Broadcom's VMware Acquisition: AT&T Faces A 1,050% Cost Increase

Table of Contents

The Anatomy of AT&T's 1050% Cost Increase

AT&T's reliance on VMware's virtualization technologies is extensive, making them particularly vulnerable to Broadcom's post-acquisition pricing strategy. Understanding the specifics of this relationship is crucial to grasping the magnitude of the cost increase.

VMware's Role in AT&T's Infrastructure

AT&T leverages VMware's virtualization solutions on a massive scale for its network and cloud operations. Their infrastructure relies heavily on several key VMware products:

- vSphere: This virtualization platform is foundational to AT&T's server infrastructure, enabling efficient resource utilization and management.

- NSX: AT&T utilizes NSX for network virtualization, providing agility and scalability in its network operations. This is especially crucial for handling the demands of modern telecommunications.

- vRealize Suite: This suite of management tools helps AT&T optimize its virtualized infrastructure.

The sheer scale of AT&T's VMware deployment, encompassing a substantial portion of their IT infrastructure, amplifies the impact of any price increase. Their dependence on VMware for Network Functions Virtualization (NFV) further highlights this reliance.

Broadcom's Pricing Strategy Post-Acquisition

Broadcom's history suggests a potential motive for the dramatic price increase. The company is known for its aggressive acquisitions and subsequent focus on maximizing profitability. Several factors might contribute to this pricing strategy:

- Consolidation of Market Power: By acquiring VMware, Broadcom gained significant market dominance in the virtualization space, reducing competition and potentially enabling higher prices.

- Increased Profit Margins: The acquisition might be viewed as an opportunity to significantly increase profit margins on existing VMware products.

- Shifting Business Strategy: Broadcom's long-term strategy may involve a shift towards higher-margin products and services, potentially justifying the price increase.

The Impact on AT&T's Budget and Operations

The reported 1050% cost increase represents a substantial financial burden for AT&T. This translates to millions, if not billions, of dollars in additional expenditure annually, significantly impacting their IT budget. This price hike poses considerable operational challenges, including:

- Budgetary Constraints: The increased costs necessitate a reassessment of AT&T's IT spending and could lead to budget cuts in other areas.

- Operational Efficiency: AT&T may need to re-evaluate its operational efficiency to offset the increased costs, potentially leading to adjustments in service offerings or staffing levels.

- Potential Response Strategies: AT&T may explore various options, such as renegotiating contracts with Broadcom, seeking alternative virtualization solutions, or even migrating to open-source alternatives.

Broader Implications for the Telecom Industry

The impact of Broadcom's price increase extends far beyond AT&T, potentially creating a domino effect across the entire telecom industry.

The Ripple Effect on Other Telecom Providers

Many major telecom companies rely heavily on VMware's virtualization technologies. The price increase could trigger similar cost hikes for these providers:

- Verizon: A major competitor to AT&T, Verizon is also a significant VMware user and could face substantial cost increases.

- T-Mobile: T-Mobile's reliance on VMware for its network infrastructure could also be affected by Broadcom's pricing strategy.

- Other Global Telecoms: Numerous international telecom operators utilize VMware, potentially facing similar challenges.

This industry-wide price increase could lead to consolidation within the telecom sector, as smaller players struggle to absorb the higher costs.

Impact on Cloud Computing and Network Virtualization

The acquisition's implications extend to the broader cloud computing and network virtualization markets:

- Market Shifts: The price hike could accelerate the adoption of alternative virtualization platforms and open-source solutions.

- Growth of Open-Source Alternatives: Companies might be driven to explore open-source alternatives like OpenStack and KVM, potentially leading to a more diverse and competitive market.

- Impact on Competition and Innovation: The reduced competition resulting from the acquisition could stifle innovation in the virtualization space.

Opportunities and Challenges for Enterprise Clients

The Broadcom-VMware acquisition presents both challenges and opportunities for enterprise clients worldwide.

Increased Costs and Vendor Lock-in

Enterprise clients face increased costs and the risk of vendor lock-in:

- Reduced Bargaining Power: The consolidation of market power reduces enterprises' bargaining power, making it difficult to negotiate favorable pricing.

- Increased Cost Burden: The increased costs for VMware products directly impact enterprise IT budgets and could lead to reduced investment in other critical areas.

Exploring Alternative Solutions

Enterprises are exploring alternative virtualization and cloud solutions:

- Alternative Virtualization Platforms: Options like Microsoft Hyper-V, Citrix XenServer, and open-source solutions offer potential alternatives.

- Cloud Providers: Migrating to cloud providers like AWS, Azure, or Google Cloud can provide cost savings and flexibility.

- Migration Complexity: Switching platforms can be a complex and costly undertaking, requiring significant time and resources.

