India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Strong Economic Fundamentals Driving the Nifty's Rise

Robust GDP Growth: India's GDP growth has consistently exceeded expectations in recent quarters, signaling a strong economic foundation for the Nifty's bullish run. The Indian GDP growth rate has been fueled by a robust performance across various sectors.

- Manufacturing Sector: The manufacturing sector has shown remarkable resilience, contributing significantly to the overall GDP growth. Government initiatives like "Make in India" have played a crucial role in boosting domestic manufacturing and attracting foreign investment. Recent data indicates a X% growth in the manufacturing sector (replace X with actual data).

- Services Sector: The services sector, a major contributor to India's economy, continues to expand steadily, driven by growth in IT, financial services, and tourism. The sector's contribution to GDP growth stands at approximately Y% (replace Y with actual data).

- Agriculture Sector: Despite occasional challenges, the agriculture sector has shown resilience, benefiting from government support programs and favorable weather conditions in certain regions. This sector's contribution to overall economic stability is undeniable.

- Government Initiatives: Government initiatives focused on infrastructure development, digitalization, and ease of doing business have further fueled economic expansion and investor confidence. These policies contribute directly to the positive outlook for the Indian GDP and Nifty 50 Growth.

Increased Foreign Institutional Investor (FII) Inflows: A significant driver of the Nifty's rise is the substantial inflow of Foreign Institutional Investor (FII) capital. This indicates strong international confidence in the Indian economy and its growth potential.

- Positive Economic Outlook: FIIs are attracted to India's robust economic growth prospects, making it an attractive destination for investment compared to other global markets.

- Attractive Valuations: Despite the recent rise, the Indian stock market still offers relatively attractive valuations compared to many developed markets, further enticing FII investment.

- Data: Recent reports indicate that FII investment in the Indian stock market has reached Z dollars (replace Z with actual data) in the last quarter, significantly impacting the Nifty's performance. This influx represents a clear vote of confidence in the Indian Stock Market Investments.

Positive Corporate Earnings: Strong corporate earnings from leading Indian companies are bolstering investor sentiment and pushing the Nifty higher. This positive trend indicates strong underlying fundamentals within the Indian corporate sector.

- Exceptional Sector Performance: Several key sectors, including IT, pharmaceuticals, and consumer goods, have reported exceptionally strong earnings, contributing significantly to the overall market strength. Specific companies (mention examples and their earnings growth) have shown outstanding results, reflecting the positive business environment in India.

- Impact on Investor Confidence: These strong earnings reports have fueled investor confidence, leading to increased investment and driving the Nifty's upward trajectory. This positive feedback loop continues to propel the Indian Company Earnings and, as a result, the Nifty's performance.

Government Policies and Initiatives Boosting Market Sentiment

Government's Pro-Growth Policies: The Indian government's continued commitment to pro-growth policies has played a significant role in the positive market sentiment. These policies aim to create a more business-friendly environment and attract both domestic and foreign investment.

- Policy Changes: Recent policy changes aimed at simplifying regulations, reducing bureaucratic hurdles, and promoting ease of doing business have made India a more attractive investment destination. These reforms positively impact the Indian Stock Market.

- Impact on Market: These pro-growth measures have demonstrably increased investor confidence, contributing directly to the current bullish run in the Nifty. This reflects the positive effects of Government Initiatives for Nifty.

Infrastructure Development: Massive government investments in infrastructure development are creating a positive ripple effect throughout the economy, boosting related sectors and contributing to overall growth.

- Infrastructure Projects: Large-scale infrastructure projects, including road construction, railway expansion, and port development, are creating employment opportunities and stimulating economic activity. This activity fuels further growth in the Indian Stock Market.

- Positive Impact: These projects contribute significantly to long-term economic growth and provide a positive outlook for the future performance of the Nifty. This increased infrastructure spending is vital for India's economic growth.

Global Factors Contributing to the Nifty's Bullish Run

Global Economic Recovery: The global economic recovery, while uneven, has positively impacted the Indian stock market. Easing inflation in several key economies has improved investor sentiment globally, benefiting the Nifty.

- Easing Inflation: Reduced global inflation has alleviated concerns about interest rate hikes and increased investor confidence in emerging markets like India. This contributes to the positive Global Economic Impact on India.

- Improving Investor Confidence: The improved global economic outlook has led to increased capital flows into emerging markets, including India, further supporting the Nifty's bullish run. This confidence reflects positively on the Global Market Trends impacting the Nifty.

Falling Commodity Prices: Falling commodity prices, particularly crude oil, have significantly benefited India's economy. Lower energy costs reduce production costs and improve the profitability of businesses.

- Crude Oil Prices: The decrease in crude oil prices has reduced India's import bill, easing inflationary pressures and improving the country's current account deficit. The Oil Prices Impact Nifty positively through this reduced inflationary pressure.

