Canada's Economic Outlook: The Impact Of An Overvalued Dollar

Table of Contents

The Mechanics of an Overvalued Canadian Dollar

An overvalued currency, like the Canadian dollar, means its exchange rate is higher than what is considered fundamentally justified based on economic factors. This occurs when the supply of the Canadian dollar exceeds demand. Several factors contribute to an overvalued Canadian dollar:

- High Commodity Prices: Canada is a major exporter of commodities like oil and lumber. High global commodity prices increase demand for the Canadian dollar, driving up its value.

- Interest Rate Differentials: Higher interest rates in Canada compared to other countries attract foreign investment, increasing demand for the Canadian dollar. The Bank of Canada plays a crucial role in managing these interest rates.

- Investor Sentiment: Positive investor sentiment towards the Canadian economy boosts demand for the Canadian dollar, leading to appreciation.

The Bank of Canada influences the exchange rate through monetary policy, primarily by adjusting interest rates. However, the Bank of Canada does not directly target a specific exchange rate; instead, it focuses on price stability and sustainable economic growth.

- How a strong dollar affects imports and exports: A strong Canadian dollar makes Canadian exports more expensive for foreign buyers, reducing demand and potentially harming export-oriented industries. Conversely, it makes imports cheaper for Canadian consumers.

- Impact on inflation and purchasing power: Cheaper imports can dampen inflation, but reduced export revenue can negatively affect domestic production and employment, potentially impacting purchasing power.

- Influence on foreign investment: A strong Canadian dollar can make Canadian assets less attractive to foreign investors, potentially reducing foreign direct investment.

Impact on Key Canadian Industries

Export-Oriented Sectors (e.g., Manufacturing, Agriculture)

An overvalued Canadian dollar significantly reduces the competitiveness of Canadian export-oriented sectors in global markets. This leads to:

-

Reduced export volume: Higher prices make Canadian goods less attractive to international buyers.

-

Decreased profits: Lower export sales translate to reduced profitability for businesses.

-

Potential job losses: Companies may be forced to cut jobs or even close down due to diminished competitiveness.

-

Specific examples: The Canadian manufacturing sector, particularly in industries like automotive parts and aerospace, has experienced challenges due to a strong dollar. Similarly, Canadian agricultural exports, facing competition from countries with weaker currencies, have felt the pinch.

Import-Dependent Sectors

While an overvalued Canadian dollar hurts exporters, it benefits import-dependent sectors by making foreign goods cheaper. This leads to:

- Lower input costs: Businesses relying on imported raw materials or components benefit from lower costs.

- Increased consumer purchasing power: Lower prices for imported consumer goods boost consumer spending.

However, excessive reliance on cheaper imports can also lead to:

-

Job displacement in domestic industries: Reduced demand for domestically produced goods can result in job losses.

-

Increased vulnerability to global supply chain disruptions: Over-reliance on foreign suppliers creates vulnerability to shocks in global supply chains.

-

Examples: Retailers selling imported consumer goods and businesses using imported components benefit from cheaper imports.

Consequences for Consumers and Businesses

The impact of an overvalued Canadian dollar on consumers and businesses is complex and multifaceted:

-

Consumer spending: Consumers benefit from cheaper imports, but reduced export revenue can lead to job losses and lower wages, potentially dampening overall consumer spending.

-

Business investment: Businesses may delay investment decisions due to reduced export revenue and uncertainty about future demand. Profitability can decline, especially for export-oriented firms.

-

Wage stagnation or decline: In sectors hit hard by reduced export competitiveness, wages may stagnate or decline due to job losses and reduced demand for labour.

-

Positive effects for consumers: Lower prices for imported goods.

-

Negative effects for consumers: Potential job losses and reduced purchasing power due to wage stagnation or decline.

-

Positive effects for businesses: Lower input costs for import-dependent industries.

-

Negative effects for businesses: Reduced export revenue, lower profits, and potential job losses for export-oriented firms.

Government Policy Responses and Potential Solutions

Addressing an overvalued Canadian dollar requires a multifaceted approach involving both monetary and fiscal policies, as well as international trade agreements.

- Monetary policy adjustments: The Bank of Canada can adjust interest rates to influence the exchange rate, but this needs to be balanced with other economic goals.

- Fiscal policy adjustments: Government spending and taxation policies can influence aggregate demand, indirectly impacting the exchange rate.

- Trade agreements: Negotiating favourable trade agreements can help improve the competitiveness of Canadian exports.

However, government intervention has limitations:

-

Unintended consequences: Policy interventions can have unintended consequences on other aspects of the economy.

-

Global economic factors: The exchange rate is influenced by global economic factors beyond the control of the Canadian government.

-

Potential government responses: Interest rate adjustments, fiscal stimulus, negotiation of new trade agreements, support for export-oriented industries.

