XRP Price Action: Analyzing The Impact Of The Derivatives Market

Table of Contents

The Mechanics of XRP Derivatives Trading

XRP derivatives provide investors with tools to speculate on XRP's price movements or hedge against potential losses. Several types of derivatives exist, each offering unique opportunities and risks.

-

Futures Contracts: These contracts obligate the buyer to purchase (or the seller to sell) a specific amount of XRP at a predetermined price on a future date. Futures contracts are useful for price prediction and hedging against price fluctuations. For example, a trader anticipating a price increase might buy a futures contract, locking in a favorable purchase price. Conversely, a trader holding XRP might sell a futures contract to protect against price drops.

-

Options Contracts: Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a specific price (strike price) on or before a certain date (expiration date). Options contracts provide flexibility for speculation and risk management. A trader believing the price will rise might buy a call option, profiting if the price exceeds the strike price at expiration.

-

Swaps: Swaps are private agreements between two parties to exchange cash flows based on the performance of XRP. These are less commonly traded publicly compared to futures and options, but play a significant role in facilitating institutional participation and price discovery within the XRP market. They allow institutions to manage their XRP exposure in more nuanced ways.

These contracts are primarily traded on regulated exchanges, providing a degree of transparency and oversight. However, over-the-counter (OTC) markets also exist, facilitating larger, private transactions, often between institutional investors.

Impact of Derivatives on XRP Price Volatility

A strong correlation exists between XRP derivatives trading volume and XRP price fluctuations. Increased trading activity in the derivatives market often amplifies price swings, both upward and downward.

-

Amplified Price Swings: The use of leverage in derivatives trading can significantly magnify price movements. A small price change in the underlying XRP asset can lead to proportionally larger gains or losses in derivative contracts.

-

Hedging Activities: Institutional investors frequently use derivatives for hedging purposes, aiming to offset potential losses from their XRP holdings. While this can sometimes stabilize prices, large-scale hedging activities can also contribute to price instability depending on the market direction and overall trader sentiment.

-

Historical Examples: Examining historical data reveals several instances where significant price movements in XRP were directly linked to surges in derivatives trading volume, particularly around major news announcements or regulatory developments. (Note: Incorporate charts and graphs here to visually represent this correlation, potentially using data from reputable sources like CoinMarketCap or specialized crypto analytics platforms).

Liquidity and Market Depth: The Role of Derivatives

The XRP derivatives market significantly influences the overall liquidity and market depth of XRP. While its role isn't solely positive, it presents a critical component of overall market health.

-

Increased Market Depth: Derivatives trading attracts a wider range of participants, including institutional investors who might otherwise be hesitant to directly hold XRP. This increased participation adds liquidity and depth to the market, making it easier for traders to buy or sell large quantities of XRP without drastically affecting the price.

-

Risks of Excessive Leverage: The availability of leverage in derivatives trading can introduce risks. Excessive leverage can amplify losses and contribute to market instability, potentially leading to cascading liquidations and price crashes.

-

Limited Derivative Offerings: The limited availability of XRP derivatives on certain exchanges can restrict price discovery and limit liquidity, especially compared to more established cryptocurrencies with more comprehensive derivative markets. Specific exchanges like (mention exchanges offering XRP derivatives here) play significant roles in setting the market tone. Their market share and trading volumes should be analyzed to understand their contribution to liquidity.

Regulatory Landscape and its Influence on XRP Derivatives

The regulatory environment surrounding crypto derivatives is constantly evolving, and this has a profound impact on the XRP market. Global regulations vary widely, influencing investor confidence and trading activity.

-

Impact on Trading Volumes: Stricter regulations often lead to reduced trading volumes as some investors may choose to exit the market due to compliance difficulties or increased costs.

-

Potential Impact on XRP Price Action: Regulatory uncertainty can significantly affect XRP's price, creating volatility as investors react to potential changes in the regulatory landscape. Positive regulatory developments can boost investor confidence, while negative news can lead to price drops.

-

Regulatory Uncertainty: The lack of clear and consistent global regulations for crypto derivatives contributes to significant uncertainty in the XRP market, fostering volatility and hindering long-term price predictability. (Mention any relevant recent regulatory developments or announcements pertaining to XRP or crypto derivatives here.)