Conclusion

Broadcom's acquisition of VMware has undeniably created significant challenges, especially for AT&T, with the reported 1050% cost increase serving as a stark warning. This merger underscores the risks of heavy reliance on single vendors and the potential for market consolidation to drive up prices. The substantial price hike emphasizes the crucial need for telecom companies and enterprise clients to proactively assess their VMware dependence and explore viable alternatives. Don't be caught unaware; thoroughly analyze your VMware spending and develop a proactive strategy to mitigate potential future cost increases resulting from the Broadcom-VMware acquisition.

Featured Posts

-

Finding Your Perfect Special Little Bag Style Function And Personalization

May 05, 2025

Finding Your Perfect Special Little Bag Style Function And Personalization

May 05, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Information

May 05, 2025

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Information

May 05, 2025 -

Will Fox 2 Simulcast Detroit Red Wings And Tigers Games

May 05, 2025

Will Fox 2 Simulcast Detroit Red Wings And Tigers Games

May 05, 2025 -

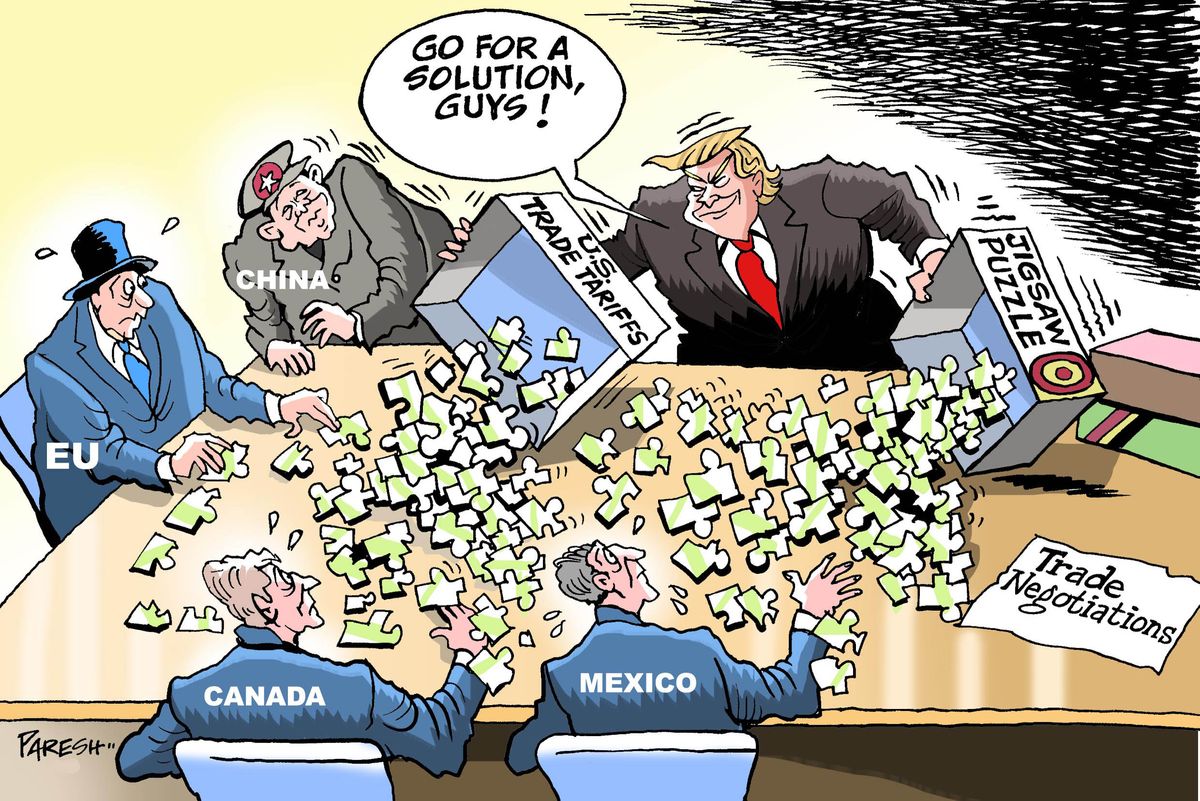

Aritzias Response To Trump Tariffs No Planned Price Increases

