Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

BofA's Perspective on Current Market Valuations

Bank of America, a leading global financial institution, has consistently offered a relatively optimistic outlook on the current high stock market valuations, despite acknowledging the apparent risks. While specific reports change frequently, BofA generally emphasizes the importance of considering the broader economic picture and long-term growth potential rather than solely focusing on short-term valuation metrics like P/E ratios. Their analyses often incorporate a blend of quantitative data and qualitative factors.

- Key arguments against excessive fear: BofA often highlights the strong earnings growth of many companies, suggesting that higher valuations are justified by increased profitability. They also emphasize the role of low interest rates and technological advancements in supporting higher stock prices.

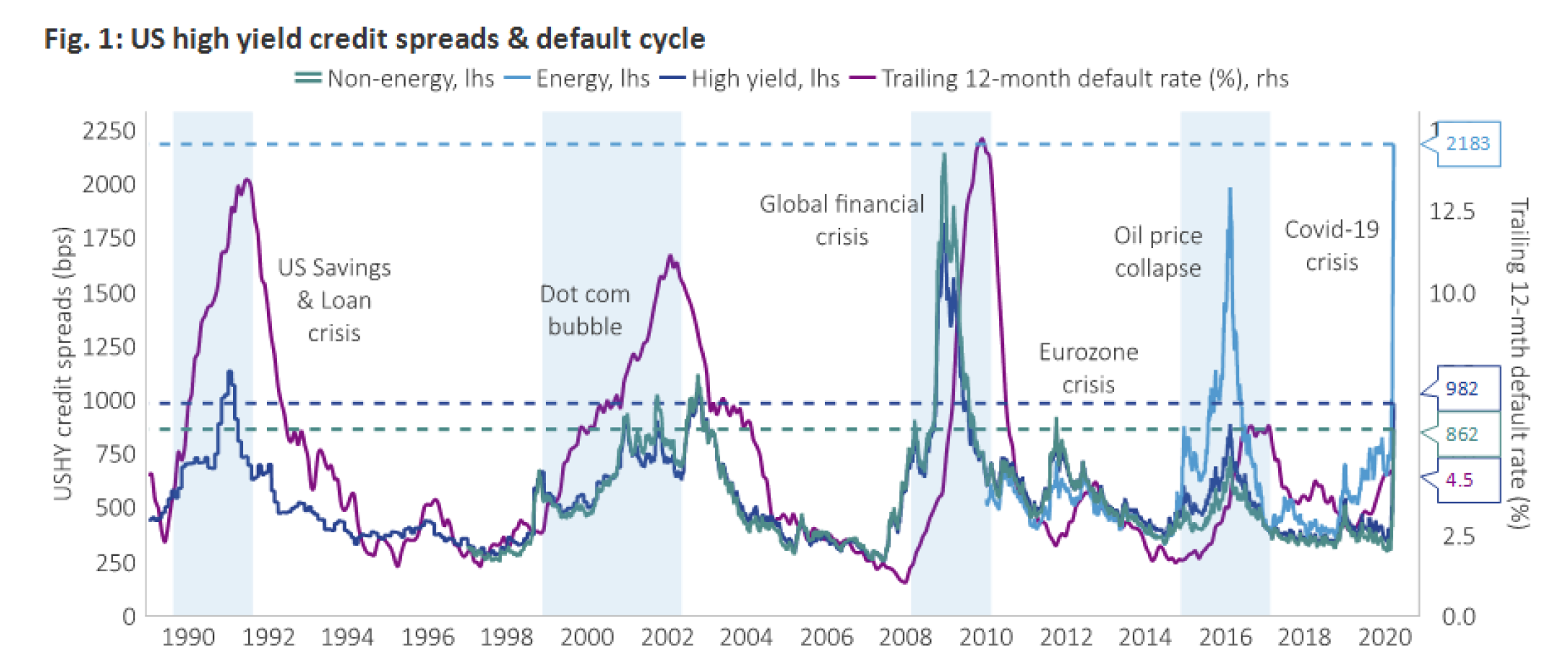

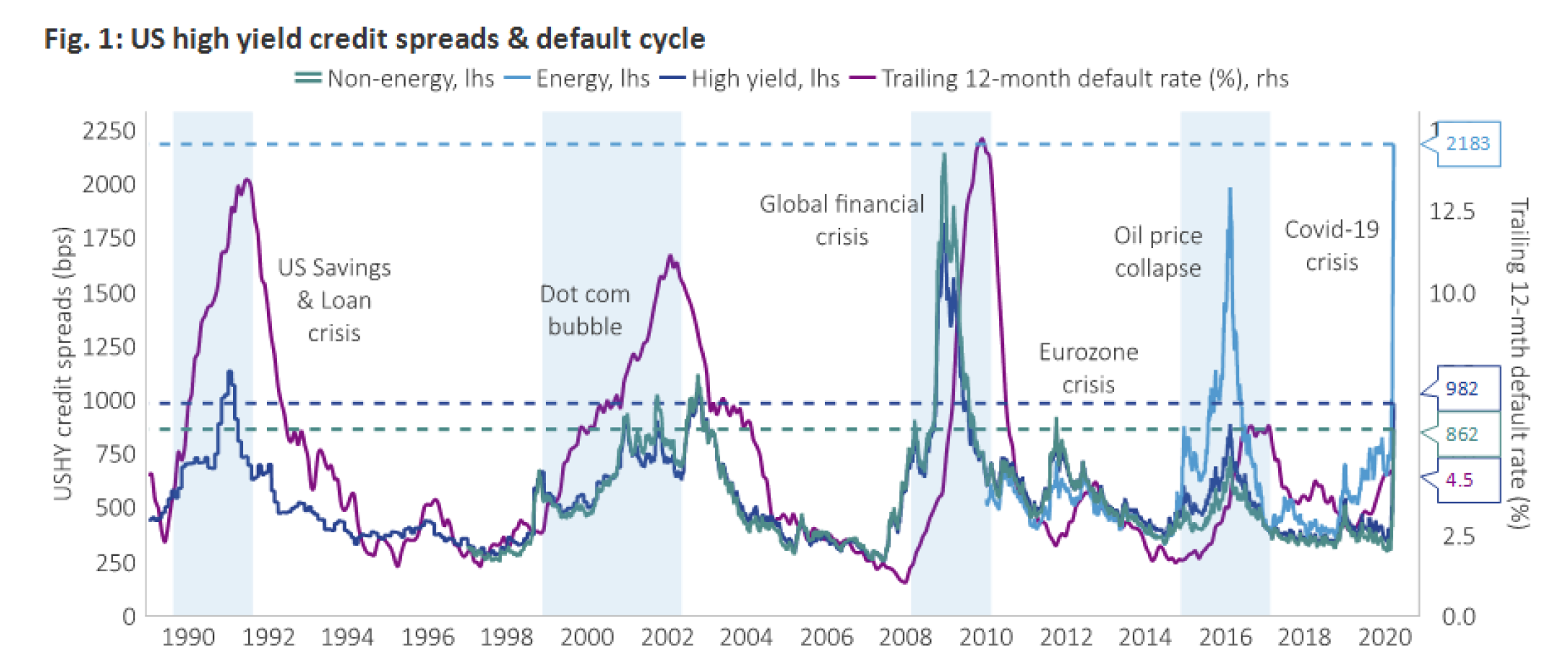

- Data points and metrics: BofA's analysis typically includes detailed examination of corporate earnings, interest rate forecasts, and macroeconomic indicators. They often use proprietary models to assess the overall market risk and potential returns, comparing current valuations to historical data and various market scenarios.

- Caveats and conditions: BofA's optimistic outlook is usually conditional. They acknowledge the potential for market corrections and emphasize the importance of diversified portfolios and risk management. They often caution against overextending investments based solely on current market sentiment.

Understanding the Factors Driving High Valuations

Several macroeconomic factors contribute to the current high stock market valuations. It's crucial to understand these factors to avoid misinterpreting the situation as solely a bubble about to burst.

- Low interest rates: Historically low interest rates make borrowing cheaper for companies, stimulating investment and fueling economic growth. This, in turn, boosts corporate earnings and makes stocks more attractive relative to bonds, supporting higher valuations. Low rates also encourage investors to seek higher returns in the stock market.

