Canada's Economic Outlook: The Urgent Need For Fiscal Responsibility Under The Liberals

Table of Contents

Mounting National Debt and Deficit

Canada's national debt and deficit are reaching alarming levels. According to Statistics Canada, the national debt has experienced significant growth under the current Liberal administration, exceeding [Insert specific figures from Statistics Canada]. This contrasts with [Insert comparison to previous governments' fiscal performance, citing sources]. The implications are profound.

- Growth of the national debt: The continuous increase in the national debt is unsustainable, placing a heavy burden on future generations. [Insert data on the rate of debt increase].

- Comparison to previous governments: A comparison with previous governments reveals a stark difference in fiscal management approaches. [Insert data comparing debt accumulation under different administrations].

- Impact of increased debt servicing costs: The rising interest rates globally are significantly impacting debt servicing costs, consuming a larger portion of the annual budget that could be allocated to essential public services. [Insert data on the proportion of the budget dedicated to debt servicing].

- Rising interest rates and debt repayment: The Bank of Canada's recent interest rate hikes exacerbate the problem, making debt repayment increasingly challenging. [Insert information on interest rate hikes and their impact on debt].

The escalating Canadian national debt and federal deficit demand immediate and decisive action to ensure the long-term fiscal health of the nation. Addressing this issue requires a multifaceted approach encompassing spending cuts, tax reforms, and enhanced government efficiency.

Impact of Increased Government Spending

Increased government spending, while often intended to stimulate the economy and improve social programs, has had both positive and negative consequences. While investments in healthcare, social programs, and infrastructure are crucial, their effectiveness and efficiency require critical assessment.

- Analysis of government spending programs: While some programs demonstrate positive impacts, others lack demonstrable effectiveness and suffer from inefficiencies. [Insert examples of successful and unsuccessful programs].

- Inefficiencies and waste in government spending: Audits and reports frequently highlight significant inefficiencies and waste within government spending. [Cite examples and sources].

- Opportunity cost of increased spending: The significant increase in spending in certain sectors has resulted in a considerable opportunity cost, limiting investments in other vital areas, such as education and research and development.

- Impact on inflation: The substantial increase in government spending has contributed to inflationary pressures, eroding the purchasing power of Canadians. [Insert data on inflation and its relationship to government spending].

Understanding the impact of government spending on various sectors is crucial to implementing responsible and effective fiscal policies. Careful analysis and prioritization of spending are essential for sustainable economic growth. Healthcare spending in Canada, for example, requires a comprehensive review to ensure efficient resource allocation and optimized outcomes. Similarly, infrastructure spending in Canada necessitates rigorous planning and execution to maximize its economic and social benefits.

The Need for Sustainable Economic Growth

Sustainable economic growth is inextricably linked to fiscal responsibility in Canada. Without it, Canada risks jeopardizing its long-term economic prosperity and social well-being.

- Strategies for fostering sustainable economic growth: Investing in innovation, developing a skilled workforce, and promoting responsible resource management are crucial for long-term economic sustainability.

- Role of private sector investment: Encouraging private sector investment through tax incentives and regulatory reforms is paramount for job creation and economic expansion.

- Tax reforms to encourage investment and job creation: Strategic tax reforms that incentivize investment and job creation without jeopardizing crucial social programs are vital.

- Impact of global economic uncertainty: Global economic uncertainty underscores the need for robust and adaptable fiscal policies to safeguard Canada's economy.

Potential Solutions for Improved Fiscal Management

Improving Canada's fiscal management requires a multi-pronged approach. This includes carefully planned spending cuts, strategic tax reforms, and enhanced government operational efficiency.

- Areas for spending reduction and efficiency: Identifying areas where spending can be reduced or made more efficient, without compromising essential public services, is crucial. [Provide specific examples, such as streamlining bureaucratic processes or reducing duplication of services].

- Tax reforms to increase government revenue: Strategic tax reforms, such as closing tax loopholes and broadening the tax base, can increase government revenue while minimizing the impact on economic growth. [Provide specific examples].

- Regulatory reform to boost economic activity: Reducing unnecessary regulations and streamlining bureaucratic processes can stimulate economic activity and boost private sector investment. [Provide specific examples].

Conclusion

The need for fiscal responsibility in Canada is undeniable. The mounting national debt, coupled with increased government spending and the impact of global economic uncertainty, poses significant risks to Canada's long-term economic prosperity. Continued unsustainable fiscal practices will inevitably lead to reduced public services, increased taxes, and a diminished quality of life for Canadians. The government must prioritize the implementation of responsible budgetary policies, including strategic spending cuts, efficient tax reforms, and enhanced government efficiency.

