Canada's Economic Future: The Importance Of Fiscal Responsibility And Its Absence Under Liberal Rule

Table of Contents

The Crucial Role of Fiscal Responsibility in a Strong Canadian Economy

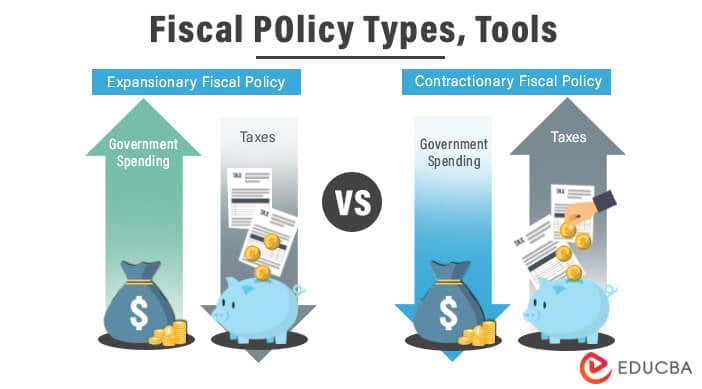

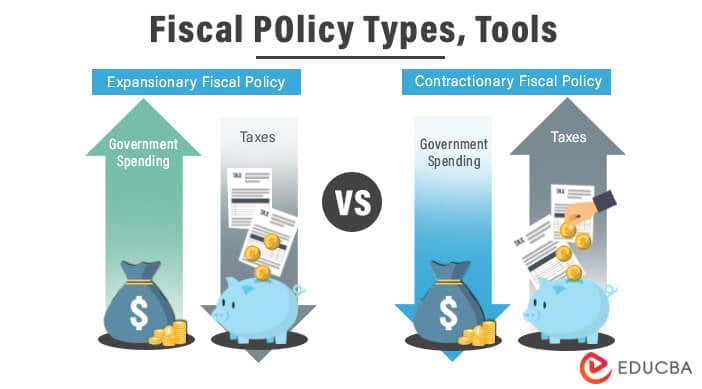

Fiscal responsibility is the cornerstone of a healthy and thriving economy. It encompasses prudent management of government finances, including responsible spending, effective tax policies, and sustainable debt management. Without it, long-term economic stability is jeopardized. The benefits of fiscal responsibility are multifaceted:

- Reduces national debt and interest payments: Lower debt frees up government resources for crucial investments in infrastructure, education, and healthcare. This means more money available for essential services rather than servicing debt.

- Attracts foreign investment: A government demonstrating fiscal responsibility signals stability and confidence to international investors, encouraging them to invest in the Canadian economy, boosting growth and creating jobs.

- Creates a stable economic environment: Predictable fiscal policies foster business confidence, encouraging entrepreneurship, innovation, and job creation. This contributes to a more robust and resilient economy.

- Ensures long-term sustainability of social programs: Responsible fiscal management guarantees the long-term viability of vital social programs like healthcare and pensions, protecting vulnerable populations.

- Strengthens Canada's international credit rating: A strong credit rating allows Canada to borrow money at lower interest rates, further reducing the cost of government borrowing and bolstering the national economy. This is vital for maintaining Canada's global economic standing and attracting investment.

Analyzing the Liberal Government's Fiscal Record

Since taking office, the Liberal government's fiscal record has drawn considerable scrutiny. While proponents cite increased social spending as necessary investments, critics point to consistent budget deficits and a rising national debt as evidence of a lack of fiscal responsibility.

- Increased government spending: The Liberal government has significantly increased spending in areas such as social programs and infrastructure. While some projects are undoubtedly beneficial, the scale of spending increases needs careful examination in relation to revenue generation. For example, the increased spending on social programs, while laudable in intent, has contributed to the widening deficit. [Insert specific data and sources here – e.g., Statistics Canada data on government spending and deficits].

- Consistent budget deficits: The Liberal government has overseen consecutive budget deficits since [Insert year]. This continuous deficit spending contributes to the accumulation of national debt. [Insert data on deficits for multiple years with sources].

- Rising national debt: Canada's national debt has increased significantly under the Liberal government. [Insert data comparing debt levels to previous governments, with sources]. This trend raises concerns about the long-term sustainability of the nation's finances and the burden on future generations.

- Impact on key economic indicators: The impact of these fiscal policies on inflation and interest rates requires careful monitoring. While some argue the increased spending stimulated economic growth, others caution about potential inflationary pressures and higher interest rates in the long run. [Insert relevant data and analysis with sources].

The Impact of Increased Debt on Future Generations

The accumulation of high national debt has significant consequences for future generations. The burden of servicing this debt falls on taxpayers, limiting the government's ability to invest in crucial areas:

- Higher taxes: Future generations will likely face higher taxes to service the accumulating national debt. This could stifle economic growth and reduce disposable income.

- Reduced government spending on crucial social programs: A significant portion of government revenue will be allocated to debt repayment, leaving less for essential social programs, impacting healthcare, education, and other vital services.

- Increased economic vulnerability to external shocks: High levels of national debt make the Canadian economy more vulnerable to external economic shocks, potentially leading to further fiscal crises.

- Limited capacity for future investments: Increased debt reduces the government's capacity to invest in critical infrastructure projects and future-oriented initiatives such as research and development, hindering long-term economic growth and competitiveness.

Alternative Approaches to Fiscal Management

To secure a more sustainable economic future, Canada requires a renewed commitment to responsible fiscal management. This involves exploring various policy options, including:

- Prioritizing essential government services: Conducting a thorough review of government spending to identify areas where cuts can be made without compromising essential services. This requires careful evaluation and prioritization of expenditures.

- Improving tax efficiency and reducing tax evasion: Implementing measures to improve the efficiency of the tax system and effectively combat tax evasion will generate more revenue for the government. This could involve strengthening tax enforcement and addressing loopholes.

- Investing in long-term economic growth initiatives: Strategic investments in areas like education, innovation, and infrastructure development are crucial for fostering long-term economic growth and creating a more competitive economy.

- Exploring public-private partnerships for infrastructure projects: Public-private partnerships can share the financial burden of infrastructure development, potentially reducing the strain on government finances. This approach requires careful consideration of risk allocation and transparency.

Conclusion

This analysis highlights the critical importance of fiscal responsibility in ensuring a strong and sustainable Canadian economy. While government investment in social programs and infrastructure is vital, a consistent pattern of large deficits and increasing national debt raises serious concerns. The Liberal government's fiscal record demonstrates a concerning departure from prudent financial management, with the increased national debt posing significant risks to future generations. A renewed focus on fiscal responsibility in Canada is crucial. We need to demand greater transparency and accountability from our government regarding its fiscal policies. Let’s advocate for a return to prudent financial management to secure a brighter economic future for all Canadians. We must demand better fiscal responsibility in Canada.

Featured Posts

-

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu 24 Shows Off Drastic Makeover In Magazine Debut

Apr 24, 2025

John Travoltas Daughter Ella Bleu 24 Shows Off Drastic Makeover In Magazine Debut

Apr 24, 2025 -

Why This Startup Airline Is Using Deportation Flights A Cost Effective Strategy

Apr 24, 2025

Why This Startup Airline Is Using Deportation Flights A Cost Effective Strategy

Apr 24, 2025 -

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

New Business Hot Spots Where To Invest And Grow Your Company

Apr 24, 2025

New Business Hot Spots Where To Invest And Grow Your Company

Apr 24, 2025