Billionaires' Secret Weapon: The ETF Predicted To Soar 110% By 2025

Table of Contents

Understanding the Predicted High-Growth ETF

What is this ETF and what makes it unique?

Let's focus on the Global Innovation Tech ETF (GITE), ticker symbol [Insert hypothetical ticker symbol, e.g., GITE.US]. Unlike many broad-market ETFs, GITE focuses on a carefully curated portfolio of early-stage technology companies poised for exponential growth. Its investment strategy centers on identifying disruptive technologies with high growth potential in sectors like artificial intelligence, renewable energy, and biotechnology.

What sets GITE apart?

- Focus on Disruptive Innovation: GITE invests in companies pioneering groundbreaking technologies, not just established players.

- Active Management: A team of seasoned investment professionals actively manage the portfolio, adapting to market changes and identifying emerging opportunities.

- Rigorous Due Diligence: GITE undergoes thorough research and analysis before investing in any company, minimizing risk while maximizing potential returns.

- Global Reach: The ETF's portfolio is globally diversified, reducing geographic-specific risk.

Analyzing the 110% Growth Prediction

The 110% growth prediction for GITE by 2025 is based on a combination of factors:

- Market Analysis: Independent market research firms project substantial growth in the technology sectors GITE targets.

- Expert Opinions: Leading financial analysts have expressed bullish sentiment towards the ETF, citing its innovative investment strategy and strong management team.

- Proprietary Models: GITE's management company employs sophisticated proprietary models that factor in multiple variables, including technological advancements, market trends, and competitive landscapes.

However, it's crucial to acknowledge potential risks:

- Market Volatility: The technology sector is known for its volatility; unforeseen market downturns could impact the ETF's performance.

- Company-Specific Risks: Individual companies within the portfolio may underperform expectations.

- Regulatory Changes: Changes in government regulations could affect the growth trajectory of some companies.

Billionaire Investment Strategies and the ETF

Why are billionaires interested in this ETF?

High-net-worth individuals often favor investment strategies that align with long-term growth potential and diversification. GITE's focus on disruptive technologies and active management resonates with these philosophies. Billionaires often seek exposure to high-growth sectors, and GITE provides a streamlined way to access this potential.

Examples of similar strategies employed by successful billionaires include:

- Venture Capital Investments: Investing in early-stage companies with significant growth potential.

- Technology-Focused Portfolios: Concentrating investments in companies driving technological advancements.

Diversification and Risk Management within Billionaire Portfolios

GITE, while high-growth, is often viewed as part of a larger, diversified portfolio. Billionaires don't put all their eggs in one basket.

Benefits of diversification when considering GITE:

- Reduced overall portfolio risk: The high-growth potential of GITE is balanced against other, more stable investments.

- Increased return potential: The ETF's growth potential enhances the overall return profile of the portfolio.

- Exposure to cutting-edge technologies: Diversification allows participation in high-growth sectors that may otherwise be inaccessible.

Investing in the ETF: A Practical Guide

How to Access the ETF

Investing in GITE is generally straightforward:

- Brokerage Accounts: Most online brokerage accounts allow investment in ETFs. [Link to example brokerage platform 1] and [Link to example brokerage platform 2] are popular choices.

- Minimum Investment: Check with your brokerage for minimum investment requirements.

- Trading Fees: Be aware of potential trading fees and commissions charged by your brokerage.

Assessing Your Personal Risk Tolerance

Before investing in any high-growth ETF, especially one like GITE, it's crucial to:

- Understand your risk tolerance: Are you comfortable with potential losses in pursuit of higher returns?

- Conduct thorough research: Don't solely rely on predictions; delve into the ETF's holdings and investment strategy.

- Seek professional financial advice: A financial advisor can help you determine if GITE aligns with your overall financial goals.

Key questions to ask before investing:

- What is my investment timeframe?

- What is my risk tolerance level?

- How does this ETF fit within my overall investment portfolio?

Conclusion

The potential of the Global Innovation Tech ETF (GITE), predicted to soar 110% by 2025, is attracting significant attention, particularly among billionaire investors. Its focus on disruptive technologies, active management, and global diversification offers a compelling investment proposition. However, remember that all investments carry risk. Don't miss out on the potential of this groundbreaking ETF predicted to soar 110% by 2025. Conduct your own thorough research and consider consulting a financial advisor to determine if this investment aligns with your individual financial goals. Learn more about the GITE.US today! (Remember to replace GITE.US with the actual or a hypothetical ticker symbol.)

