Bitcoin Price Rally: 10-Week High Breached, $100,000 Target Near?

Table of Contents

Factors Fueling the Bitcoin Price Rally

Several key factors are contributing to the current Bitcoin price rally. Understanding these drivers is crucial for assessing the sustainability of the upward trend and the potential for further growth.

Increased Institutional Adoption

The growing interest from institutional investors is a significant catalyst for the Bitcoin price rally. Large corporations and hedge funds are increasingly allocating assets to Bitcoin, recognizing its potential as a long-term store of value and a diversifying asset.

- Examples: MicroStrategy's significant Bitcoin holdings, Tesla's previous investment (and subsequent partial sale), and the growing number of publicly traded companies adding Bitcoin to their balance sheets demonstrate this institutional interest.

- Motivations: Institutional investors are driven by factors including diversification, hedging against inflation, and the potential for substantial long-term returns. The increasing maturity and regulatory clarity surrounding Bitcoin are also contributing to this institutional adoption.

- Volume: The sheer volume of institutional buying is a powerful force driving up the Bitcoin price. This sustained demand from large players is a key indicator of Bitcoin's increasing legitimacy in the financial world. Keywords: Institutional Bitcoin investment, corporate Bitcoin adoption, hedge fund Bitcoin holdings.

Positive Regulatory Developments

While not always explicitly positive, the absence of major negative regulatory news is significantly impacting Bitcoin's price. A more predictable and less hostile regulatory environment encourages greater participation from institutional investors and retail traders.

- Examples: Gradual clarification of cryptocurrency regulations in various jurisdictions, along with the lack of significant crackdowns, is bolstering investor confidence. The ongoing regulatory debates are less fear-inducing than they were in previous years, contributing to a more positive sentiment.

- Impact: A more stable regulatory landscape reduces uncertainty, leading to increased investment and speculation. Clearer rules make it easier for institutional players to allocate funds, further fueling the Bitcoin price rally.

- Keywords: Bitcoin regulation, crypto regulation, Bitcoin legal framework.

Growing Macroeconomic Uncertainty

Global economic uncertainty is pushing investors towards Bitcoin as a safe haven asset. Inflation concerns and fears of economic instability are driving demand for Bitcoin, perceived by some as a hedge against traditional financial systems.

- Examples: High inflation rates in several countries, geopolitical instability, and concerns about central bank policies are all contributing factors.

- Correlation: The correlation between Bitcoin's price and macroeconomic uncertainty is becoming increasingly apparent. As economic conditions worsen, investors often seek alternative investments, boosting Bitcoin's demand.

- Inflation Hedge: Bitcoin's fixed supply and decentralized nature make it an attractive inflation hedge for many investors. This aspect is further driving the Bitcoin price rally. Keywords: Bitcoin safe haven, inflation hedge Bitcoin, macroeconomic factors Bitcoin.

Technological Advancements

Significant technological upgrades and developments within the Bitcoin network continue to enhance its efficiency and scalability, indirectly contributing to price increases.

- Examples: The ongoing development and adoption of the Lightning Network for faster and cheaper transactions, as well as layer-2 scaling solutions, are enhancing Bitcoin's functionality.

- Impact: Improved scalability and transaction efficiency make Bitcoin more appealing to a wider range of users and businesses, increasing demand and, consequently, its price.

- Keywords: Bitcoin Lightning Network, Bitcoin scaling solutions, Bitcoin upgrades.

