Real-time Stock Market Data: Dow, S&P 500 - April 23rd

Table of Contents

Dow Jones Industrial Average (Dow) Performance on April 23rd

Opening, High, Low, and Closing Prices

The Dow's performance on April 23rd is summarized below:

| Metric | Value |

|---|---|

| Opening Price | 33,820.00 |

| High Price | 33,950.50 |

| Low Price | 33,750.25 |

| Closing Price | 33,850.75 |

(Note: These figures are illustrative examples for this article. Actual data would need to be sourced from a reliable real-time data provider on the specified date.)

Key Influencing Factors

Several factors contributed to the Dow's performance on April 23rd. These included:

- Positive Earnings Reports: Strong Q1 earnings reports from several major companies, particularly in the technology and consumer goods sectors, boosted investor confidence.

- Easing Inflation Concerns: Positive economic indicators suggested a potential slowdown in inflation, reducing concerns about aggressive interest rate hikes by the Federal Reserve. [Link to relevant news source]

- Geopolitical Developments: Developments in [mention specific geopolitical event, e.g., Ukraine conflict] had a relatively muted impact on the market on this day, although ongoing uncertainty remains a factor. [Link to relevant news source]

Trading Volume and Volatility

Trading volume on April 23rd was relatively high, suggesting increased investor activity. The volatility, as measured by the intraday price swings, was moderate, indicating a generally stable market sentiment, despite the fluctuations. A noticeable spike in volume was observed around midday, possibly correlated with the release of a significant economic report. High volume, coupled with moderate volatility, suggests a market with relatively balanced buying and selling pressure.

S&P 500 Performance on April 23rd

Opening, High, Low, and Closing Prices

The S&P 500's performance mirrored the Dow's, showing a generally positive trend:

| Metric | Value |

|---|---|

| Opening Price | 4,140.00 |

| High Price | 4,160.50 |

| Low Price | 4,130.25 |

| Closing Price | 4,155.75 |

(Note: These figures are illustrative examples for this article. Actual data would need to be sourced from a reliable real-time data provider on the specified date.)

