BP's Chief Executive Plans To Double The Company's Valuation: FT Report

Table of Contents

Looney's Vision: Transitioning Beyond Fossil Fuels

Looney's plan hinges on a rapid acceleration of BP's energy transition away from fossil fuels and into renewable energy sources. This involves significant investments in wind, solar, and other clean energy technologies, marking a decisive shift towards sustainable energy practices. This decarbonization strategy is central to attracting investors seeking environmentally responsible investments and aligning with global efforts to combat climate change. The success of this aspect of the plan is crucial to increasing BP valuation.

- Massive investment in renewable energy infrastructure: BP is committing significant capital to build and acquire renewable energy assets, including offshore wind farms and solar power plants.

- Development of new technologies for carbon capture and storage: Investing in CCS technologies is vital to mitigating the environmental impact of existing fossil fuel operations while simultaneously improving the company's environmental, social, and governance (ESG) profile, vital for attracting environmentally conscious investors and improving BP valuation.

- Phasing out of high-carbon assets: BP is strategically divesting from high-carbon assets to streamline its portfolio and focus resources on lower-carbon energy sources. This signifies a proactive response to evolving environmental regulations and investor expectations, contributing to the increase of BP valuation.

- Focus on building a sustainable and profitable energy business: The ultimate goal is not just sustainability but also profitable growth in the renewable energy sector. This dual focus is essential to demonstrating long-term value to shareholders and ultimately increasing BP valuation.

Financial Strategy: Growth Through Innovation and Efficiency

The doubling of BP's valuation requires not only growth but also significantly improved financial performance. Looney's strategy incorporates a focus on operational efficiency, cost reduction, and strategic investments with high returns on investment. This approach aims to boost profitability and attract investors seeking strong financial returns.

- Streamlining operations to reduce costs: BP is implementing measures to improve operational efficiency across all its divisions, reducing unnecessary expenditure and maximizing profitability. This directly impacts the company's bottom line and consequently the BP valuation.

- Targeted investments in high-growth areas of the renewable energy sector: BP's investments are strategically focused on high-potential areas within renewable energy, aiming to maximize returns and drive future growth in the company's valuation.

- Focus on improving return on investment for all projects: Every project undergoes rigorous evaluation to ensure it meets the criteria for profitability and contributes to the overall increase of BP valuation.

- Attracting investors through demonstrating long-term sustainable profitability: Consistently demonstrating sustainable profitability is key to attracting investors and improving investor sentiment, directly leading to an increase in BP valuation.

Challenges and Risks: Navigating the Energy Landscape

Achieving such an ambitious goal presents significant challenges. Market volatility, regulatory changes, geopolitical instability, and intense competition within the energy sector all pose considerable risks to the company’s plan to increase BP valuation.

- Competition from established renewable energy companies: The renewable energy sector is highly competitive, with many established players vying for market share. This intense competition presents a significant challenge in increasing BP valuation.

- Uncertainty surrounding government policies on climate change and energy transition: Government policies regarding climate change and the energy transition can significantly impact BP's investment decisions and ultimately its valuation.

- Fluctuations in oil and gas prices impacting profitability: While transitioning to renewables, BP remains reliant on oil and gas revenues, making it susceptible to price fluctuations, impacting the timeline for increasing BP valuation.

- Managing the environmental and social impact of BP's operations: Maintaining a strong environmental, social, and governance (ESG) profile is crucial to attracting responsible investors and ensuring the long-term success of the company’s plan to increase BP valuation.

Investor Reaction and Market Outlook

The FT report's revelations have generated considerable discussion amongst investors. Analyzing market reaction and forecasting future performance are crucial aspects to understanding the feasibility of Looney's plan to increase BP valuation.

- Initial market response to the announcement: The initial market reaction to Looney's ambitious plan was generally positive, indicating investor confidence in the direction of the company.

- Analyst predictions on BP's future stock performance: Analysts have offered varied predictions, reflecting the inherent uncertainties and risks involved in the company’s plan to increase BP valuation.

- Potential impact on the broader energy sector: BP's transformation could influence the strategies of other oil and gas companies, accelerating the energy transition across the sector.

- Investment opportunities and risks associated with BP's transformation: The transformation presents both significant investment opportunities and considerable risks, making it crucial for investors to carefully assess the potential outcomes before investing in BP to increase BP valuation.

