BofA's View: Why Current Stock Market Valuations Are Not A Threat

Table of Contents

Recent market volatility has sparked concerns about stock market valuations. Many investors are questioning whether current prices are justified, leading to uncertainty and potential hesitancy. However, Bank of America (BofA) offers a counter-narrative, suggesting that current valuations aren't as alarming as many believe. This article delves into BofA's perspective, examining the key arguments and supporting data. We'll explore why BofA isn't sounding the alarm bell on current stock prices and what factors they believe support the continued bull market.

BofA's Rationale: Strong Earnings Growth Outpaces Valuation Concerns

BofA's analysis centers on the idea that robust corporate earnings growth is currently outpacing concerns about high valuations. This suggests that the market's pricing, while seemingly elevated, is underpinned by strong fundamentals.

Superior Corporate Earnings

BofA's research highlights several sectors exhibiting exceptional earnings growth, exceeding even the impact of inflation and recent interest rate hikes. This demonstrates a resilience in corporate profits that supports current market levels.

- Technology: The tech sector continues to demonstrate impressive earnings growth, driven by cloud computing, software-as-a-service (SaaS), and artificial intelligence (AI).

- Energy: High energy prices have boosted the profits of energy companies, contributing significantly to overall earnings growth.

- Financials: Despite rising interest rates, many financial institutions are reporting strong earnings, benefiting from increased lending activity and higher net interest margins.

These examples, supported by numerous statistical analyses from BofA, indicate a broad-based strength in corporate profits that outweighs concerns about high valuation multiples. This strong earnings growth is a key driver of stock market performance, according to BofA.

The Role of Low Inflation

BofA anticipates that declining inflation will further support current stock market valuations. Lower inflation leads to reduced pressure on interest rates, creating a more favorable environment for investors.

- BofA projects inflation to fall below 3% by the end of 2024.

- This downward trend in inflation is expected to allow the Federal Reserve to slow or pause interest rate increases.

- Reduced interest rate hikes boost investor confidence, leading to greater willingness to invest in equities.

The anticipated decline in inflation and subsequent moderation of interest rates are significant components of BofA's positive outlook on stock market valuations.

