Buffett's Apple Investment: Impact Of Trump-Era Tariffs

Table of Contents

The Significance of Apple in Berkshire Hathaway's Portfolio

Berkshire Hathaway's Apple investment is monumental, representing a considerable portion of its overall portfolio. This strategic decision wasn't arbitrary; it reflected Buffett's recognition of Apple's exceptional characteristics: a powerful brand, consistent profitability, and unwavering consumer loyalty. Before the implementation of significant China tariffs, this investment yielded substantial financial benefits for Berkshire Hathaway.

- Percentage of Berkshire Hathaway's portfolio allocated to Apple: At its peak, Apple represented over 40% of Berkshire Hathaway's equity portfolio, making it the largest holding by far.

- Timeline of Berkshire Hathaway's Apple stock acquisition: Berkshire Hathaway began acquiring Apple stock gradually, starting in 2016, steadily increasing its holdings over several years.

- Financial benefits reaped from the Apple investment prior to the tariff implementation: The substantial appreciation of Apple's stock price resulted in significant capital gains for Berkshire Hathaway, contributing considerably to its overall profitability.

The Impact of Trump-Era Tariffs on Apple's Supply Chain

The Trump administration's tariffs, particularly those targeting electronics manufactured in China, directly affected Apple's supply chain. Many of Apple's products rely on components and manufacturing processes based in China. These "Trump-era tariffs" and "China tariffs" presented challenges for Apple.

- Specific tariff rates impacting Apple products: Tariffs varied depending on the specific product and component, leading to a complex calculation of increased costs.

- Impact on Apple's manufacturing costs: The tariffs led to a direct increase in Apple's production costs, impacting its profit margins.

- Analysis of Apple's response to increased costs: Apple responded by exploring options including absorbing some costs, implementing minor price increases on certain products, and diversifying its manufacturing base to lessen its reliance on Chinese production.

Berkshire Hathaway's Response to the Tariff-Induced Challenges

Berkshire Hathaway's response to the tariffs impacting its substantial Apple investment is a case study in how a long-term investor navigates unforeseen geopolitical events. While there were no public announcements of significant divestment, the situation undoubtedly prompted a reassessment.

- Berkshire Hathaway's public statements regarding the tariffs and their impact: Berkshire Hathaway, known for its long-term investment horizon, largely remained silent on the direct impact of tariffs on its Apple holdings.

- Any observable changes in Berkshire Hathaway's Apple holdings during the tariff period: While Berkshire Hathaway didn't drastically reduce its holdings, the rate of acquisition slowed considerably during the period of heightened tariff uncertainty.

- Analysis of Buffett's overall investment philosophy in light of the tariffs: The tariffs served as a stark reminder of the inherent risks associated with global trade and the importance of diversified investment strategies, even for seemingly secure assets like Apple.

Long-Term Effects and Lessons Learned

The long-term effects of the Trump-era tariffs on Apple and Berkshire Hathaway's investment remain a subject of ongoing analysis. However, the experience offers valuable lessons about global trade, supply chain resilience, and risk management.

- Apple’s long-term financial performance post-tariffs: While the tariffs presented short-term challenges, Apple's overall financial performance remained strong, demonstrating resilience and adaptability.

- Changes in Berkshire Hathaway's investment strategies due to the experience: The tariffs likely reinforced the importance of diversification and a careful assessment of geopolitical risks in Berkshire Hathaway's future investment decisions.

- Implications for future investors considering global trade risks: The experience highlights the necessity for investors to consider the complexities of international trade and potential disruptions to supply chains when evaluating investment opportunities.

Conclusion: Understanding Buffett's Apple Investment and the Influence of Tariffs

The Trump-era tariffs presented a significant challenge to "Buffett's Apple Investment," impacting Apple's supply chain and profitability. While Berkshire Hathaway's response was measured, the experience underscores the importance of considering global trade dynamics in investment strategies. Both Apple and Berkshire Hathaway demonstrated adaptability and resilience in navigating these unprecedented trade headwinds. To further explore these complexities and understand the intricate relationship between global trade policies and investment returns, delve deeper into case studies of similar multinational corporations facing fluctuating "China tariffs." Understanding these intricacies is critical for navigating the volatile landscape of global markets and making informed investment decisions. Explore resources like academic journals and financial news outlets to expand your knowledge on the impact of global trade on investment strategies and the continued evolution of "Buffett's Apple Investment."

