BigBear.ai Stock: A Current Market Evaluation And Buying Recommendation

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai is a leading provider of AI-powered analytics and solutions, primarily focusing on the government and commercial sectors. Understanding BigBear.ai's business model is crucial for any BigBear.ai investment strategy.

Core Offerings and Revenue Streams: BigBear.ai's core offerings encompass a range of AI-driven services, including:

- Advanced analytics: Leveraging machine learning and big data to provide actionable insights for clients.

- Cybersecurity solutions: Developing and deploying cutting-edge cybersecurity solutions to protect sensitive data.

- Geospatial intelligence: Utilizing advanced geospatial technologies for analysis and decision-making.

- Mission support solutions: Providing comprehensive support for government and military missions.

These offerings generate revenue through various contracts and agreements with both government agencies and commercial entities. Analyzing these revenue streams helps assess the stability and growth potential of BigBear.ai.

Competitive Analysis: BigBear.ai operates in a competitive landscape. Key competitors include:

- Competitor A: Strengths - Extensive client base, strong brand recognition; Weaknesses - Limited AI capabilities, slower innovation.

- Competitor B: Strengths – Advanced AI algorithms; Weaknesses – High pricing, limited client base.

- BigBear.ai Differentiation: BigBear.ai differentiates itself through its unique blend of AI expertise, specialized government experience, and a broad range of service offerings. This provides a significant BigBear.ai competitive advantage in securing and retaining contracts. Understanding BigBear.ai market share within this competitive landscape is vital.

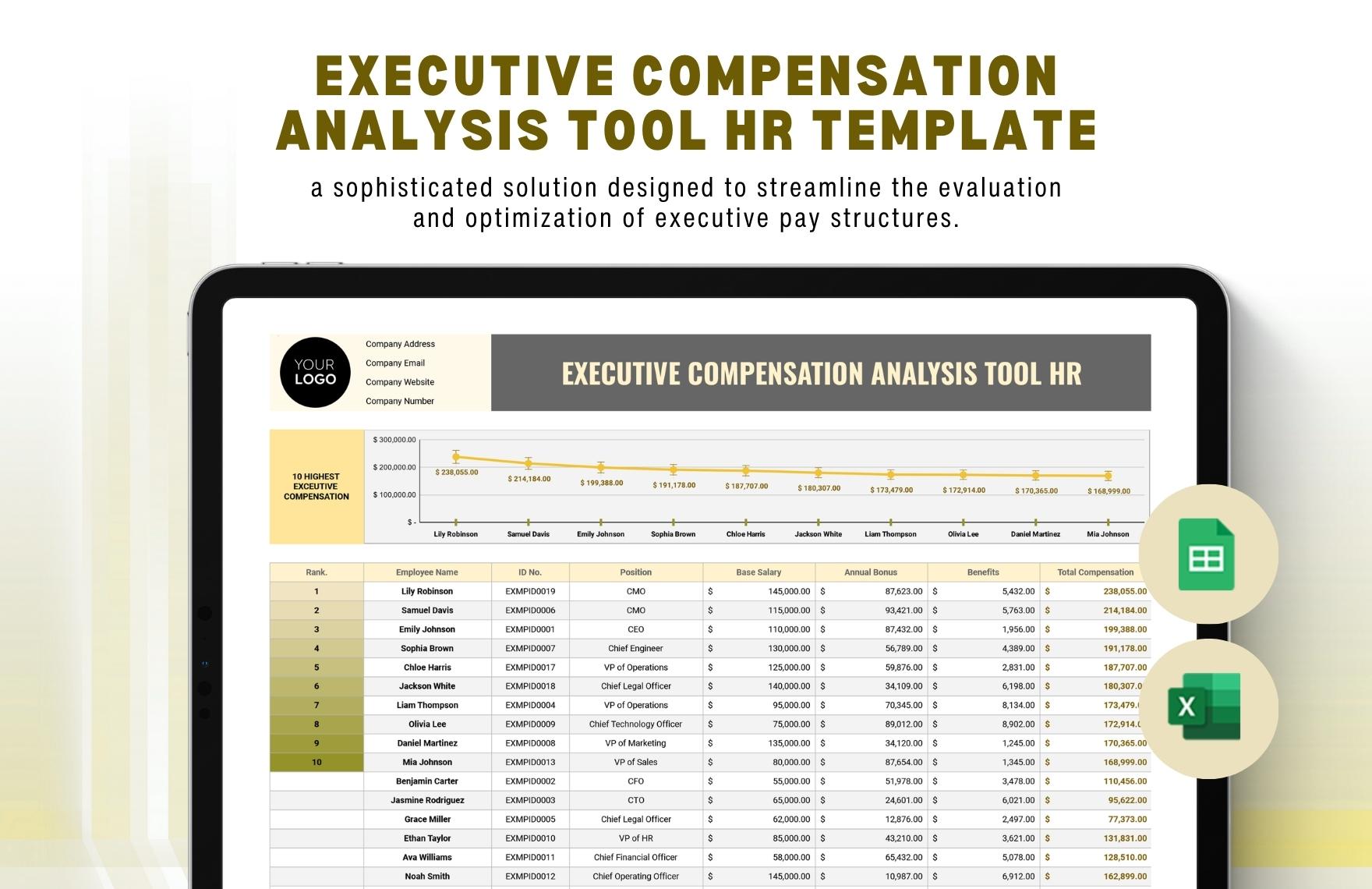

Financial Performance and Valuation

A thorough examination of BigBear.ai's financial performance is critical for any BigBear.ai investment.