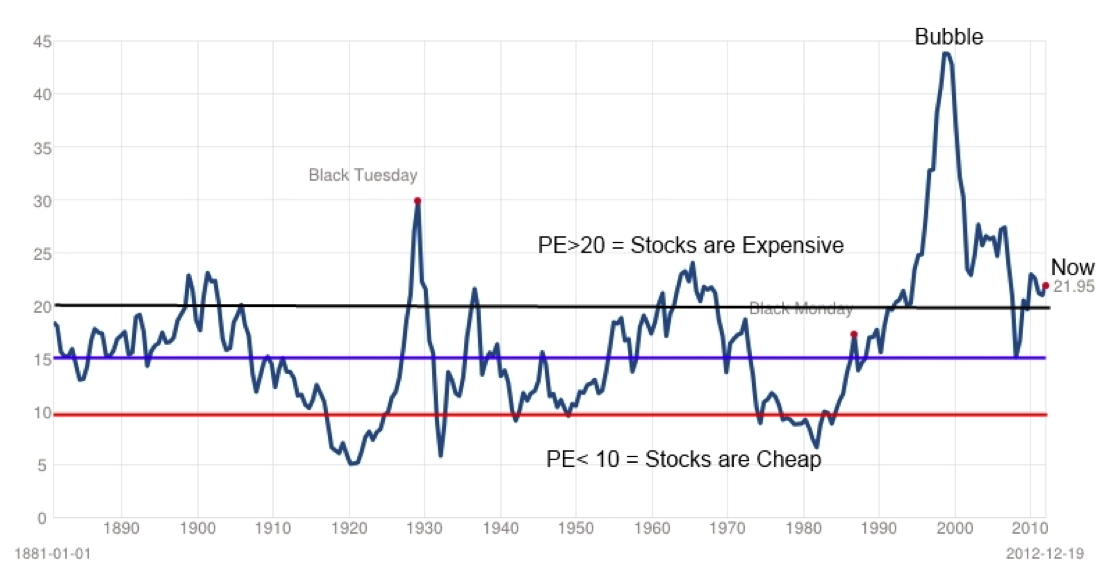

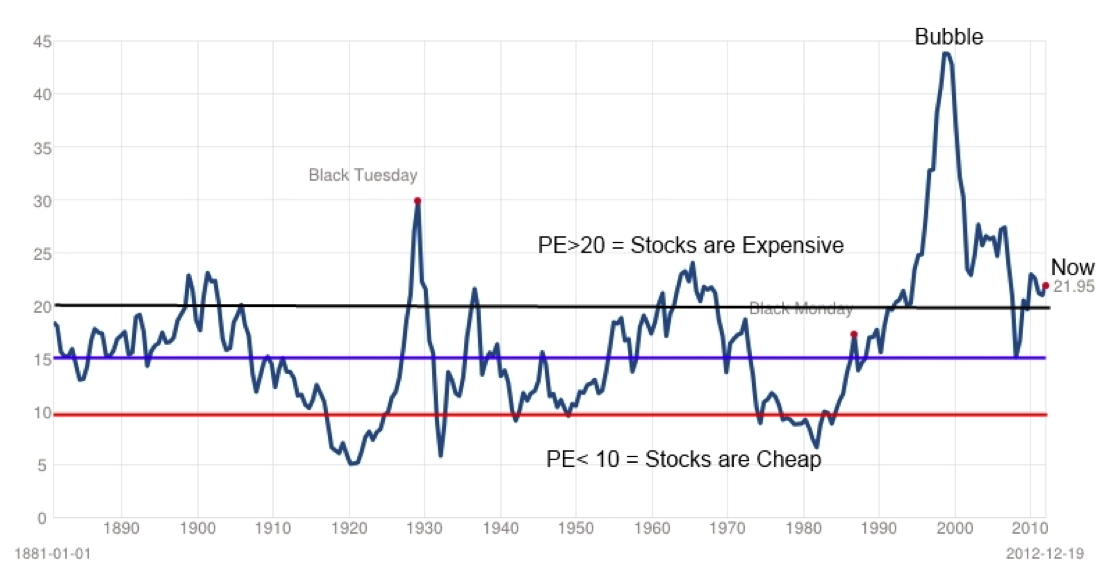

Addressing Valuation Metrics: A Deeper Dive Beyond P/E Ratios

While some focus solely on Price-to-Earnings (P/E) ratios, BofA advocates for a more nuanced approach to valuation metrics. They argue that relying solely on P/E ratios provides an incomplete picture.

Beyond Simple P/E Ratios

Traditional valuation metrics like the P/E ratio can be misleading, particularly when used in isolation. BofA points out that factors like growth rates and industry dynamics are often not fully reflected in simple P/E multiples.

- Price-to-Sales (P/S) Ratio: This metric offers a broader perspective, especially for companies with high growth potential but currently low or negative earnings.

- PEG Ratio: This combines the P/E ratio with the company’s growth rate, offering a more comprehensive valuation tool, especially for high-growth companies.

- Market capitalization should also be considered in the context of a company’s revenue and future growth prospects.

BofA utilizes a broader range of valuation metrics to gain a more comprehensive understanding of market capitalization and individual stock performance.

Considering Sector-Specific Valuations

BofA’s analysis doesn't treat all sectors equally. They acknowledge that valuations vary significantly across different market segments.

- Some sectors may be considered overvalued based on their sector performance and future growth projections.

- Other sectors may be undervalued, presenting attractive opportunities for investors.

- BofA's stock selection strategy considers these sector-specific differences, emphasizing the importance of market segmentation in investment decisions.

Long-Term Growth Prospects and Technological Advancements

BofA's optimistic view is further underpinned by long-term growth prospects, particularly in innovative sectors.

Technological Innovation Driving Growth

Technological advancements and disruptive technologies are seen as key drivers of future long-term growth. BofA identifies numerous sectors poised for significant expansion.

- Artificial intelligence (AI) is revolutionizing multiple industries, leading to increased productivity and efficiency.

- The growth of renewable energy presents significant investment opportunities.

- Advances in biotechnology are driving innovation in healthcare.

These technological innovations are expected to fuel future market trends and contribute significantly to long-term growth in the stock market.

Geopolitical Factors and Their Limited Impact

While geopolitical risks are acknowledged, BofA believes their potential impact on stock market valuations is manageable. Their analysis considers several factors:

- BofA assesses the likelihood and potential severity of various geopolitical events.

- They integrate these assessments into their overall market outlook.

- Their analysis emphasizes the resilience of the global economy and its ability to absorb shocks.

BofA's analysis considers geopolitical risks and their potential effects on market stability and the overall economic outlook. However, they do not see these as a significant threat to the long-term growth potential.

Conclusion

BofA's analysis suggests that strong earnings growth, a nuanced understanding of valuation metrics, promising long-term growth prospects fueled by technological innovation, and a considered assessment of geopolitical risks all contribute to their view that current stock market valuations are not an immediate threat. While their perspective provides valuable insight, remember to conduct your own thorough research and consider your risk tolerance before making any investment decisions. Stay informed on current market valuations and continue to learn about BofA's analysis to make informed decisions about your portfolio. Learn more about BofA's stock market valuation analysis and discover how to manage your investments effectively.

