China's Energy Strategy: Middle Eastern LPG As A US Tariff Alternative

Table of Contents

The Impact of US Tariffs on China's Energy Market

US tariffs have significantly altered the dynamics of China's energy market, creating both challenges and opportunities.

Increased Costs and Reduced Supply

The imposition of US tariffs has directly increased the cost of US-sourced energy for China. This has several detrimental effects:

- Higher import costs: Tariffs add a substantial premium to the price of US energy imports, making them less competitive.

- Reduced competitiveness of Chinese goods: Increased energy costs translate to higher production costs for Chinese manufacturers, impacting their global competitiveness.

- Search for alternative energy sources: Facing higher prices and potential supply disruptions, China has been actively seeking more reliable and cost-effective energy alternatives. This has led to a renewed focus on energy diversification and security.

China's Response to Tariff Hikes

China's response to the US tariff hikes has been multifaceted and strategic:

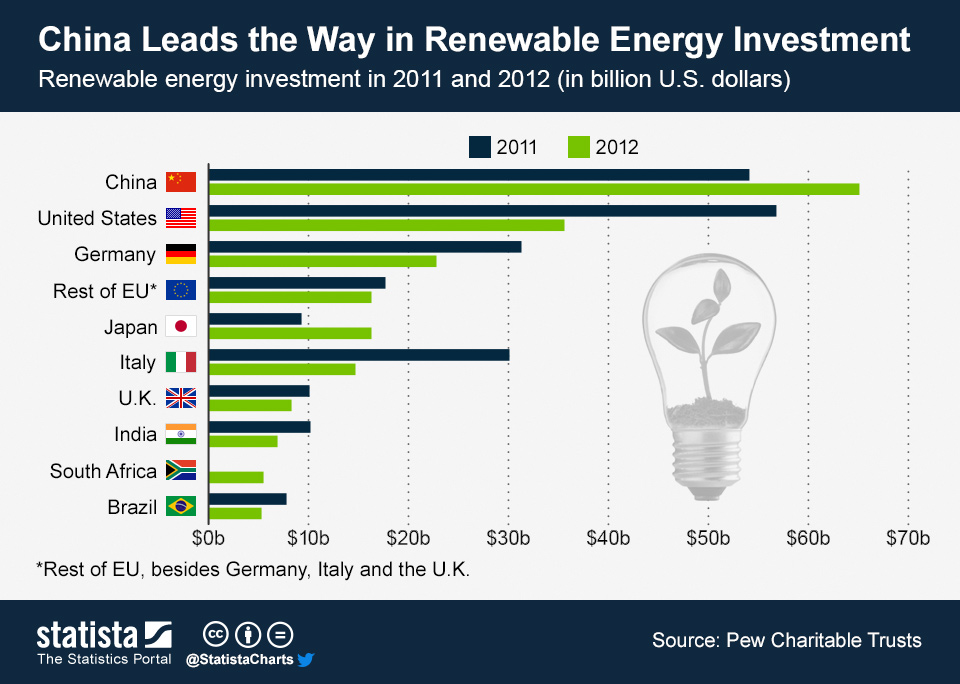

- Increased investment in domestic energy production: China is accelerating its investments in renewable energy sources, such as solar and wind power, as well as bolstering its domestic fossil fuel production.

- Exploration of new international partnerships: The country is forging stronger energy partnerships with nations outside the US, diversifying its supply chains and reducing reliance on a single source.

- Focus on energy security: Energy security has become a paramount concern for China, prompting a comprehensive strategy to ensure a stable and reliable energy supply for its economy. This includes strategic reserves and diversification of supply routes.

Middle Eastern LPG: A Viable Alternative

Middle Eastern Liquefied Petroleum Gas (LPG) has emerged as a compelling alternative to US energy imports for China.

Abundant LPG Resources in the Middle East

The Middle East possesses vast reserves of LPG, making it a potentially lucrative source for China:

- Major Middle Eastern LPG producers: Countries like Saudi Arabia, Qatar, and Iran are major LPG producers with established export infrastructure.

- Pipeline and shipping infrastructure: Existing pipelines and robust shipping networks facilitate the efficient transportation of LPG from the Middle East to China.

- Competitive pricing strategies: Middle Eastern LPG often offers a more competitive price point compared to US-sourced energy, especially considering the added cost of US tariffs.

Geopolitical Implications of Increased Middle East Energy Ties

China's increased reliance on Middle Eastern LPG has significant geopolitical implications:

- Strengthened diplomatic ties: The energy relationship fosters stronger diplomatic ties between China and Middle Eastern nations.

- Increased trade agreements: The increased energy trade is likely to lead to broader trade agreements and economic collaborations.

