BofA On Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Valuation Methodology and Key Findings

BofA employs a multi-faceted approach to evaluating stock market valuations, incorporating various metrics to gain a comprehensive understanding. Their analysis typically involves examining price-to-earnings ratios (P/E), dividend yields, and other fundamental indicators, comparing current figures to historical averages and projected future earnings.

Their recent report, while not explicitly stating "calm," suggests a more measured approach might be warranted. While specific numbers fluctuate with market changes, the general findings often highlight a comparison between current valuations and historical averages, suggesting whether the market is overvalued, undervalued, or trading within a reasonable range.

- Valuation Metrics Used: Price-to-earnings ratio (P/E), Price-to-book ratio (P/B), dividend yield, cyclically adjusted price-to-earnings ratio (CAPE).

- Key Numerical Results (Illustrative): BofA might report that the current S&P 500 P/E ratio is, say, 22, compared to a historical average of 16. However, this would need to be replaced with the actual data from their latest report. They might also analyze sector-specific P/E ratios to identify potential opportunities or risks.

- BofA's Assessment: BofA's assessment often avoids blanket statements like "overvalued" or "undervalued." Instead, they provide a nuanced perspective, considering various factors and presenting a range of possibilities.

Factors Contributing to BofA's Relatively Optimistic Outlook

BofA's relatively less bearish outlook isn't based solely on valuation metrics. They consider a wide range of macroeconomic factors that influence their overall assessment:

-

Interest Rate Expectations: BofA's analysis considers the Federal Reserve's monetary policy and its potential impact on inflation and economic growth. Their projections for interest rate hikes (or cuts) directly influence their valuation models.

-

Inflation Outlook: Inflation significantly impacts corporate profitability and investor sentiment. BofA's assessment of future inflation plays a crucial role in their valuation conclusions.

-

Economic Growth Projections: Stronger economic growth projections generally support higher valuations, while weaker projections might lead to lower valuations. BofA's economic growth forecasts are integral to their analysis.

-

Specific Macroeconomic Factors and Impact: Lower-than-expected inflation, coupled with a potential softening of interest rate hikes, might contribute to a more optimistic outlook on valuations.

-

BofA's Projections: Specific projections will vary depending on the report, but they would likely include GDP growth forecasts, inflation predictions, and unemployment rate estimates.

-

Support for Valuation View: These projections are incorporated into their models to determine whether current valuations are justified given the anticipated economic environment.

Potential Risks and Cautions Highlighted by BofA

While BofA might present a relatively calm perspective, they invariably acknowledge potential risks that could significantly impact their assessment:

- Geopolitical Risks: Global conflicts and political instability can negatively affect market sentiment and valuations. BofA will likely incorporate geopolitical risks into their analysis.

- Inflationary Pressures: Persistent high inflation could erode corporate profits and lead to lower valuations. Unexpected inflationary spikes are a significant risk.

- Potential for Unexpected Economic Downturns: Economic forecasts are not always accurate. The possibility of a sharper-than-anticipated economic slowdown is a key risk factor.

BofA's Recommendations for Investors (Illustrative)

Based on their analysis, BofA might offer several recommendations. Note that these are illustrative and not a reflection of any specific BofA report. They could suggest:

- Specific Asset Classes: A shift towards defensive sectors (e.g., consumer staples) or opportunities within value stocks might be recommended if valuations are perceived as high in growth sectors.

- Portfolio Adjustments: Investors might be advised to rebalance their portfolios to reduce exposure to specific sectors or asset classes they deem overly risky.

- Investment Strategies to Mitigate Risks: Hedging strategies, diversification, or a more conservative approach might be recommended depending on the overall market outlook and risk appetite.

Maintaining Investor Calm Amidst Market Fluctuations Based on BofA's Analysis

BofA's analysis of stock market valuations, while not necessarily signaling complete calm, often provides a framework for a more measured approach. Their assessment typically incorporates a variety of factors, including valuation metrics and macroeconomic projections. However, it's crucial to remember that even with a relatively positive outlook, potential risks remain. Geopolitical instability, persistent inflation, and unexpected economic downturns could all impact market performance.

Therefore, while BofA's perspective can contribute to a calmer investor outlook, it's vital to conduct thorough research and develop a well-informed investment strategy based on your own risk tolerance and financial goals. Learn more about BofA's stock market valuation analysis to make informed decisions based on their assessment of stock market valuations and understand the factors influencing investor calm.