Featured Posts

-

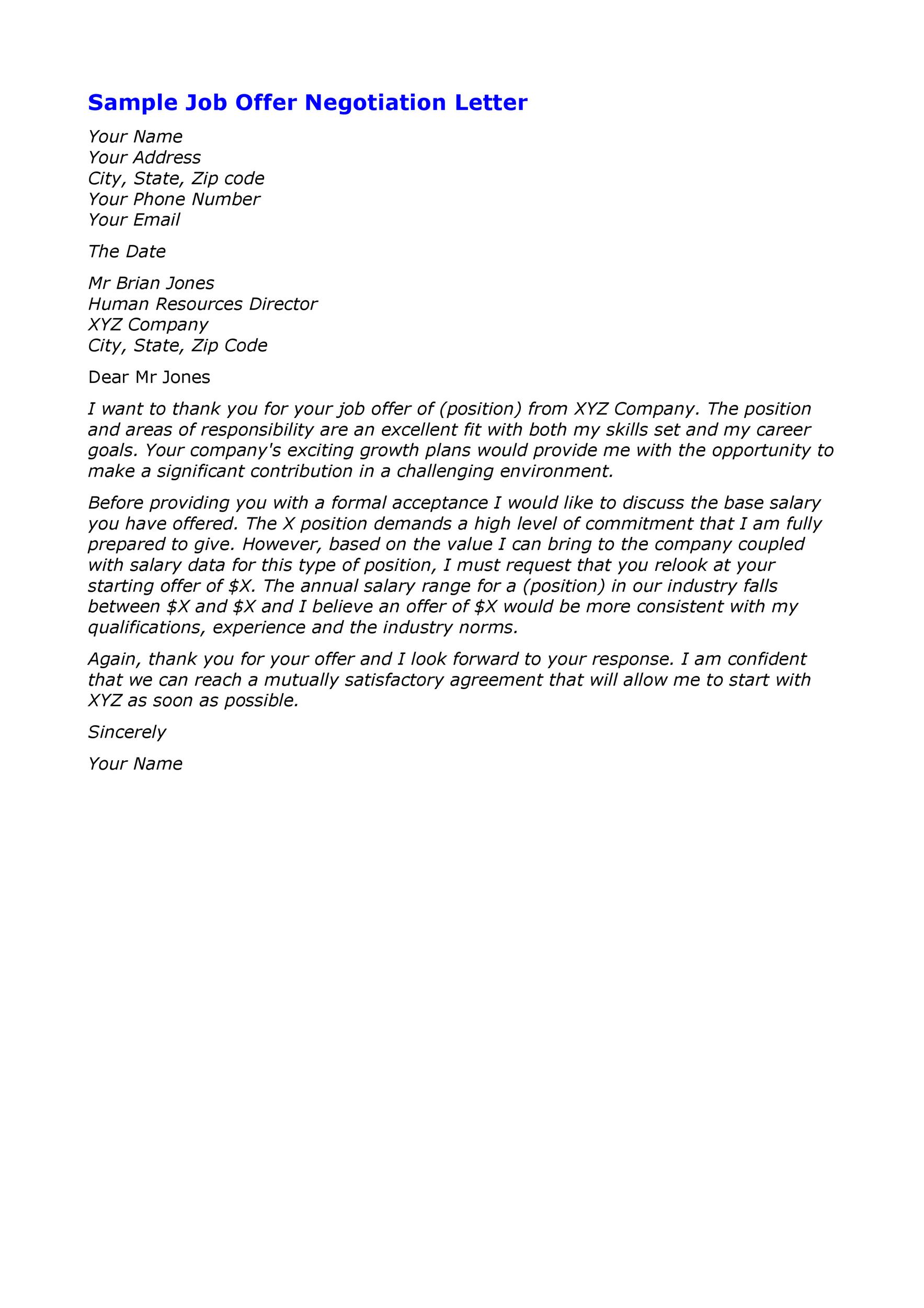

Negotiating A Final Job Offer Is It Possible

May 24, 2025

Negotiating A Final Job Offer Is It Possible

May 24, 2025 -

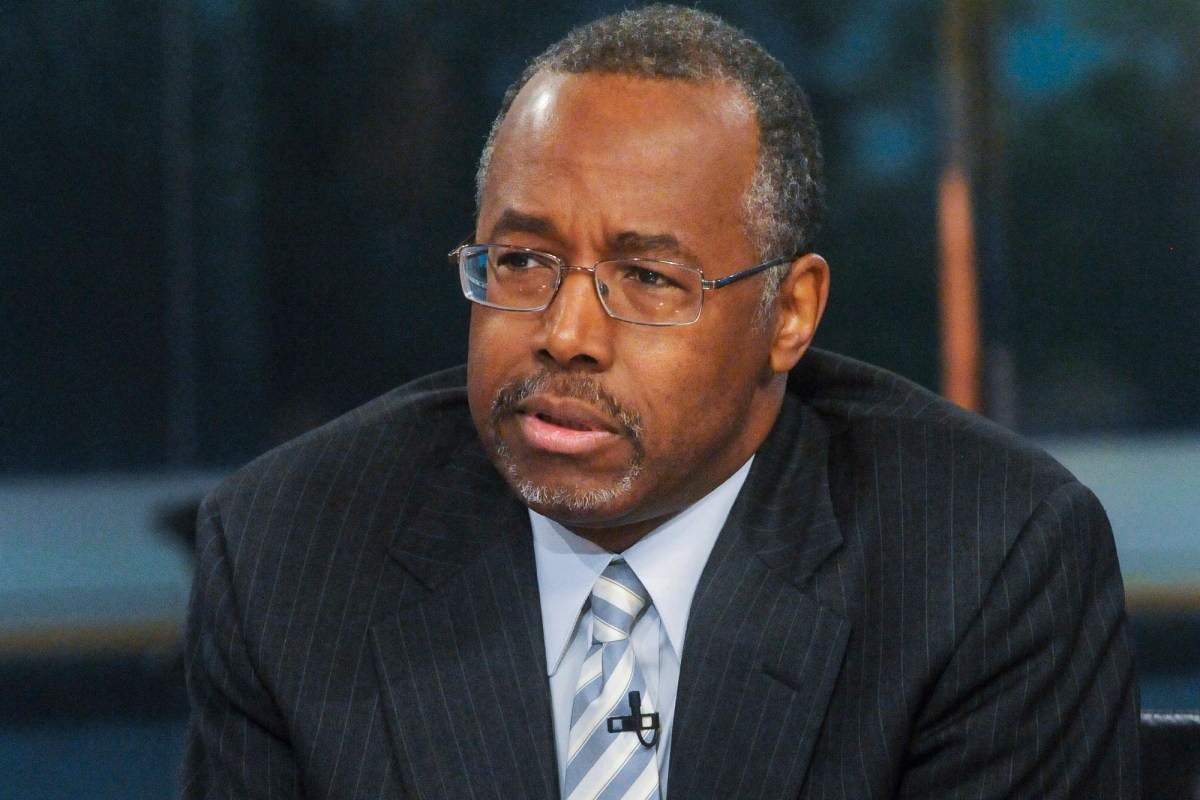

Bardellas Presidential Bid A Contender Emerges

May 24, 2025

Bardellas Presidential Bid A Contender Emerges

May 24, 2025 -

Wall Street Comeback Threatens Daxs Recent Surge A Market Analysis

May 24, 2025

Wall Street Comeback Threatens Daxs Recent Surge A Market Analysis

May 24, 2025 -

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025 -

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Latest Posts

-

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 24, 2025

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 24, 2025 -

Office365 Executive Accounts Compromised Millions In Losses Reported

May 24, 2025

Office365 Executive Accounts Compromised Millions In Losses Reported

May 24, 2025 -

Millions Stolen Inside The Office365 Hack Targeting Executives

May 24, 2025

Millions Stolen Inside The Office365 Hack Targeting Executives

May 24, 2025 -

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 24, 2025

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 24, 2025 -

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025