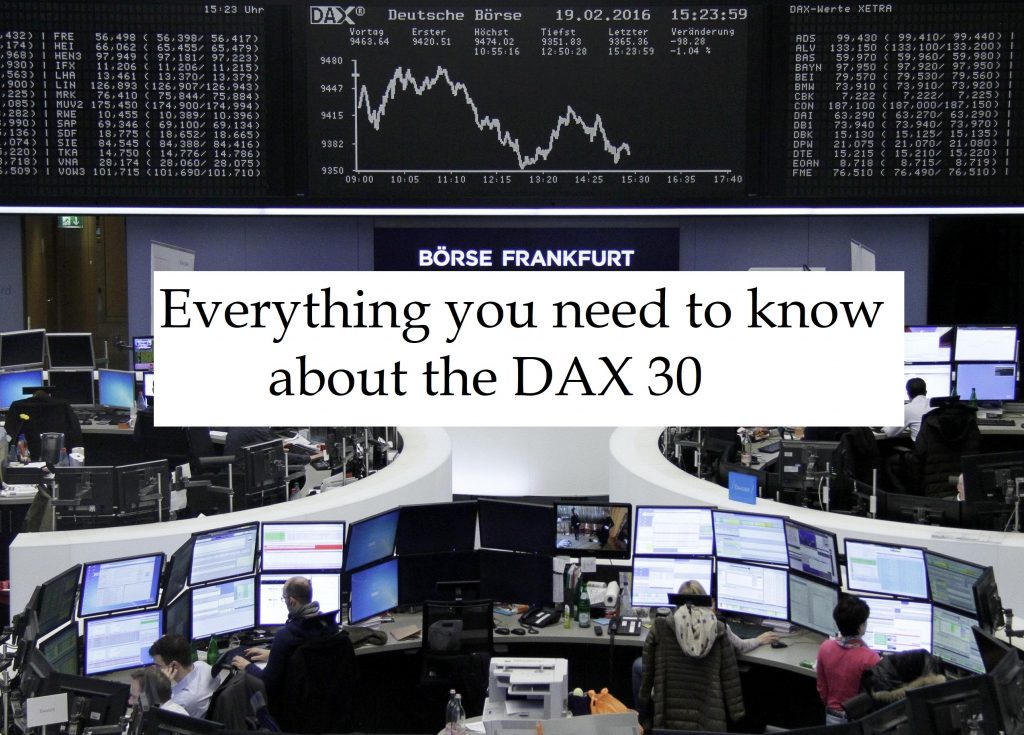

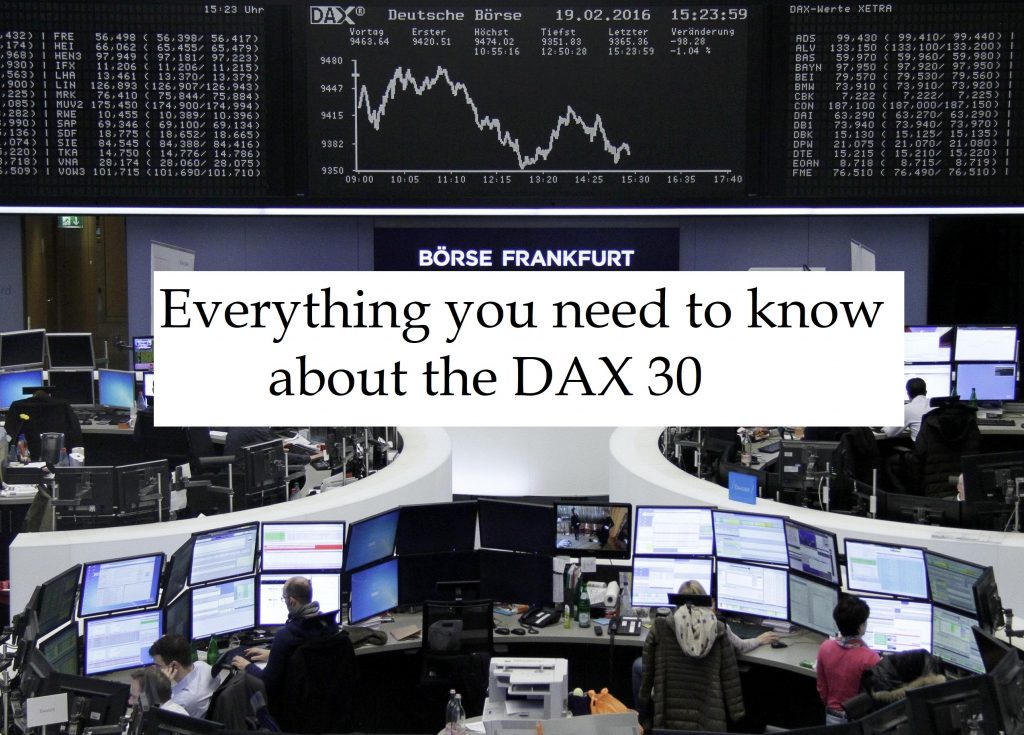

Bundestag Elections And Their Impact On The Dax

Table of Contents

Historical Analysis: How Past Bundestag Elections Affected the DAX

Analyzing past Bundestagswahlen reveals a fascinating, albeit inconsistent, relationship with DAX performance. While some elections triggered immediate volatility, others yielded more subtle, long-term effects. Let's examine the last three election cycles:

-

2017 Bundestagswahl: This election resulted in a coalition government between CDU/CSU and SPD. The initial market reaction was relatively muted, with a slight dip followed by gradual recovery. Longer-term effects were largely influenced by broader European and global economic factors rather than specific policy changes stemming from the election.