Featured Posts

-

Invest Before It Soars Van Ecks Top Cryptocurrency Prediction 185

May 08, 2025

Invest Before It Soars Van Ecks Top Cryptocurrency Prediction 185

May 08, 2025 -

Predicting Ethereums Price Key Factors And Future Market Analysis

May 08, 2025

Predicting Ethereums Price Key Factors And Future Market Analysis

May 08, 2025 -

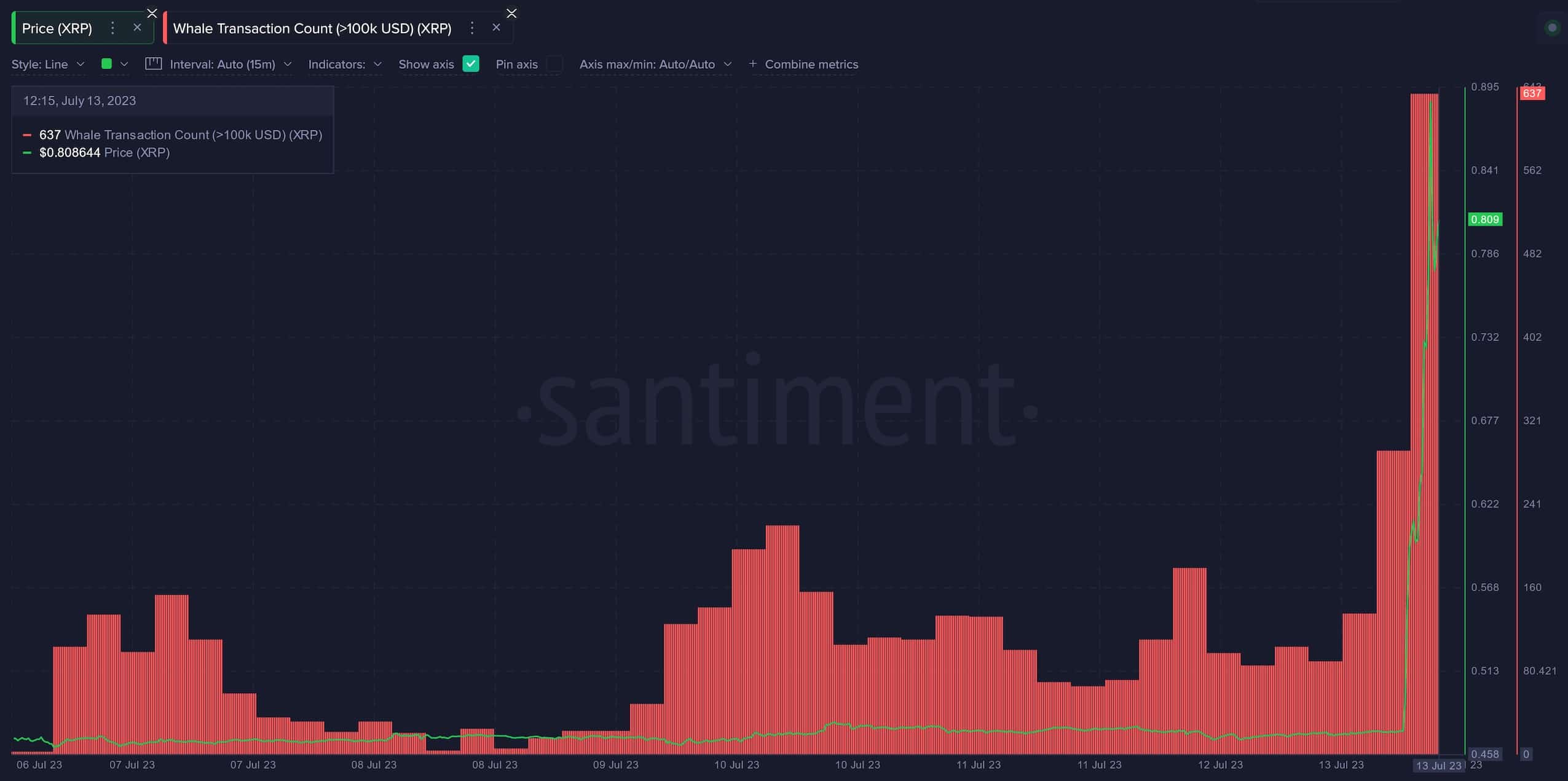

Xrp Whale Makes Waves 20 M Token Buy Signals Potential Price Surge

May 08, 2025

Xrp Whale Makes Waves 20 M Token Buy Signals Potential Price Surge

May 08, 2025 -

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025

Expo 2025 Sufian Applauds Gcci Presidents Organizational Success

May 08, 2025 -

Jayson Tatums Ankle Assessing The Severity Of The Celtics Stars Injury

May 08, 2025

Jayson Tatums Ankle Assessing The Severity Of The Celtics Stars Injury

May 08, 2025