Bitcoin Price Golden Cross: What It Means For Investors

Table of Contents

Understanding the Bitcoin Golden Cross

What is a Golden Cross?

A golden cross is a bullish technical indicator formed when a shorter-term moving average crosses above a longer-term moving average on a price chart. In the context of Bitcoin, this often involves the 50-day moving average crossing above the 200-day moving average. This crossover suggests a potential shift in momentum from bearish to bullish.

-

Definition: Moving averages smooth out price fluctuations, providing a clearer picture of the overall trend. When the shorter-term MA crosses above the longer-term MA, it signals that the short-term trend is now stronger than the long-term trend, indicating potential upward movement.

-

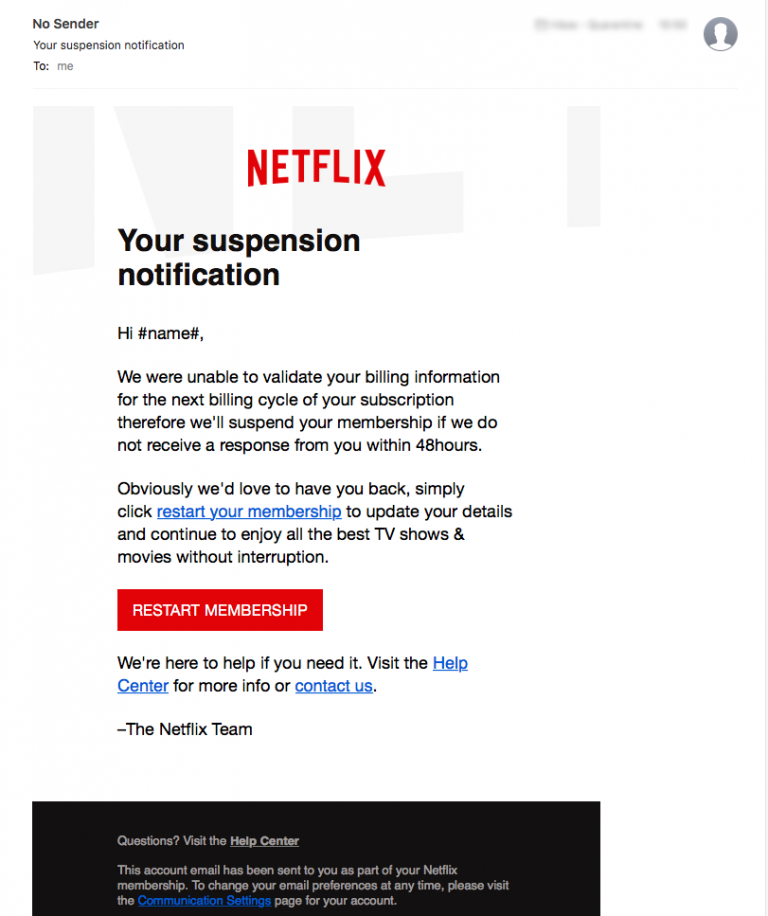

Visual Aid: [Insert a chart here clearly illustrating a Bitcoin golden cross formation. Ideally, this chart should show the 50-day and 200-day moving averages crossing, with clear labeling.]

-

Importance of Timeframes: The choice of moving average periods is crucial. The 50-day/200-day combination is common, but other combinations (e.g., 10-day/50-day) can also be used, leading to different interpretations. Shorter-term golden crosses might indicate shorter-term buying opportunities, while the 50/200-day cross often suggests a more significant potential shift in the long-term trend.

Historical Performance of Golden Crosses in Bitcoin

Analyzing past occurrences of Bitcoin golden crosses reveals a mixed bag. While many instances have been followed by price increases, some have proved to be false signals, leading to subsequent price declines.

-

Past Occurrences: [Insert data here showing past Bitcoin golden cross occurrences, perhaps in a table format. Include the date of the crossover, the subsequent price movement (percentage change over a specific period, e.g., 1 month, 3 months, 6 months), and a brief description of the market context.]

-

Successful and Unsuccessful Predictions: Charts illustrating both successful and unsuccessful golden crosses will strengthen the argument. Show examples where the golden cross accurately predicted a price surge and instances where it failed to materialize.

