BofA On Stock Market Valuations: Why Investors Can Remain Confident

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

BofA's recent reports convey a surprisingly optimistic message regarding current stock market valuations. Their analysts argue that while the market has experienced periods of heightened uncertainty, several key metrics suggest that valuations aren't excessively inflated. This contradicts some of the more pessimistic market predictions currently circulating.

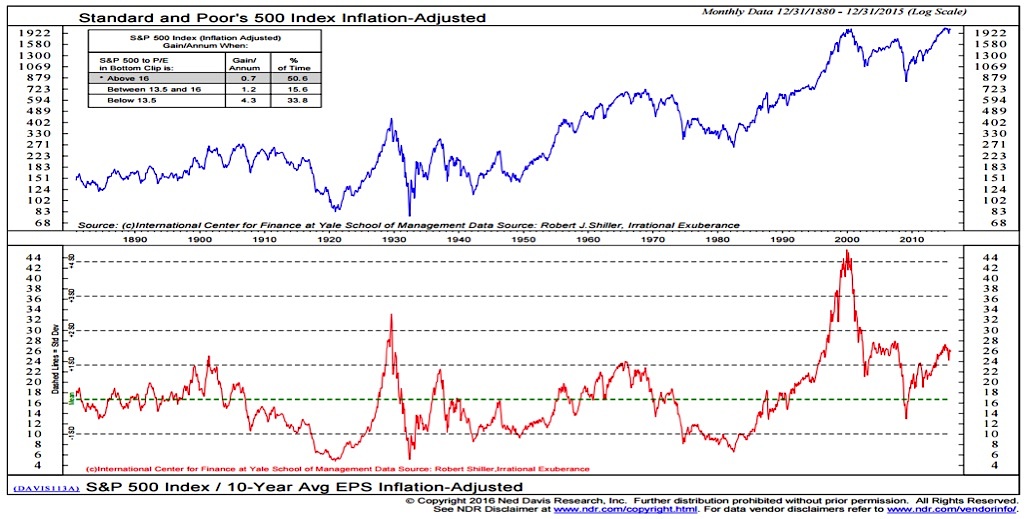

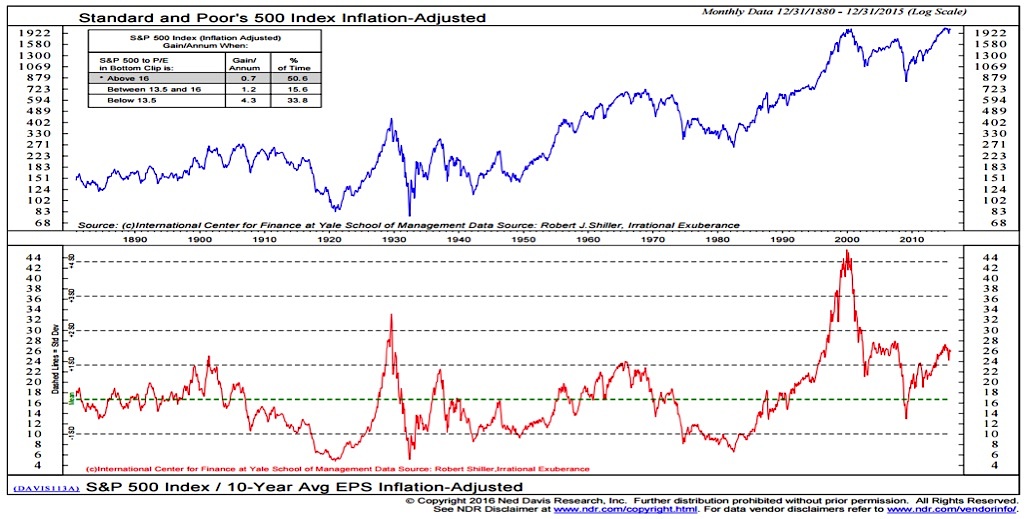

- Specific valuation metrics: BofA's analysis likely cites metrics such as Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios. While specific numbers will vary depending on the report, the overall message often centers on these ratios being within historically acceptable ranges, or even slightly below average compared to previous market cycles.

- Justification for current valuations: BofA's justification typically hinges on strong corporate earnings growth projections and the belief that these earnings will continue to support current market prices. They likely emphasize the resilience of many businesses and their adaptability in the face of economic headwinds.