Conclusion: Understanding the Canadian Dollar's Influence on the Economic Outlook

An overvalued Canadian dollar presents a mixed bag for the Canadian economy. While it benefits consumers through cheaper imports, it significantly challenges export-oriented industries, potentially leading to job losses and reduced economic growth. The government's response requires a careful balancing act, considering the impact on various sectors and the limitations of intervention. Monitoring the Canadian dollar's value and its influence on economic indicators is crucial for understanding Canada's future economic trajectory. To stay informed about Canada's economic outlook and the impact of Canadian dollar fluctuations, follow reputable economic news sources and engage with further analysis on topics such as Canadian economic forecasts and managing exchange rate risk. Understanding the nuances of the Canadian dollar's value is critical for navigating the complexities of Canada's economic future.

Featured Posts

-

Neymar Podria Volver A La Seleccion De Brasil Prelista Para Partido Contra Argentina

May 08, 2025

Neymar Podria Volver A La Seleccion De Brasil Prelista Para Partido Contra Argentina

May 08, 2025 -

Secure Data Transfer Protecting Your Information

May 08, 2025

Secure Data Transfer Protecting Your Information

May 08, 2025 -

Sergio Hernandez El Nuevo Entrenador Del Flamengo

May 08, 2025

Sergio Hernandez El Nuevo Entrenador Del Flamengo

May 08, 2025 -

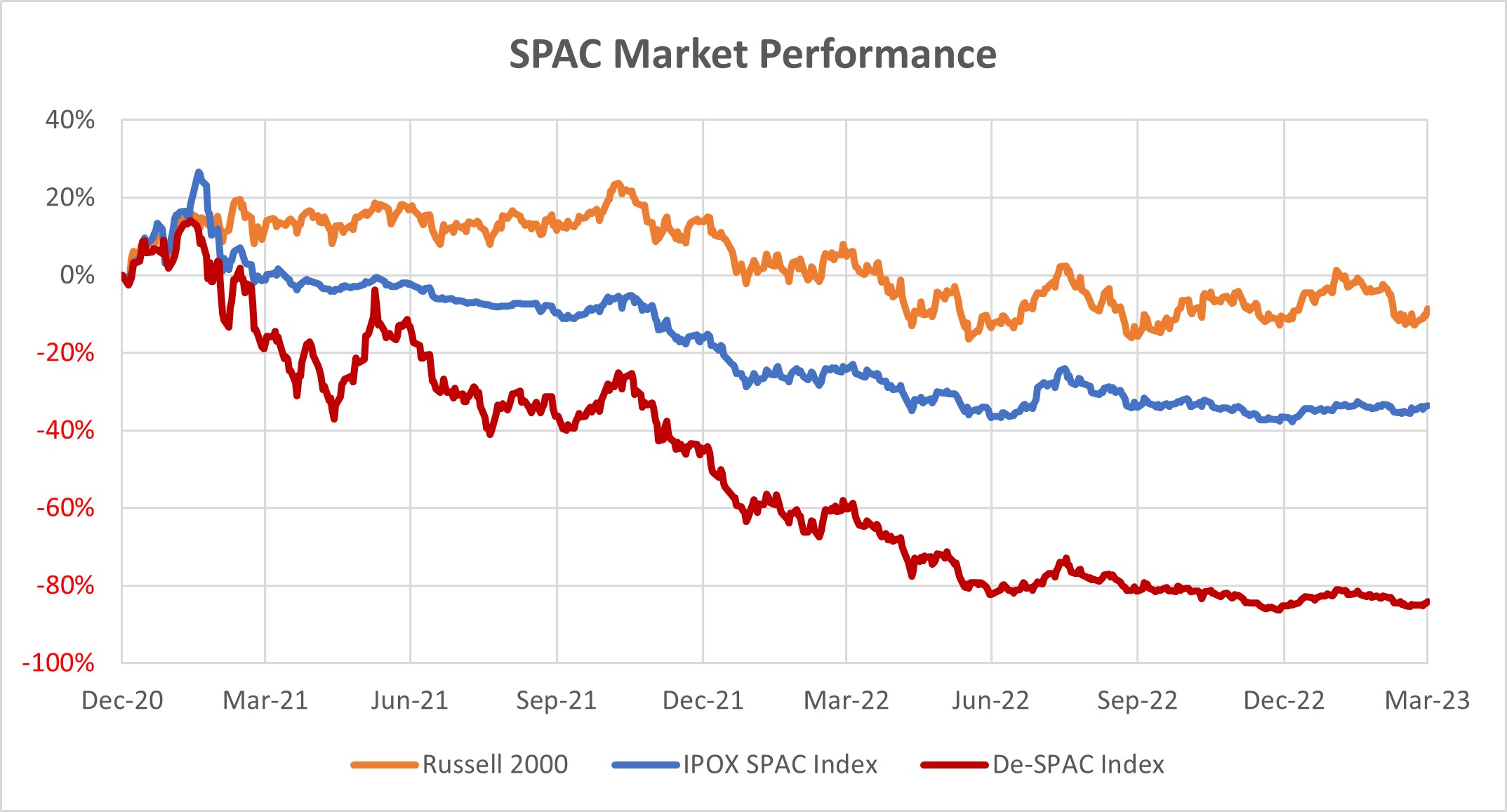

Is This New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025

Is This New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025 -

Ukraines Cemetery Corruption A Grim Harvest Of War

May 08, 2025

Ukraines Cemetery Corruption A Grim Harvest Of War

May 08, 2025