Broadcom's VMware Acquisition: AT&T Highlights A 1050% Price Surge

Table of Contents

The Broadcom-VMware Deal: A Closer Look

The $61 billion acquisition of VMware by Broadcom, finalized in late 2022, represents one of the largest technology mergers in history. This deal brought together a leading semiconductor company (Broadcom) with a dominant player in enterprise software and virtualization (VMware).

-

Strategic Rationale: Broadcom's acquisition aimed to expand its portfolio into the lucrative enterprise software market, leveraging VMware's strong position in cloud computing, virtualization, and network infrastructure. This vertical integration allows Broadcom to offer a more comprehensive suite of solutions to its enterprise clients.

-

Combined Market Power: The merger significantly increased Broadcom's market power, creating a tech giant with a vast reach across hardware and software. This consolidation raises concerns about potential monopolies and reduced competition in various segments of the technology sector.

-

Potential Synergies: Broadcom anticipates significant synergies from integrating VMware's software solutions with its existing hardware offerings. This includes improved efficiency, enhanced product offerings, and cross-selling opportunities. The integration promises to create a more streamlined and efficient technology ecosystem for enterprise clients. However, the path to integration is complex and the full realization of synergies is not guaranteed.

AT&T's Experience: A 1050% Price Increase

AT&T's experience serves as a stark example of the potential post-acquisition pricing changes following the Broadcom VMware merger. Reports indicate that AT&T has seen price increases of up to 1050% on certain VMware products.

-

Specific Product Examples: While specific product names haven't been publicly disclosed by AT&T due to contractual obligations, reports suggest that increases affected several key VMware software and services used by large enterprises for network virtualization and cloud management.

-

Reasons Behind Price Hikes: The dramatic price increases are likely attributed to several factors, including reduced competition following the merger and Broadcom's newly acquired market dominance. The lack of viable alternatives for some VMware products also contributes to the substantial price hikes.

-

AT&T Statements: AT&T hasn't publicly commented extensively on the specific price increases, but industry analysts interpret the situation as a clear indication of potential monopolistic practices following the Broadcom acquisition of VMware.

The Broader Market Impact of the Acquisition

The Broadcom-VMware merger has significant implications for the entire technology industry. Its effects ripple across various sectors, impacting competitors, customers, and regulatory bodies.

-

Impact on Competitors: The merger has intensified competitive pressure on companies offering alternative cloud computing and network infrastructure solutions. Smaller players face a formidable competitor with significantly increased market power and resources.

-

Implications for Customers: Customers face potential concerns regarding pricing, product availability, and the level of support they receive. The increased pricing power held by Broadcom-VMware could result in less choice and higher costs for enterprise clients. Concerns about vendor lock-in are also emerging.

-

Antitrust Concerns and Regulatory Scrutiny: The merger has drawn significant regulatory scrutiny, with antitrust authorities in various jurisdictions investigating potential anti-competitive effects. The outcome of these investigations could have substantial implications for the future of the combined entity and the broader tech landscape.

Future Implications and Predictions

The long-term effects of the Broadcom-VMware acquisition are still unfolding, but several potential outcomes are worth considering.

-

Potential Innovations and Changes: While some anticipate reduced innovation due to decreased competition, others believe that the combined resources of Broadcom and VMware could lead to new and improved products and services. The integration could lead to innovative solutions at the intersection of hardware and software.

-

Shifts in Competitive Dynamics: The merger will undoubtedly reshape the competitive landscape, forcing other players to adapt and innovate to compete with the newly formed tech giant. Expect a surge in mergers and acquisitions within the industry as competitors seek to consolidate their positions.

-

Future of VMware and Broadcom: The future success of the combined entity hinges on the effectiveness of its integration strategy and its ability to navigate regulatory hurdles and maintain customer trust. The long-term prospects are promising if the integration is managed well and synergies are successfully realized.

