Buy XRP (Ripple) Now? Analyzing The Current Price Below $3

Table of Contents

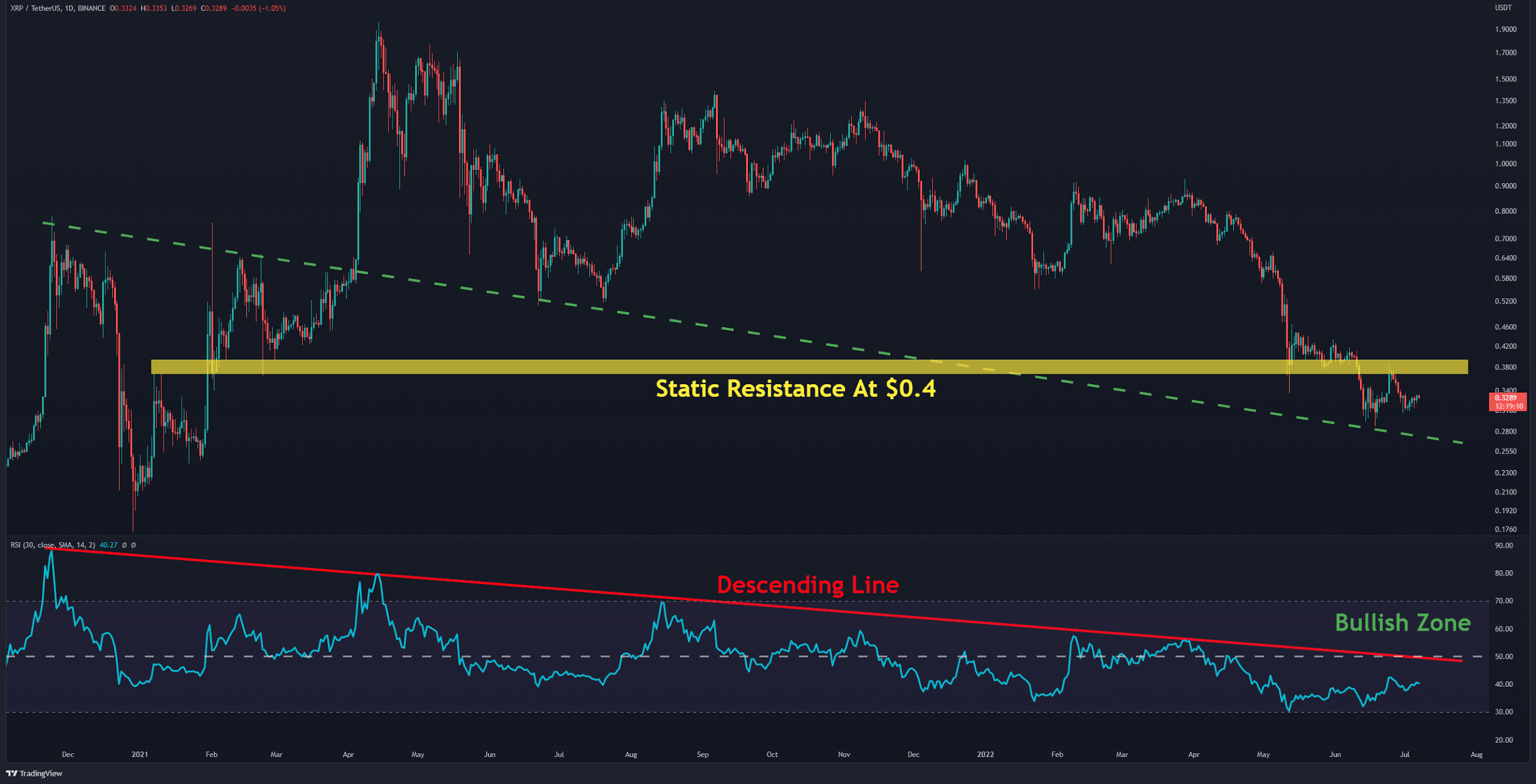

XRP Price Analysis: Understanding the Current Dip

XRP's price has experienced significant volatility in recent times. Understanding the current dip below $3 requires examining several factors. Analyzing technical indicators like moving averages and the Relative Strength Index (RSI) provides valuable insights. A look at the historical price performance can also help determine if this dip is anomalous or part of a larger trend.

- Key price support and resistance levels: Identifying key support and resistance levels helps predict potential price reversals or further declines. Currently, support levels around $2.50 and $2.00 are being closely watched by traders.

- Impact of recent market news and events: News regarding the Ripple lawsuit, broader cryptocurrency market trends, and regulatory announcements directly influence XRP's price.

- Comparison to historical price performance: Comparing the current price dip to previous price corrections helps gauge the severity and potential duration of the current downturn. Historically, XRP has shown periods of significant price drops followed by substantial rallies.

Ripple's Legal Battle and its Impact on XRP Price

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price. The SEC alleges that XRP is an unregistered security, a claim that significantly impacts investor sentiment and trading volume. The outcome of this case will drastically influence XRP's future trajectory.

