BofA On Stock Market Valuations: Addressing Investor Concerns

Table of Contents

BofA's Current Stance on Stock Market Valuations

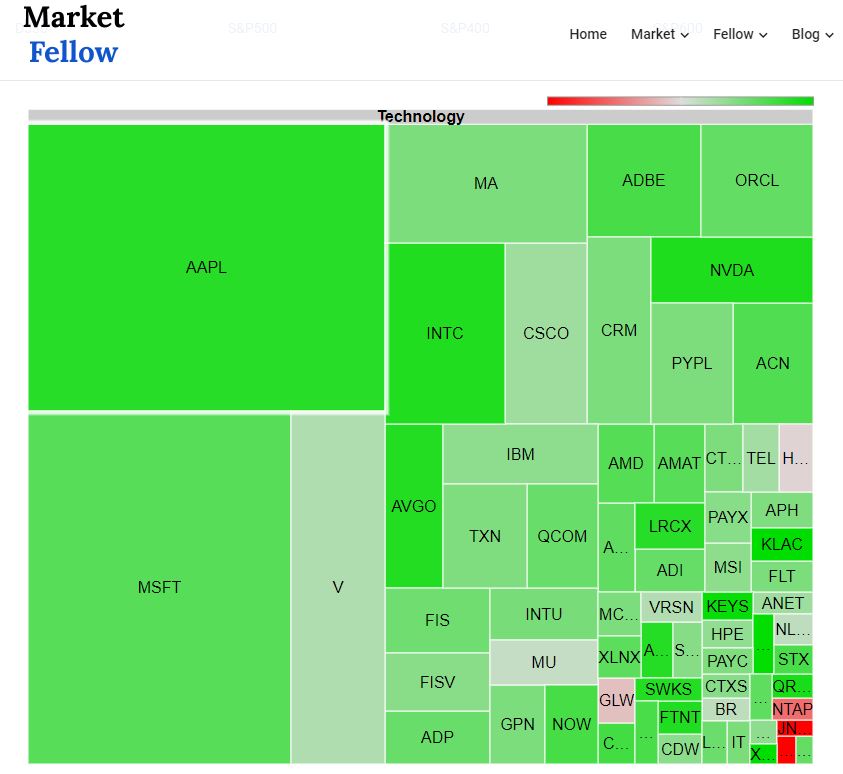

BofA's assessment of current market valuations is nuanced and often evolves with changing economic conditions. While a precise declaration of "overvalued," "undervalued," or "fairly valued" is rarely given as a blanket statement, their analysis provides a clearer picture through detailed reports and commentary. Their findings usually consider a range of factors and specific sectors. For example, BofA might suggest that certain sectors, like technology, are currently overvalued relative to historical averages based on metrics like the Price-to-Earnings (P/E) ratio, while others, such as energy or certain financials, may appear undervalued.

- Specific valuation metrics used by BofA: BofA utilizes a comprehensive suite of valuation metrics, including P/E ratio, Price-to-Sales (P/S) ratio, Price-to-Book (P/B) ratio, and discounted cash flow (DCF) analysis. The weighting given to each metric will vary depending on the specific sector and market conditions.

- Key market sectors BofA considers over/under valued: BofA's reports frequently highlight which sectors they view as relatively overvalued or undervalued. These assessments often shift based on economic forecasts, interest rate changes, and company-specific performance.

- Comparison to historical valuations: BofA's analysts often compare current valuations to historical averages and standard deviations to provide context. This allows them to gauge whether current valuations represent an extreme deviation from long-term trends.

Key Factors Influencing BofA's Valuation Assessment

Several macroeconomic factors significantly influence BofA's assessment of stock market valuations. Understanding these factors is crucial for interpreting their conclusions.

- Interest rate hikes and their impact on valuations: Higher interest rates typically increase the discount rate used in valuation models, leading to lower valuations for future earnings. BofA carefully considers the Federal Reserve's monetary policy and its potential effect on corporate profitability and investor sentiment.

