CAC 40 Weekly Performance: Slight Dip, Maintaining Steady Position (March 7, 2025)

Table of Contents

Key Factors Contributing to the CAC 40's Slight Dip

Several factors contributed to the slight decrease observed in the CAC 40's weekly performance. The release of weaker-than-expected inflation figures for the Eurozone, coupled with concerns about rising interest rates from the European Central Bank (ECB), created a climate of uncertainty. Geopolitical tensions related to the ongoing situation in Eastern Europe also added to the market's apprehension, impacting investor confidence.

Specific sectors felt the impact more acutely than others.

- Energy: The energy sector experienced a notable 2.5% decline, largely attributed to fluctuating oil prices and concerns about future energy demand.

- Technology: The tech sector saw a more moderate dip of 1.8%, reflecting a broader global trend of investors moving away from growth stocks in favor of more defensive investments.

- Finance: The finance sector showed resilience, with a relatively small decline of 0.5%, indicating a degree of stability within the financial system.

Furthermore, company-specific news also played a role.

- Airbus: Negative news surrounding potential production delays impacted Airbus's stock price and, consequently, the CAC 40's overall performance.

- LVMH: Despite strong overall performance, a slight dip in LVMH's stock price contributed to the index's slight decrease.

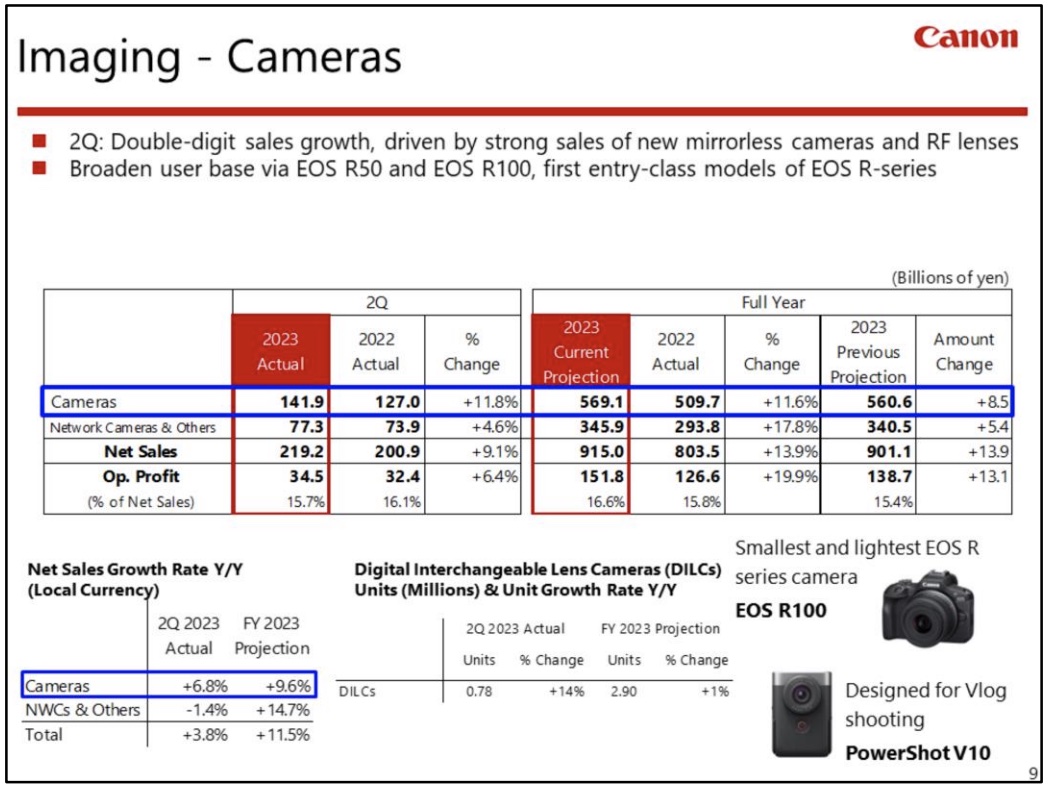

These factors, as illustrated in the chart below [insert chart showing sector performance and CAC 40 movement], contributed to the overall weekly performance of the CAC 40.

Resilience and Steady Position Despite the Dip

Despite the slight dip, the CAC 40 demonstrated resilience compared to other major indices. Its performance showcases a degree of stability amidst global market uncertainty.

- CAC 40: -0.8% weekly change

- DAX (Germany): -1.2% weekly change

- FTSE 100 (UK): -0.3% weekly change

- S&P 500 (US): +0.5% weekly change

This comparison highlights the relatively better performance of the CAC 40 against some other major European indices. The long-term outlook for the CAC 40 remains positive, with many analysts predicting continued growth in the coming quarters, driven by factors such as the ongoing recovery in the Eurozone and the strength of several key French companies. These predictions, however, should be considered alongside the ever-present challenges within the global economy.

Investor Sentiment and Market Volatility

Investor sentiment remained cautious throughout the week, characterized by increased hedging activity and a preference for less risky assets. Market volatility, as measured by the VIX index [insert relevant chart showing volatility], saw a slight increase, reflecting the uncertainty surrounding the economic outlook. Trading volume also saw a moderate rise, suggesting increased investor activity in response to the unfolding economic events. This heightened activity emphasizes the importance of constant monitoring of the index.

Understanding the CAC 40's Weekly Trajectory

In summary, the CAC 40 weekly performance showed a slight dip, primarily attributed to weaker-than-expected inflation figures, rising interest rate concerns, geopolitical uncertainties, and some company-specific news. However, the CAC 40 demonstrated resilience, outperforming some other major European indices. The level of market volatility increased, reflecting investor caution. Monitoring the CAC 40 market analysis and understanding these contributing factors are crucial for informed investment decisions.

To stay informed about the latest developments and continue tracking the CAC 40 weekly performance, subscribe to our newsletter for regular updates and in-depth CAC 40 market analysis. Don't miss out on vital insights into this crucial European market index.

Featured Posts

-

Crisi Dazi Mercati Azionari In Ribasso La Risposta Dell Ue

May 25, 2025

Crisi Dazi Mercati Azionari In Ribasso La Risposta Dell Ue

May 25, 2025 -

Avrupa Borsalari 16 Nisan 2025 Duesuesue Stoxx 600 Ve Dax 40 Analizi

May 25, 2025

Avrupa Borsalari 16 Nisan 2025 Duesuesue Stoxx 600 Ve Dax 40 Analizi

May 25, 2025 -

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 25, 2025

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 25, 2025 -

Apple Stock Key Levels Breached Ahead Of Q2 Financial Results

May 25, 2025

Apple Stock Key Levels Breached Ahead Of Q2 Financial Results

May 25, 2025 -

Refleksiya Na Temu Trillerov Lavrov O Pavle I I Lyudskoy Tyage K Ostrym Oschuscheniyam

May 25, 2025

Refleksiya Na Temu Trillerov Lavrov O Pavle I I Lyudskoy Tyage K Ostrym Oschuscheniyam

May 25, 2025

Latest Posts

-

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025 -

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025 -

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025