Brexit's Toll: UK Luxury Exports Struggle In The EU Market

Table of Contents

Increased Customs Procedures and Delays

The post-Brexit customs regime has imposed a considerable administrative burden on luxury goods exporters. Keywords like customs checks, border controls, paperwork, delays, supply chain disruption, and logistics are central to understanding this challenge.

- Increased customs declarations and documentation requirements lead to significant processing delays, often causing goods to be held up at borders. This is particularly problematic for time-sensitive, perishable luxury items like fresh produce or high-end floral arrangements.

- Longer border crossing times result in perishable goods spoiling, leading to substantial financial losses. Increased transportation costs, due to longer transit times and the need for specialized transport solutions, add further strain.

- Complex regulatory compliance adds to administrative burdens and operational costs. Businesses need to navigate a complex web of regulations, requiring specialized expertise and software, leading to increased overhead.

- Lack of clear guidance and inconsistent application of customs rules creates uncertainty and frustration. The inconsistent application of rules across different border points adds to unpredictability and increases the risk of delays and penalties.

The sheer volume of paperwork and the unpredictable nature of customs delays have severely disrupted supply chains, leading to increased costs and reputational damage due to late deliveries. This is particularly damaging for high-value luxury goods where timely delivery is paramount.

Tariffs and Increased Costs

The introduction of tariffs on UK luxury exports to the EU has directly impacted profitability. Keywords such as tariffs, duties, import taxes, cost increase, price competitiveness, and profitability highlight the financial impact.

- New tariffs on luxury goods exported from the UK to the EU significantly increase the final price, making them less attractive to consumers. The added costs can range from a few percentage points to considerably more, depending on the specific item and its classification.

- Higher costs reduce the price competitiveness of UK luxury goods compared to competitors from within the EU, who benefit from tariff-free access to the EU market. This makes it harder for UK businesses to compete effectively.

- Reduced profit margins threaten the viability of many smaller luxury exporters, who lack the resources to absorb these increased costs. Many smaller businesses are facing significant financial pressures, leading to possible closures.

- Some businesses have been forced to absorb costs, impacting their profitability. Others have passed costs on to consumers, affecting demand and potentially damaging brand image.

Impact on Supply Chains and Logistics

The complexities of post-Brexit logistics have forced a significant restructuring of supply chains for many UK luxury exporters. Relevant keywords include supply chain, logistics, transportation, distribution, warehousing, and Brexit impact.

- Disruption to established supply chains has forced businesses to seek new routes and partners, adding complexity and cost. Re-establishing reliable supply chains across the new border requires significant investment of time and resources.

- Increased transportation costs are adding to the overall cost of exporting luxury goods. This increased cost is further impacting already squeezed profit margins.

- Warehousing and storage solutions have become more complex and expensive due to the need for compliance with new customs regulations. The increased storage requirements are further increasing costs.

- The need for new logistics expertise adds to the operational burden on businesses. Navigating the new complexities of post-Brexit trade requires additional expertise and investment in technology.

Finding reliable and cost-effective alternatives is proving challenging, and the additional logistical hurdles have significantly contributed to higher costs and decreased efficiency.

Loss of Market Share and Economic Impact

The cumulative effect of Brexit-related challenges is a decline in UK luxury goods' market share within the EU. Keywords such as market share, economic impact, UK economy, job losses, investment, and competitiveness are essential here.

- UK luxury brands are losing market share to competitors from within the EU, who now enjoy a significant advantage in terms of cost and ease of trade. This market share loss is directly impacting UK businesses.

- Reduced exports negatively impact the UK economy and associated jobs, leading to potential job losses across the supply chain, from manufacturing to retail. The economic impact is far-reaching.

- Uncertainty around future trade relations discourages investment in the sector, impacting the long-term growth and competitiveness of UK luxury brands. The lack of clarity makes it difficult for businesses to plan for the future.

- The overall competitiveness of UK luxury goods on the European market has been significantly diminished. This diminished competitiveness puts the future of the sector at risk.

This loss of export revenue has a knock-on effect on the UK economy, potentially impacting jobs and discouraging further investment in this vital sector.