Conclusion

BP's CEO, Bernard Looney, has set an ambitious goal: to double the company's valuation. This ambitious plan centers around a rapid transition to renewable energy, coupled with a focused approach to financial efficiency and strategic investment. While significant challenges exist, the potential rewards could reshape the energy landscape and redefine BP's position within it. The success of this strategy will depend on navigating market volatility, managing the energy transition effectively, and consistently delivering strong financial results. Stay informed about the progress of BP's transformation and its impact on the global energy market by following further updates on BP's valuation and its ambitious strategy. Learn more about the details of BP's plan to double its valuation and the potential implications for the future of energy.

Featured Posts

-

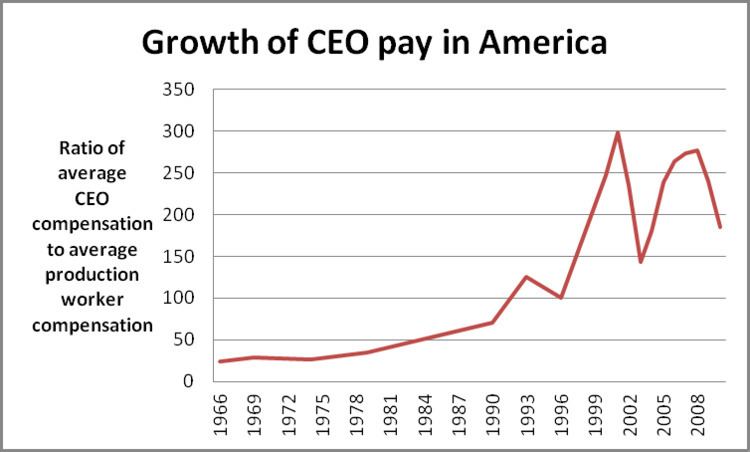

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 21, 2025

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 21, 2025 -

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Mmyz Yndm Lawl Mrt

May 21, 2025

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Mmyz Yndm Lawl Mrt

May 21, 2025 -

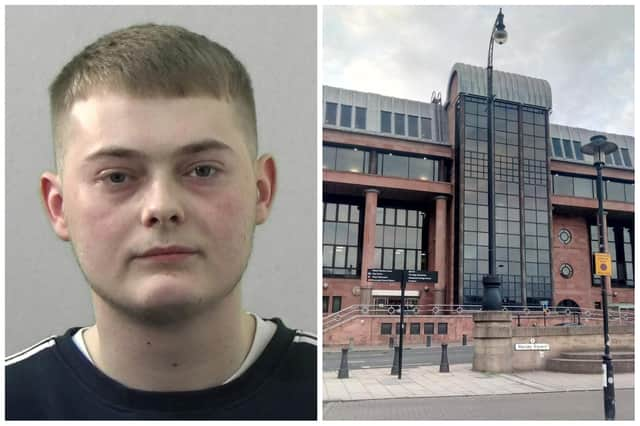

Court Challenge To Racial Hatred Tweet Sentence By Ex Tory Councillors Wife

May 21, 2025

Court Challenge To Racial Hatred Tweet Sentence By Ex Tory Councillors Wife

May 21, 2025 -

96 1 1

May 21, 2025

96 1 1

May 21, 2025 -

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025

Latest Posts

-

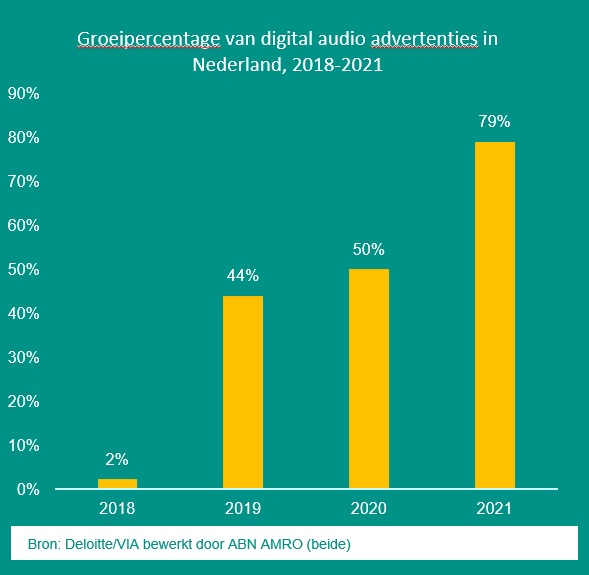

Occasionmarkt Bloeit Abn Amro Ziet Sterke Verkoopstijging

May 21, 2025

Occasionmarkt Bloeit Abn Amro Ziet Sterke Verkoopstijging

May 21, 2025 -

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 21, 2025 -

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 21, 2025

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 21, 2025 -

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025 -

Half Dome Awarded Abn Group Victorias Digital Marketing Contract

May 21, 2025

Half Dome Awarded Abn Group Victorias Digital Marketing Contract

May 21, 2025