Buy-and-Hold Investing: The Long Game's Harsh Truth

Table of Contents

The Emotional Rollercoaster of Buy-and-Hold Investing

Buy-and-hold, at its core, involves purchasing assets like stocks, bonds, or real estate and holding them for an extended period, typically years or even decades, regardless of short-term market fluctuations. However, this seemingly simple strategy can be emotionally challenging.

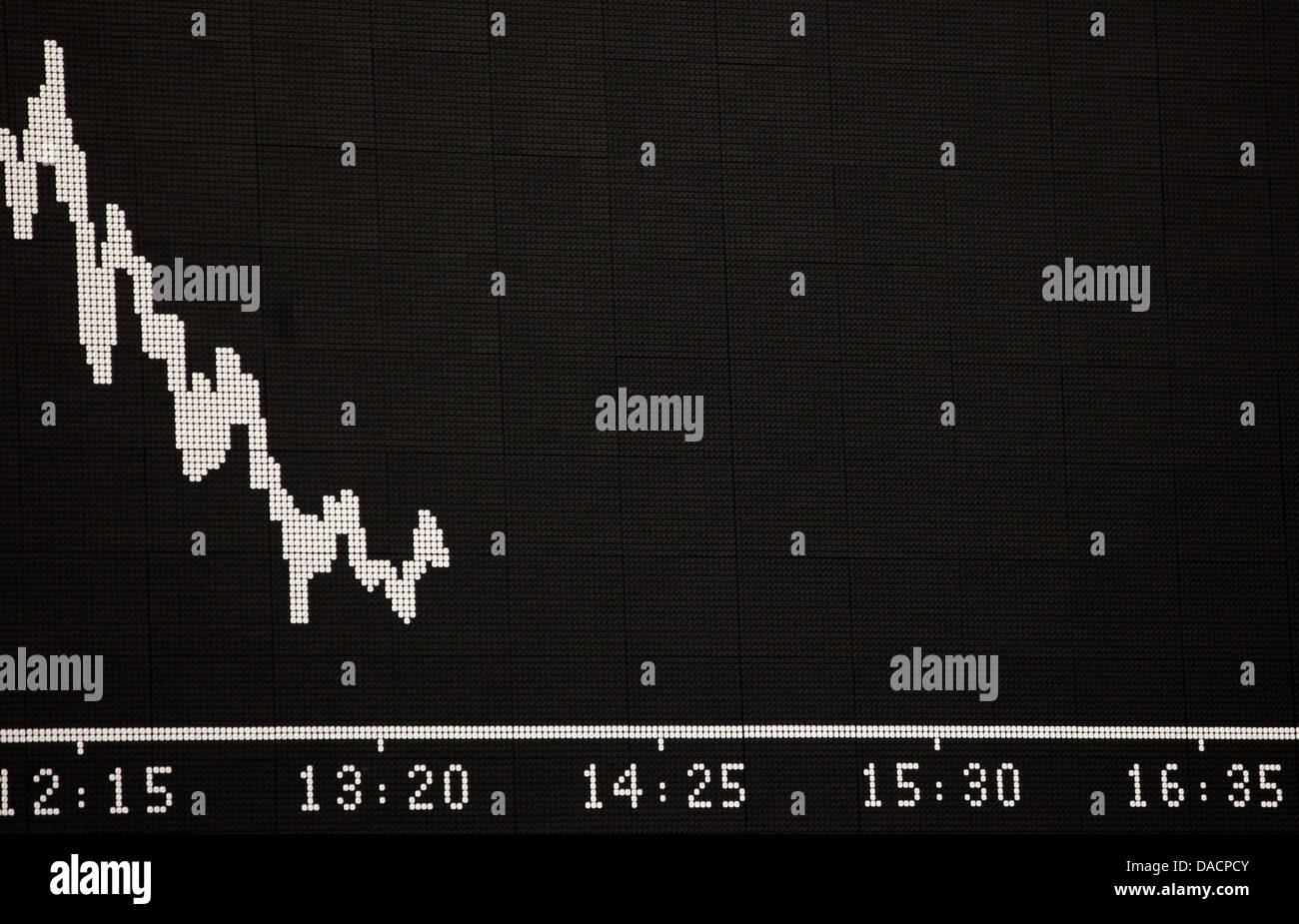

Dealing with Market Volatility

The stock market is inherently volatile. Sharp market corrections and even crashes are inevitable. Witnessing your portfolio value plummet can trigger panic, leading many investors to sell their assets at the worst possible time – selling low. Conversely, during bull markets, the temptation to chase gains and buy high is equally strong.

- Examples: The dot-com bubble burst in 2000, the 2008 financial crisis, and the COVID-19 market crash of 2020 all highlight the significant volatility inherent in market investing. These events underscore the importance of a long-term perspective.

- Long-Term Perspective: A buy-and-hold strategy necessitates patience and a belief in the long-term growth potential of your chosen assets. Short-term market fluctuations are viewed as temporary setbacks rather than reasons to abandon the strategy.

- Managing Emotional Responses: Diversification across different asset classes is crucial for mitigating risk. Regular contributions, often referred to as dollar-cost averaging, help smooth out the volatility of market fluctuations. Consider seeking guidance from a financial advisor to help manage emotional responses.

Opportunity Cost and Missed Gains

Sticking rigidly to a buy-and-hold strategy might mean missing out on potentially higher returns achievable through alternative investment strategies. Market timing, while risky, can sometimes yield significant gains if executed successfully.