Conclusion

Brexit has undeniably imposed a significant toll on UK luxury exports to the EU. Increased customs procedures, tariffs, and supply chain disruptions have created a challenging environment, impacting profitability, competitiveness, and market share. Addressing these issues requires a proactive approach from both the government and businesses involved in the UK luxury goods export sector. Understanding the ongoing impact of Brexit on UK luxury exports is crucial for developing effective strategies to mitigate further losses and safeguard this important segment of the British economy. Further research into the specific challenges faced by different luxury sectors and tailored solutions are vital to navigate the complexities of post-Brexit trade. Failing to address these challenges could lead to long-term damage to the UK’s luxury goods industry. Therefore, proactive engagement with the government and a commitment to adapting to the new trade landscape are essential for the future success of UK luxury exports in the EU market.

Featured Posts

-

Understanding The Love Monster Phenomenon

May 21, 2025

Understanding The Love Monster Phenomenon

May 21, 2025 -

Pandemic Fraud Lab Owner Convicted Of Falsified Covid Tests

May 21, 2025

Pandemic Fraud Lab Owner Convicted Of Falsified Covid Tests

May 21, 2025 -

The Goldbergs Impact On Television Comedy

May 21, 2025

The Goldbergs Impact On Television Comedy

May 21, 2025 -

Exclusive Vybz Kartel On Prison Family And Upcoming Music

May 21, 2025

Exclusive Vybz Kartel On Prison Family And Upcoming Music

May 21, 2025 -

Bolid De Lux Si Fani Entuziasmati Cum Au Fost Intampinati Fratii Tate In Bucuresti

May 21, 2025

Bolid De Lux Si Fani Entuziasmati Cum Au Fost Intampinati Fratii Tate In Bucuresti

May 21, 2025

Latest Posts

-

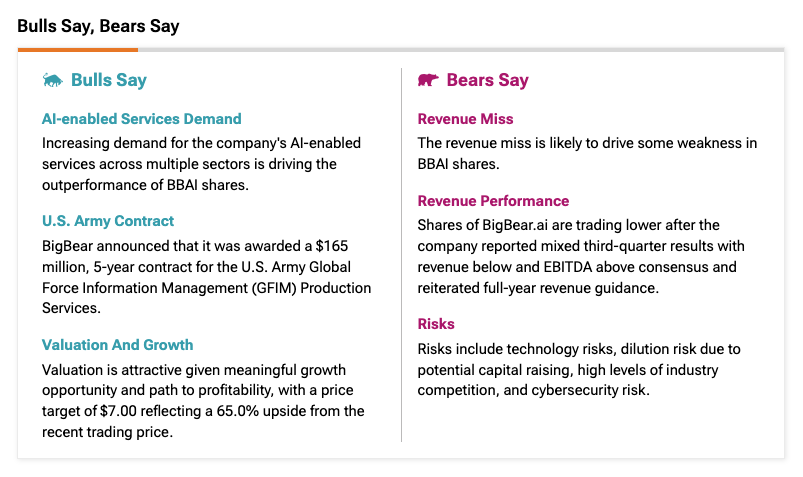

Investing In Big Bear Ai Bbai A Penny Stock Perspective Using Key Indicators

May 21, 2025

Investing In Big Bear Ai Bbai A Penny Stock Perspective Using Key Indicators

May 21, 2025 -

Defense Sector Investment Surge Big Bear Ai Bbai Holds Strong Buy Rating

May 21, 2025

Defense Sector Investment Surge Big Bear Ai Bbai Holds Strong Buy Rating

May 21, 2025 -

Investing In Ai Quantum Computing One Key Reason To Buy The Dip

May 21, 2025

Investing In Ai Quantum Computing One Key Reason To Buy The Dip

May 21, 2025 -

Big Bear Ai Holdings Inc Bbai Evaluating This Ai Penny Stocks Potential

May 21, 2025

Big Bear Ai Holdings Inc Bbai Evaluating This Ai Penny Stocks Potential

May 21, 2025 -

Big Bear Ai Bbai Retains Buy Rating Defense Spending Fuels Positive Outlook

May 21, 2025

Big Bear Ai Bbai Retains Buy Rating Defense Spending Fuels Positive Outlook

May 21, 2025