- Positive Impact on Economy: The overall impact of reduced commodity prices has been positive for India's economy and contributed to the improved performance of the Nifty. This makes it easier to understand how Inflation Impact on India affects the Nifty.

Conclusion

The Nifty's bullish run is a reflection of strong economic fundamentals, supportive government policies, and positive global factors. Robust GDP growth, increased FII inflows, strong corporate earnings, and government initiatives are all contributing to this positive market buzz. While market volatility is inherent, the current indicators suggest a sustained period of growth for the Indian stock market. Staying informed about these trends is crucial for investors looking to capitalize on the opportunities presented by the Nifty's bullish run and the overall positive developments in the Indian Market. Continue monitoring the Nifty and other key Indian Stock Market indicators to make informed investment decisions.

Featured Posts

-

The Business Of Deportations How One Startup Airline Is Making It Work

Apr 24, 2025

The Business Of Deportations How One Startup Airline Is Making It Work

Apr 24, 2025 -

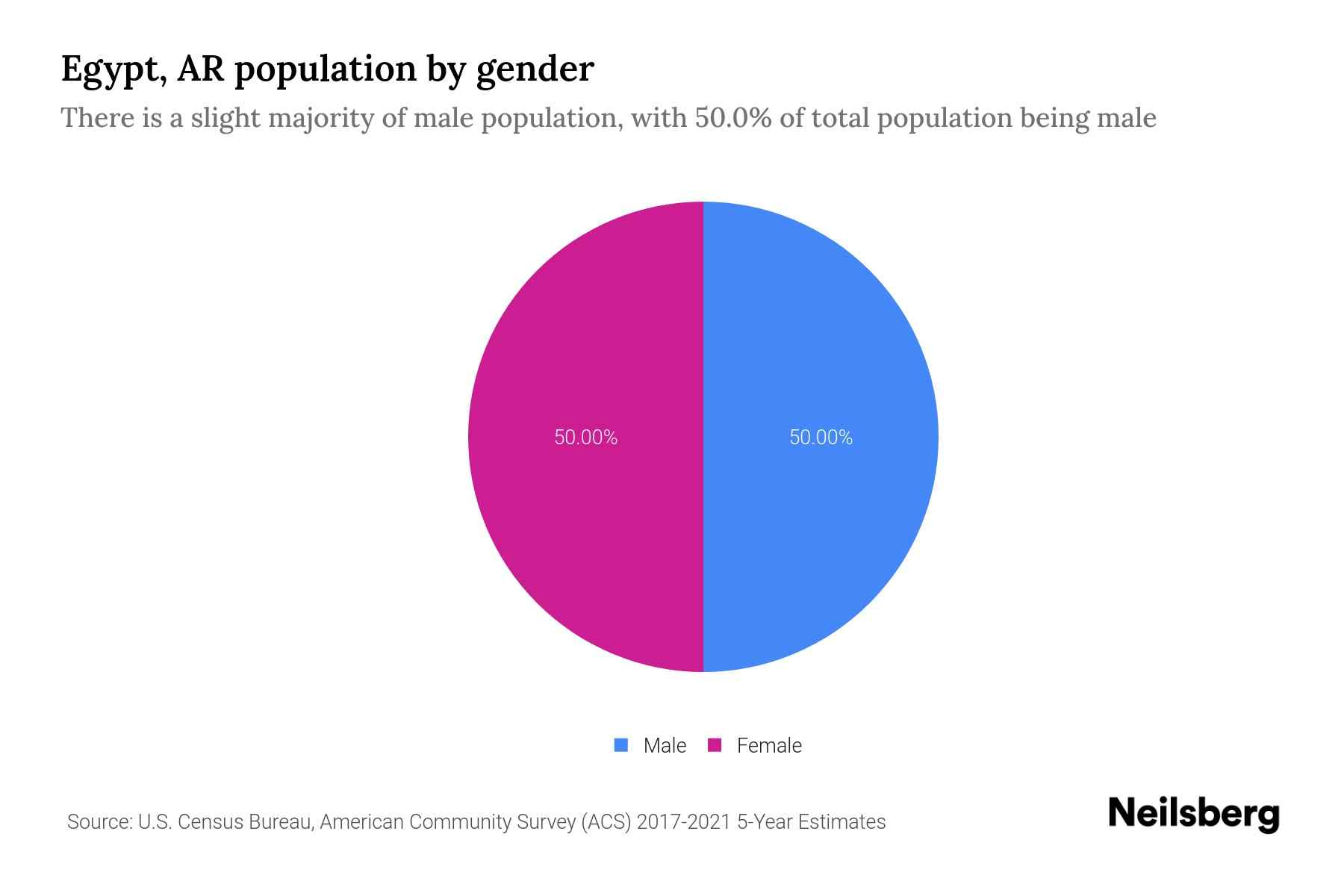

The Role Of Al Riyada In Shaping Gender Dynamics In Egypt A Historical Perspective 1820 1936