- Strong corporate earnings growth: Many companies have experienced robust earnings growth in recent years, justifying higher price-to-earnings ratios. This growth is often driven by factors such as technological innovation, globalization, and efficient management practices.

- Technological innovation: Technological advancements are creating entirely new markets and disrupting existing ones, generating substantial growth opportunities for innovative companies. These companies often command high valuations based on their anticipated future earnings potential.

- Increased investor confidence: Positive economic indicators and expectations of continued growth can lead to increased investor confidence, driving up demand for stocks and pushing valuations higher.

The Role of Interest Rates in Valuation

The relationship between interest rates and stock valuations is inversely correlated. Low interest rates reduce the attractiveness of bonds, driving investors towards higher-yielding assets, such as stocks. This increased demand pushes stock prices up, potentially leading to higher P/E ratios. However, this doesn't automatically imply an overvalued market; it reflects a shift in investor preferences given the low-yield environment. A rise in interest rates, on the other hand, can lead to a reassessment of valuations as investors re-allocate capital to bonds.

The Importance of Long-Term Investment Horizons

A long-term investment strategy is paramount in navigating periods of high stock market valuations. Short-term fluctuations, while concerning, are less impactful on long-term investment goals.

- Volatility's impact: Short-term investors are more susceptible to market volatility and emotional decision-making. Long-term investors can weather these storms by focusing on the overall upward trajectory of the market.

- Risk mitigation strategies: Diversification across different asset classes and sectors is crucial. Regular portfolio rebalancing can help manage risk and ensure that investments align with long-term goals. Dollar-cost averaging – investing a fixed amount regularly – is another proven strategy to mitigate risk.

