Bitcoin Chart Analysis: Entering A Rally Zone? (May 6, 2024)

Table of Contents

Technical Indicators Suggesting a Potential Bitcoin Rally

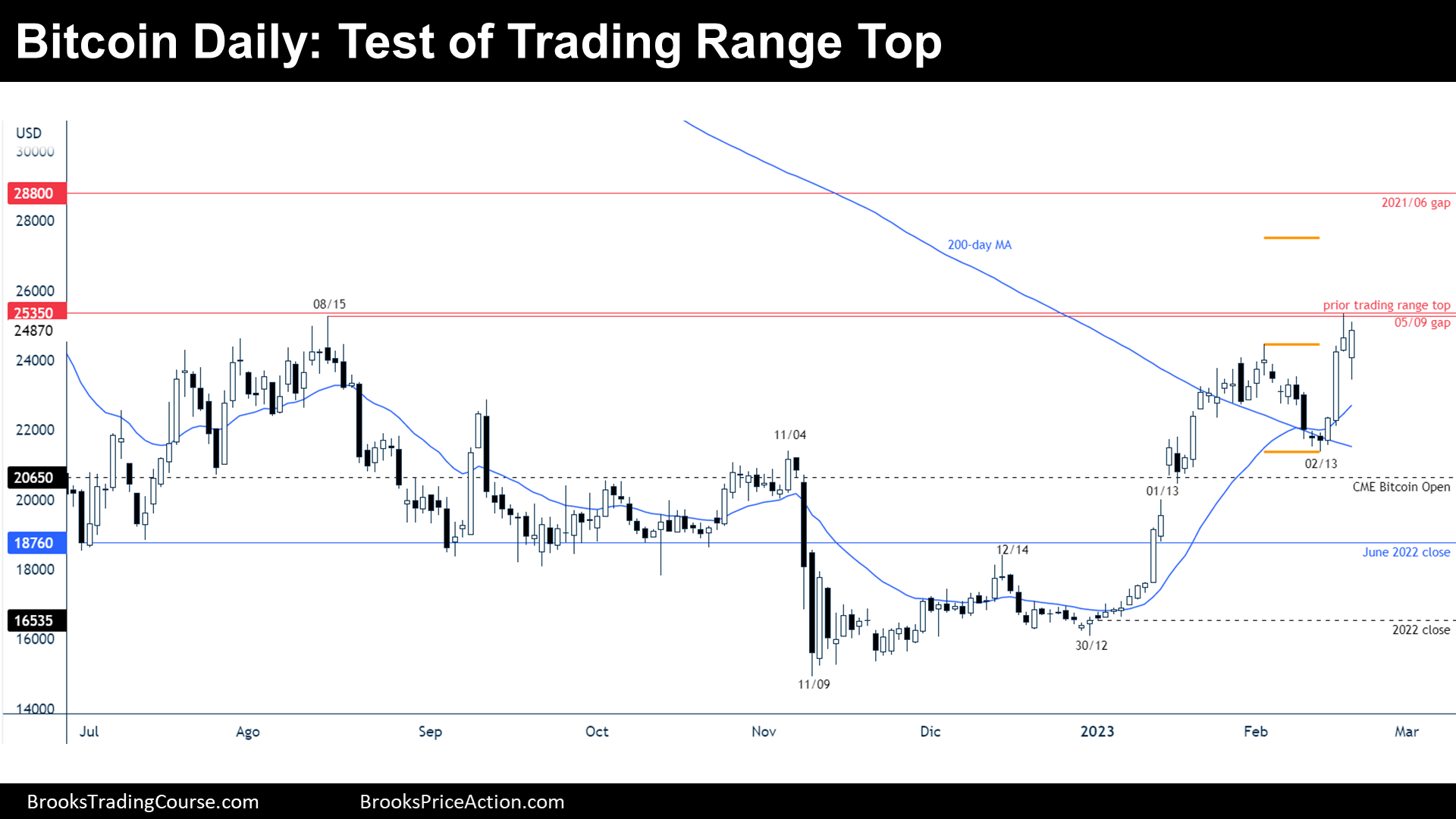

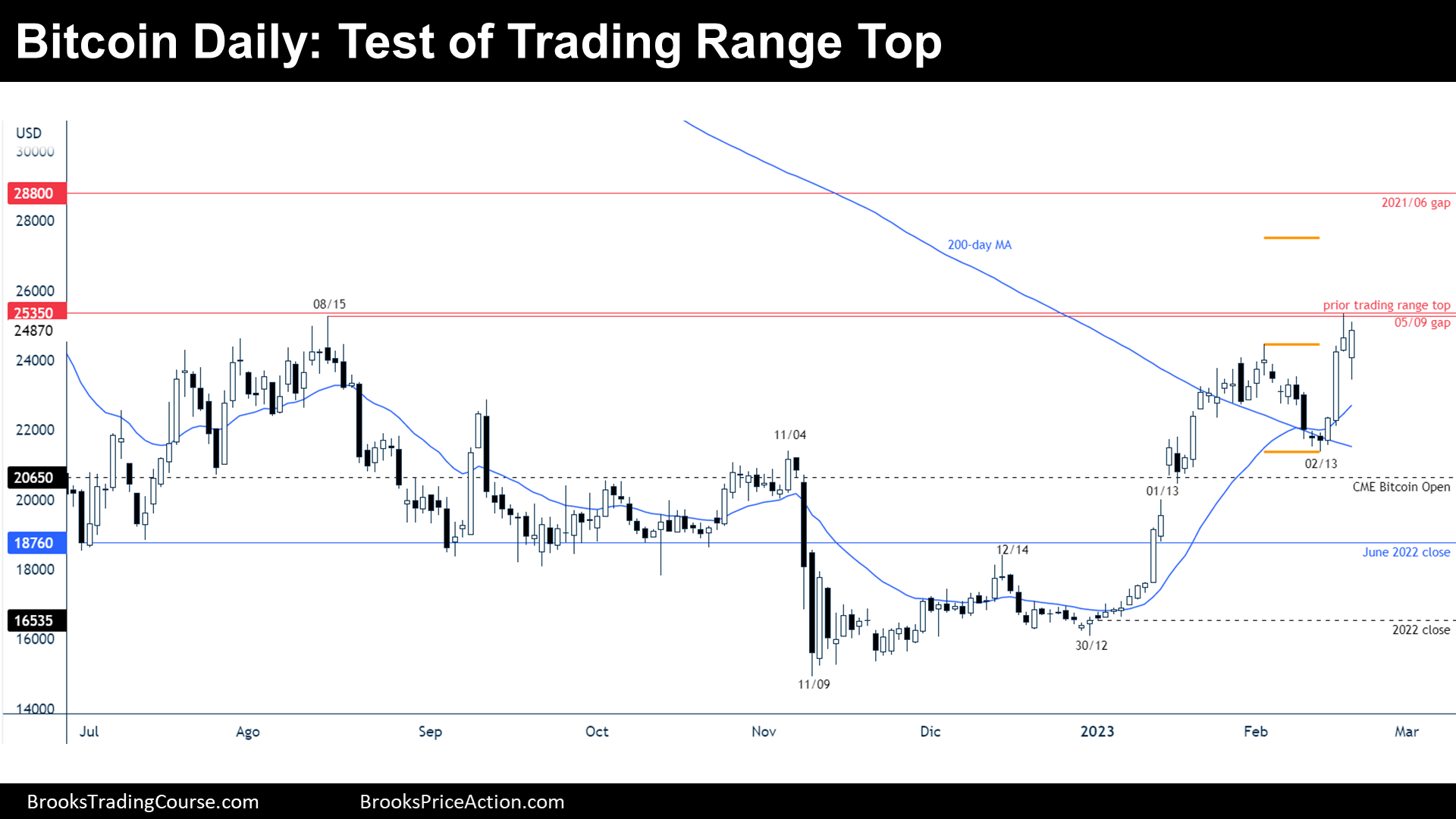

Technical analysis is a cornerstone of Bitcoin trading strategies. By studying Bitcoin technical indicators, we can glean valuable insights into potential price movements. Let's examine some key indicators:

-

Relative Strength Index (RSI): The RSI is currently showing oversold conditions, suggesting that the Bitcoin price may be nearing a bottom. An RSI below 30 often signals potential upward momentum. This is a bullish sign for Bitcoin price prediction.

-

Moving Average Convergence Divergence (MACD): The MACD is hinting at a bullish crossover, a classic indicator of a potential trend reversal. This, combined with the oversold RSI, strengthens the case for a potential Bitcoin rally.

-

Bollinger Bands: The Bollinger Bands are squeezing, indicating a period of low volatility. This compression often precedes a significant price breakout, either to the upside or downside. Given the other indicators, an upward breakout seems more likely in our Bitcoin chart analysis.

