Canadian Dollar: A Case Study In Currency Appreciation And Depreciation

Table of Contents

Factors Affecting Canadian Dollar Appreciation

Several interconnected factors contribute to periods of Canadian dollar appreciation. A strong loonie benefits importers and international travelers from Canada, but can hurt Canadian exporters.

Commodity Prices

Canada's economy is heavily reliant on the export of natural resources. The price of commodities like oil, natural gas, lumber, and minerals significantly impacts the Canadian dollar's value.

- Increased demand for Canadian resources: Booming global demand for these commodities translates to increased export revenue, flooding the market with Canadian dollars and consequently strengthening the currency. Higher demand pushes the price up, leading to a stronger loonie.

- Global economic growth: Periods of robust global economic growth typically correlate with higher commodity prices, further bolstering the Canadian dollar. Think of the strong growth in China and other Asian economies in recent decades driving commodity demand and a stronger Canadian dollar.

- Examples: The surge in oil prices in the mid-2000s led to a period of significant Canadian dollar appreciation. Conversely, a drop in oil prices has a similar but inverse effect.

Interest Rate Differentials

Interest rate differentials between Canada and other major economies play a crucial role in influencing the Canadian dollar's exchange rate.

- Attracting foreign investment: When the Bank of Canada sets higher interest rates compared to other countries (like the US), it attracts foreign investment. Investors seek higher returns on their investments, leading to an inflow of capital into Canada and increased demand for the Canadian dollar.

- Bank of Canada's monetary policy: The Bank of Canada's monetary policy decisions directly impact interest rates and consequently the loonie's value. Raising rates strengthens the dollar while lowering them weakens it.

- Comparison to major trading partners: A comparison of Canadian interest rates to those of major trading partners, particularly the United States, reveals the relative attractiveness of investing in Canada, and this directly influences the Canadian dollar.

Geopolitical Factors

Global and domestic geopolitical events can significantly impact investor confidence and, therefore, the Canadian dollar's value.

- Political stability: Political uncertainty or instability within Canada can lead to capital flight and currency depreciation as investors seek safer havens for their money.

- International events: Major international events like trade wars, global recessions, or geopolitical tensions can indirectly impact the Canadian dollar. For example, global uncertainty often leads to a flight to safety, strengthening the US dollar and potentially weakening the Canadian dollar.

- Specific examples: The 2008 financial crisis and the ongoing US-China trade tensions are examples of geopolitical events that have influenced the loonie's value.

Factors Affecting Canadian Dollar Depreciation

Conversely, several factors contribute to periods of Canadian dollar depreciation. A weaker loonie helps Canadian exporters but makes imports more expensive.

Commodity Price Slumps

A downturn in global commodity prices directly weakens the Canadian dollar.

- Reduced export earnings: Lower commodity prices lead to reduced export revenue, weakening the currency. This is because Canada's export earnings are significantly tied to commodity sales.

- Global economic slowdowns: Global economic slowdowns often coincide with lower commodity prices, putting downward pressure on the Canadian dollar.

- Examples: The sharp drop in oil prices in 2014-2016 resulted in a significant period of Canadian dollar depreciation.

Interest Rate Cuts

The Bank of Canada's decision to cut interest rates can lead to capital outflow and currency depreciation.

- Capital outflow: Lower interest rates in Canada make the country less attractive for foreign investment, leading to capital outflow and a weaker Canadian dollar. Investors look for better returns elsewhere.

- Bank of Canada's response to economic downturns: Interest rate cuts are often part of the Bank of Canada's response to economic downturns, but this negatively impacts the Canadian dollar.

- Historical analysis: Studying historical interest rate changes and their corresponding impact on the Canadian dollar provides valuable insights into these dynamics.

Economic Slowdown

A weaker domestic Canadian economy reduces demand for the Canadian dollar.

- Lower economic growth: Lower economic growth in Canada reduces investment and trade, ultimately leading to a weaker Canadian dollar.

