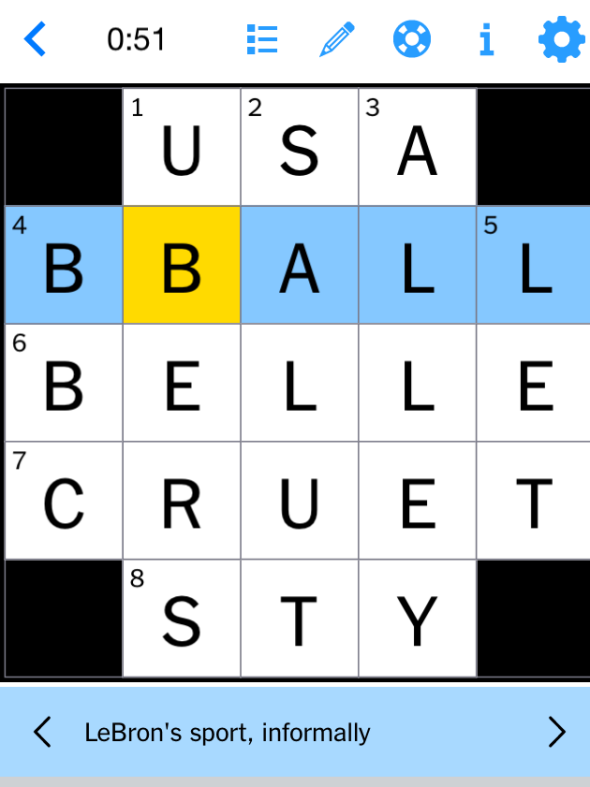

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025 -

Herecka Jennifer Lawrence Opaet Mamou Tajne Druhe Dieta

May 20, 2025

Herecka Jennifer Lawrence Opaet Mamou Tajne Druhe Dieta

May 20, 2025 -

Big Bear Ai Bbai Growth Uncertainty Prompts Analyst Downgrade

May 20, 2025

Big Bear Ai Bbai Growth Uncertainty Prompts Analyst Downgrade

May 20, 2025 -

Hmrc Tax Letters Uk Households Earning Over 23 000 Targeted

May 20, 2025

Hmrc Tax Letters Uk Households Earning Over 23 000 Targeted

May 20, 2025

Latest Posts

-

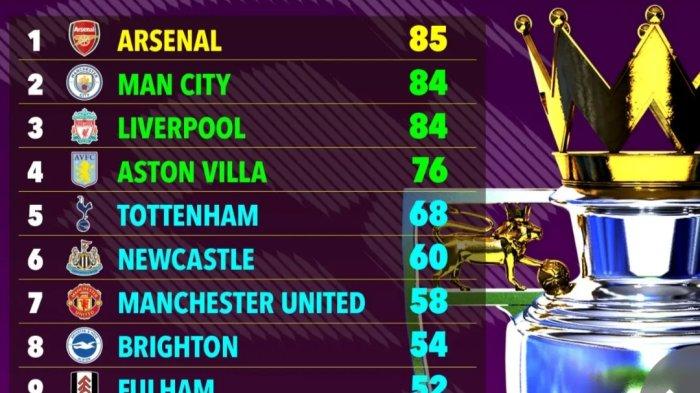

Prediksi Juara Liga Inggris 2024 2025 Jejak Pelatih Sukses Liverpool

May 21, 2025

Prediksi Juara Liga Inggris 2024 2025 Jejak Pelatih Sukses Liverpool

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caan An Obscure Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Obscure Western Neo Noir

May 21, 2025 -

Chicago Cubs Fans Recreate Iconic Lady And The Tramp Scene With A Hot Dog

May 21, 2025

Chicago Cubs Fans Recreate Iconic Lady And The Tramp Scene With A Hot Dog

May 21, 2025 -

Siapa Saja Pelatih Yang Pernah Membawa Liverpool Juara Liga Inggris Menjelang Musim 2024 2025

May 21, 2025

Siapa Saja Pelatih Yang Pernah Membawa Liverpool Juara Liga Inggris Menjelang Musim 2024 2025

May 21, 2025 -

Cubs Fans Share A Lady And The Tramp Hot Dog Moment

May 21, 2025

Cubs Fans Share A Lady And The Tramp Hot Dog Moment

May 21, 2025