- Historical context: By comparing current valuation multiples to historical averages, BofA aims to demonstrate that the market isn't in a bubble-like situation. This comparative analysis helps investors assess current valuations within a longer-term perspective, calming fears of an imminent market crash.

Factors Supporting BofA's Confidence

BofA's confident outlook is underpinned by several key macroeconomic factors:

- Strong corporate earnings growth: BofA's projections likely point towards continued robust earnings growth for many companies. This growth, fueled by factors like technological innovation and increased productivity, helps justify current valuations.

- Positive economic indicators: Positive indicators like GDP growth (though perhaps slowing), a strong labor market (with low unemployment), and continued consumer spending contribute to BofA's overall positive assessment. These fundamentals support the belief that the economy can withstand current challenges.

- Technological advancements: The transformative power of technology continues to drive innovation and efficiency improvements across various sectors. This leads to increased corporate profits and supports market valuations.

- Sector-specific bullishness: BofA likely highlights specific sectors poised for significant growth. For example, they might point to the continued strength of the technology sector or the potential for growth in renewable energy.

Addressing Potential Risks and Concerns

While BofA maintains a positive outlook, it's crucial to acknowledge potential risks and challenges:

- Inflationary pressures: Persistent inflationary pressures can erode corporate profits and negatively impact consumer spending, potentially dampening stock market performance. BofA likely acknowledges this risk but perhaps points to signs that inflation is cooling or is being managed effectively by central banks.

- Geopolitical risks: Geopolitical uncertainty, such as ongoing international conflicts, can introduce volatility into the market. BofA's analysis might assess the potential impact of these events on various sectors and the overall market.

- Interest rate hikes: Interest rate hikes by central banks aim to control inflation but can also slow economic growth and impact corporate borrowing costs. BofA's perspective likely incorporates an assessment of the potential impact of interest rate changes on market valuations.

- Risk mitigation strategies: BofA's reports might suggest ways to mitigate these risks, potentially through diversification, hedging strategies, or focusing on companies with strong balance sheets.

Investment Strategies Based on BofA's Analysis

BofA's analysis can inform several investment strategies:

- Sector-specific opportunities: Investors can capitalize on BofA's sector-specific insights by focusing investments on sectors predicted to outperform the broader market.

- Diversification: Diversifying across various sectors and asset classes is crucial to mitigate risk, aligning with the advice likely found in BofA's research.

- Risk management: Implementing robust risk management techniques, such as setting stop-loss orders and diversifying investments, is vital to protect against potential market downturns.

- Investment horizon: BofA's outlook likely supports a long-term investment strategy, emphasizing that market fluctuations are normal and that long-term growth is achievable despite short-term volatility.

Maintaining Confidence in Stock Market Valuations with BofA's Insights

In summary, BofA's analysis suggests that while market uncertainty exists, stock market valuations are not excessively high based on several key metrics and macroeconomic factors. While acknowledging potential risks like inflation and geopolitical uncertainty, BofA's generally positive outlook offers reassurance to investors. By understanding these factors and incorporating BofA's insights, investors can develop well-informed strategies to navigate the market effectively. Learn more about BofA's stock market valuation analysis and explore BofA's insights for confident investing. Use BofA's data to build your investment strategy and make informed decisions in today's dynamic market.

Featured Posts

-

Hengrui Pharmas Hong Kong Ipo Approved By Chinese Regulators

Apr 29, 2025

Hengrui Pharmas Hong Kong Ipo Approved By Chinese Regulators

Apr 29, 2025 -

Pw C Faces One Year Advisory Ban From Saudi Arabias Pif

Apr 29, 2025

Pw C Faces One Year Advisory Ban From Saudi Arabias Pif

Apr 29, 2025 -

The Role Of Tax Credits In Growing Minnesotas Film Industry

Apr 29, 2025

The Role Of Tax Credits In Growing Minnesotas Film Industry

Apr 29, 2025 -

The Bank Of Canadas Monetary Policy A Rosenberg Critique

Apr 29, 2025

The Bank Of Canadas Monetary Policy A Rosenberg Critique

Apr 29, 2025 -

Reflecting On 11 Years Since The Louisville Tornado Disaster

Apr 29, 2025

Reflecting On 11 Years Since The Louisville Tornado Disaster

Apr 29, 2025