- GDP growth vs. currency performance: A comparison of Canadian GDP growth and currency performance reveals a strong correlation.

- Contributing factors: Factors contributing to economic slowdowns, such as high unemployment or decreased consumer spending, influence the Canadian dollar's value.

Forecasting the Canadian Dollar

Accurately forecasting the Canadian dollar's value is challenging but crucial for informed decision-making.

- Economic indicators: Analyzing current economic indicators, including inflation, interest rates, commodity prices, and economic growth, is essential.

- Forecasting models: Employing various forecasting models such as fundamental analysis (examining economic factors) and technical analysis (studying price charts) can provide insights.

- Geopolitical factors: Considering geopolitical factors and potential risks is vital for improving forecast accuracy.

- Disclaimer: Currency forecasting is inherently uncertain, and no model can guarantee accuracy.

Conclusion

The Canadian dollar's value is a complex interplay of various economic and geopolitical factors. Understanding the influence of commodity prices, interest rates, global events, and the domestic economic climate is crucial for businesses and individuals engaging in international trade, investment, or travel. By monitoring these factors and utilizing available forecasting tools, you can better manage the risks and opportunities presented by fluctuations in the Canadian dollar. Stay informed about developments impacting the Canadian dollar to make sound financial decisions. Continue learning about the Canadian dollar to effectively manage your financial exposures.

Featured Posts

-

Game Recap Hield And Paytons Bench Play Leads Warriors Past Blazers

Apr 24, 2025

Game Recap Hield And Paytons Bench Play Leads Warriors Past Blazers

Apr 24, 2025 -

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025 -

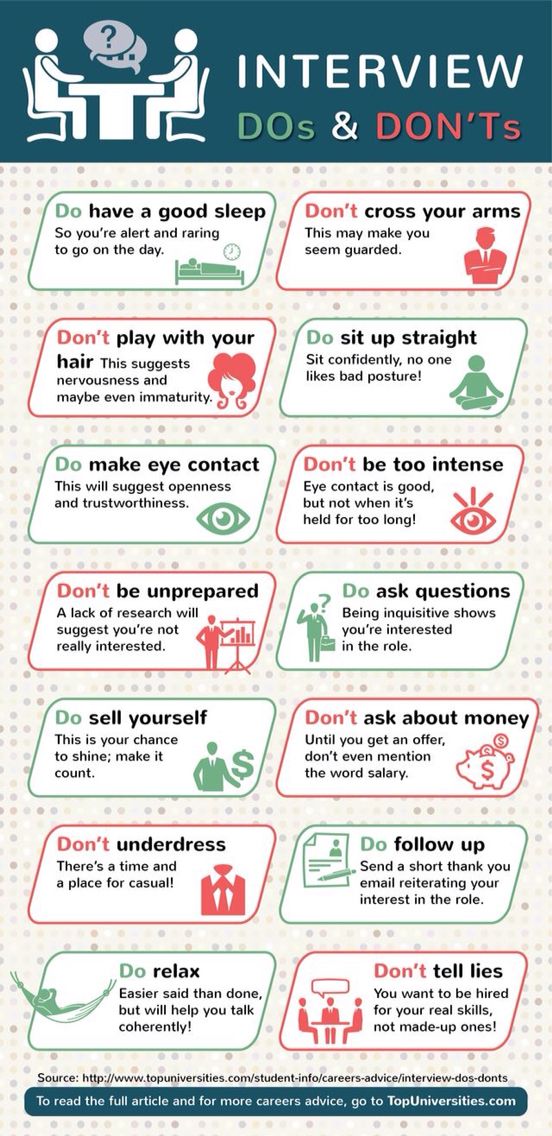

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse A Spoiler Filled Update On His Health

Apr 24, 2025

The Bold And The Beautiful Liams Collapse A Spoiler Filled Update On His Health

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liam Collapses Bills Exit And Hopes New Home

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liam Collapses Bills Exit And Hopes New Home

Apr 24, 2025