Bitcoin Investment: Exploring A Potential 1,500% Return In 5 Years

Table of Contents

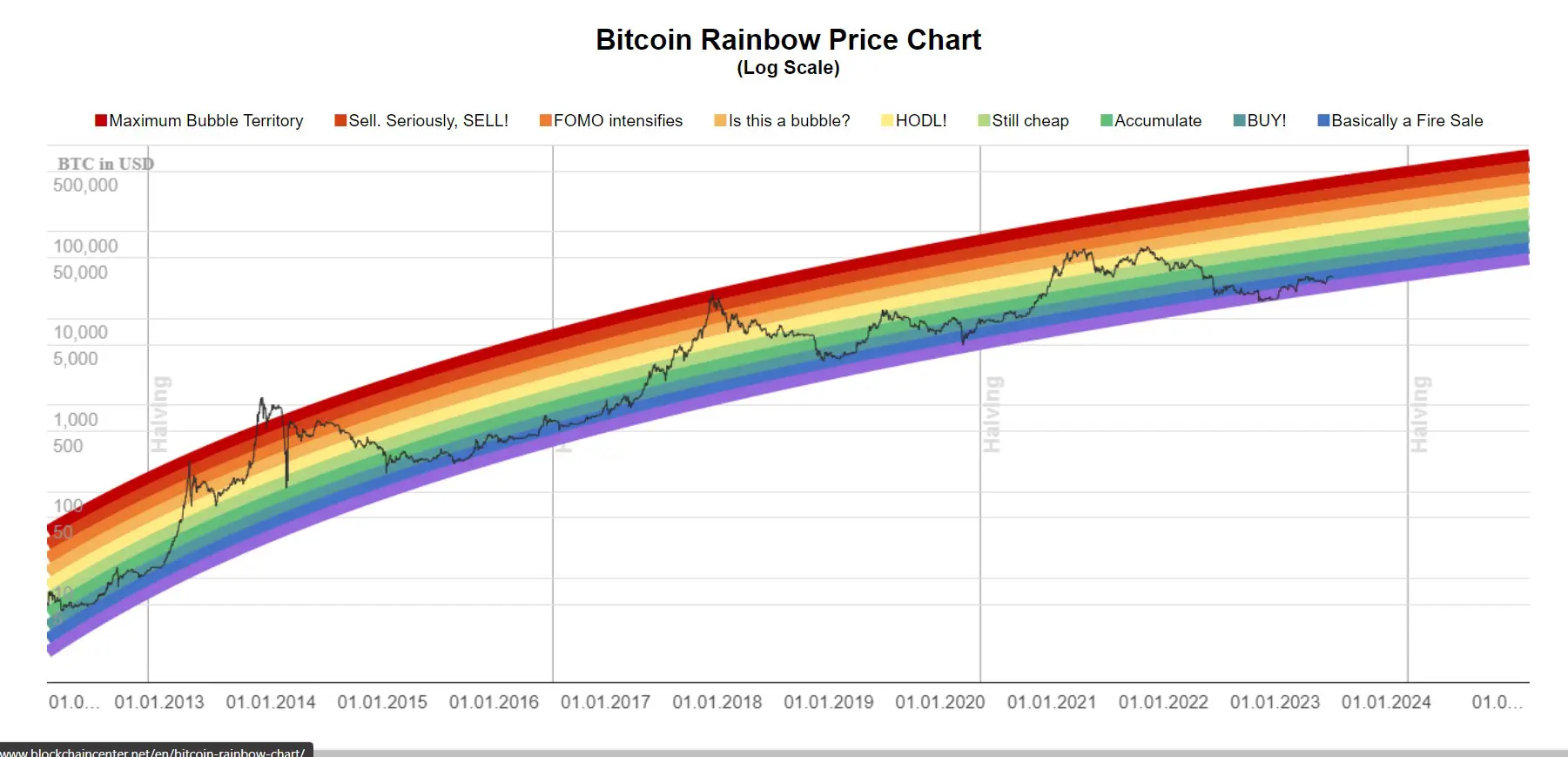

Historical Bitcoin Price Volatility and Growth Potential

Bitcoin's history is marked by periods of explosive growth interspersed with significant corrections. Understanding these cycles is crucial to assessing its future potential.

-

Past Price Surges: Bitcoin has experienced several instances of dramatic price increases in relatively short periods. For example, its price surged from under $1,000 in 2017 to nearly $20,000 by the end of the year, a phenomenal increase. While past performance doesn't guarantee future results, analyzing these periods helps identify potential catalysts for future growth.

-

Market Cycle Analysis: Bitcoin's price typically follows cyclical patterns, characterized by periods of bull markets (rapid price appreciation) and bear markets (price declines). Studying these cycles helps investors anticipate potential trends and adjust their strategies accordingly. Understanding halving events, which reduce the rate of new Bitcoin creation, is also key to predicting future price movements.

