Can Ripple (XRP) Overcome Resistance And Reach $3.40?

Table of Contents

Technical Analysis: Chart Patterns and Indicators Suggesting a Potential Rise to $3.40

Technical analysis provides valuable insights into potential price movements. By studying XRP's price charts, we can identify key support and resistance levels, chart patterns, and the behavior of various technical indicators.

Analyzing the XRP/USD chart reveals several crucial support levels (e.g., $[insert example support level]) that have historically provided a floor for price action. Conversely, resistance levels (e.g., $[insert example resistance level]) have previously capped price increases. A decisive breakout above a significant resistance level could trigger a substantial rally, potentially paving the way to $3.40.

Key technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) offer further clues.

- Breakout from a significant resistance level: A sustained break above a key resistance level, confirmed by increased trading volume, could be a powerful bullish signal, initiating a move towards $3.40.

- Positive RSI divergence: If the price makes lower lows while the RSI forms higher lows, it suggests weakening bearish momentum and potential for a price reversal. This divergence could precede a rally.

- Bullish MACD crossover: A bullish crossover, where the MACD line crosses above the signal line, indicates a shift in momentum towards a bullish trend. This signal, coupled with other positive indicators, could strengthen the case for a price increase.

- Identifying chart patterns: The appearance of bullish chart patterns like flags, pennants, or even a successful completion of a head and shoulders bottom formation could signal a forthcoming price surge.

Market Sentiment and Investor Confidence: Is the Crypto Community Bullish on XRP?

Market sentiment plays a crucial role in driving cryptocurrency prices. Positive sentiment, fueled by bullish news and increased adoption, can lead to substantial price appreciation. Conversely, negative sentiment can trigger sell-offs.

Currently, the overall sentiment towards cryptocurrencies is [insert current overall sentiment – bullish, bearish, or neutral]. However, sentiment towards XRP specifically is influenced heavily by the ongoing legal battle with the SEC. Social media discussions and news coverage concerning XRP offer a real-time gauge of investor confidence.

- Positive news regarding Ripple's legal battles: A favorable court ruling or a positive development in the SEC lawsuit could trigger a significant surge in investor confidence and drive XRP's price higher.

- Increased adoption by financial institutions: Widespread adoption of XRP by banks and payment processors for cross-border transactions would significantly increase demand, potentially pushing the price towards $3.40.

- Positive social media sentiment: A wave of positive sentiment on platforms like Twitter and Reddit can fuel speculative buying, leading to price increases.

Regulatory Landscape and Legal Battles: How Will SEC vs. Ripple Impact XRP's Price?

The ongoing legal battle between Ripple Labs and the SEC casts a significant shadow over XRP's price. The outcome of this lawsuit will undeniably influence investor confidence and potentially determine the future trajectory of XRP.

A favorable ruling for Ripple could lead to a significant price surge, as it would likely remove regulatory uncertainty and attract more institutional investment. Conversely, an unfavorable outcome could dampen investor enthusiasm and trigger a sell-off. The regulatory landscape surrounding cryptocurrencies globally also plays a crucial role. Clearer and more favorable regulations could boost XRP's appeal to institutional investors.

- Favorable court ruling: A win for Ripple could unlock significant pent-up demand, driving the price substantially higher.

- Regulatory clarity: Clearer regulatory frameworks worldwide can attract institutional investment, increasing the demand and price of XRP.

- Negative regulatory developments: Conversely, adverse regulatory actions could significantly hinder XRP's price growth.

Adoption and Utility: Real-World Applications Driving XRP's Price?

XRP's utility and adoption rate are critical factors influencing its price. Its primary use case lies in facilitating fast and low-cost cross-border payments. The more widely XRP is adopted by financial institutions and payment processors, the higher the demand, and potentially, the price.

- Increased adoption by banks and payment processors: The integration of XRP into existing payment systems would significantly boost its usage and value.

- Strategic partnerships with major financial institutions: Collaborations with large financial players can enhance XRP's credibility and accelerate its adoption.

- Expansion into new markets and use cases: Exploring new applications and expanding into untapped markets could unlock significant growth potential.

Conclusion: The Path to $3.40 for XRP - A Realistic Goal?

Reaching $3.40 for XRP is a significant undertaking. While technical analysis suggests potential for upward movement, market sentiment, regulatory hurdles, and adoption rates all present considerable challenges. A favorable resolution to the SEC lawsuit and widespread adoption are key factors that would need to align for XRP to reach this price target. However, the inherent volatility of the cryptocurrency market means that unforeseen events can significantly impact price movements.