-

Limitations: Relying solely on the golden cross for Bitcoin trading decisions is inherently risky. It's a lagging indicator, meaning it confirms a trend that has already begun, not predict future movements. Other factors significantly impact Bitcoin’s price.

Factors Influencing the Accuracy of the Bitcoin Golden Cross

The accuracy of a Bitcoin golden cross as a predictive indicator is significantly influenced by several factors. Ignoring these factors can lead to inaccurate interpretations and potentially poor investment decisions.

Market Sentiment and News Events

External factors heavily influence Bitcoin's price. Positive news (e.g., regulatory approvals, institutional adoption) can boost prices, regardless of technical indicators. Conversely, negative news (e.g., regulatory crackdowns, security breaches) can cause sharp declines.

-

Regulatory Changes: New regulations in major jurisdictions can significantly impact Bitcoin's price and overall market sentiment.

-

Adoption Rates: Increased adoption by businesses and individuals can fuel demand and drive prices up.

-

Macroeconomic Conditions: Global economic events, such as inflation or recessions, can impact investor sentiment and Bitcoin's value.

Trading Volume and Market Liquidity

High trading volume accompanying a golden cross confirms its validity. Low volume suggests weak buying pressure and increases the likelihood of a false signal.

-

Volume Confirmation: A strong golden cross should be accompanied by a significant increase in trading volume, demonstrating strong buying interest.

-

Low Volume False Signals: A golden cross forming on low volume often lacks the conviction to drive sustained upward price movement.

Other Technical Indicators

Using the golden cross in conjunction with other technical indicators offers a more robust and comprehensive analysis.

-

RSI (Relative Strength Index): RSI helps assess whether the market is overbought or oversold.

-

MACD (Moving Average Convergence Divergence): MACD identifies changes in momentum.

-

Support and Resistance Levels: Identifying key support and resistance levels can help determine potential price targets.

Investment Strategies Based on the Bitcoin Golden Cross

While the golden cross can be a useful indicator, it should never be the sole basis for investment decisions. A comprehensive strategy incorporating risk management is essential.

Risk Management

Investing in Bitcoin always involves risk. Never invest more than you can afford to lose.

-

Diversification: Diversify your investment portfolio across different assets to reduce risk.

-

Stop-Loss Orders: Use stop-loss orders to limit potential losses if the price moves against you.

Long-Term vs. Short-Term Investments

The golden cross's relevance differs depending on your investment horizon.

-

Long-Term Investors: A golden cross might signal a good entry point for long-term positions, expecting gradual price appreciation.

-

Short-Term Traders: Short-term traders might use the golden cross to identify potential short-term trading opportunities, aiming for quicker profits.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

Conclusion

The Bitcoin price golden cross is a valuable technical indicator but shouldn't be the sole basis for investment decisions. While historically associated with bullish price movements, its accuracy is influenced by various factors, including market sentiment, trading volume, and broader macroeconomic conditions. Combining the golden cross with other technical indicators and incorporating robust risk management strategies is crucial for successful Bitcoin investing. Remember to conduct thorough research and consider your risk tolerance before making any investment choices. Don't just rely on the Bitcoin golden cross; understand its limitations and develop a comprehensive trading strategy. Learn more about effective Bitcoin trading strategies and diversify your crypto portfolio wisely.

Featured Posts

-

Barcelona And Inter Milan Deliver Champions League Semi Final Classic

May 08, 2025

Barcelona And Inter Milan Deliver Champions League Semi Final Classic

May 08, 2025 -

Massive Office365 Breach Executive Inboxes Targeted Millions Stolen

May 08, 2025

Massive Office365 Breach Executive Inboxes Targeted Millions Stolen

May 08, 2025 -

Will Ethereum Hit 2 700 Wyckoff Accumulation Signals

May 08, 2025

Will Ethereum Hit 2 700 Wyckoff Accumulation Signals

May 08, 2025 -

Psg Angers Macini Izlemek Icin En Iyi Yoentemler

May 08, 2025

Psg Angers Macini Izlemek Icin En Iyi Yoentemler

May 08, 2025 -

Abc Promo Tnt Announcers Epic Roast Of Jayson Tatum Lakers Vs Celtics

May 08, 2025

Abc Promo Tnt Announcers Epic Roast Of Jayson Tatum Lakers Vs Celtics

May 08, 2025