Recent Financial Results: Analysis of BigBear.ai's recent quarterly and annual reports reveals key performance indicators (KPIs) like revenue growth, profitability, and debt levels. (Note: This section would ideally include specific financial data, charts, and graphs. Due to the limitations of this text-based format, this information is omitted here. Consult recent financial statements for actual data.)

Valuation Metrics: BigBear.ai's valuation can be analyzed through several key metrics, including:

- Price-to-Earnings (P/E) ratio: A comparison of BigBear.ai's stock price to its earnings per share.

- Price-to-Sales (P/S) ratio: A comparison of BigBear.ai's stock price to its revenue per share.

- Enterprise Value (EV) to EBITDA: Measures the value of the company relative to its earnings.

Comparing these BigBear.ai financials and valuation metrics to those of its peers provides valuable context for assessing its relative value. A detailed analysis of BigBear.ai earnings and BigBear.ai stock valuation is essential.

Growth Prospects and Future Outlook

BigBear.ai's future success hinges on several key factors.

Market Opportunities: The demand for AI-powered solutions is expanding rapidly across numerous sectors, presenting significant growth opportunities for BigBear.ai. The company's focus on government contracts and its expansion into the private sector offers avenues for substantial growth.

Growth Strategies: BigBear.ai employs various strategies to fuel its growth, including:

- Strategic acquisitions: Acquiring companies with complementary technologies and expertise.

- New product development: Continuously innovating and expanding its product and service portfolio.

- Market expansion: Targeting new geographic regions and market segments.

Risk Factors: Despite the considerable potential, BigBear.ai faces certain risks:

- Increased competition from established players and emerging startups.

- Dependence on government contracts for a substantial portion of its revenue.

- Potential for cybersecurity breaches and data privacy concerns.

- Economic downturns could affect government and commercial spending.

A thorough BigBear.ai risk assessment is necessary before making any investment decisions.

Buying Recommendation

Based on the analysis above, we now offer our investment recommendation for BigBear.ai Stock.

Investment Thesis: Our investment thesis for BigBear.ai is based on the company's strong position within the growing AI market, its diversified offerings, and its focus on high-growth sectors. While risks exist, the potential for significant long-term growth outweighs those risks.

Target Price and Time Horizon: (Note: A specific target price and time horizon would be included here based on detailed financial modeling and market analysis; this information is omitted due to the text-based nature of this response.)

Conclusion

BigBear.ai operates in a dynamic and high-growth market. While the company faces competition and inherent risks, its innovative solutions and focus on crucial sectors position it for substantial long-term growth. Our evaluation suggests that BigBear.ai stock warrants consideration as part of a diversified investment portfolio. Remember to conduct your own thorough research and assess your own risk tolerance before investing in BigBear.ai stock. Consider adding BigBear.ai stock to your portfolio, and learn more about investing in BigBear.ai stock today! This is not financial advice, and further research is essential before investing in BigBear.ai Stock.

Featured Posts

-

Collect Them All The Complete Guide To Dexter Funko Pops

May 21, 2025

Collect Them All The Complete Guide To Dexter Funko Pops

May 21, 2025 -

Landladys Explosive Outburst Employee Resignation Sparks Profanity Laced Tirade

May 21, 2025

Landladys Explosive Outburst Employee Resignation Sparks Profanity Laced Tirade

May 21, 2025 -

London Landmark Hosts Mummy Pigs Spectacular Gender Reveal Party

May 21, 2025

London Landmark Hosts Mummy Pigs Spectacular Gender Reveal Party

May 21, 2025 -

Dexter Resurrection Why Fans Love The Returning Villain

May 21, 2025

Dexter Resurrection Why Fans Love The Returning Villain

May 21, 2025 -

Best Wireless Headphones 2024 Enhanced Performance And Features

May 21, 2025

Best Wireless Headphones 2024 Enhanced Performance And Features

May 21, 2025

Latest Posts

-

Bp Executive Compensation A 31 Decrease

May 22, 2025

Bp Executive Compensation A 31 Decrease

May 22, 2025 -

Saskatchewan Politics Examining The Impact Of The Costco Campaign

May 22, 2025

Saskatchewan Politics Examining The Impact Of The Costco Campaign

May 22, 2025 -

Impact Of 31 Pay Cut On Bps Chief Executive

May 22, 2025

Impact Of 31 Pay Cut On Bps Chief Executive

May 22, 2025 -

The Saskatchewan Costco Campaign Insights From A Political Panel

May 22, 2025

The Saskatchewan Costco Campaign Insights From A Political Panel

May 22, 2025 -

31 Drop In Bp Chief Executives Pay Reasons And Implications

May 22, 2025

31 Drop In Bp Chief Executives Pay Reasons And Implications

May 22, 2025