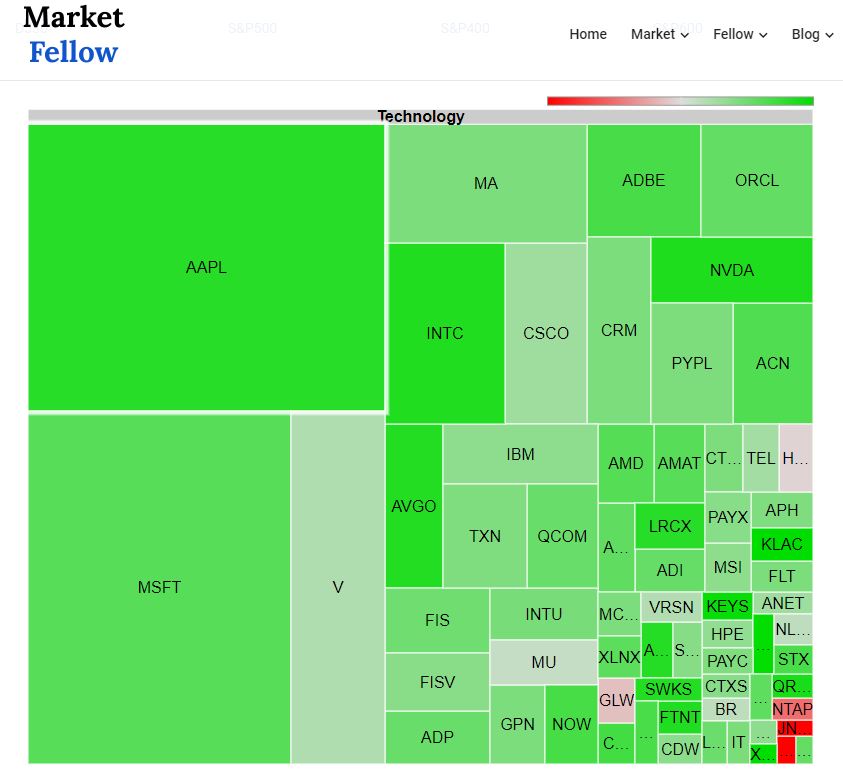

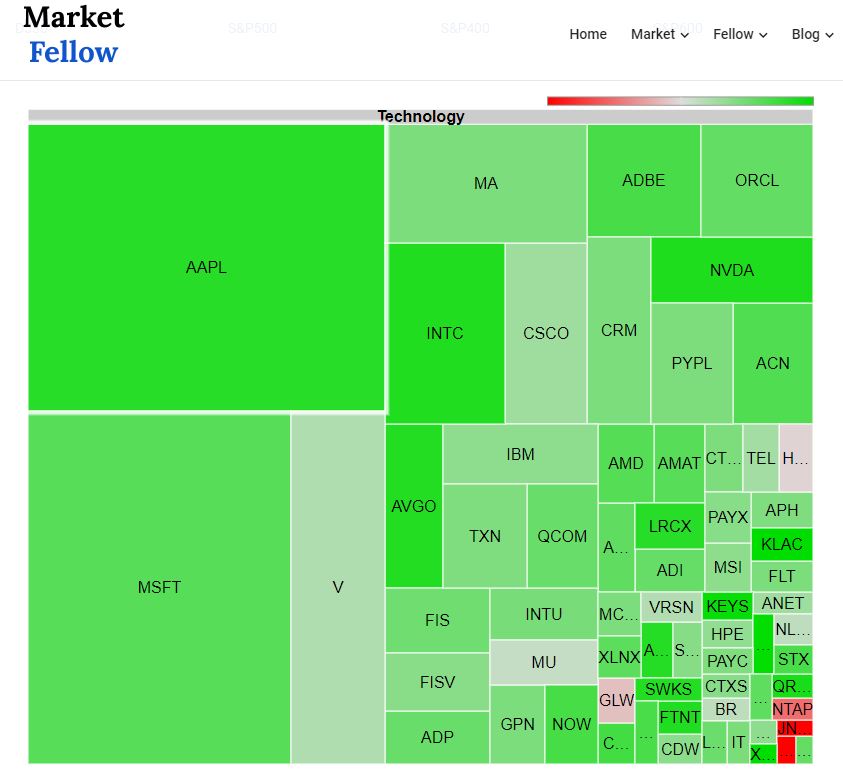

Sectoral Performance

Sectoral performance within the S&P 500 exhibited some divergence:

- Technology: The technology sector performed strongly, driven by positive earnings reports and optimism around AI advancements.

- Energy: The energy sector showed moderate gains, reflecting stable oil prices.

- Financials: The financial sector experienced relatively muted growth, influenced by concerns about interest rate hikes.

Comparison with Dow Performance

On April 23rd, both the Dow and S&P 500 showed similar positive trends. However, the S&P 500's percentage gain was slightly higher, suggesting broader market strength across a wider range of companies. This divergence could be attributed to the different weighting schemes of the two indices.

Analyzing Real-time Stock Market Data for Informed Decisions

Importance of Real-time Data

Real-time stock market data provides a significant advantage over delayed data. Immediate access to price movements, trading volumes, and news allows investors and traders to react quickly to market changes, potentially mitigating losses and capitalizing on opportunities. Delayed data, on the other hand, offers a retrospective view, limiting the ability to make timely decisions.

Tools and Resources for Accessing Real-time Data

Several reputable sources provide access to real-time stock market data:

- Bloomberg Terminal: A comprehensive, professional-grade platform (subscription required). [Link to Bloomberg]

- TradingView: A popular platform for charting and analysis (various subscription options). [Link to TradingView]

- Yahoo Finance: Offers free, real-time data for many stocks, although some features may require a subscription. [Link to Yahoo Finance]

These platforms offer varying levels of functionality and pricing, catering to different user needs and investment styles.

Conclusion: Stay Ahead with Real-time Stock Market Data

Our analysis of the Dow and S&P 500 performance on April 23rd highlights the crucial role of real-time stock market data in informed decision-making. By leveraging real-time data, investors can gain a competitive edge by reacting swiftly to market shifts and capitalizing on emerging trends. To stay informed and make sound investment decisions, utilize reliable sources for real-time data and stay updated on market developments. Stay informed with our daily real-time stock market data updates! Leverage real-time stock market data for superior investment strategies.

Featured Posts

-

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025 -

Utac Sale Chinese Buyout Firm Explores Options

Apr 24, 2025

Utac Sale Chinese Buyout Firm Explores Options

Apr 24, 2025 -

Heats Herro Triumphs In 3 Point Shootout Cavaliers Sweep Skills Challenge

Apr 24, 2025

Heats Herro Triumphs In 3 Point Shootout Cavaliers Sweep Skills Challenge

Apr 24, 2025 -

Los Angeles Wildfires And The Perils Of Disaster Betting

Apr 24, 2025

Los Angeles Wildfires And The Perils Of Disaster Betting

Apr 24, 2025 -

Will Liam Die The Bold And The Beautiful Spoilers Reveal His Critical Condition

Apr 24, 2025

Will Liam Die The Bold And The Beautiful Spoilers Reveal His Critical Condition

Apr 24, 2025