- Potential for joint energy ventures: China may engage in joint energy ventures with Middle Eastern countries, further strengthening their economic and political alliances.

Economic Benefits and Challenges of the LPG Strategy

The shift towards Middle Eastern LPG presents both economic benefits and challenges for China.

Cost Savings and Economic Growth

The transition offers substantial potential for cost reduction and economic growth:

- Lower energy costs: Access to cheaper LPG can significantly lower China's overall energy costs.

- Improved profitability for businesses: Reduced energy costs enhance the profitability of Chinese businesses, boosting their competitiveness.

- Enhanced export potential: Lower production costs translate to more competitive export prices for Chinese goods in the global market.

Infrastructure Development and Logistics

However, significant infrastructure investments are required to support increased LPG imports:

- Investments in pipeline infrastructure: New pipelines may be needed to efficiently transport LPG from ports to inland consumption areas.

- Upgrades to port facilities: Existing port facilities may require upgrades to handle the increased volume of LPG imports.

- Development of logistics networks: Efficient logistics networks are crucial for the timely and cost-effective distribution of LPG across China.

Conclusion

China's shift towards Middle Eastern LPG, driven by US tariffs, signifies a crucial geopolitical and economic realignment. This strategy offers substantial cost savings and boosts economic competitiveness, but demands significant infrastructure investment. Further research is needed to fully understand the long-term implications, including environmental considerations and regional stability. To stay abreast of the latest developments in this evolving energy landscape, continue to research China's energy strategy, Middle Eastern LPG, and the impact of US tariffs. Understanding these dynamics is crucial for navigating the complexities of the global energy market.

Featured Posts

-

Is The Canadian Dollars Rise Against The Us Dollar Sustainable

Apr 24, 2025

Is The Canadian Dollars Rise Against The Us Dollar Sustainable

Apr 24, 2025 -

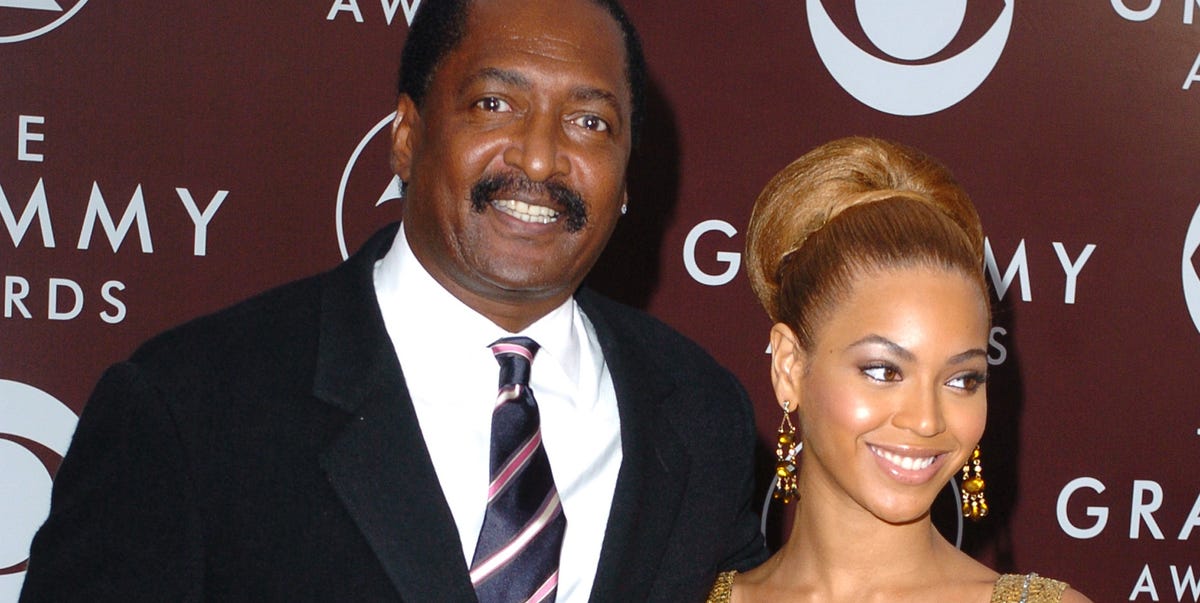

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025 -

Epa Crackdown On Tesla And Space X Elon Musk And Dogecoins Response

Apr 24, 2025

Epa Crackdown On Tesla And Space X Elon Musk And Dogecoins Response

Apr 24, 2025 -

Vote Informed William Watsons Analysis Of The Liberal Platform

Apr 24, 2025

Vote Informed William Watsons Analysis Of The Liberal Platform

Apr 24, 2025