While the possibility of XRP reaching $3.40 exists, it's crucial to approach this scenario with caution and realism. Conduct thorough research and understand the risks involved before investing in XRP. Continue to monitor XRP's price, the ongoing legal battles, regulatory developments, and adoption rates to make informed decisions. Can Ripple (XRP) overcome resistance and reach $3.40? Only time will tell, but a comprehensive understanding of these factors is crucial for navigating this volatile market.

Featured Posts

-

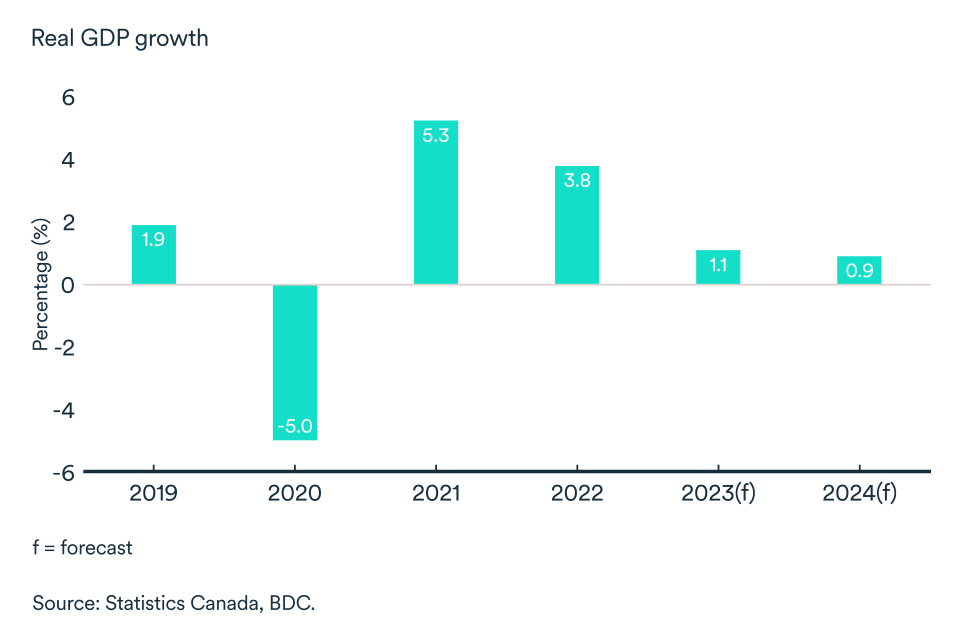

Canadas Economic Outlook The Impact Of An Overvalued Dollar

May 08, 2025

Canadas Economic Outlook The Impact Of An Overvalued Dollar

May 08, 2025 -

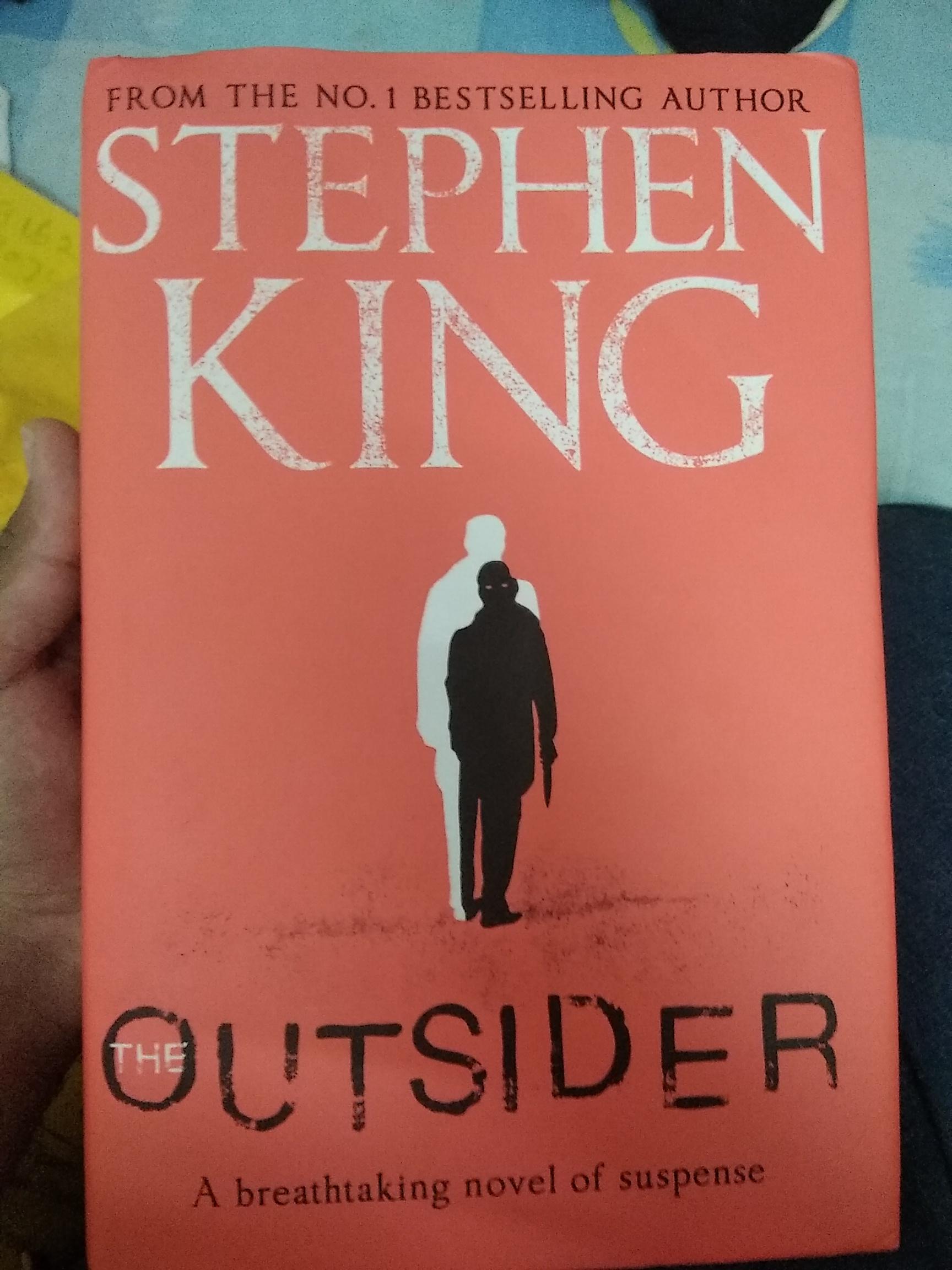

The Long Walk New Trailer Adapting Stephen Kings Novel

May 08, 2025

The Long Walk New Trailer Adapting Stephen Kings Novel

May 08, 2025 -

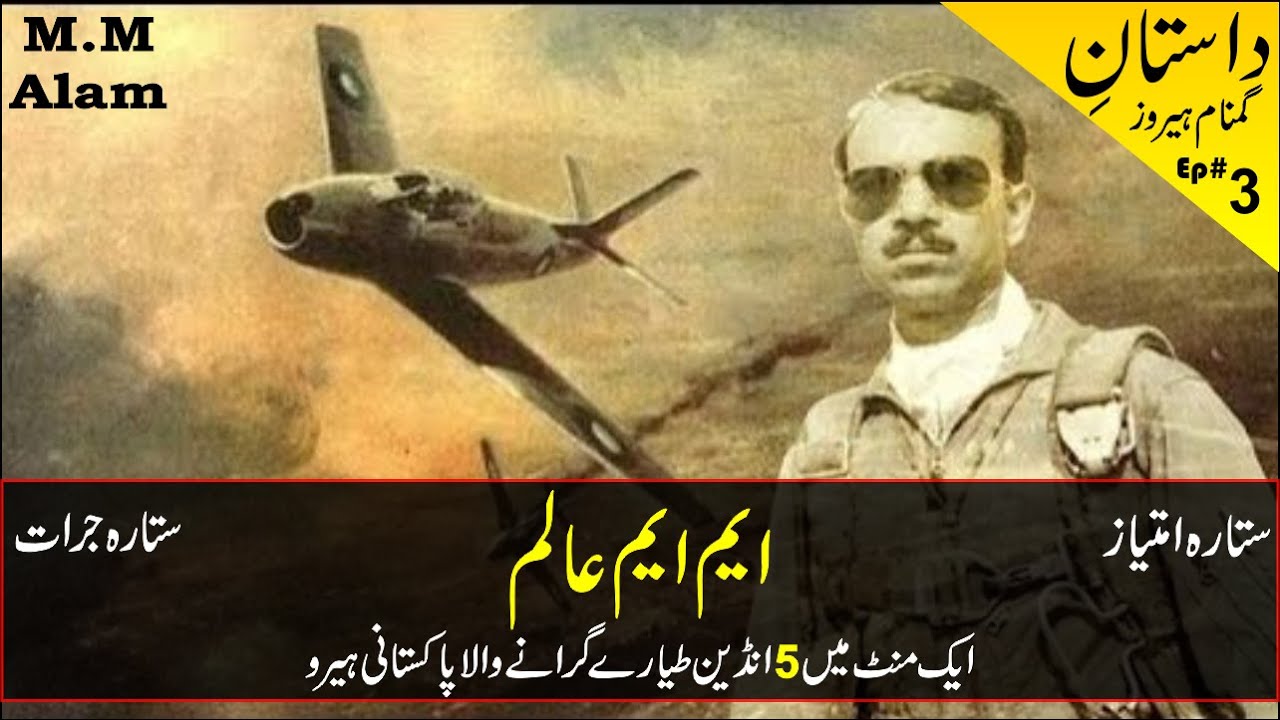

