Recent Bitcoin Mining Increase: Factors And Implications

Table of Contents

The Rise of Institutional Mining

The increased participation of institutional investors is a significant factor driving the recent Bitcoin mining boom. This influx of capital is reshaping the landscape of Bitcoin mining, leading to larger operations and higher overall hashrate.

Increased Institutional Investment

Large-scale institutional investors, including publicly traded mining companies and hedge funds, are increasingly drawn to Bitcoin mining. Several factors fuel this trend:

- Increased capital injection leads to larger mining operations and higher hashrate: The substantial financial resources of institutional investors allow them to establish massive mining farms, significantly boosting the overall network hashrate and contributing to enhanced security.

- Examples of institutional players entering the market (e.g., publicly traded mining companies): Companies like Riot Platforms, Marathon Digital Holdings, and Argo Blockchain are prominent examples of publicly traded companies heavily invested in Bitcoin mining, showcasing the growing institutional interest. Their financial reports and public statements often highlight the profitability and strategic advantages of Bitcoin mining within their investment portfolios.

- Analysis of the impact of institutional investment on Bitcoin price volatility: While the impact is complex and debated, increased institutional involvement could potentially reduce price volatility in the long run by providing greater market stability and liquidity.

Sophisticated Mining Technologies

Advancements in Application-Specific Integrated Circuits (ASICs) are making Bitcoin mining significantly more efficient and profitable. This technological progress is a key driver of the recent increase in mining activity.

- Discussion of new ASIC chip designs and their impact on mining efficiency: The continuous development of more powerful and energy-efficient ASICs allows miners to generate more Bitcoin with less energy consumption, increasing profitability even at lower Bitcoin prices. This technological arms race constantly pushes the boundaries of mining efficiency.

- Comparison of energy consumption between older and newer ASIC miners: Modern ASIC miners are orders of magnitude more energy-efficient than their predecessors, reflecting significant improvements in semiconductor technology. This efficiency gain is critical in an industry increasingly scrutinized for its energy consumption.

- Analysis of the role of technological innovation in driving mining profitability: Technological innovation is a crucial factor in ensuring the long-term viability of Bitcoin mining. As technology advances, the cost of mining decreases, making it more accessible and profitable even with fluctuating Bitcoin prices.

The Impact of Regulatory Changes

Regulatory landscapes are significantly influencing the geographic distribution and intensity of Bitcoin mining activity. Favorable regulations in some regions attract miners, while crackdowns in others force relocation.

Favorable Regulatory Environments

Some jurisdictions are actively promoting Bitcoin mining by implementing policies that incentivize investment and streamline operations.

- Examples of countries adopting Bitcoin-friendly policies: Countries like El Salvador, which has adopted Bitcoin as legal tender, and several others offering tax breaks or streamlined permitting processes for mining operations, are attracting significant mining activity.

- Analysis of the impact of regulatory clarity on attracting mining operations: Clear and predictable regulations create a stable and attractive environment for institutional and individual miners, encouraging investment and fostering growth.

- Discussion of the potential downsides of lax regulations (e.g., environmental concerns): While attracting miners can boost a region's economy, inadequate environmental regulations can lead to concerns about energy consumption and carbon emissions, requiring a balance between economic benefits and environmental sustainability.

Crackdowns in Other Regions

Conversely, stricter regulations and crackdowns in certain regions are pushing miners to relocate to more favorable jurisdictions.

- Examples of regions implementing stricter regulations on Bitcoin mining: China's 2021 crackdown on Bitcoin mining is a prime example of how regulatory changes can drastically alter the global distribution of mining activity. Similar actions in other regions have led to miners seeking more permissive environments.

- Discussion of the challenges faced by miners due to regulatory uncertainty: Regulatory uncertainty creates significant challenges for miners, including investment risks and the potential for significant disruptions to operations.

- Analysis of the impact of migration on the geographic distribution of Bitcoin mining: The migration of miners has led to a shift in the geographic distribution of Bitcoin mining power, with certain regions becoming dominant hubs.

The Role of Bitcoin Price and Market Sentiment

The price of Bitcoin and overall market sentiment are undeniable drivers of Bitcoin mining activity. Higher prices and positive sentiment directly impact miner profitability and incentives.