May 05, 2025

Aritzias Response To Trump Tariffs No Planned Price Increases

May 05, 2025 -

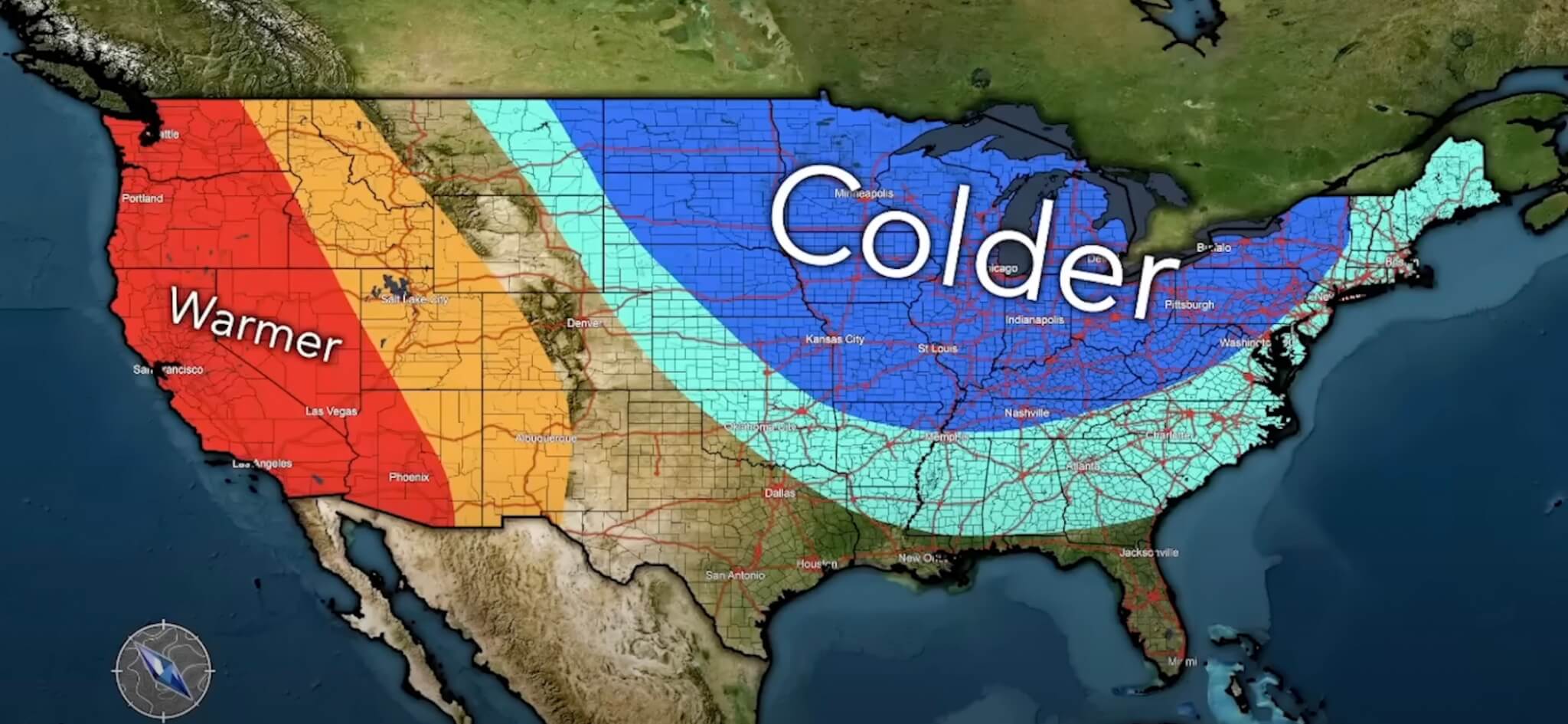

Winter Storm Watch Snow Forecast For New York New Jersey And Connecticut

May 05, 2025

Winter Storm Watch Snow Forecast For New York New Jersey And Connecticut

May 05, 2025

Latest Posts

-

Emma Stooyn Kai Body Heat Syzitiseis Gia To Rimeik Tis Thrylikis Tainias

May 05, 2025

Emma Stooyn Kai Body Heat Syzitiseis Gia To Rimeik Tis Thrylikis Tainias

May 05, 2025 -

Rimeik Body Heat T Ha Doyme Tin Emma Stooyn Ston Protagonistiko Rolo

May 05, 2025

Rimeik Body Heat T Ha Doyme Tin Emma Stooyn Ston Protagonistiko Rolo

May 05, 2025 -

Body Heat I Emma Stooyn Os Protagonistria Nea Pliroforia Gia To Eperxomeno Rimeik

May 05, 2025

Body Heat I Emma Stooyn Os Protagonistria Nea Pliroforia Gia To Eperxomeno Rimeik

May 05, 2025 -

I Emma Stooyn Sto Rimeik Tis Tainias Body Heat Pithanes Ekselikseis

May 05, 2025

I Emma Stooyn Sto Rimeik Tis Tainias Body Heat Pithanes Ekselikseis

May 05, 2025 -

Disneys Cruella A Closer Look At The Stone Thompson Conflict In The New Trailer

May 05, 2025

Disneys Cruella A Closer Look At The Stone Thompson Conflict In The New Trailer

May 05, 2025