XRP Whale Makes Waves: 20M Token Buy Signals Potential Price Surge

Table of Contents

The 20 Million XRP Purchase: A Deep Dive

The acquisition of 20 million XRP represents a substantial investment in the cryptocurrency. Understanding the details surrounding this transaction is crucial to assessing its impact.

Identifying the Whale

Pinpointing the exact entity behind this large XRP transaction requires careful on-chain analysis. By examining publicly available blockchain data, we can attempt to identify the wallet address or addresses involved. This process often involves scrutinizing transaction histories, looking for patterns and connections to other known XRP wallets. While complete anonymity is difficult to guarantee on a public blockchain like XRP Ledger, identifying the wallet's historical activity can offer clues to the buyer's identity and investment strategy. Understanding if this was a single large purchase or a series of coordinated buys from multiple entities is also a critical factor in determining the market influence of this action. Keywords like XRP whale, large XRP transaction, on-chain analysis, and XRP wallet are essential for understanding this aspect.

Market Reaction to the XRP Buy

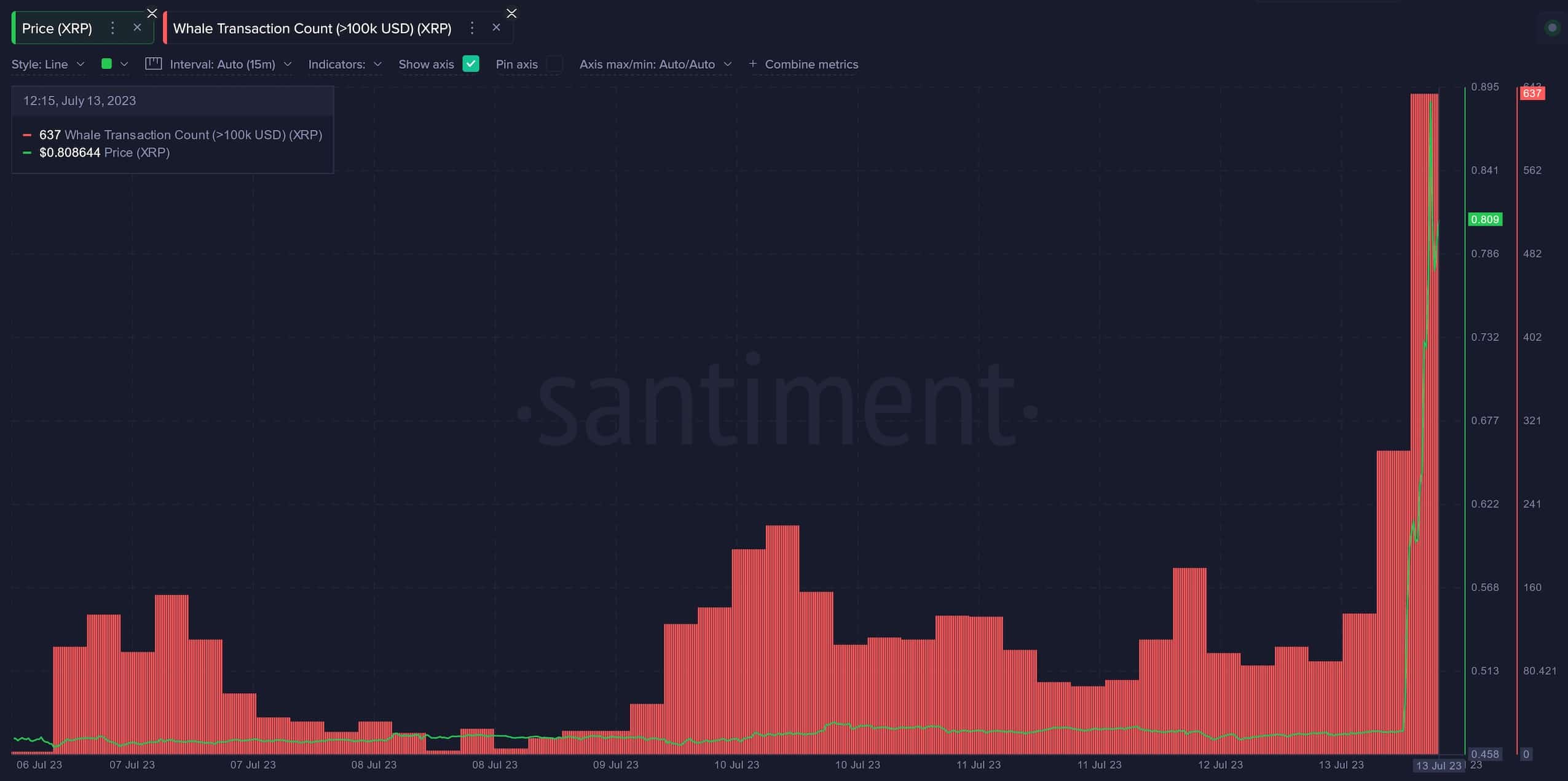

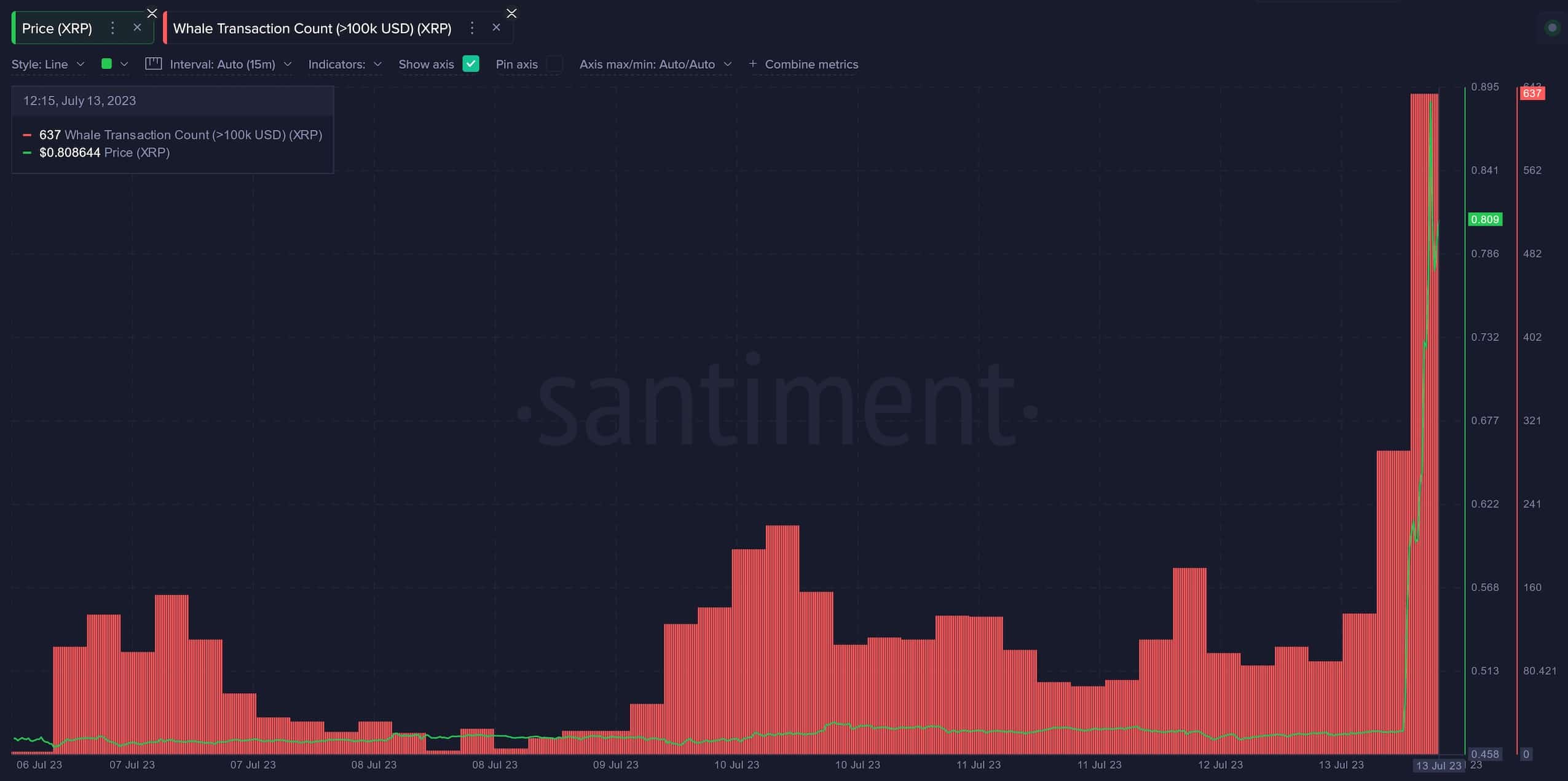

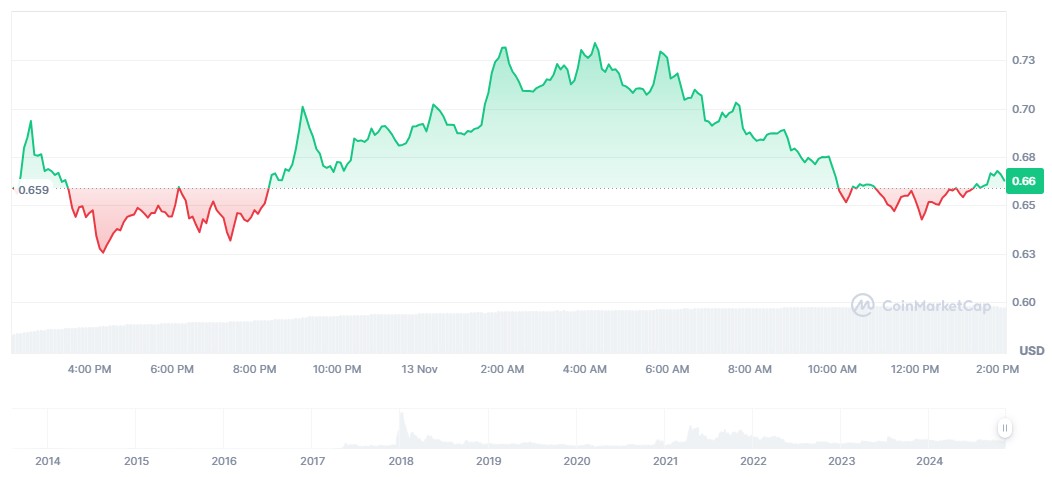

The immediate aftermath of the 20 million XRP purchase was a noticeable surge in trading activity. Analyzing the XRP price chart reveals a clear correlation between the news of the large purchase and a subsequent price increase. This price jump is not solely attributable to the buy itself, as market sentiment and other factors also play a significant role. Examining the XRP price chart, we can observe the price volatility surrounding the transaction and compare the price movements before and after the event. This provides concrete evidence of the market's short-term reaction to the whale's activity. We can further analyze changes in market capitalization and trading volume to get a complete picture of the impact.

- Percentage Change: The XRP price experienced a [insert percentage]% increase within [insert timeframe] following the news of the large purchase.

- Trading Volume Spike: A significant surge in trading volume was observed, indicating heightened market interest and activity.

- Unusual Activity: [Mention any unusual trading patterns, such as large sell orders immediately preceding the buy, or unusual price fluctuations].

Analyzing the Whale's History and Intent

Understanding the historical behavior of this XRP whale is crucial to interpreting the recent 20 million XRP purchase.

