Challenges Facing The Next Federal Reserve Chair Under Trump's Economic Policies

Table of Contents

The selection of the next Federal Reserve Chair is a pivotal moment for the US economy. This decision carries immense weight, especially considering the complex economic legacy of President Trump's policies. This article delves into the significant challenges the incoming chair will face in navigating this intricate economic landscape. Understanding these hurdles is crucial for anyone seeking to comprehend the future trajectory of the US economy and the impact on their financial well-being.

<h2>Navigating the Legacy of Fiscal Policy</h2>

President Trump's economic policies, characterized by significant tax cuts and increased government spending, have left a lasting impact on the nation's fiscal health. The resulting budget deficit and soaring national debt pose considerable challenges for the next Federal Reserve Chair. These fiscal choices directly influence monetary policy, creating a delicate balancing act for the central bank.

- Increased national debt impacting interest rates: A larger national debt increases borrowing costs for the government, potentially driving up interest rates across the board. This can stifle economic growth and complicate the Federal Reserve's ability to manage inflation.

- Potential for inflationary pressures due to increased government spending: Stimulus spending, while boosting economic activity in the short term, can fuel inflation if not carefully managed. The Federal Reserve must carefully monitor price levels and adjust monetary policy accordingly to prevent runaway inflation.

- Challenges in balancing fiscal and monetary policy coordination: The Federal Reserve and the Treasury Department must work in concert. However, differing priorities can lead to conflict and hinder effective economic management. The incoming chair must skillfully navigate these inter-agency dynamics.

- Long-term sustainability of the current fiscal path: The current trajectory of the national debt raises concerns about long-term economic stability. The Federal Reserve Chair will need to consider the long-term implications of current fiscal policies on monetary policy effectiveness.

<h2>Managing Inflation and Interest Rates</h2>

Managing inflation and interest rates effectively is paramount. The next Federal Reserve Chair will grapple with the delicate task of balancing economic growth with inflation control. This challenge is amplified by the lingering effects of Trump's fiscal policies and global economic uncertainties.

- Balancing economic growth with inflation control: The Federal Reserve's dual mandate – to maximize employment and maintain price stability – requires a nuanced approach to interest rate adjustments. Finding the right balance is crucial to avoiding both recession and hyperinflation.

- Predicting and responding to changing inflation expectations: Inflation expectations play a significant role in shaping actual inflation. The Federal Reserve Chair must accurately anticipate and react to shifts in public perception of inflation to maintain credibility and control.

- The effectiveness of different monetary policy tools in the current environment: The effectiveness of traditional monetary policy tools, such as adjusting the Federal Funds Rate and quantitative easing, may be altered by the current economic conditions. The incoming chair must explore innovative approaches to monetary policy.

- Potential risks of premature interest rate hikes or prolonged low rates: Raising interest rates too early can stifle economic growth, while keeping them low for too long can fuel inflation. The optimal path for interest rate adjustments requires careful consideration of various economic indicators.

<h2>Addressing Unemployment and Economic Inequality</h2>

While Trump's policies aimed to boost employment, addressing persistent unemployment and economic inequality remains a major challenge. The next Federal Reserve Chair will need to consider the complexities of achieving inclusive growth.

- Impact of automation and technological advancements on employment: Automation and technological advancements continue to transform the labor market, displacing workers in some sectors while creating new opportunities in others. The Federal Reserve must address the resulting job displacement and retraining needs.

- Effectiveness of monetary policy in addressing income inequality: Monetary policy alone cannot solve income inequality, but it can play a supportive role by fostering economic growth that benefits all segments of society. Finding this balance will be crucial.

- Balancing the need for economic growth with the need for inclusive growth: The Federal Reserve must strive for economic growth that is broadly shared across the population, addressing disparities in income and wealth. This requires considering the impact of monetary policy on different demographics.

- The role of the Federal Reserve in promoting social equity: While the Federal Reserve's primary mandate is economic stability, the social consequences of economic inequality cannot be ignored. The incoming chair must carefully consider the social equity implications of their policy decisions.

<h3>Maintaining Independence of the Federal Reserve</h3>

The independence of the Federal Reserve is paramount for its effectiveness. The next chair must safeguard the central bank's autonomy from undue political pressure to ensure credibility and maintain its ability to make objective decisions based on economic data rather than political considerations. Transparency and accountability are key to maintaining this independence.

<h2>Conclusion</h2>

The next Federal Reserve Chair will inherit a complex and challenging economic landscape shaped significantly by President Trump's economic policies. Successfully navigating these multifaceted challenges demands a deep understanding of monetary and fiscal policies, a commitment to the Federal Reserve's independence, and a keen awareness of the social implications of economic decisions. The ability to balance competing priorities – inflation control, economic growth, and social equity – will define the success of the next Federal Reserve leadership.

Understanding the challenges facing the next Federal Reserve Chair under Trump's economic policies is critical for anyone concerned about the future of the US economy. Learn more about the complexities of monetary policy and the role of the Federal Reserve by [link to relevant resource]. Stay informed about the challenges facing the next Federal Reserve Chair and their potential impact on your financial future.