- Summary of the key arguments in the case: The core of the dispute centers on whether XRP meets the definition of a security under the Howey Test. Understanding the arguments presented by both sides is crucial for assessing the potential outcomes.

- Potential positive and negative outcomes for Ripple: A positive outcome could see the price of XRP surge, while a negative outcome could lead to further price declines. Various scenarios and their potential impact need careful consideration.

- Impact of the legal uncertainty on XRP trading volume and price: The ongoing uncertainty creates volatility, affecting trading volume and price fluctuations. Many exchanges have delisted XRP, further contributing to price instability.

XRP's Utility and Future Potential: Beyond the Legal Battle

Beyond the legal complexities, XRP possesses inherent utility and potential for future growth. Its primary use case revolves around its speed and efficiency in facilitating cross-border payments, a significant advantage over traditional banking systems. This technology also has several other potential applications and growth avenues.

- Key advantages of XRP compared to other cryptocurrencies: XRP's speed, low transaction fees, and scalability distinguish it from other cryptocurrencies. Its focus on payment efficiency positions it favorably in a rapidly evolving financial landscape.

- Potential growth areas for XRP adoption and usage: Partnerships with financial institutions, expansion into new markets, and integration into existing payment systems are key areas driving potential adoption and growth.

- Long-term outlook for XRP based on technological advancements: Continued technological improvements and wider adoption of its payment solutions could significantly enhance its long-term potential.

Risk Assessment: Should You Invest in XRP?

Investing in XRP carries substantial risks. Its price is highly volatile, subject to significant fluctuations influenced by market sentiment, regulatory developments, and the outcome of the Ripple lawsuit. Therefore, a considered approach to risk management is essential.

- Potential for both high rewards and high losses: The highly speculative nature of XRP presents the possibility of both substantial gains and significant losses.

- Importance of thorough research and understanding of risks: Before investing in XRP, it’s crucial to conduct thorough research and fully understand the associated risks.

- Guidance on how much of your portfolio to allocate to XRP: A prudent approach involves diversifying your investments and allocating only a small portion of your portfolio to high-risk assets like XRP.

Conclusion: Should You Buy XRP (Ripple) Now? A Final Verdict

The decision of whether to buy XRP (Ripple) now is complex. While its current price below $3 might seem attractive, the ongoing legal battle presents significant uncertainty. However, XRP's technological utility and potential for future growth cannot be ignored. Weighing the potential rewards against the inherent risks requires careful consideration of the points discussed above.

Ultimately, the decision to buy XRP (Ripple) now rests with you. Weigh the potential rewards against the inherent risks, conduct your own thorough research, and make an informed decision. Remember to only invest what you can afford to lose. Understanding the intricacies of XRP's price, the legal landscape, and its future prospects are key to making a sound investment choice. Consider seeking advice from a qualified financial advisor before making any investment decisions.

Featured Posts

-

Us Health Officials Intensify Vaccine Monitoring As Measles Cases Rise

May 02, 2025

Us Health Officials Intensify Vaccine Monitoring As Measles Cases Rise

May 02, 2025 -

School Desegregation Order Terminated Analyzing The Justice Departments Action

May 02, 2025

School Desegregation Order Terminated Analyzing The Justice Departments Action

May 02, 2025 -

Merrie Monarch Festival A Celebration Of Pacific Island Cultures

May 02, 2025

Merrie Monarch Festival A Celebration Of Pacific Island Cultures

May 02, 2025 -

Will The Sec Declare Xrp A Commodity Ripple Settlement Update

May 02, 2025

Will The Sec Declare Xrp A Commodity Ripple Settlement Update

May 02, 2025 -

Train Engine Malfunction Halts Warri Itakpe Rail Services Nrc Announcement

May 02, 2025

Train Engine Malfunction Halts Warri Itakpe Rail Services Nrc Announcement

May 02, 2025

Latest Posts

-

A List Celebrity Seeks Invite To Melissa Gorgas Exclusive New Jersey Beach House

May 02, 2025

A List Celebrity Seeks Invite To Melissa Gorgas Exclusive New Jersey Beach House

May 02, 2025 -

Mlw Battle Riot Vii The Addition Of Bobby Fish

May 02, 2025

Mlw Battle Riot Vii The Addition Of Bobby Fish

May 02, 2025 -

Battle Riot Vii Adds Major Player Bobby Fish Joins The Fray

May 02, 2025

Battle Riot Vii Adds Major Player Bobby Fish Joins The Fray

May 02, 2025 -

Melissa Gorga Reveals A Lister Seeking Nj Beach House Invite

May 02, 2025

Melissa Gorga Reveals A Lister Seeking Nj Beach House Invite

May 02, 2025 -

Bobby Fish Confirmed For Mlw Battle Riot Vii

May 02, 2025

Bobby Fish Confirmed For Mlw Battle Riot Vii

May 02, 2025