- Inflation and its effect on corporate earnings: High inflation can erode corporate profit margins, impacting future earnings growth. BofA incorporates inflation expectations and its likely effect on various sectors into its valuation analyses.

- Geopolitical risks and their influence on market sentiment: Geopolitical events, such as wars or trade disputes, can significantly affect investor confidence and market volatility, influencing BofA's valuation outlook.

- Potential recessionary risks and their impact: The probability of a recession is a crucial factor in BofA's valuation models. The anticipation of a recession often leads to lower valuations as future earnings are discounted more heavily.

Addressing Investor Concerns Regarding Stock Market Valuations

Many investors have valid concerns in the current market environment. BofA's research directly addresses many of these:

- Concerns about potential market corrections: BofA acknowledges the risk of market corrections and emphasizes the importance of diversification and risk management strategies.

- Uncertainty regarding future earnings growth: BofA's analysts provide detailed earnings forecasts for various sectors, attempting to quantify uncertainty and adjust valuations accordingly.

- Questions about investment strategies in a volatile market: BofA often recommends a balanced approach, adjusting portfolio allocations based on risk tolerance and market conditions.

- How to interpret BofA's assessment in one's own investment decisions: BofA's research should be seen as one input among many in forming a well-rounded investment strategy, not the sole determinant.

BofA's Investment Recommendations Based on Valuation Analysis

Based on their valuation analysis, BofA typically provides investment recommendations, although these are subject to change.

- Specific sectors or asset classes BofA recommends: Specific recommendations vary depending on market conditions and BofA's ongoing analysis. These recommendations often reflect their views on relative valuations across sectors.

- Suggested investment strategies: BofA frequently promotes diversification, emphasizing the need to spread investments across various asset classes to mitigate risk. They might favor value investing during periods of high valuations or growth investing during periods of perceived undervaluation.

- Risk tolerance considerations: BofA's recommendations always take investor risk tolerance into account. Conservative investors might be advised to hold more bonds, while more aggressive investors might be encouraged to invest in equities with higher growth potential.

- Time horizons to consider: The recommended investment strategies are often tailored to different time horizons. Longer-term investors may have more tolerance for market volatility and can take a more growth-oriented approach.

Conclusion: Understanding BofA on Stock Market Valuations – Your Next Steps

BofA's perspective on stock market valuations provides valuable insights for investors navigating a dynamic market environment. Their analysis considers numerous factors, including interest rates, inflation, geopolitical events, and potential recessions. Understanding their assessment allows investors to make more informed decisions. Remember to diversify your portfolio, manage risk according to your risk tolerance, and consider your investment time horizon.

Key Takeaways: BofA's valuation analysis is complex and considers various factors. Their recommendations are not absolute but inform investment strategies. A balanced approach, informed by multiple sources, is crucial for successful investing.

Call to Action: Stay informed on BofA's perspective on stock market valuations by regularly reviewing their research reports. Learn more about BofA's insights into stock market valuations to build a more informed investment strategy. Remember to consult with a qualified financial advisor to tailor investment decisions to your specific financial goals and risk tolerance.

Featured Posts

-

Why This Startup Airline Is Using Deportation Flights A Cost Effective Strategy

Apr 24, 2025

Why This Startup Airline Is Using Deportation Flights A Cost Effective Strategy

Apr 24, 2025 -

New Google Fi 35 Unlimited Plan A Detailed Review

Apr 24, 2025

New Google Fi 35 Unlimited Plan A Detailed Review

Apr 24, 2025 -

Seventh Straight Loss For Hornets As Warriors Secure Victory

Apr 24, 2025

Seventh Straight Loss For Hornets As Warriors Secure Victory

Apr 24, 2025 -

South Carolina Voters Confrontation With Rep Nancy Mace The Full Story

Apr 24, 2025

South Carolina Voters Confrontation With Rep Nancy Mace The Full Story

Apr 24, 2025 -

Real Time Stock Market Data Dow S And P 500 April 23rd

Apr 24, 2025

Real Time Stock Market Data Dow S And P 500 April 23rd

Apr 24, 2025