-

Support and Resistance Levels: Bitcoin's price has recently bounced off a key support level, demonstrating buyer interest and potentially indicating a floor for the current price. Breaking through the nearest resistance level would confirm a rally. Careful observation of these levels is crucial for successful Bitcoin trading.

On-Chain Metrics Pointing Towards Increased Bitcoin Accumulation

Beyond technical analysis, on-chain metrics provide valuable insights into the behavior of Bitcoin holders. These metrics offer a different perspective on Bitcoin price prediction:

-

Decreasing Exchange Balances: A significant decrease in Bitcoin held on exchanges suggests that investors are accumulating Bitcoin rather than selling. This accumulation trend supports the notion of a bullish market sentiment.

-

Increased Network Activity: Higher network activity, measured by transaction volume and hash rate, usually signifies increased interest and engagement in the Bitcoin network. This is a positive sign for long-term Bitcoin price predictions.

-

Bitcoin Whale Activity: Monitoring the activity of large Bitcoin holders ("whales") can provide clues about market sentiment. Increased accumulation by whales can be a significant bullish indicator for Bitcoin's future price.

-

Bitcoin Hash Rate: A stable or increasing Bitcoin hash rate demonstrates the network's robust security and resilience, further bolstering confidence in the cryptocurrency.

Macroeconomic Factors Influencing Bitcoin's Price

Bitcoin's price is not immune to macroeconomic influences. Several global factors can impact its price trajectory and potential for a rally:

-

Inflation and Interest Rates: High inflation often drives investors towards Bitcoin as a hedge against inflation, boosting its price. Conversely, interest rate hikes can reduce risk appetite, potentially impacting Bitcoin investment.

-

Regulatory Environment: Clearer regulatory frameworks in various jurisdictions could increase institutional investment in Bitcoin, leading to higher prices. Uncertainty around regulation can, conversely, suppress price increases.

-

Global Economic Outlook: A positive global economic outlook generally fosters greater risk appetite, benefiting Bitcoin's price. Conversely, economic uncertainty tends to drive investors towards safer assets.

Potential Catalysts for a Bitcoin Rally

Several potential events could act as catalysts for a Bitcoin price rally:

-

Increased Institutional Adoption: Further adoption of Bitcoin by institutional investors could significantly boost demand and price.

-

Regulatory Clarity: Clearer regulatory frameworks worldwide would likely increase institutional confidence and investment.

-

Technological Upgrades: Improvements to the Bitcoin network's scalability and efficiency could increase adoption and value.

-

Bitcoin Halving: The upcoming Bitcoin halving (a reduction in the rate of new Bitcoin creation) is historically associated with price increases due to reduced supply.

Conclusion

Our Bitcoin chart analysis, incorporating technical indicators, on-chain metrics, and macroeconomic factors, suggests a potential for an upcoming Bitcoin rally. The oversold RSI, the bullish MACD crossover, decreasing exchange balances, and the potential impact of the upcoming halving all point towards a positive outlook. However, it's crucial to remember that macroeconomic conditions and regulatory developments could significantly influence the market.

Before making any investment decisions, conduct thorough research and consult with a financial advisor. Stay tuned for further Bitcoin chart analysis and predictions as we continue to monitor the market and provide updates on Bitcoin price prediction. For more insights, check out our resources on [link to related articles on Bitcoin chart analysis].

Featured Posts

-

222 Milione Euro Agjenti Zbulon Detaje Te Transferimit Te Neymar Te Psg

May 08, 2025

222 Milione Euro Agjenti Zbulon Detaje Te Transferimit Te Neymar Te Psg

May 08, 2025 -

Violenta Pelea Entre Flamengo Y Botafogo Detalles Del Incidente En El Partido

May 08, 2025

Violenta Pelea Entre Flamengo Y Botafogo Detalles Del Incidente En El Partido

May 08, 2025 -

Xrp Price Action Analyzing The Impact Of The Derivatives Market

May 08, 2025

Xrp Price Action Analyzing The Impact Of The Derivatives Market

May 08, 2025 -

Crypto Whales Bet Big This Altcoins Projected 5880 Rally

May 08, 2025

Crypto Whales Bet Big This Altcoins Projected 5880 Rally

May 08, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And Its Implications

May 08, 2025

Activision Blizzard Acquisition Ftcs Appeal And Its Implications

May 08, 2025