Chime Launches Fast $500 Loan Program For Direct Deposit Accounts

Table of Contents

Understanding Chime's Fast $500 Loan Program

Chime's fast $500 loan program is designed to provide short-term financial assistance to eligible Chime members. It's specifically created for emergency situations, offering a rapid and convenient way to access funds without the complexities of traditional loans or high-interest payday loans. The program prioritizes speed and ease of access, making it a valuable resource for those facing unexpected expenses.

- Quick application process: Apply in minutes, not days, unlike many traditional loan applications.

- No credit check required: Eligibility is based on your Chime account activity, not your credit score. (Specific eligibility criteria are detailed below.)

- Funds deposited directly into your Chime account: Once approved, the funds are transferred directly to your account for immediate use.

- Competitive fees and interest rates: Chime's fees and interest rates are designed to be significantly more favorable than those typically found with payday loans or other high-cost short-term borrowing options.

Eligibility Requirements for the Chime $500 Loan

To qualify for Chime's $500 loan, you must meet several criteria. This ensures responsible lending and helps Chime assess your ability to repay the loan. While a credit check isn't required, meeting these requirements is essential.

- Active Chime account with direct deposit: You must have an active Chime account and receive regular direct deposits.

- Consistent direct deposit history: A minimum of X months of consistent direct deposits is usually required (the exact timeframe may be specified on the Chime website or app). The minimum amount deposited may also be a factor.

- Meeting specific spending and account activity requirements: Chime will likely review your account activity to assess responsible financial behavior. This may involve maintaining a positive account balance and avoiding overdrafts.

Specific eligibility criteria may vary, so it is crucial to check the most up-to-date information directly on the Chime app or website.

- Minimum direct deposit amount: A specific minimum amount of regular direct deposit is typically needed to qualify.

- Account age requirements: Your Chime account needs to have been active for a specific duration.

- Potential restrictions based on prior loan usage: If you've previously used Chime's loan program, there might be restrictions on how frequently you can reapply.

- Clarification on eligibility for existing SpotMe users: The eligibility for this loan may differ slightly for those who are already using Chime's SpotMe overdraft protection feature.

How to Apply for a Chime $500 Loan

Applying for a Chime $500 loan is a streamlined and straightforward process, designed for maximum convenience.

- Access the loan application through the Chime app: Open your Chime app and look for the loan application section. (Screenshots would be helpful here in a visual guide)

- Review and accept the loan terms and conditions: Carefully read and understand all terms before proceeding.

- Confirm your identity and account information: You'll likely need to verify your identity and provide some basic account information.

- Funds deposited directly into your account: Upon approval, the funds will be deposited directly into your Chime account within a short timeframe (usually within minutes or a few hours).

Comparing Chime's $500 Loan to Other Options

Chime's $500 loan offers a compelling alternative to other short-term loan options, especially when compared to payday loans and overdraft protection.

- Lower interest rates compared to payday loans: Payday loans are notorious for their exorbitant interest rates. Chime's loan program offers a significantly more affordable alternative.

- Avoids the high fees associated with overdraft protection: Overdraft fees can quickly accumulate, creating a financial burden. Chime's loan provides a more manageable and transparent solution.

- Transparent fees and repayment terms: Chime provides clear information on fees and repayment schedules, preventing unexpected charges.

- Potential for building credit (if applicable): While this isn't guaranteed, responsible repayment of a Chime loan could potentially help build credit over time. (This requires further clarification directly with Chime).

Frequently Asked Questions (FAQs)

- What happens if I miss a payment? Missing a payment will likely incur late fees. Contact Chime customer support immediately if you anticipate difficulty making a payment.

- How long is the repayment period? The repayment period will be clearly specified in the loan agreement.

- Does this impact my credit score? Typically, Chime's loan program does not directly impact your credit score, although responsible repayment could positively influence it indirectly over time. Consult your credit report for confirmation.

- How can I contact Chime customer support? Chime provides various customer support channels, including phone, email, and online chat; check the Chime website or app for the most up-to-date contact information.

Conclusion

Chime's new fast $500 loan program offers a convenient and accessible solution for Chime members facing unexpected financial challenges. Its speed, ease of application, and competitive terms set it apart from traditional loan options like payday loans and high-fee overdraft protection. It provides a responsible and potentially life-saving financial tool for emergency situations.

Call to Action: If you're a Chime customer with direct deposit and need quick access to emergency funds, apply for the Chime $500 loan today and experience the ease and speed of this innovative financial tool. Learn more about Chime's loan program and eligibility requirements on the official Chime website. Remember to always borrow responsibly and only borrow what you can comfortably repay.

Featured Posts

-

Barcelona Eyeing Dean Huijsen As Araujos Successor

May 14, 2025

Barcelona Eyeing Dean Huijsen As Araujos Successor

May 14, 2025 -

Maya Jamas Skincare And Haircare Routine A Detailed Look

May 14, 2025

Maya Jamas Skincare And Haircare Routine A Detailed Look

May 14, 2025 -

Fintech Ipos And Trade Wars The Case Of Affirm Holdings Afrm And Trump Tariffs

May 14, 2025

Fintech Ipos And Trade Wars The Case Of Affirm Holdings Afrm And Trump Tariffs

May 14, 2025 -

Sociologo Danny Shaw Haiti Sufre La Peor Tragedia Y Trump No Ayudara

May 14, 2025

Sociologo Danny Shaw Haiti Sufre La Peor Tragedia Y Trump No Ayudara

May 14, 2025 -

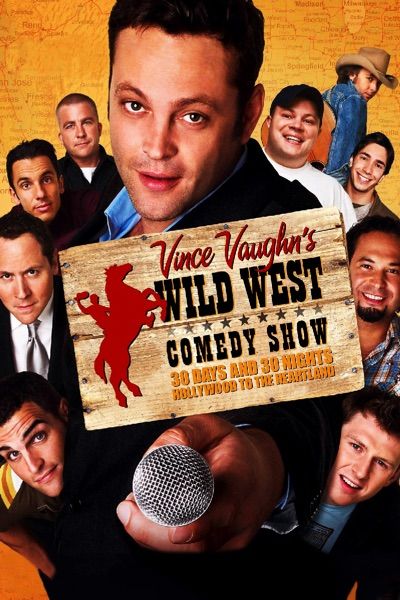

Vince Vaughns New Netflix Drama A Star Studded Crowd Pleaser

May 14, 2025

Vince Vaughns New Netflix Drama A Star Studded Crowd Pleaser

May 14, 2025