Aym Aym Ealm Ky 12 Wyn Brsy Yadgar Tqaryb Awr Khraj Eqydt

May 08, 2025

Aym Aym Ealm Ky 12 Wyn Brsy Yadgar Tqaryb Awr Khraj Eqydt

May 08, 2025 -

Fettermans Senate Bid Dismissing Fitness Concerns

May 08, 2025

Fettermans Senate Bid Dismissing Fitness Concerns

May 08, 2025 -

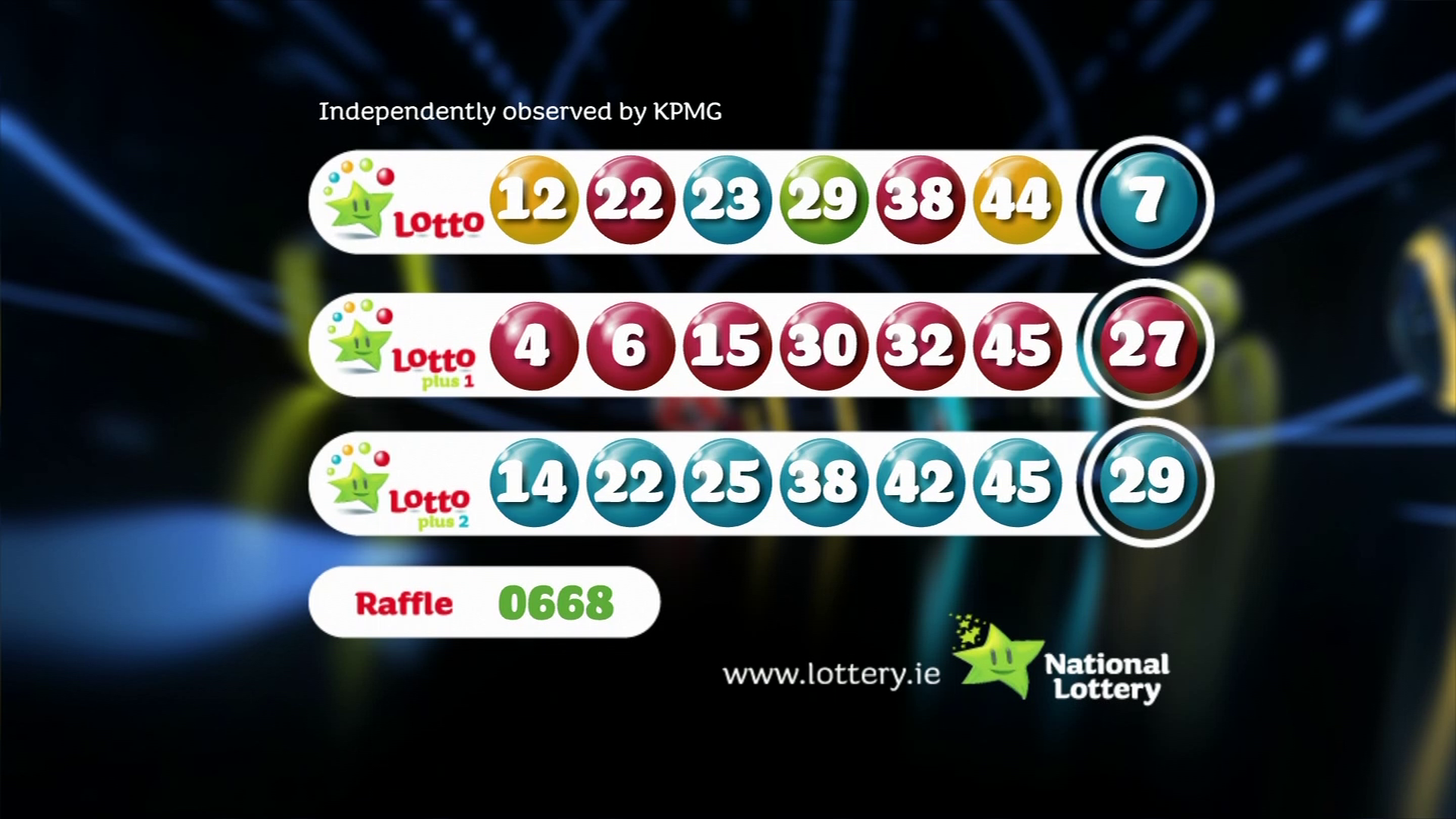

Saturday April 12th Lotto Draw Winning Numbers And Prizes

May 08, 2025

Saturday April 12th Lotto Draw Winning Numbers And Prizes

May 08, 2025