Featured Posts

-

Anchor Brewing Company To Shutter A Legacy Ends After 127 Years

Apr 26, 2025

Anchor Brewing Company To Shutter A Legacy Ends After 127 Years

Apr 26, 2025 -

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025 -

Are Chinese Cars The Future Of The Automotive Industry

Apr 26, 2025

Are Chinese Cars The Future Of The Automotive Industry

Apr 26, 2025 -

Office365 Executive Account Compromise Leads To Multi Million Dollar Theft

Apr 26, 2025

Office365 Executive Account Compromise Leads To Multi Million Dollar Theft

Apr 26, 2025 -

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 26, 2025

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 26, 2025

Latest Posts

-

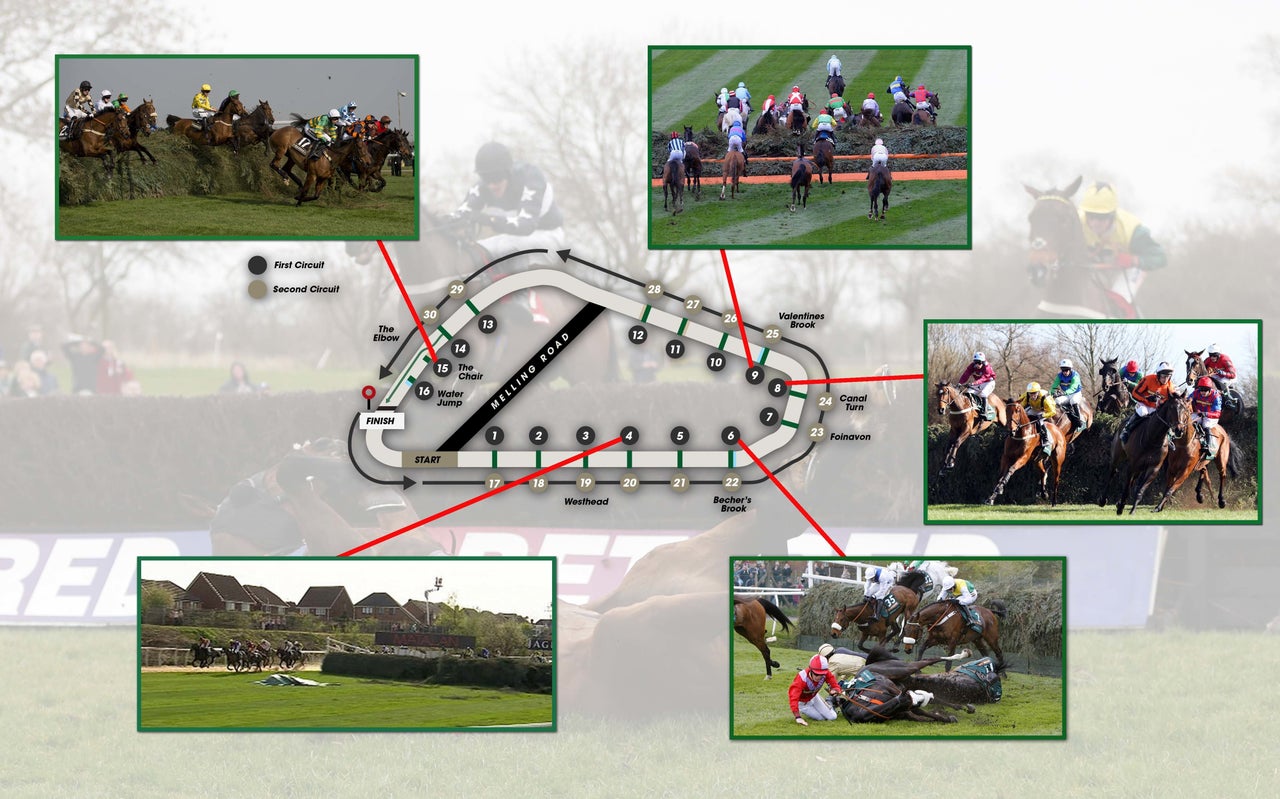

Grand National Horse Mortality Data And Concerns Before 2025

Apr 27, 2025

Grand National Horse Mortality Data And Concerns Before 2025

Apr 27, 2025 -

The Toll Of The Grand National Horse Deaths Before The 2025 Race

Apr 27, 2025

The Toll Of The Grand National Horse Deaths Before The 2025 Race

Apr 27, 2025 -

Pre 2025 Grand National Understanding The Risks To Participating Horses

Apr 27, 2025

Pre 2025 Grand National Understanding The Risks To Participating Horses

Apr 27, 2025 -

Horse Fatalities At The Grand National Statistics Ahead Of The 2025 Race

Apr 27, 2025

Horse Fatalities At The Grand National Statistics Ahead Of The 2025 Race

Apr 27, 2025 -

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025