Past XRP Whale Activity

Has this specific wallet address engaged in similar large-scale XRP purchases or sales in the past? Analyzing the whale's trading history can reveal if this is a typical pattern of accumulation or a significant deviation from their usual strategy. Identifying whether this whale typically engages in short-term trading or long-term investments provides valuable context. This historical data, combined with current market conditions, allows for a more nuanced interpretation of their intentions. Keywords like XRP trading history, whale accumulation, long-term investment, and short-term trading are crucial here.

Speculative Reasons Behind the Purchase

The motivation behind the 20 million XRP purchase remains speculative but several hypotheses can be explored. The whale might believe in XRP's future price increase, positioning themselves for long-term gains. It could also be a strategic investment based on upcoming news or developments within the Ripple ecosystem. Alternatively, the possibility of market manipulation, though less likely, cannot be entirely ruled out.

- Upcoming Ripple Developments: The ongoing Ripple lawsuit and potential regulatory clarity could significantly impact XRP's price. Any upcoming partnerships or technological advancements would also influence this decision.

- Market Sentiment: A bullish sentiment surrounding XRP, driven by factors such as positive news, technological advancements, or increased adoption, would likely encourage large purchases.

- Regulatory Changes: Changes in regulatory landscape impacting cryptocurrencies, particularly in key jurisdictions, could significantly affect XRP's price.

Predicting Future XRP Price Movements

Predicting future price movements is inherently uncertain, but analyzing technical and fundamental factors can help us assess potential scenarios.

Technical Analysis

Technical analysis of XRP price charts using indicators like moving averages, Relative Strength Index (RSI), and identification of support and resistance levels can offer insights into potential price movements. Are there signs of a continuation of the upward trend following the recent whale purchase? Or are there indications of an impending correction or consolidation phase? This analysis provides a short-term perspective on the potential price trajectory. Keywords such as XRP technical analysis, support and resistance levels, and price targets are vital for understanding this aspect.

Fundamental Analysis

Fundamental analysis focuses on the underlying value of XRP and the Ripple ecosystem. Factors such as Ripple's ongoing legal battles, technological advancements in its payment solutions, the rate of XRP adoption, and the competitive landscape within the cryptocurrency market are crucial considerations. A strong fundamental outlook suggests a higher likelihood of long-term price appreciation. Keywords like Ripple technology, XRP utility, adoption rate, and market competition are relevant here.

- Price Prediction Scenarios: We can outline optimistic, neutral, and pessimistic price prediction scenarios based on the combination of technical and fundamental analysis.

- Disclaimers: It's crucial to emphasize that any price prediction carries inherent uncertainty.

- Expert Opinions: Incorporating opinions from reputable crypto analysts and experts can add valuable perspective.

Conclusion: XRP Whale Activity and the Path Forward

The 20 million XRP purchase by a whale has generated substantial market interest and introduced potential price volatility. While the whale's exact motivations remain speculative, the transaction serves as a significant event warranting close observation. Analyzing both technical and fundamental factors is essential for formulating a comprehensive forecast of future XRP price movements. The ongoing Ripple lawsuit and broader regulatory landscape will continue to play a crucial role in shaping the XRP market's trajectory.

Call to action: Stay informed about the evolving XRP market and the impact of this significant purchase. Continue monitoring XRP whale activity and follow us for further insights into potential XRP price surges. Learn more about XRP investment strategies and stay updated on the latest developments in the XRP market.

Featured Posts

-

Ethereum Price Holds Strong Is A Breakout Imminent

May 08, 2025

Ethereum Price Holds Strong Is A Breakout Imminent

May 08, 2025 -

Analyzing Trumps Statement On Protecting Greenland From China

May 08, 2025

Analyzing Trumps Statement On Protecting Greenland From China

May 08, 2025 -

Ripple Xrp Price Increase Analyzing The Trump Influence

May 08, 2025

Ripple Xrp Price Increase Analyzing The Trump Influence

May 08, 2025 -

Jayson Tatums Commercial Fuels Speculation Baby With Ella Mai

May 08, 2025

Jayson Tatums Commercial Fuels Speculation Baby With Ella Mai

May 08, 2025 -

Leveraging Technology Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025

Leveraging Technology Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025