Featured Posts

-

Bof As Reassurance Why Current Stock Market Valuations Arent A Worry

May 10, 2025

Bof As Reassurance Why Current Stock Market Valuations Arent A Worry

May 10, 2025 -

Bondi Faces Scrutiny Senate Democrats Allege Suppression Of Epstein Files

May 10, 2025

Bondi Faces Scrutiny Senate Democrats Allege Suppression Of Epstein Files

May 10, 2025 -

Greenland Under Scrutiny Examining The Pentagons Proposal For Northern Command Jurisdiction

May 10, 2025

Greenland Under Scrutiny Examining The Pentagons Proposal For Northern Command Jurisdiction

May 10, 2025 -

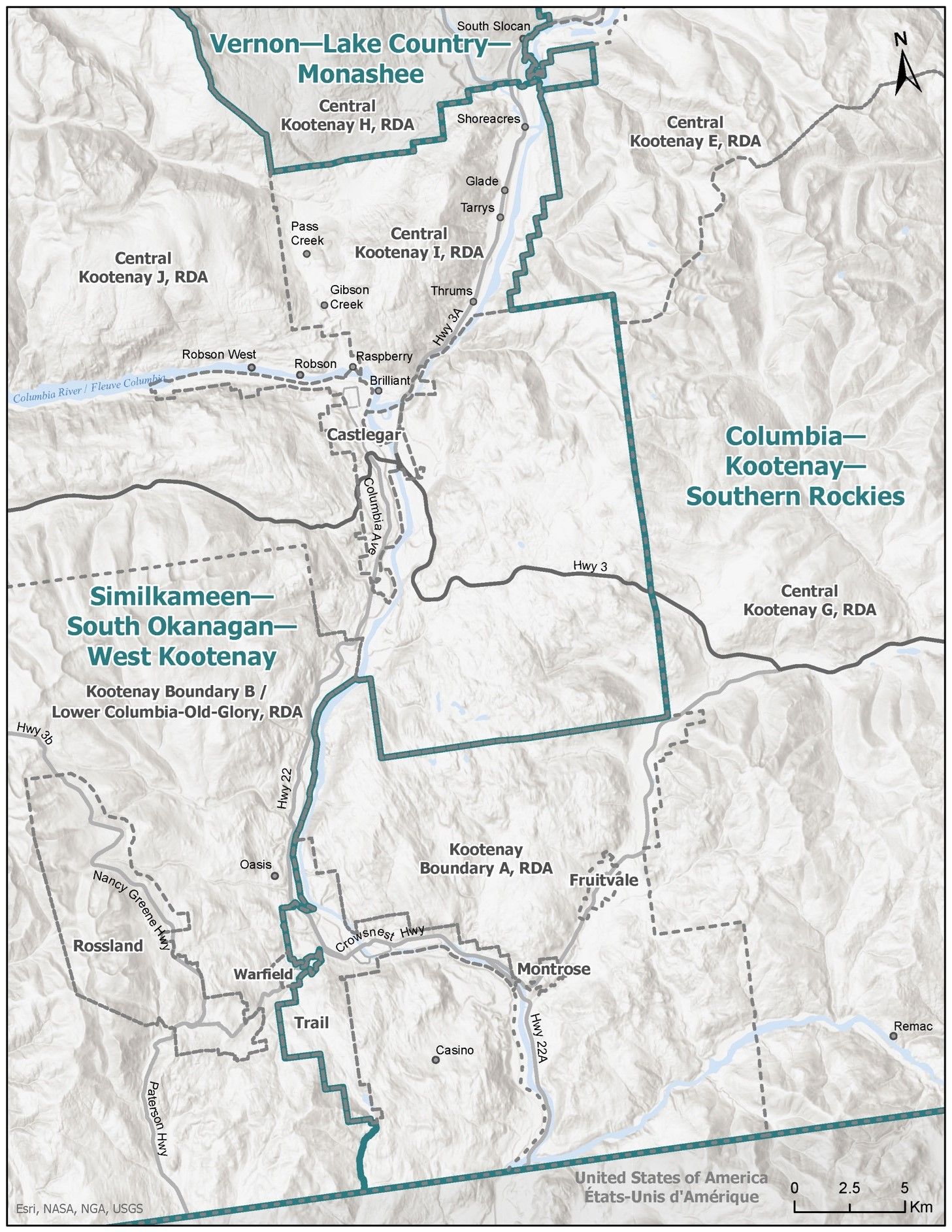

Learn About Every Candidate In Your Nl Federal Riding

May 10, 2025

Learn About Every Candidate In Your Nl Federal Riding

May 10, 2025 -

Ice Detainee Rumeysa Ozturk Released Following Judges Order

May 10, 2025

Ice Detainee Rumeysa Ozturk Released Following Judges Order

May 10, 2025