Bitcoin Price Appreciation

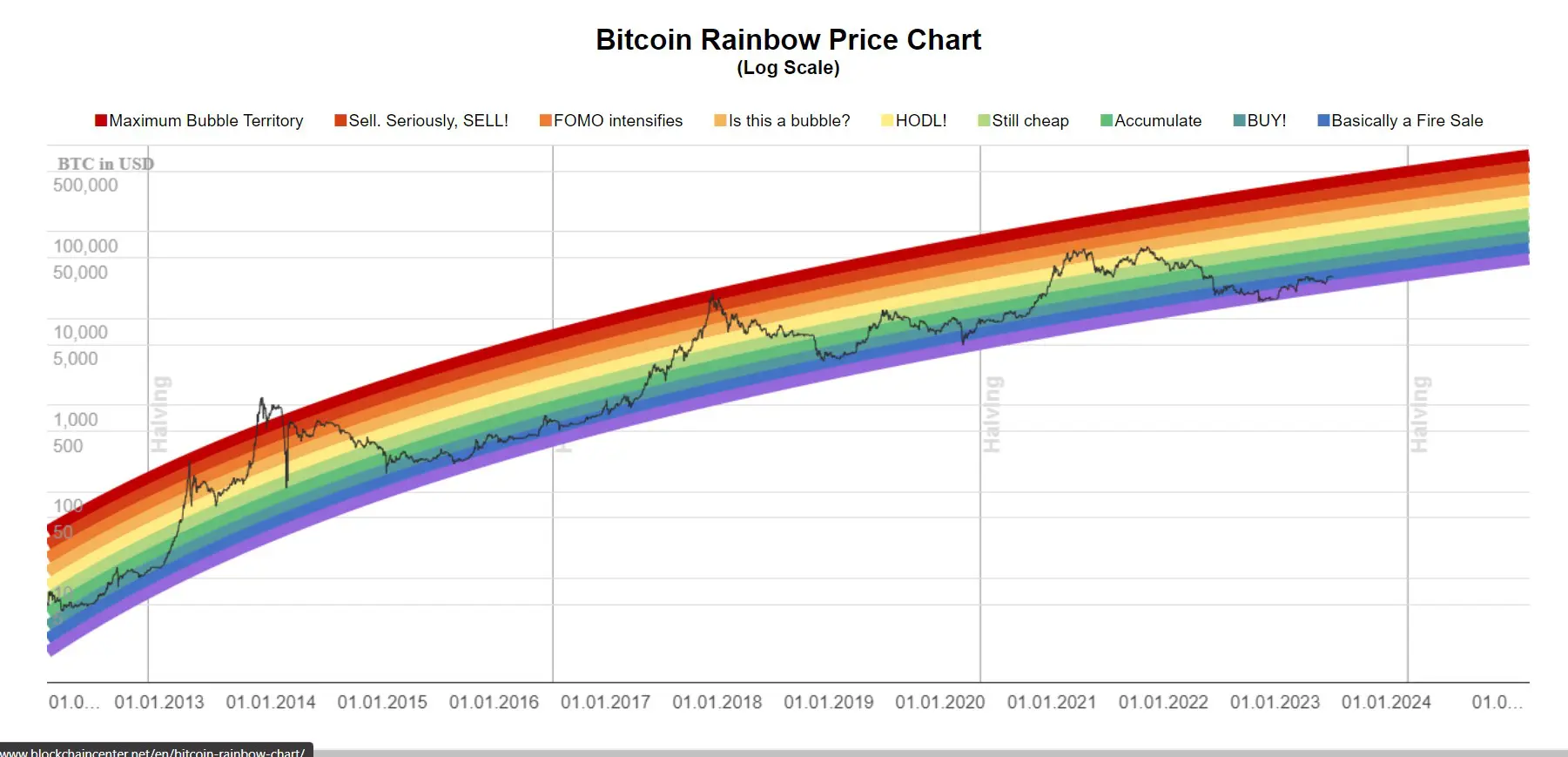

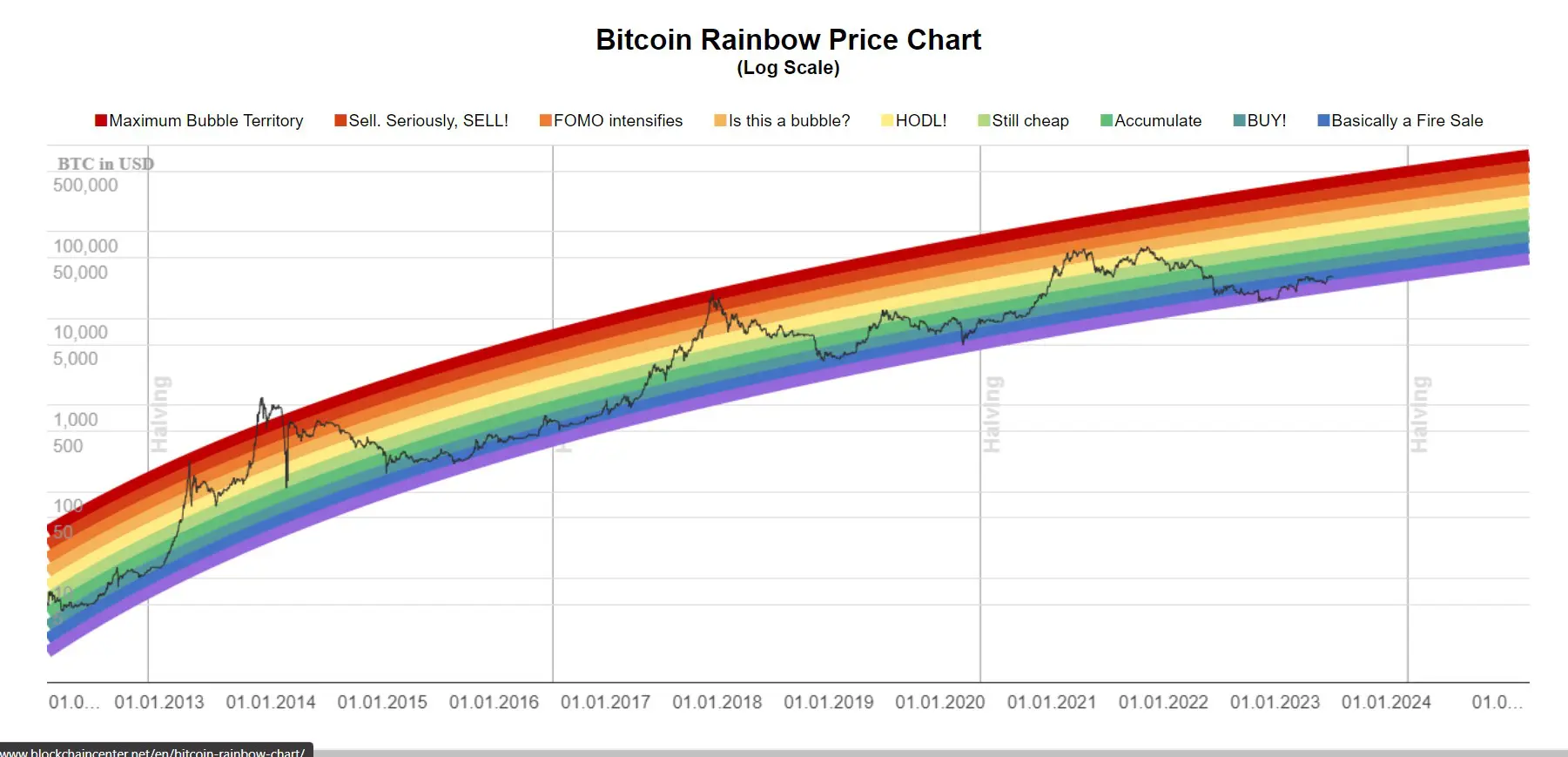

Bitcoin's price is directly correlated with mining profitability. Higher prices incentivize miners to increase their operations.

- Correlation analysis between Bitcoin price and mining hashrate: A strong positive correlation exists between Bitcoin's price and the network's hashrate, demonstrating the direct impact of price on mining activity.

- Discussion of the price threshold at which Bitcoin mining becomes profitable: The profitability threshold depends on factors such as electricity costs, equipment costs, and mining difficulty. Higher Bitcoin prices expand the profitability range for a broader array of mining operations.

- Examination of the impact of price volatility on miner behavior: Price volatility introduces risk and uncertainty for miners, influencing their decisions regarding expansion, investment, and even whether to continue mining.

Growing Demand for Bitcoin

Increased demand for Bitcoin fuels its price appreciation and further incentivizes mining activity.

- Analysis of the factors driving increased demand for Bitcoin: Factors such as institutional adoption, growing retail investment, and Bitcoin's use as a store of value all contribute to increased demand.

- Discussion of the relationship between demand and mining profitability: Strong demand drives up the Bitcoin price, enhancing mining profitability and spurring further investment in mining infrastructure.

- Examination of the impact of network effects on Bitcoin mining: As more miners join the network, security strengthens and the network becomes more resilient, further enhancing the value proposition of Bitcoin and attracting more miners.

Conclusion

The recent increase in Bitcoin mining is a multifaceted phenomenon driven by a complex interplay of institutional investment, technological advancements, evolving regulatory landscapes, and the overall health of the Bitcoin market. Understanding these factors is crucial for navigating the evolving cryptocurrency landscape. While increased mining activity strengthens the Bitcoin network's security and decentralization, it also presents challenges, including environmental concerns and the potential for market manipulation. Staying informed about the latest trends in Bitcoin mining and its implications is essential for anyone involved in this dynamic and rapidly changing industry. Continue to monitor the developments in Bitcoin mining to make informed decisions. Understanding the factors influencing Bitcoin mining profitability and the impact of Bitcoin mining regulations is key to successfully navigating this dynamic market.