- Alternative Strategies: Active trading, short-selling, and sector-specific investments are examples of strategies that may potentially outperform buy-and-hold in specific market conditions.

- Performance Comparison: While buy-and-hold has historically generated strong returns over the long term, comparing its performance against active management strategies across different timeframes reveals periods where active management might have been a superior approach. This comparison, however, should be viewed cautiously due to survivorship bias and the difficulty in accurately benchmarking.

- Risk Tolerance and Goals: The choice between buy-and-hold and active management hinges on individual risk tolerance and financial goals. A higher-risk tolerance may allow for active management strategies, while those with lower risk tolerance might find buy-and-hold more suitable.

The Importance of Due Diligence in Buy-and-Hold

While the simplicity of buy-and-hold is appealing, it's crucial to remember that this strategy is not passive. Thorough research and ongoing monitoring are essential for success.

Selecting the Right Assets

Not all assets are created equal for a buy-and-hold approach. Careful selection of assets is paramount to achieving your long-term financial objectives.

- Stock Selection: Before investing in individual stocks, research company fundamentals (revenues, earnings, debt levels), assess valuation (price-to-earnings ratio, price-to-book ratio), and analyze industry trends.

- Diversification: Diversifying across asset classes (stocks, bonds, real estate, commodities) and geographies is essential to reduce portfolio risk. Don’t put all your eggs in one basket.

- Professional Advice: Seeking advice from a qualified financial advisor can help you make informed decisions about asset allocation and diversification based on your risk profile and goals.

Risk Management and Diversification

Even with a buy-and-hold strategy, risk management is crucial. Diversification is key to mitigating potential losses and protecting your capital.

- Types of Diversification: Geographic diversification (investing in different countries) and sector diversification (investing across various industries) can help reduce overall portfolio volatility.

- Rebalancing: Regularly rebalancing your portfolio involves adjusting your asset allocation to maintain your target asset mix. This helps avoid becoming overweighted in any single asset class.

- Risk Tolerance Assessment: Before investing, it's vital to assess your risk tolerance. Understanding your comfort level with potential losses will help you make appropriate investment choices.

The Harsh Realities of Long-Term Holding

Buy-and-hold is often presented as a simple path to riches, but several often-overlooked realities can impact your returns.

Taxes and Fees

Taxes and fees significantly erode long-term investment returns, a factor often downplayed in idealized depictions of buy-and-hold.

- Capital Gains Taxes: Profits from selling assets are subject to capital gains taxes, impacting your overall return.

- Transaction Fees: Brokerage fees, management fees, and other transaction costs can chip away at your investment gains over time.

- Inflation: Inflation erodes the purchasing power of your returns over the long term. A 10% return might not seem as impressive when considering a 3% inflation rate.

Unexpected Life Events

Unforeseen circumstances can force investors to deviate from their carefully planned buy-and-hold strategies.

- Emergency Funds: Maintaining a robust emergency fund is crucial to avoid liquidating investments during unexpected events like job loss or medical emergencies.

- Flexibility: A buy-and-hold strategy should incorporate flexibility. While the core strategy remains long-term holding, life changes might necessitate adjustments to the portfolio's composition or investment timeline.

- Adjusting Strategy: Major life events, such as retirement or starting a family, might require reassessing your risk tolerance and adjusting your investment strategy accordingly.

Buy-and-Hold Investing: A Realistic Perspective

Buy-and-hold investing, while potentially rewarding, is not a guaranteed path to wealth. Success hinges on careful planning, thorough due diligence, emotional discipline, and a realistic understanding of the inherent challenges. The long-term nature of this strategy requires patience and resilience during inevitable market downturns. It's not a passive strategy; ongoing monitoring and adjustments may be necessary.

Before embarking on a buy-and-hold investment strategy, understand the long game's harsh truths. Conduct thorough research, seek professional advice if needed, and develop a plan that aligns with your risk tolerance and financial goals. Remember, successful buy-and-hold investing requires active management, even within a passive investment strategy.

Featured Posts

-

Frankfurt Dax Closes Below 24 000 Amid Market Losses

May 25, 2025

Frankfurt Dax Closes Below 24 000 Amid Market Losses

May 25, 2025 -

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And Key Artists

May 25, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And Key Artists

May 25, 2025 -

Southern Vacation Hot Spot Fights Back Against Negative Safety Assessment

May 25, 2025

Southern Vacation Hot Spot Fights Back Against Negative Safety Assessment

May 25, 2025 -

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 25, 2025

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 25, 2025 -

10 Let Posle Pobedy Na Evrovidenii Gde Seychas Pobediteli

May 25, 2025

10 Let Posle Pobedy Na Evrovidenii Gde Seychas Pobediteli

May 25, 2025

Latest Posts

-

Italian Open Semifinals Gauff Triumphs Over Zheng In Three Sets

May 25, 2025

Italian Open Semifinals Gauff Triumphs Over Zheng In Three Sets

May 25, 2025 -

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal

May 25, 2025

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal

May 25, 2025 -

Gauff Defeats Zheng In Italian Open Semifinal

May 25, 2025

Gauff Defeats Zheng In Italian Open Semifinal

May 25, 2025 -

Gauff Defeats Zheng In Three Sets At Italian Open Semifinals

May 25, 2025

Gauff Defeats Zheng In Three Sets At Italian Open Semifinals

May 25, 2025 -

Zhengs Italian Open Run Ends In Semifinal Loss To Gauff

May 25, 2025

Zhengs Italian Open Run Ends In Semifinal Loss To Gauff

May 25, 2025