-

Drivers of Historical Growth: Several factors have driven Bitcoin's past price surges, including:

- Increased adoption: Wider acceptance by businesses and institutions fuels demand.

- Technological advancements: Upgrades to the Bitcoin network improve scalability and efficiency.

- Regulatory changes: Positive regulatory developments in certain jurisdictions can boost investor confidence.

Factors Contributing to Potential 1,500% Growth

While a 1,500% return is ambitious, several factors could contribute to significant Bitcoin price appreciation:

-

Institutional Adoption: Increased investment from large financial institutions, hedge funds, and corporations signifies growing mainstream acceptance.

-

Global Demand and Scarcity: Bitcoin's limited supply (21 million coins) creates inherent scarcity, potentially driving up prices as demand increases.

-

Technological Upgrades: The Lightning Network and other scalability solutions aim to improve transaction speeds and reduce fees, making Bitcoin more user-friendly and attractive to a wider audience.

-

Regulatory Clarity: Increased regulatory clarity and acceptance in major economies could legitimize Bitcoin further, encouraging wider investment.

-

Macroeconomic Factors: Economic uncertainty and inflation could drive investors towards Bitcoin as a hedge against traditional assets.

Risks Associated with Bitcoin Investment and Mitigation Strategies

Investing in Bitcoin carries substantial risks. It's crucial to understand these risks before committing your capital.

-

Market Volatility: Bitcoin's price is highly volatile, meaning significant price swings can occur in short periods. This volatility can lead to substantial gains but also significant losses.

-

Market Crashes: The cryptocurrency market has experienced several sharp corrections in the past, resulting in large price drops. Investors need to be prepared for such events.

-

Security Risks: Bitcoin security risks include exchange hacks, loss of private keys, and phishing scams. These risks can lead to the loss of your investment.

Understanding Bitcoin's Value Proposition and Long-Term Outlook

Bitcoin's value proposition rests on its underlying technology and principles:

-

Decentralization: Bitcoin operates on a decentralized network, making it resistant to censorship and single points of failure.

-

Store of Value: Many see Bitcoin as a store of value, similar to gold, due to its limited supply and growing adoption.

-

Expert Predictions: While predictions are inherently speculative, many analysts offer forecasts for Bitcoin's future price. It's essential to critically evaluate these predictions and understand the underlying assumptions.

-

Emerging Technologies: The evolution of blockchain technology and related innovations could influence Bitcoin's value and adoption.

Developing a Smart Bitcoin Investment Strategy

A successful Bitcoin investment strategy requires careful planning and risk management:

-

Thorough Research: Conduct in-depth research before investing in Bitcoin. Understand the technology, the market, and the risks involved.

-

Risk Tolerance Assessment: Assess your risk tolerance before investing any amount. Bitcoin is a high-risk investment, not suitable for everyone.

-

Investment Approach: Choose an investment approach that aligns with your risk tolerance and financial goals. This could be long-term holding (hodling) or short-term trading.

-

Secure Storage: Use reputable exchanges and secure hardware wallets (cold storage) to protect your Bitcoin investments.

-

Continuous Learning: Stay updated on the latest developments in the cryptocurrency market through reputable news sources and educational resources.

Conclusion

Investing in Bitcoin offers the potential for substantial returns, potentially reaching a 1,500% increase in five years, driven by factors like institutional adoption, growing demand, and technological advancements. However, the inherent volatility and risks associated with Bitcoin investment cannot be ignored. A well-informed investment strategy, including diversification and risk management, is crucial.

Call to Action: Investing in Bitcoin requires careful research and understanding of the market. Before making any investment decisions, conduct thorough research, assess your risk tolerance, and develop a sound Bitcoin investment strategy. Begin exploring the potential of Bitcoin investment and its potential for growth. Don't miss out on the opportunity to learn more about Bitcoin investment and its potential for substantial returns.

Featured Posts

-

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025 -

Thunder Vs Pacers Latest Injury Report For March 29th Matchup

May 08, 2025

Thunder Vs Pacers Latest Injury Report For March 29th Matchup

May 08, 2025 -

Recent Bitcoin Mining Increase Factors And Implications

May 08, 2025

Recent Bitcoin Mining Increase Factors And Implications

May 08, 2025 -

Thunder Vs Trail Blazers On March 7th Where To Watch And Live Stream

May 08, 2025

Thunder Vs Trail Blazers On March 7th Where To Watch And Live Stream

May 08, 2025 -

El Betis Una Historia De Exitos

May 08, 2025

El Betis Una Historia De Exitos

May 08, 2025