Conclusion

The XRP derivatives market exerts a substantial, often underestimated, influence on XRP price action. Understanding the mechanics of these derivative instruments, their impact on volatility and liquidity, and the surrounding regulatory environment is essential for anyone involved in XRP trading or investment. While derivatives can enhance liquidity and provide valuable risk management tools, they can also amplify price swings and contribute to market instability. By meticulously analyzing the interaction between the underlying XRP market and its derivative counterpart, investors can develop better-informed strategies and navigate the complexities of this evolving cryptocurrency landscape. Keep monitoring the XRP price action and its correlation with the derivatives market for informed decision-making. Stay updated on the latest news and regulatory developments impacting the XRP market and its derivatives to make well-informed investment decisions regarding XRP price action.

Featured Posts

-

Gambits New Weapon A Poignant Tribute To Rogue

May 08, 2025

Gambits New Weapon A Poignant Tribute To Rogue

May 08, 2025 -

Bitcoins Potential A Growth Investors 1 500 Prediction For The Next 5 Years

May 08, 2025

Bitcoins Potential A Growth Investors 1 500 Prediction For The Next 5 Years

May 08, 2025 -

Is Xrps Recovery Stalled A Look At The Derivatives Market

May 08, 2025

Is Xrps Recovery Stalled A Look At The Derivatives Market

May 08, 2025 -

Analyst Sees Bitcoin Entering Rally Zone Chart Analysis May 6 2024

May 08, 2025

Analyst Sees Bitcoin Entering Rally Zone Chart Analysis May 6 2024

May 08, 2025 -

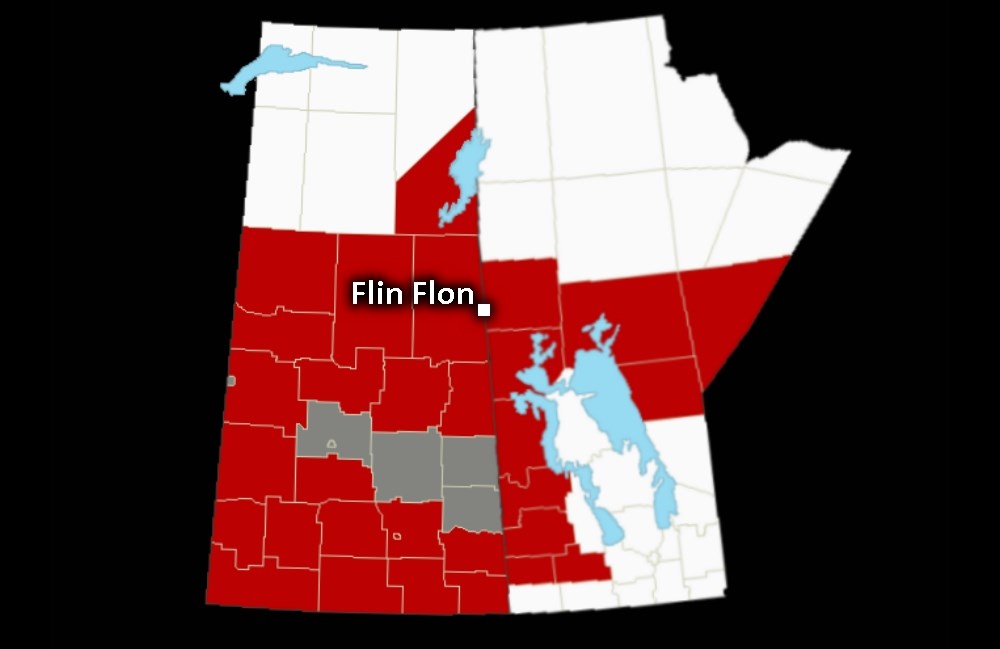

Heavy Snow To Hit Western Manitoba Travel Impacts Expected Tuesday

May 08, 2025

Heavy Snow To Hit Western Manitoba Travel Impacts Expected Tuesday

May 08, 2025