Apr 24, 2025

The Role Of Al Riyada In Shaping Gender Dynamics In Egypt A Historical Perspective 1820 1936

Apr 24, 2025 -

Bold And The Beautiful Spoilers Thursday February 20 Steffy Comforts Liam Finns Warning

Apr 24, 2025

Bold And The Beautiful Spoilers Thursday February 20 Steffy Comforts Liam Finns Warning

Apr 24, 2025 -

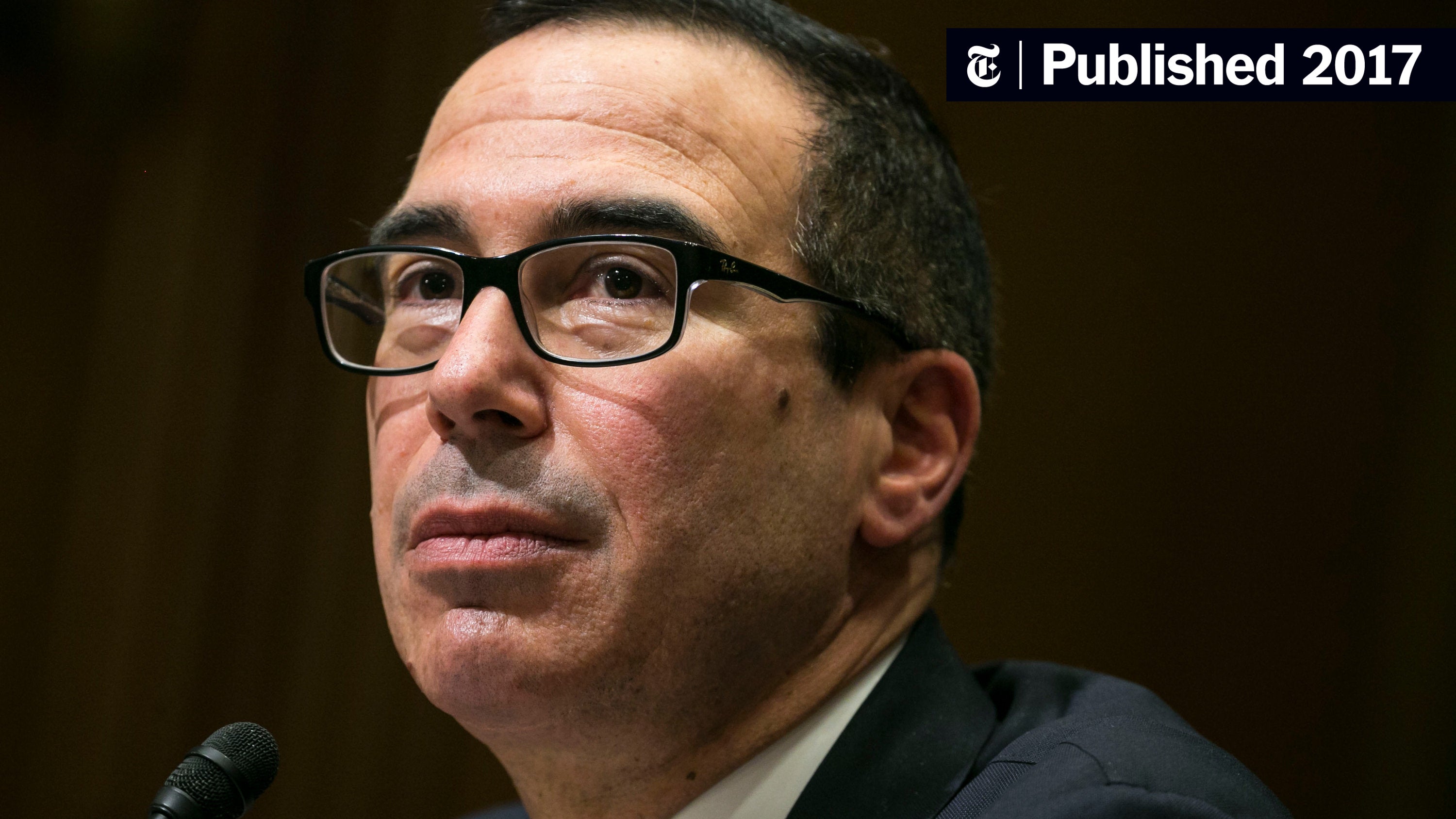

Trumps Softer Tone On Fed Boosts Us Dollar

Apr 24, 2025

Trumps Softer Tone On Fed Boosts Us Dollar

Apr 24, 2025 -

Will Liam Die The Bold And The Beautiful Spoilers Reveal His Critical Condition

Apr 24, 2025

Will Liam Die The Bold And The Beautiful Spoilers Reveal His Critical Condition

Apr 24, 2025