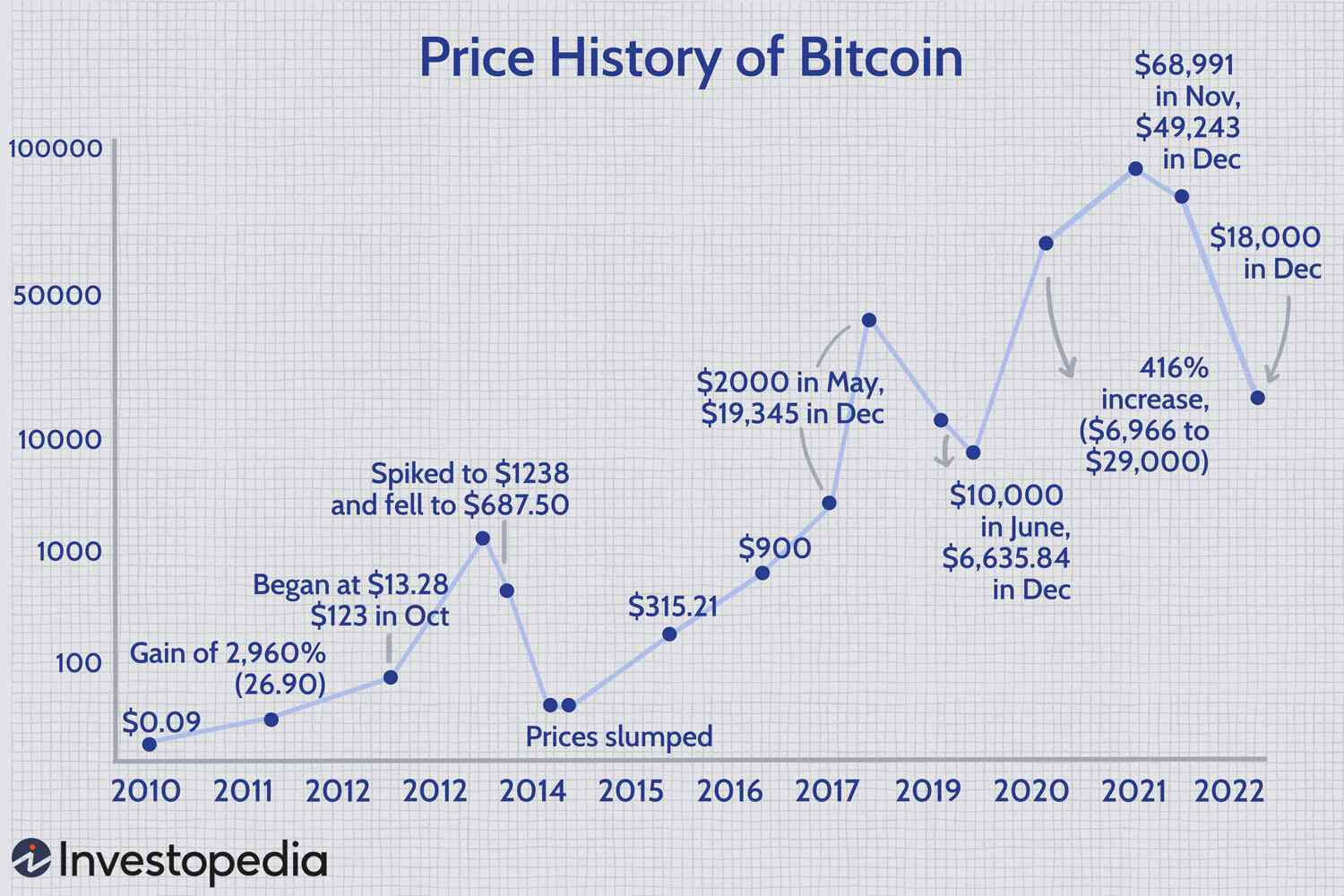

Analyzing the $100,000 Bitcoin Price Target

The question of whether Bitcoin will reach $100,000 is complex, requiring a thorough analysis of technical and fundamental factors.

Technical Analysis

Technical analysis of the Bitcoin price chart suggests the possibility of reaching $100,000, but it's not a guarantee.

- Indicators: Certain technical indicators, such as moving averages, RSI (Relative Strength Index), and support/resistance levels, might suggest a potential upward trajectory. However, technical analysis is not foolproof.

- Chart Patterns: Some analysts identify bullish chart patterns, but these are just interpretations and not definite predictions.

- Keywords: Bitcoin technical analysis, Bitcoin chart patterns, Bitcoin price prediction 2024.

Fundamental Analysis

Fundamental analysis focuses on underlying factors that support or hinder Bitcoin's potential to reach the $100,000 mark.

- Adoption Rate: Widespread global adoption is crucial. Increased usage by businesses and individuals will drive demand and, consequently, price.

- Network Security: The security and robustness of the Bitcoin network are fundamental to its long-term value.

- Market Capitalization: Reaching a $100,000 price would require a substantial increase in Bitcoin's market capitalization, which depends on various factors.

- Keywords: Bitcoin market cap, Bitcoin adoption rate, Bitcoin fundamental analysis.

Potential Roadblocks

Several challenges could prevent Bitcoin from reaching $100,000.

- Regulatory Hurdles: Stringent or unpredictable regulations could dampen investor enthusiasm and negatively impact price.

- Macroeconomic Downturns: A global economic recession could lead to a sell-off in risk assets, including Bitcoin.

- Market Corrections: Significant price corrections are common in cryptocurrency markets. A sharp downturn could delay or prevent Bitcoin from reaching $100,000.

- Keywords: Bitcoin price correction, Bitcoin market volatility, Bitcoin risks.

Conclusion

The Bitcoin price rally is fueled by a confluence of factors, including increased institutional adoption, positive regulatory developments (or lack of negative ones), growing macroeconomic uncertainty driving safe-haven demand, and continuous technological advancements. While the $100,000 target is a significant milestone, analyzing both technical and fundamental aspects, alongside recognizing potential roadblocks, provides a more balanced perspective. The Bitcoin price rally is a dynamic situation. Stay informed about the latest market trends and conduct thorough research to make informed decisions regarding your Bitcoin investments. Continue to monitor the Bitcoin price rally and its potential to reach new highs.

Featured Posts

-

Analyzing Randles Performance Lakers Vs Timberwolves

May 07, 2025

Analyzing Randles Performance Lakers Vs Timberwolves

May 07, 2025 -

Find The Daily Lotto Results For Tuesday April 15th 2025

May 07, 2025

Find The Daily Lotto Results For Tuesday April 15th 2025

May 07, 2025 -

Celtics Vs Cavs 4 Takeaways From A Shocking Defeat

May 07, 2025

Celtics Vs Cavs 4 Takeaways From A Shocking Defeat

May 07, 2025 -

Nba Game Edwards Lakers Center Shoving Incident

May 07, 2025

Nba Game Edwards Lakers Center Shoving Incident

May 07, 2025 -

5 Dos And Don Ts Securing A Role In The Private Credit Boom

May 07, 2025

5 Dos And Don Ts Securing A Role In The Private Credit Boom

May 07, 2025

Latest Posts

-

Inter Milans Triumph Over Barcelona Securing A Champions League Final Spot

May 08, 2025

Inter Milans Triumph Over Barcelona Securing A Champions League Final Spot

May 08, 2025 -

76

May 08, 2025

76

May 08, 2025 -

Barcelonas Champions League Dream Ends Against Inter Milan

May 08, 2025

Barcelonas Champions League Dream Ends Against Inter Milan

May 08, 2025 -

How Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025

How Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025 -

Inter Milan Through To Champions League Final After Barcelona Win

May 08, 2025

Inter Milan Through To Champions League Final After Barcelona Win

May 08, 2025