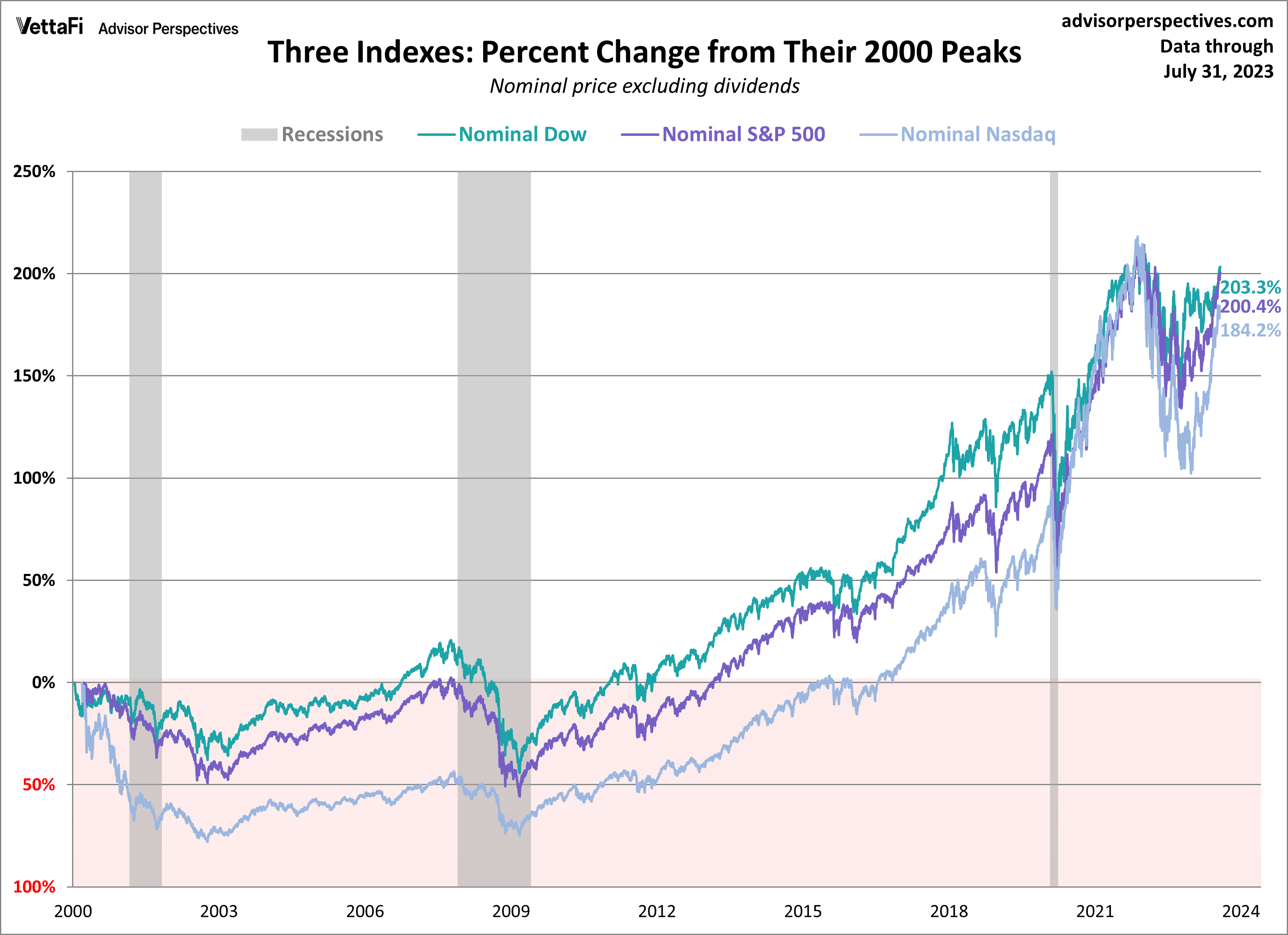

- Historical data: History shows that despite periods of high valuations, the stock market has generally delivered positive returns over the long term. While corrections are inevitable, they are typically followed by periods of recovery and growth.

Identifying Opportunities within a High-Valuation Market

Even in a seemingly overvalued market, savvy investors can find opportunities. The key is to focus on quality and fundamental analysis.

- Strong fundamentals: Look for companies with robust financial performance, sustainable competitive advantages, and strong growth prospects. Thorough due diligence is crucial.

- Diversification strategies: Diversifying your portfolio across various sectors and asset classes helps mitigate risk and potentially uncover undervalued segments. Geographical diversification also reduces exposure to specific economic regions.

- Sector-specific analysis: Certain sectors might be undervalued despite the overall high market valuation. Thorough research into various sectors can identify potential bargains.

Addressing Concerns about Potential Corrections

Market corrections are a natural part of market cycles, and it's crucial not to panic during these periods.

- Corrections as normal: Corrections are healthy adjustments that often clear out unsustainable excesses and pave the way for future growth. They represent opportunities for long-term investors to buy quality assets at discounted prices.

- Navigating corrections: Avoid emotional decisions. Stick to your long-term investment plan and avoid panic selling. A well-diversified portfolio can help cushion the impact of a correction.

- Historical recovery: History shows that market corrections are typically followed by periods of recovery and substantial growth. Long-term investors who maintain their discipline tend to benefit significantly in the long run.

Conclusion

High stock market valuations, while seemingly intimidating, don’t automatically predict a crash. BofA's relatively positive outlook, coupled with an understanding of the underlying macroeconomic factors and the importance of long-term investing, provides a more nuanced perspective. By focusing on strong fundamentals, diversifying investments, and employing a disciplined long-term approach, investors can effectively manage risk and capitalize on opportunities even in a high-valuation environment. Don't let fear of high stock market valuations paralyze your investment strategy. Consult with a financial advisor to develop a plan that aligns with your risk tolerance and long-term financial goals. Learn more about BofA's market analysis and gain a clearer understanding of how to approach high stock market valuations and build a robust investment strategy.

Featured Posts

-

Mining Meaning From Messy Data An Ais Poop Podcast Project

Apr 24, 2025

Mining Meaning From Messy Data An Ais Poop Podcast Project

Apr 24, 2025 -

The Symbolic Destruction Of Pope Francis Ring Tradition And Meaning

Apr 24, 2025

The Symbolic Destruction Of Pope Francis Ring Tradition And Meaning

Apr 24, 2025 -

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025 -

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025 -

Dow Jones S And P 500 Stock Market Report April 23rd

Apr 24, 2025

Dow Jones S And P 500 Stock Market Report April 23rd

Apr 24, 2025