Conclusion

The Broadcom-VMware acquisition, and the subsequent 1050% price surge experienced by AT&T, highlights the significant and potentially disruptive impact of this mega-merger on the technology industry. The increased market power of Broadcom-VMware raises concerns about pricing, competition, and regulatory scrutiny. The long-term consequences remain to be seen, but the potential for significant shifts in the competitive landscape and the availability of enterprise software and cloud computing solutions is undeniable. Stay informed about the ongoing developments in the aftermath of the Broadcom VMware acquisition and its impact on pricing and the wider technology landscape. Further research into the VMware price surge is crucial for understanding its future implications for businesses. Monitor the market closely for further updates on this landmark technology acquisition.

Featured Posts

-

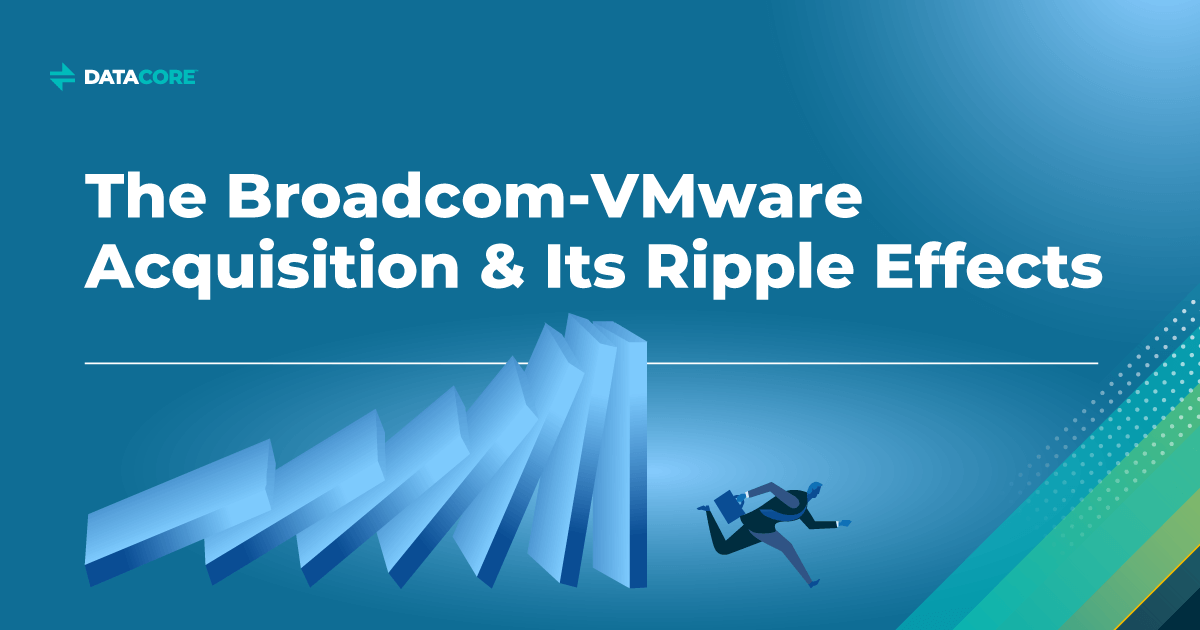

Powells Feds Calculated Risk Waiting Too Long To Cut Interest Rates

May 07, 2025

Powells Feds Calculated Risk Waiting Too Long To Cut Interest Rates

May 07, 2025 -

Orlando Magic Upset Cleveland Cavaliers Ending Historic Winning Streak

May 07, 2025

Orlando Magic Upset Cleveland Cavaliers Ending Historic Winning Streak

May 07, 2025 -

Lewis Capaldis 2024 Comeback Surprise Performance At Tom Walker Charity Gig

May 07, 2025

Lewis Capaldis 2024 Comeback Surprise Performance At Tom Walker Charity Gig

May 07, 2025 -

Conclave 2023 La Mappa Dei Cardinali Scelti Da Papa Francesco

May 07, 2025

Conclave 2023 La Mappa Dei Cardinali Scelti Da Papa Francesco

May 07, 2025 -

The Kelsey Plum And Kate Martin Courtside Moment A Feel Good Story

May 07, 2025

