Bitcoin Price Rebound: Investing Strategies For The Future

Table of Contents

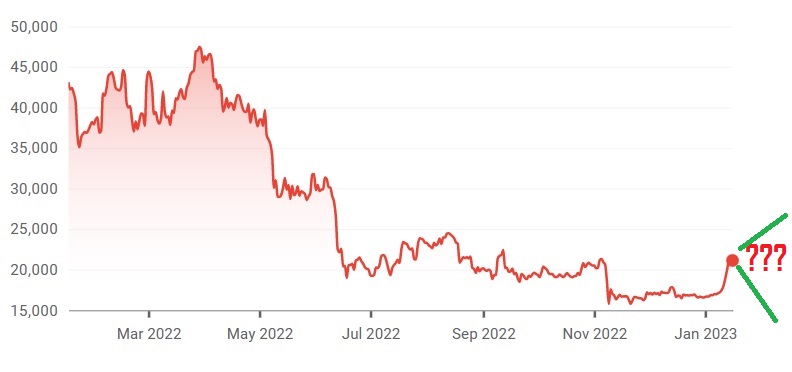

Understanding the Bitcoin Price Rebound

Analyzing Market Trends

Several factors influence Bitcoin's price rebound. Understanding these trends is crucial for informed investment decisions.

- Positive News Cycles: Positive regulatory developments, successful Bitcoin ETF applications, or adoption by major corporations can significantly impact Bitcoin's price. For example, the recent approval of Bitcoin ETFs in certain jurisdictions triggered a notable price surge.

- Regulatory Clarity: Increased regulatory clarity in key markets reduces uncertainty and attracts institutional investors, leading to price appreciation. Conversely, negative regulatory news can cause significant price drops.

- Institutional Adoption: Large-scale institutional investments, like those from corporations and investment firms, inject substantial capital into the market, boosting demand and subsequently, the price. This increased institutional participation signals growing confidence in Bitcoin as an asset class.

- Macroeconomic Factors: Global economic conditions play a vital role. During periods of economic uncertainty or inflation, investors may seek refuge in Bitcoin, driving up its value as a hedge against traditional assets.

(Insert relevant chart illustrating Bitcoin price fluctuations alongside these factors)

Technical analysis tools, such as moving averages, relative strength index (RSI), and chart patterns, can help predict future price movements. However, it's important to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Risk Assessment and Volatility

Bitcoin's price is inherently volatile. Risk management is paramount.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes, including other cryptocurrencies, stocks, bonds, and real estate.

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your Bitcoin if the price drops below a predetermined level, limiting potential losses.

- Only Invest What You Can Afford to Lose: Investing in highly volatile assets like Bitcoin carries significant risk. Only invest funds you can afford to lose without impacting your financial well-being. Market corrections are inevitable, and you need to be prepared for potential price drops.

Investing Strategies for a Bitcoin Price Rebound

Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals (e.g., weekly or monthly). This strategy reduces the impact of volatility by averaging your purchase price over time.

- How it Works: Regardless of Bitcoin's price, you invest the same amount. When the price is low, you buy more Bitcoin; when the price is high, you buy less.

- Advantages: Reduces risk, simplifies investment process, emotionally detached investment approach.

- Disadvantages: You might miss out on some gains if the price consistently rises.

- Example: Investing $100 per week regardless of Bitcoin's price will smooth out your average cost basis over time.

Long-Term Holding (HODLing)

HODLing, a term derived from "hold on for dear life," involves holding Bitcoin for an extended period, irrespective of short-term price fluctuations.

- Rationale: Based on the belief in Bitcoin's long-term value proposition and potential for future growth.

- Potential Rewards: Significant returns if Bitcoin's price appreciates over the long term.

- Risks: Potential for significant losses if the price declines substantially during the holding period. Requires considerable patience and a long-term investment horizon.

Diversification and Portfolio Management

Diversification is crucial to mitigate risk. Don't rely solely on Bitcoin.

- Asset Allocation: Allocate your investments across various asset classes (e.g., 60% stocks, 20% bonds, 10% Bitcoin, 10% other cryptocurrencies).

- Risk Tolerance: Adjust your portfolio allocation based on your risk tolerance and investment goals. A higher risk tolerance allows for a larger Bitcoin allocation.

- Market Conditions: Rebalance your portfolio periodically to maintain your desired asset allocation.

Utilizing Bitcoin Futures and Options (For Experienced Investors Only)

Futures and options contracts offer advanced strategies for experienced investors. However, they involve significant risk.

- Hedging: Futures contracts can be used to hedge against price declines.

- Leveraged Gains/Losses: Options contracts offer leveraged returns, but also amplified losses.

- High Risk: These instruments are extremely risky and require a deep understanding of derivatives trading. Only engage if you possess significant experience and risk tolerance.

Staying Informed About the Bitcoin Market

Reliable News Sources and Market Data

Staying informed is essential for making sound investment decisions.

- Reputable News Sources: CoinDesk, Cointelegraph, Bloomberg, and Reuters provide reliable news and market analysis.

- Analytical Platforms: TradingView, CoinGecko, and CoinMarketCap offer comprehensive market data and charting tools.

- Social Media: Use social media cautiously. Focus on verified accounts and official announcements from reputable sources.

Understanding Market Sentiment and Community Discussion

Gauging market sentiment helps assess investor confidence.

- Bullish vs. Bearish: Identify whether the overall sentiment is positive (bullish) or negative (bearish).

- Community Forums: Use forums like Reddit's r/Bitcoin cautiously. Critical thinking and discernment are crucial to avoid misinformation.

Conclusion

The Bitcoin price rebound presents opportunities, but careful planning is necessary. By understanding market trends, employing strategies like dollar-cost averaging and diversification, and staying informed, you can potentially capitalize on future Bitcoin price rebounds. Develop a sound investment plan, conduct thorough research, and consult a financial advisor before making any investment decisions. Start your journey towards leveraging the potential of the Bitcoin price rebound today. Remember, responsible investment practices are crucial for success in this volatile market.

Featured Posts

-

Spk Dan Kripto Para Piyasalarina Oenemli Aciklama

May 08, 2025

Spk Dan Kripto Para Piyasalarina Oenemli Aciklama

May 08, 2025 -

Executive Office365 Accounts Compromised Millions In Losses Criminal Charges Filed

May 08, 2025

Executive Office365 Accounts Compromised Millions In Losses Criminal Charges Filed

May 08, 2025 -

Counting Crows Snl Appearance A Career Defining Moment

May 08, 2025

Counting Crows Snl Appearance A Career Defining Moment

May 08, 2025 -

The Long Walk Trailer Adaptation Of Stephen Kings Disturbing Novel

May 08, 2025

The Long Walk Trailer Adaptation Of Stephen Kings Disturbing Novel

May 08, 2025 -

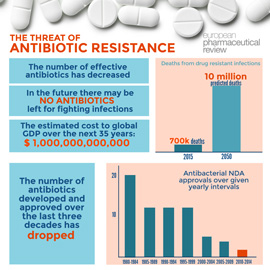

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025