Featured Posts

-

Your Good Life Creating A Life Of Purpose And Intention

May 31, 2025

Your Good Life Creating A Life Of Purpose And Intention

May 31, 2025 -

30 Days To A More Minimalist You

May 31, 2025

30 Days To A More Minimalist You

May 31, 2025 -

Exec Office365 Breach Millions Made By Hacker Feds Say

May 31, 2025

Exec Office365 Breach Millions Made By Hacker Feds Say

May 31, 2025 -

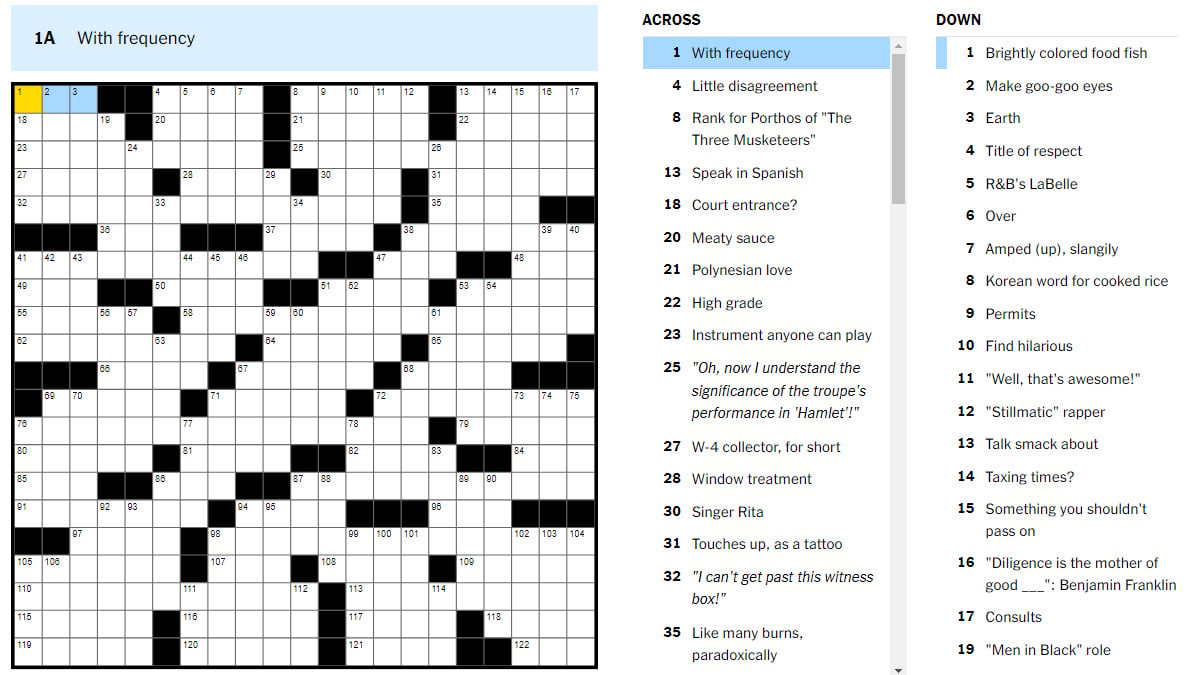

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025 -

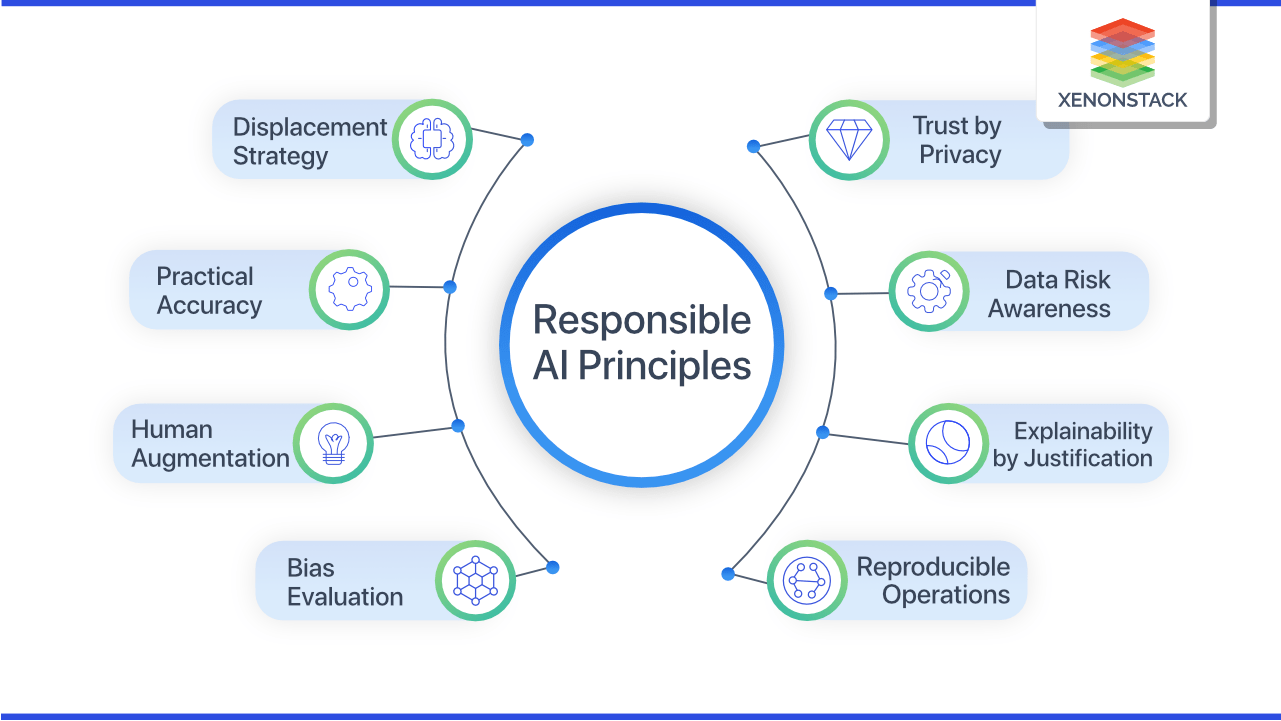

The Reality Of Ai Learning Navigating The Challenges Of Responsible Ai

May 31, 2025

The Reality Of Ai Learning Navigating The Challenges Of Responsible Ai

May 31, 2025