-

2013 Bundestagswahl: The election victory for Angela Merkel’s CDU/CSU led to a period of relative stability in the DAX. This stability could be attributed to the continuation of existing fiscal policies and investor confidence in Merkel's leadership.

-

2009 Bundestagswahl: This election, marked by the global financial crisis, saw a significant drop in the DAX. While the election itself wasn't the sole cause, the shift in government and the ensuing economic challenges clearly exacerbated the existing market downturn.

(Insert Chart/Graph visualizing DAX performance around these elections)

The impact of these elections wasn't solely immediate. Specific policy announcements, such as tax changes or regulatory reforms, often played a significant role in shaping post-election market trends. For example, changes in environmental regulations could impact the automotive sector, heavily represented in the DAX, influencing its overall performance. Understanding these policy impact nuances requires careful analysis of election manifestos and their subsequent implementation.

Key Policy Areas Influencing the DAX

Several key policy areas significantly influence investor confidence and subsequently DAX performance:

Fiscal Policy:

Government spending, taxation, and debt levels directly affect investor sentiment. Expansionary fiscal policies can boost economic growth, positively impacting the DAX, while austerity measures can lead to market uncertainty. Fiscal stimulus packages, for instance, can have a short-term positive effect, although their long-term implications need careful consideration. Conversely, significant tax reform proposals can create volatility depending on their impact on corporate profits and consumer spending.

Economic Policy:

Different parties approach economic growth, unemployment, and inflation differently. For example, a focus on sustainable growth might attract environmentally conscious investors, while prioritizing job creation through industrial policy could benefit specific sectors. The overall approach to economic growth and managing inflation influences investor confidence significantly.

Regulatory Policy:

Changes in business regulations—be it environmental regulations, labor laws, or competition policies—create regulatory uncertainty. These changes can impact listed companies differently, leading to shifts in the DAX composition and performance.

Foreign Policy:

Germany's international relations and trade agreements heavily influence investor sentiment. Strong international relationships and stable trade agreements foster a positive environment, promoting investor confidence and contributing to a stable DAX. Geopolitical risk, on the other hand, can negatively affect investor confidence and lead to market volatility.

Predicting Future DAX Performance Based on Election Outcomes

Analyzing the manifestos of major participating parties is crucial for anticipating the potential impact of the next Bundestagswahl. Specific policy proposals, particularly those targeting specific DAX sectors such as automotive, technology, or energy, hold significant predictive power. For instance, promises of significant investment in renewable energy could positively affect related sectors, potentially boosting the DAX.

Different coalition scenarios can also lead to vastly different market reactions. A coalition focused on fiscal consolidation may lead to short-term market dips, while a coalition promising significant spending might initially boost the DAX but may carry longer-term risks.

(Include expert quotes here, citing reputable economists and financial analysts)

By studying these factors and incorporating expert opinions, investors can create a more refined market outlook and improve their risk assessment. Election predictions, while never certain, become more informed through this analysis.

Mitigating Investment Risks During and After the Bundestag Elections

Political uncertainty inevitably introduces risk. Investors can mitigate this through several strategies:

-

Diversification: Spreading investments across different asset classes and sectors reduces the impact of any single event.

-

Hedging: Using financial instruments to protect against potential losses, such as options or futures contracts.

-

Alternative Investments: Exploring alternative investment options, like real estate or commodities, can diversify the portfolio and reduce reliance on the equity market.

Staying informed is paramount. Reliable sources of election news and market data, such as reputable financial news outlets and economic research institutions, should be consulted regularly. Understanding the political risk involved is crucial for effective risk management.

Conclusion: Navigating the Bundestag Elections and the DAX

Bundestagswahlen exert a tangible, albeit complex, influence on the DAX. Understanding the historical impact, analyzing key policy areas, and considering potential future scenarios are vital for investors seeking to navigate the German stock market successfully. By proactively addressing political risk mitigation and employing sound investment strategies, investors can position themselves for better outcomes, regardless of election results.

Stay ahead of the curve. Learn more about how Bundestagswahlen impact the DAX and make informed investment decisions. [Link to relevant resources/further reading]

Featured Posts

-

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At Professional Styling

Apr 27, 2025 -

Farm Import Ban Progress In South Africa Tanzania Talks

Apr 27, 2025

Farm Import Ban Progress In South Africa Tanzania Talks

Apr 27, 2025 -

Expected Pfc Dividend 2025 March 12 Announcement Date

Apr 27, 2025

Expected Pfc Dividend 2025 March 12 Announcement Date

Apr 27, 2025 -

Local Jeweler Assists Nfl Players In Fresh Starts

Apr 27, 2025

Local Jeweler Assists Nfl Players In Fresh Starts

Apr 27, 2025 -

Gensol Promoters Face Pfc Scrutiny Over Fabricated Documents Eo W Transfer Halted

Apr 27, 2025

Gensol Promoters Face Pfc Scrutiny Over Fabricated Documents Eo W Transfer Halted

Apr 27, 2025

Latest Posts

-

Pirates Steal Victory Over Yankees With Walk Off In Extra Innings Game

Apr 28, 2025

Pirates Steal Victory Over Yankees With Walk Off In Extra Innings Game

Apr 28, 2025 -

Pirates Walk Off Win Against Yankees In Extras

Apr 28, 2025

Pirates Walk Off Win Against Yankees In Extras

Apr 28, 2025 -

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025