Canada Defends Tariff Policy Amidst Oxford Report Criticism

Table of Contents

The Oxford Report's Key Findings and Criticisms of Canada Tariff Policy

The Oxford report, using a detailed econometric model and analyzing years of trade data, concluded that Canada's current tariff structure is less efficient than previously believed and imposes significant costs on the Canadian economy. The methodology involved analyzing various tariff levels across different sectors, comparing them to projected economic output under alternative scenarios.

- Specific criticisms: The report criticizes the breadth of tariffs applied, arguing that they disproportionately affect certain sectors, hindering competition and innovation. It also questions the effectiveness of protectionist measures in fostering long-term economic growth.

- Disproportionately affected sectors: The report points to the agricultural and manufacturing sectors as bearing a significant burden of the current tariff structure, facing higher input costs and reduced export competitiveness. Specific examples cited included increased prices for imported machinery and raw materials.

- Specific tariffs/rates: While the report didn't focus on individual tariff rates, it highlighted the cumulative effect of multiple tariffs across various import categories. This cumulative effect, the report argues, significantly reduces overall economic efficiency.

- Quantitative data: The report projects an annual economic loss of X billion dollars due to inefficiencies stemming from the current Canada Tariff Policy. This figure, though debated, underscores the gravity of the criticisms leveled against the existing system.

The Canadian Government's Defense of its Tariff Policy

The Canadian government has staunchly defended its tariff policy, arguing that the Oxford report oversimplifies a complex issue and fails to account for several crucial factors. The government's counter-arguments focus on the benefits of protecting domestic industries and maintaining national security.

- Key arguments: The government emphasizes the role of tariffs in protecting vital domestic industries, preventing job losses, and maintaining a level playing field against foreign competitors who may engage in unfair trade practices.

- Counter-arguments against the report: The government contests the report's economic projections, arguing that its model doesn't adequately reflect the complexity of the Canadian economy or account for the positive impacts of tariff protection in specific sectors.

- Cited economic benefits: The government highlights the positive contribution of certain protected industries to the Canadian economy, including job creation and investment in domestic research and development. Specific examples and statistical data from government reports are used to support these claims.

- Government statements: Numerous press releases and statements from government officials reiterate the commitment to the current Canadian tariff policies and reject the Oxford report's conclusions.

Focus on Specific Sectors Affected by Canada Tariff Policy

The impact of tariffs varies widely across different Canadian sectors.

- Differing effects: Agriculture, for example, faces both challenges and benefits. While some agricultural products benefit from protection, others face higher input costs due to tariffs on imported machinery. The manufacturing sector similarly experiences a mixed impact.

- Industries benefiting from protection: Certain specialized manufacturing industries might benefit from protection against cheaper imports, safeguarding jobs and fostering domestic production. Examples could be cited, along with supporting economic data.

- Industries negatively impacted: Industries reliant on imported inputs, such as those in the automotive sector, could face higher production costs due to tariffs. This can reduce competitiveness and lead to job losses. Data on increased prices and decreased output should be included here.

International Trade Implications and Relations

The debate surrounding Canada’s tariff policy has international implications, impacting relationships with key trading partners.

- Potential repercussions: The criticisms from the Oxford report could strain Canada's trade relationships with countries that perceive its tariffs as protectionist. This could lead to retaliatory measures or trade disputes.

- Responses from trading partners: The reactions of other nations are crucial. Some might challenge Canada's tariff levels through the WTO, leading to lengthy trade negotiations.

- WTO implications: If Canada's tariff policies are deemed to violate WTO rules, the government could face penalties or pressure to adjust its policies.

Future Outlook and Potential Policy Adjustments

The ongoing debate necessitates careful consideration of potential policy adjustments.

- Possible policy changes: The government may consider targeted tariff reductions in certain sectors to improve economic efficiency without compromising the protection of vital industries. Further research and consultations with stakeholders are necessary.

- Predictions for future impacts: Changes to the Canada Tariff Policy will inevitably have economic consequences, impacting trade balances, employment, and consumer prices. Economic modeling and analysis would be vital in predicting these outcomes.

- Considerations for long-term trade strategy: Canada's long-term trade strategy must balance the need to protect domestic industries with the benefits of international trade and free markets. A more nuanced and sector-specific approach could be necessary.

Conclusion

The debate surrounding the Canada Tariff Policy, ignited by the Oxford University report, highlights the complexities of balancing protectionism with economic efficiency. While the Canadian government defends its current approach, emphasizing the importance of protecting domestic industries, the report raises legitimate concerns about the potential negative economic impacts of the current tariff structure. Understanding the nuances of Canada's trade tariffs and their impact on various sectors is critical. To stay informed about further developments regarding Canadian tariff policies, consult resources such as the Government of Canada's website and publications from reputable economic analysis organizations. The ongoing dialogue surrounding the Canada Tariff Policy will significantly shape Canada's economic future and its standing in the global trading system.

Featured Posts

-

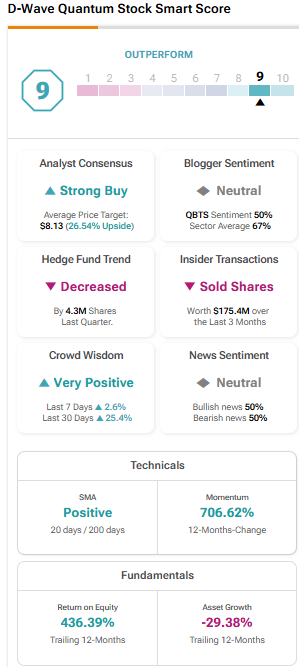

D Wave Quantum Qbts Stock Price Movement On Monday A Comprehensive Overview

May 20, 2025

D Wave Quantum Qbts Stock Price Movement On Monday A Comprehensive Overview

May 20, 2025 -

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025 -

Michael Schumacher Poznavanje Njegove Kceri Gine Marie Schumacher

May 20, 2025

Michael Schumacher Poznavanje Njegove Kceri Gine Marie Schumacher

May 20, 2025 -

Urgent Hmrc Child Benefit Update Important Messages You Shouldnt Miss

May 20, 2025

Urgent Hmrc Child Benefit Update Important Messages You Shouldnt Miss

May 20, 2025 -

Suki Waterhouses Whimsical Valentino Look Grandma Chic Style

May 20, 2025

Suki Waterhouses Whimsical Valentino Look Grandma Chic Style

May 20, 2025

Latest Posts

-

1 231 Billion Recovery Sought From 28 Oil Companies Representatives Pledge

May 20, 2025

1 231 Billion Recovery Sought From 28 Oil Companies Representatives Pledge

May 20, 2025 -

Reps Vow To Recover 1 231 Billion From Oil Firms Details Inside

May 20, 2025

Reps Vow To Recover 1 231 Billion From Oil Firms Details Inside

May 20, 2025 -

82 Ai

May 20, 2025

82 Ai

May 20, 2025 -

The Ai Industrys Triumph Navigating The Aftermath Of Trumps Bill

May 20, 2025

The Ai Industrys Triumph Navigating The Aftermath Of Trumps Bill

May 20, 2025 -

The Old North State Report For May 9 2025

May 20, 2025

The Old North State Report For May 9 2025

May 20, 2025