We urge readers to actively engage with policymakers, demanding greater fiscal responsibility and a clear plan for achieving long-term fiscal sustainability. The future of Canada's economic prosperity depends on it. Let's work together to ensure a financially secure and prosperous future for Canada by advocating for improved fiscal responsibility in Canada.

Featured Posts

-

Legal Showdown Harvard Challenges Trump Administration Could Negotiation Avert A Full Scale Conflict

Apr 24, 2025

Legal Showdown Harvard Challenges Trump Administration Could Negotiation Avert A Full Scale Conflict

Apr 24, 2025 -

Mahmoud Khalil Columbia Student Denied Travel To Witness Sons Birth By Ice

Apr 24, 2025

Mahmoud Khalil Columbia Student Denied Travel To Witness Sons Birth By Ice

Apr 24, 2025 -

John Travoltas Lowest Rated Movies A Rotten Tomatoes Analysis

Apr 24, 2025

John Travoltas Lowest Rated Movies A Rotten Tomatoes Analysis

Apr 24, 2025 -

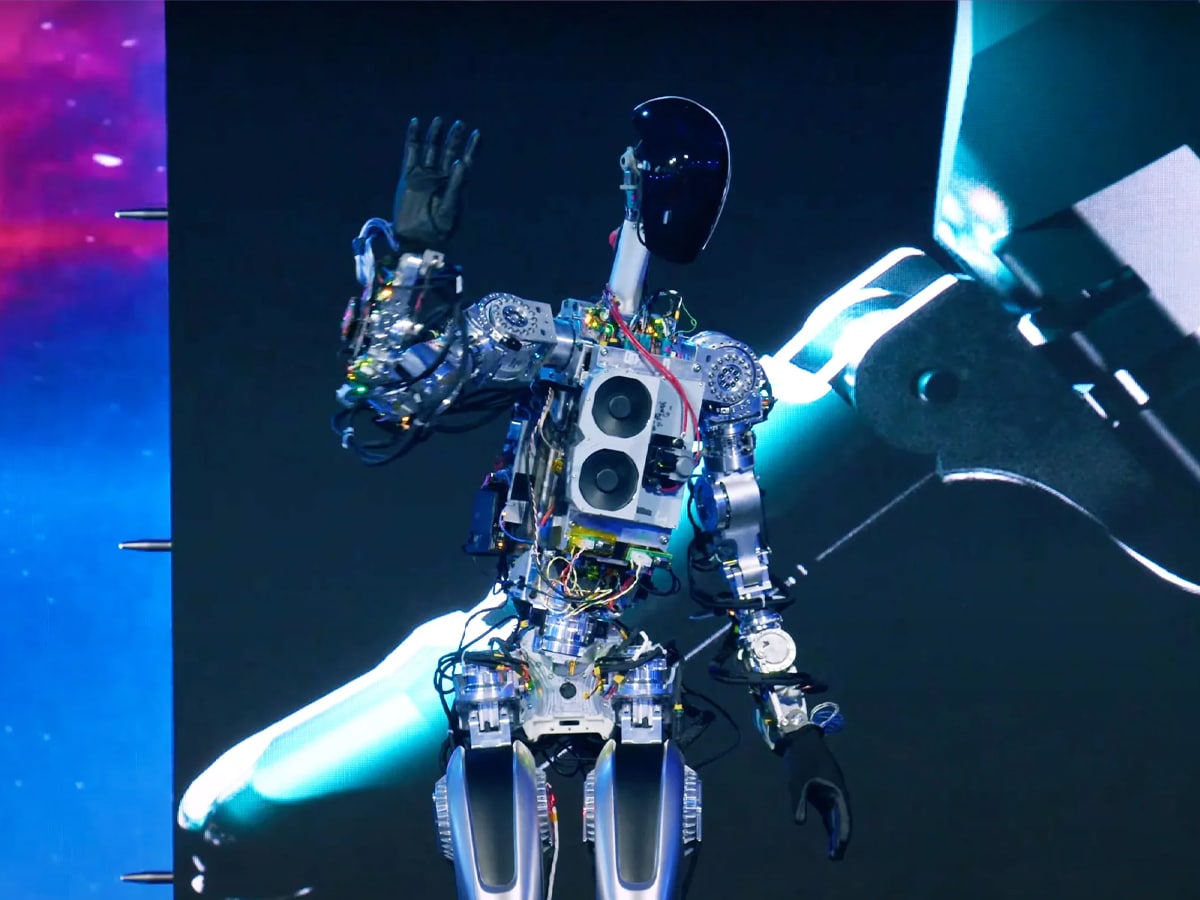

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

Google Chrome Acquisition Rumor A Chat Gpt Leaders Perspective

Apr 24, 2025

Google Chrome Acquisition Rumor A Chat Gpt Leaders Perspective

Apr 24, 2025