The Kelsey Plum And Kate Martin Courtside Moment A Feel Good Story

May 07, 2025

Latest Posts

-

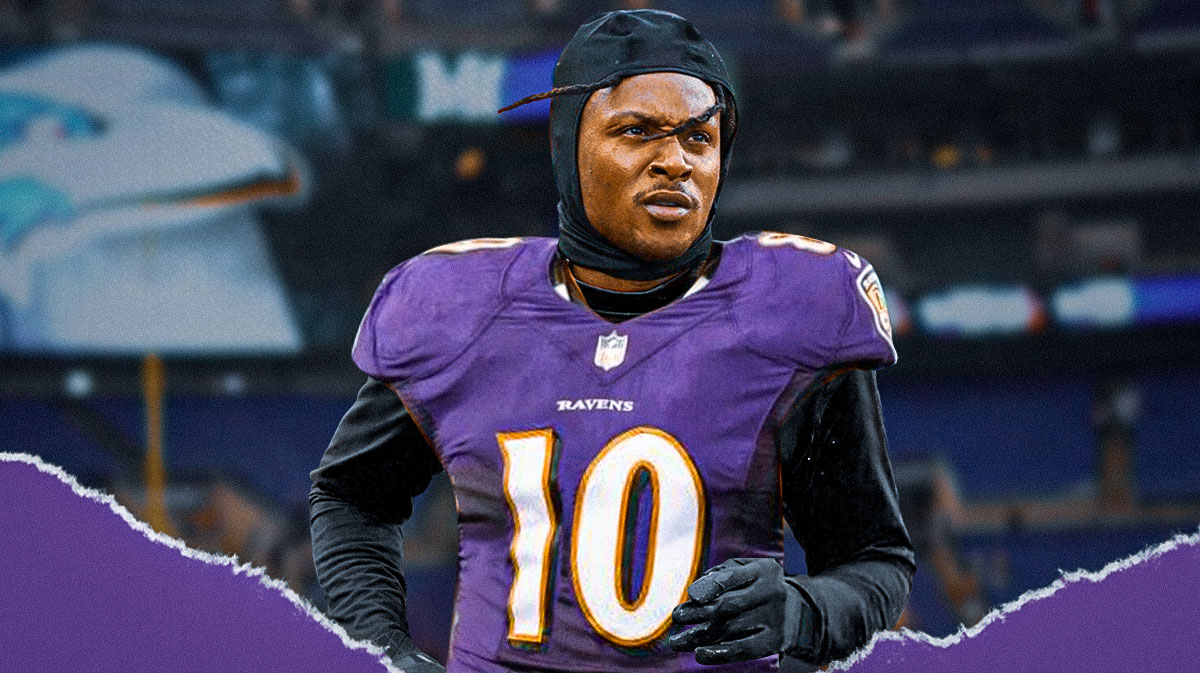

One Year Deal De Andre Hopkins Move To Baltimore

May 08, 2025

One Year Deal De Andre Hopkins Move To Baltimore

May 08, 2025 -

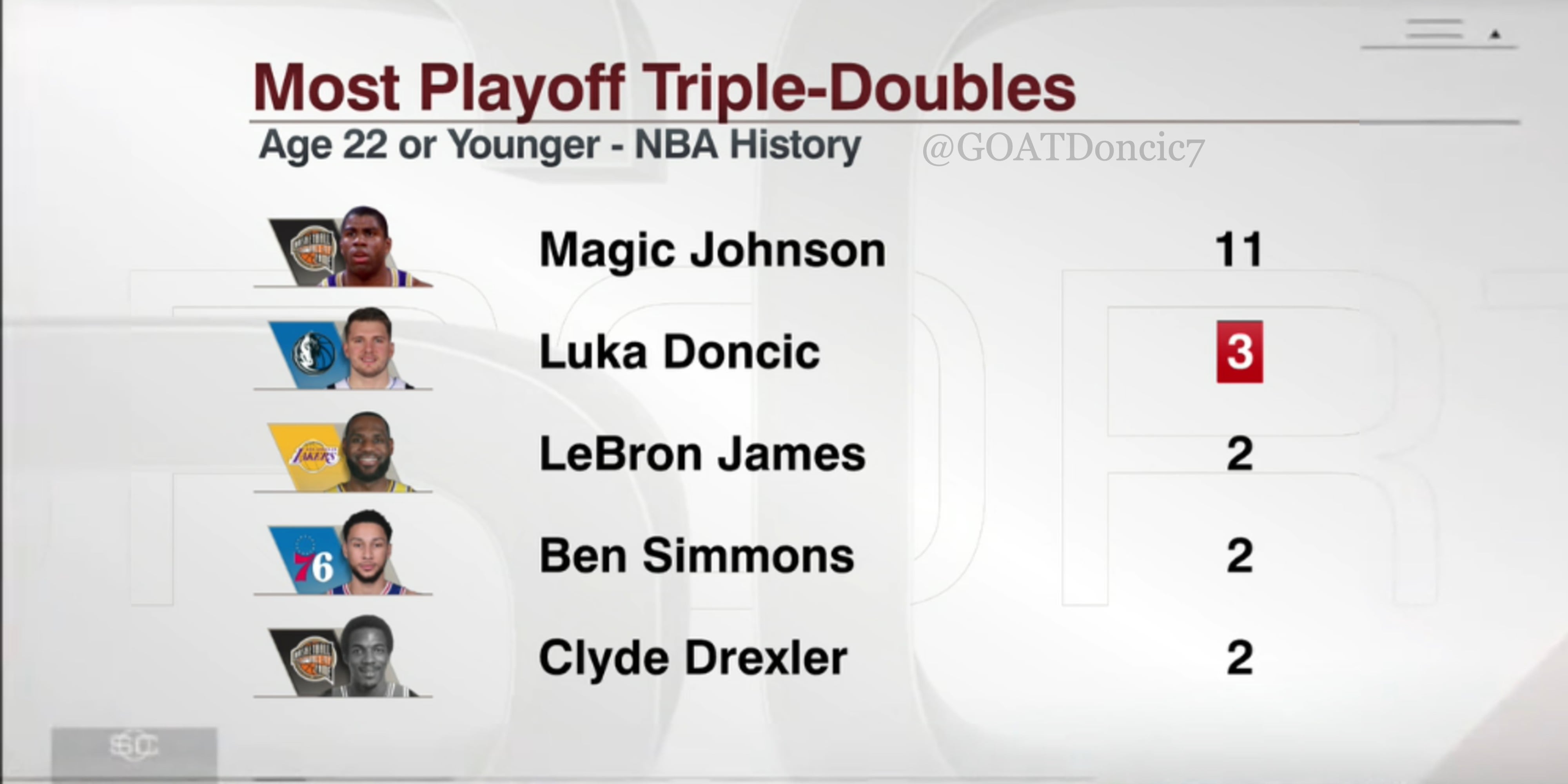

Are You An Nba Expert Take This Triple Doubles Playoffs Quiz

May 08, 2025

Are You An Nba Expert Take This Triple Doubles Playoffs Quiz

May 08, 2025 -

Ravens Bolster Receiving Corps With Hopkins Signing

May 08, 2025

Ravens Bolster Receiving Corps With Hopkins Signing

May 08, 2025 -

How Well Do You Know Nba Playoff Triple Doubles Leaders

May 08, 2025

How Well Do You Know Nba Playoff Triple Doubles Leaders

May 08, 2025 -

De Andre Hopkins Joins Ravens Impact And Expectations

May 08, 2025

De Andre Hopkins Joins Ravens Impact And Expectations

May 08, 2025