BigBear.ai Holdings: Q1 Report Sends Stock Lower

Table of Contents

BigBear.ai Q1 Earnings Report: A Detailed Breakdown

The Q1 2024 earnings report revealed a disappointing performance for BigBear.ai, falling short of both analyst expectations and previous quarter's results. Understanding the specifics is critical for assessing the implications for BigBear.ai stock.

Revenue and Earnings Miss

BigBear.ai missed revenue and earnings expectations, raising concerns about the company's growth trajectory.

- Revenue: [Insert actual revenue figure] fell short of the analyst consensus estimate of [Insert analyst estimate]. This represents a [Percentage]% decrease compared to Q4 2023 revenue of [Insert Q4 revenue].

- Earnings Per Share (EPS): The reported EPS of [Insert EPS figure] significantly missed the anticipated [Insert analyst EPS estimate], indicating lower-than-projected profitability.

- Reasons for the Miss: The shortfall can be attributed to several factors, including a lower-than-expected number of new contract wins in the government sector, increased competition, and higher-than-anticipated operating expenses related to research and development and sales and marketing.

Key Performance Indicators (KPIs)

Beyond revenue and earnings, other KPIs provide a more comprehensive picture of BigBear.ai's performance.

- Contract Backlog: While the company might have a healthy backlog of future contracts, the rate of securing new contracts needs close monitoring. [Insert data on backlog if available].

- Customer Acquisition Cost (CAC): High CAC suggests challenges in acquiring new clients, impacting profitability. [Insert data on CAC if available].

- Gross Margins: [Insert data on gross margins]. Analyzing trends in gross margins helps to determine the efficiency of operations and pricing strategies.

- Operating Expenses: [Insert data on operating expenses broken down by category]. High operating expenses, especially in research and development, can impact short-term profitability but are crucial for long-term growth.

Management Commentary and Guidance

BigBear.ai management's commentary on the Q1 results and their outlook for the rest of the year is crucial for understanding their strategic response.

- Key Quotes: [Insert key quotes from the earnings call transcript regarding the Q1 performance and future outlook].

- Revised Guidance: Management likely revised its revenue projections for the year. [Insert details on revised guidance, if available]. This will be a key factor in determining future investor sentiment towards BigBear.ai stock.

- Strategic Initiatives: Any changes to strategic initiatives or plans to address the Q1 shortfall should be noted and evaluated for their potential impact on future performance.

Market Reaction and Investor Sentiment

The market reacted negatively to BigBear.ai's Q1 earnings miss, triggering a significant drop in the company's stock price.

Stock Price Decline

The release of the Q1 report resulted in a substantial decline in BigBear.ai stock.

- Percentage Drop: The stock price dropped by [Insert percentage]% following the announcement.

- Trading Volume: Trading volume likely spiked significantly on the day of the announcement, reflecting increased investor activity. [Insert data if available].

- Historical Comparison: Compare the current stock price to its historical performance to put the drop in perspective.

Analyst Reactions

Financial analysts responded to the Q1 results with a mix of reactions.

- Upgrades/Downgrades: Several analysts may have downgraded their rating for BigBear.ai stock. [Insert details on any rating changes and justifications].

- Price Target Adjustments: Analyst price targets likely decreased, reflecting the revised outlook for the company. [Insert details on any price target changes].

- Analyst Quotes: Quotes from prominent analysts provide valuable insight into their assessment of the situation and expectations for the future.

Investor Concerns

Investor concerns following the disappointing Q1 results center around several key areas.

- Future Growth: Investors are concerned about the company's ability to achieve its long-term growth targets given the Q1 performance.

- Competition: Increased competition in the market could further pressure BigBear.ai's revenue and profitability.

- Profitability: The Q1 results raise concerns about the company's ability to achieve sustained profitability.

- Management Execution: Some investors may question the effectiveness of management's strategies and execution capabilities.

Future Outlook for BigBear.ai Stock

Despite the challenges, there are potential catalysts for future growth and factors to consider for long-term investment in BigBear.ai stock.

Potential Catalysts for Growth

Several factors could drive future growth for BigBear.ai.

- New Contract Wins: Securing significant new contracts, especially in the government sector, would significantly boost revenue.

- Successful Product Launches: Successful launches of new products or services could expand the company's market reach and revenue streams.

- Strategic Partnerships: Strategic partnerships with other companies could provide access to new markets and technologies.

- Market Expansion: Expanding into new geographic markets or market segments could unlock new growth opportunities.

Risks and Challenges

However, several risks and challenges remain.

- Competition from Larger Players: Competition from larger, more established companies poses a significant threat.

- Economic Slowdown: A potential economic slowdown could negatively impact government spending and reduce demand for BigBear.ai's services.

- Execution Risks: The company's ability to effectively execute its strategic plans and address the challenges it faces is crucial.

