5 Dos And Don'ts: Securing A Role In The Private Credit Boom

Table of Contents

DO: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit industry. It's not just about who you know, but about building genuine relationships with key players.

Attend industry conferences and events.

Networking is crucial for securing a private credit career. Attending relevant conferences and events allows you to connect directly with professionals in the field. Consider attending:

- SuperReturn: A leading global private equity and infrastructure event.

- InfraShare: Focused on infrastructure investments and related private credit opportunities.

- Smaller, niche conferences focused on specific sectors within private credit (e.g., real estate private credit).

Remember to actively engage in conversations, exchange business cards, and follow up after the event. Building relationships with senior professionals can lead to invaluable mentorship and job opportunities. Keywords: private credit networking, industry events, private credit conferences.

Leverage LinkedIn effectively.

Your LinkedIn profile is your digital resume. Optimize it by highlighting your relevant skills and experience within the private credit space (or related fields like alternative lending). Keywords: LinkedIn profile optimization, private credit LinkedIn, professional networking. Specifically:

- Use keywords relevant to private credit jobs, such as "private credit analyst," "direct lending," "credit analysis," and "financial modeling."

- Join relevant LinkedIn groups related to private credit, alternative investments, and finance.

- Share insightful articles and commentary related to private credit market trends to establish yourself as a thought leader.

Informational interviews.

Don't underestimate the power of informational interviews. Reaching out to professionals for informational interviews allows you to gain invaluable insights into the industry, learn about specific roles, and make connections. Keywords: informational interviews, private credit insights, career advice. Remember to:

- Prepare thoughtful questions beforehand.

- Be respectful of their time.

- Follow up with a thank-you note.

DON'T: Underestimate the Importance of Financial Modeling Skills

Private credit roles demand strong financial modeling skills. This is non-negotiable.

Master essential financial modeling techniques.

Proficiency in financial modeling is crucial. You should be well-versed in:

- LBO Modeling: Leveraged buyout modeling is fundamental for understanding private equity transactions.

- DCF Analysis: Discounted cash flow analysis is essential for valuing investments.

- Other key techniques include sensitivity analysis, scenario planning, and cash flow forecasting.

Mastering Excel (or a more advanced financial modeling software) is non-negotiable. Keywords: financial modeling skills, LBO modeling, DCF analysis, Excel skills, private credit modeling.

Neglect understanding of credit analysis.

A deep understanding of credit analysis principles is critical. You need to be able to:

- Assess the creditworthiness of borrowers.

- Conduct thorough due diligence.

- Evaluate and manage risk effectively.

This is essential for assessing the viability of private credit investments. Keywords: credit analysis, due diligence, risk assessment, private credit risk.

DO: Highlight Relevant Experience and Skills in Your Application

Tailoring your application materials is crucial for showcasing your suitability for private credit jobs.

Tailor your resume and cover letter.

Customize your resume and cover letter for each application. Keywords: resume optimization, cover letter writing, private credit resume, tailored applications. Use keywords from the job description and highlight:

- Specific achievements and quantifiable results.

- Relevant skills such as financial modeling, credit analysis, and industry knowledge.

Showcase transferable skills.

Even if your background isn't directly in private credit, you likely possess transferable skills. Keywords: transferable skills, analytical skills, problem-solving, financial analysis. Highlight:

- Analytical skills from previous roles.

- Problem-solving abilities and critical thinking.

- Experience in financial analysis or similar fields.

DON'T: Undersell Your Passion for the Industry

Enthusiasm is infectious, and your passion for the private credit industry will make you stand out.

Demonstrate genuine enthusiasm.

During interviews, convey your genuine interest in private credit and the specific firm you're interviewing with. Keywords: private credit passion, interview tips, enthusiasm. Show your passion by:

- Asking insightful questions about the firm's investment strategy.

- Sharing your knowledge of current market trends.

Lack knowledge of market trends.

Stay updated on private credit market trends and industry news. Keywords: private credit market trends, industry news, market analysis. Utilize resources such as:

- Industry publications like PEI Media and Private Debt Investor.

- News websites such as Bloomberg and Reuters.

DO: Prepare Thoroughly for Interviews

Thorough interview preparation is crucial for success.

Practice behavioral questions.

Prepare for behavioral interview questions by practicing your responses. Keywords: behavioral interview questions, interview preparation, private credit interviews. Common questions include:

- "Tell me about a time you failed."

- "Describe a situation where you had to work under pressure."

Research the firm and interviewer.

Research the firm's investment strategy, recent transactions, and the interviewer's background. Keywords: company research, interview preparation, private credit firms. Use resources like:

- The firm's website.

- LinkedIn.

- News articles and press releases.

Securing Your Place in the Private Credit Boom

To recap, securing a role in the thriving private credit industry requires strategic networking, strong financial modeling and credit analysis skills, tailored applications that highlight transferable skills, demonstrating genuine enthusiasm, and thorough interview preparation. The private credit market offers significant opportunities for skilled professionals. Start implementing these dos and don'ts today and take the first step towards a successful career in the exciting world of private credit!