Featured Posts

-

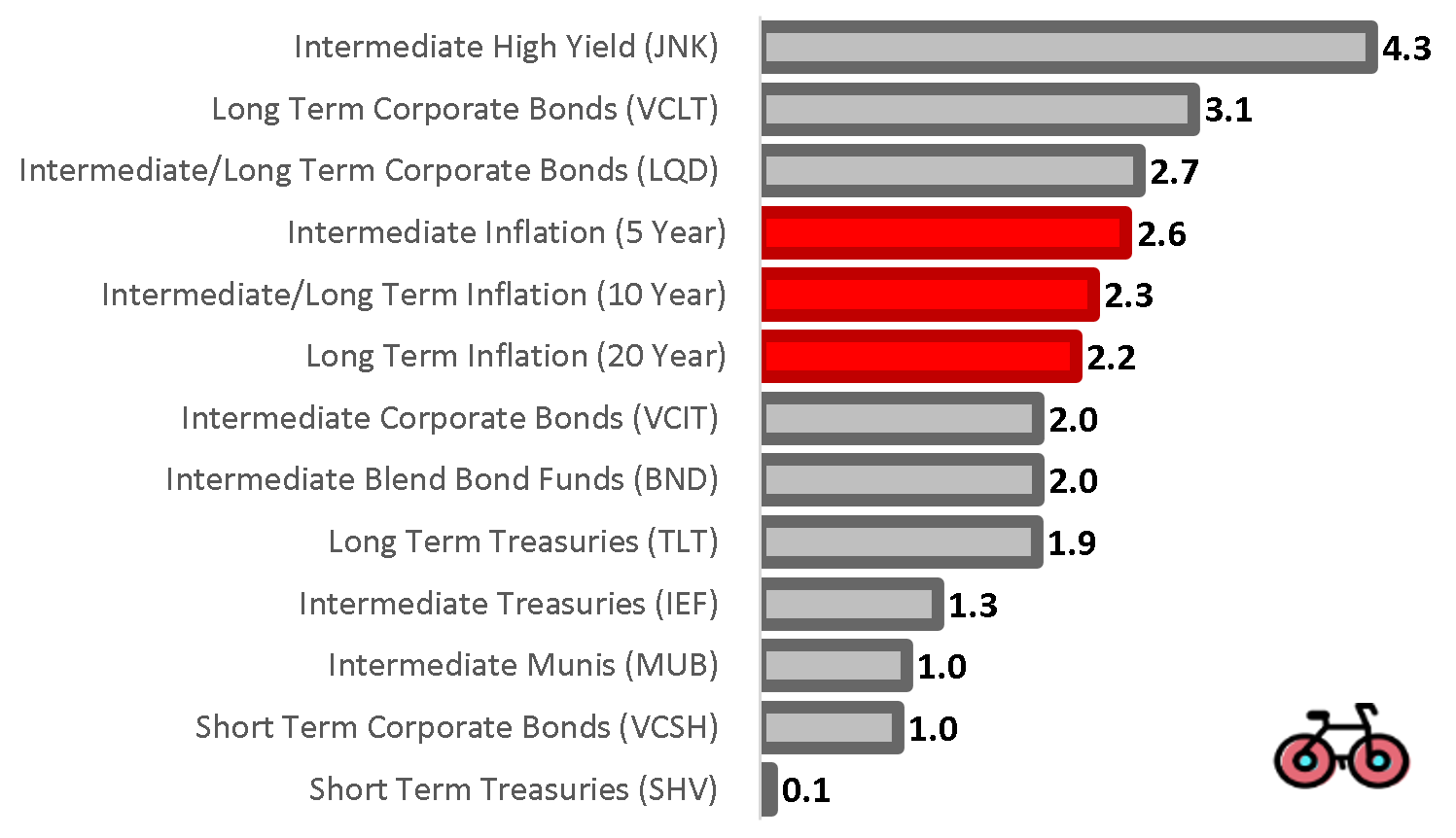

Taiwan Investors Retreat From Us Bond Etfs A Shift In Investment Strategy

May 08, 2025

Taiwan Investors Retreat From Us Bond Etfs A Shift In Investment Strategy

May 08, 2025 -

1 0

May 08, 2025

1 0

May 08, 2025 -

Star Wars New Tv Show To Reveal The Origin Of A Rogue One Hero

May 08, 2025

Star Wars New Tv Show To Reveal The Origin Of A Rogue One Hero

May 08, 2025 -

Bitcoin Guencel Fiyati Son Dakika Degerlendirme

May 08, 2025

Bitcoin Guencel Fiyati Son Dakika Degerlendirme

May 08, 2025 -

Kripto Para Duezenlemeleri Bakan Simsek In Son Uyarisi Ve Yatirimcilar Icin Oeneriler

May 08, 2025

Kripto Para Duezenlemeleri Bakan Simsek In Son Uyarisi Ve Yatirimcilar Icin Oeneriler

May 08, 2025