- Integration Challenges: If BigBear.ai has recently undergone mergers or acquisitions, integration challenges could impact performance.

Long-Term Investment Perspective

Investing in BigBear.ai stock involves a degree of risk. While the Q1 report is undeniably disappointing, the long-term potential of the company depends on its ability to address the challenges outlined above and capitalize on the potential catalysts for growth. A thorough due diligence process is essential before making any investment decisions.

Conclusion

BigBear.ai's Q1 earnings report significantly impacted investor sentiment, resulting in a substantial drop in BigBear.ai stock. The reasons for the shortfall include lower-than-expected revenue, missed earnings targets, and heightened concerns about the company's future growth trajectory. While risks associated with competition and economic conditions remain, potential catalysts for future growth exist. Careful consideration of both the challenges and opportunities is crucial before making any investment decisions related to BigBear.ai stock. Conduct your own thorough research and consider your risk tolerance before investing in BigBear.ai stock.

Featured Posts

-

Dusan Tadic In Sueper Lig Deki 100 Maci

May 20, 2025

Dusan Tadic In Sueper Lig Deki 100 Maci

May 20, 2025 -

The Best Wireless Headphones Even Better Than Before

May 20, 2025

The Best Wireless Headphones Even Better Than Before

May 20, 2025 -

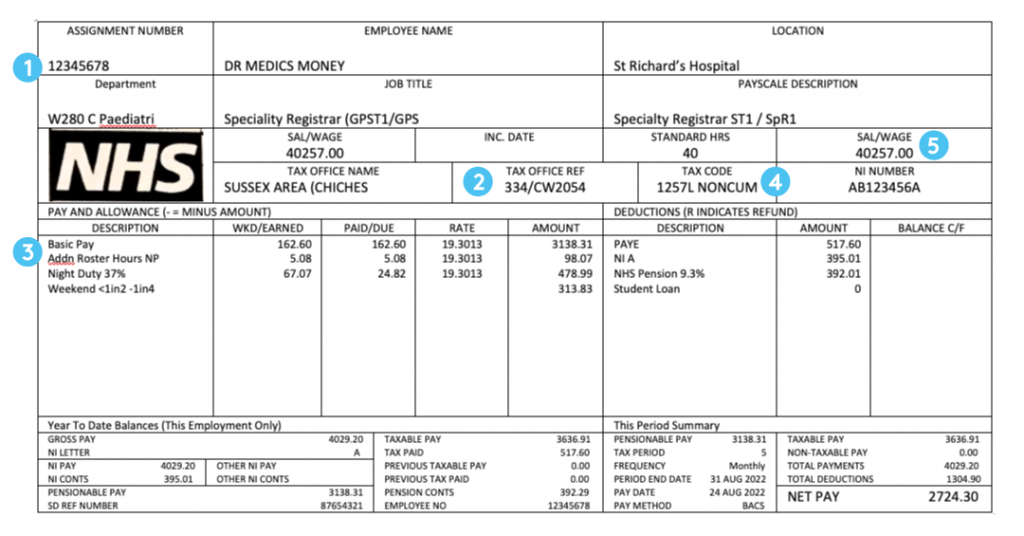

Hmrc Payslip Check Claim Your Potential Refund Today

May 20, 2025

Hmrc Payslip Check Claim Your Potential Refund Today

May 20, 2025 -

Meta Faces Ftc Defense In Monopoly Trial

May 20, 2025

Meta Faces Ftc Defense In Monopoly Trial

May 20, 2025 -

Femicide A Deep Dive Into The Causes Behind The Increasing Number Of Incidents

May 20, 2025

Femicide A Deep Dive Into The Causes Behind The Increasing Number Of Incidents

May 20, 2025

Latest Posts

-

Duenya Futbolu Nda Yeni Bir Doenem Juergen Klopp Geri Doenueyor

May 21, 2025

Duenya Futbolu Nda Yeni Bir Doenem Juergen Klopp Geri Doenueyor

May 21, 2025 -

Real Madrid In Gelecegi Ancelotti Den Klopp A Gecis Muemkuen Mue

May 21, 2025

Real Madrid In Gelecegi Ancelotti Den Klopp A Gecis Muemkuen Mue

May 21, 2025 -

Premier League Champions 2024 25 A Picture Special

May 21, 2025

Premier League Champions 2024 25 A Picture Special

May 21, 2025 -

Ancelottis Future Uncertain Klopps Agent On Potential Real Madrid Move

May 21, 2025

Ancelottis Future Uncertain Klopps Agent On Potential Real Madrid Move

May 21, 2025 -

Juergen Klopp Real Madrid In Yeni Teknik Direktoerue Olabilir Mi

May 21, 2025

Juergen Klopp Real Madrid In Yeni Teknik Direktoerue Olabilir Mi

May 21, 2025