Featured Posts

-

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

May 07, 2025

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

May 07, 2025 -

Jagger No Oscar Supersticao Brasileira E O Temor Do Pe Frio

May 07, 2025

Jagger No Oscar Supersticao Brasileira E O Temor Do Pe Frio

May 07, 2025 -

Barkleys Bold Prediction The Cleveland Cavaliers Future

May 07, 2025

Barkleys Bold Prediction The Cleveland Cavaliers Future

May 07, 2025 -

Should The Wolves Sign Julius Randle A Detailed Analysis

May 07, 2025

Should The Wolves Sign Julius Randle A Detailed Analysis

May 07, 2025 -

Cobra Kai Star Ralph Macchio On Marriage Longevity The Hollywood Factor

May 07, 2025

Cobra Kai Star Ralph Macchio On Marriage Longevity The Hollywood Factor

May 07, 2025

Latest Posts

-

A Closer Look At Nathan Fillions Impactful Scene In Saving Private Ryan

May 08, 2025

A Closer Look At Nathan Fillions Impactful Scene In Saving Private Ryan

May 08, 2025 -

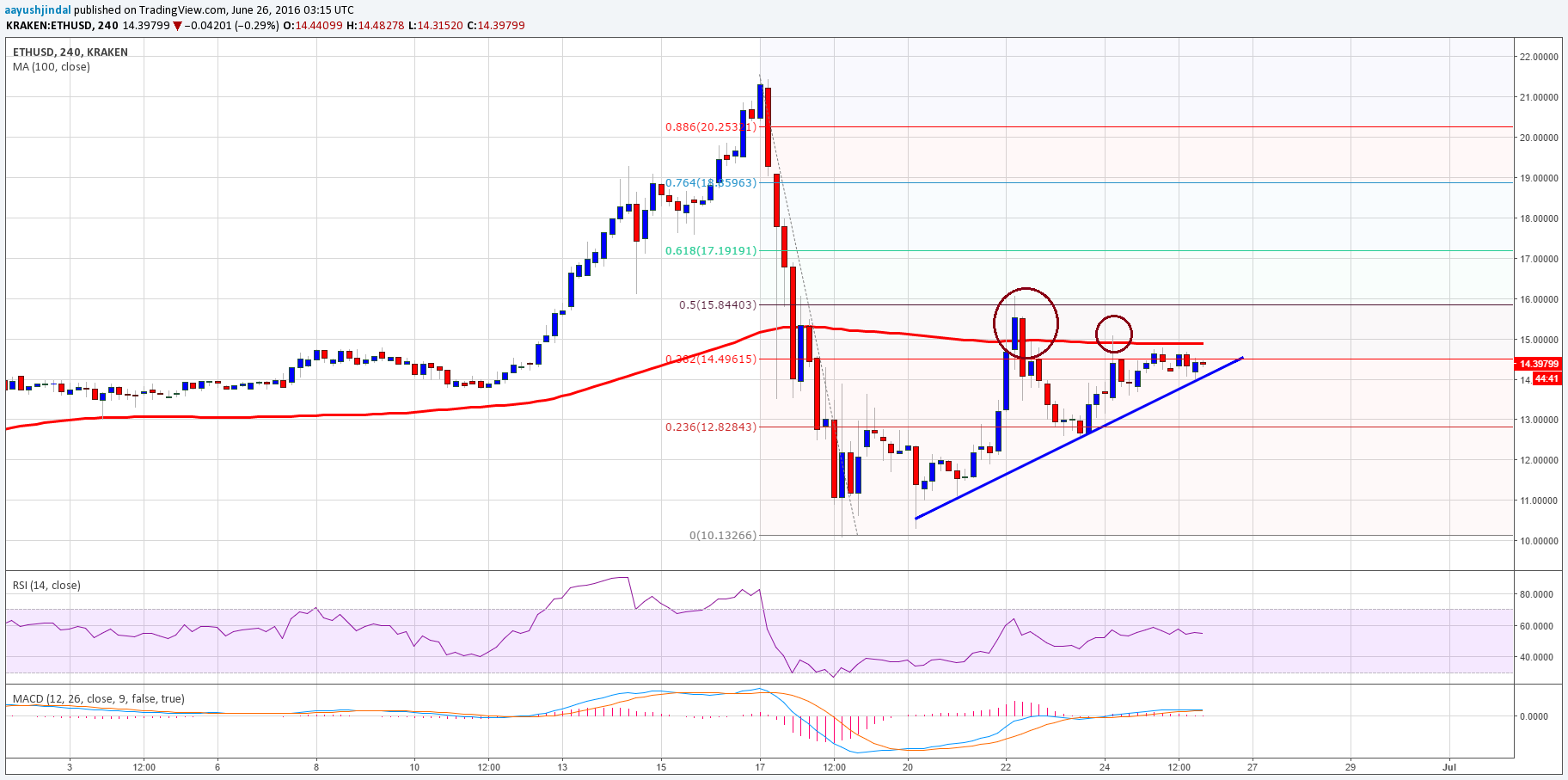

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025 -

Bitcoin And Ethereum Options Billions Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions Expire Impact On Market Volatility

May 08, 2025 -

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025 -

Crypto Market On Edge Massive Bitcoin And Ethereum Options Expiration Looms

May 08, 2025

Crypto Market On Edge Massive Bitcoin And Ethereum Options Expiration Looms

May 08, 2025