Chinese Firm Considers Offloading Chip Tester UTAC

Table of Contents

Potential Reasons Behind the Sale of UTAC

Several factors might be driving the Chinese firm's decision to potentially offload its UTAC chip tester. These include financial pressures, strategic restructuring, and intense competitive pressures within the chip testing market.

Financial Difficulties

The Chinese firm may be facing significant financial headwinds.

- Decreased Profitability: Falling margins in the chip testing sector, coupled with increased operational costs, could be impacting the firm's bottom line.

- High Debt Burden: Existing debt obligations may be putting immense pressure on the company's finances, forcing them to consider asset sales to alleviate the burden.

- Need for Capital Injection: The company might require substantial capital to pursue other strategic initiatives or to weather the current economic storm, making the sale of UTAC a necessary measure to secure funding.

The financial performance of the undisclosed firm is not publicly available, however, industry analysts suggest that the current macroeconomic conditions and increased competition in the chip testing market are leading to decreased profitability for many companies in the sector.

Strategic Restructuring

The sale of UTAC could also be part of a broader strategic restructuring effort.

- Focus Shift to Other Sectors: The firm might be shifting its focus towards more profitable or strategically important sectors, deeming the chip testing division a non-core asset.

- Streamlining Operations: Selling UTAC could streamline the firm's operations, improving efficiency and reducing overhead costs.

- Divestment of Non-Core Assets: As part of a broader portfolio optimization strategy, the company might be divesting itself of non-core assets to improve its overall financial health and competitiveness.

This strategic move could reflect a shift in the company's long-term vision, potentially focusing on areas with higher growth potential or greater synergies with its core business.

Competition and Market Pressure

The highly competitive chip testing market presents significant challenges.

- Intense Competition: The market is characterized by intense competition from both domestic and international players, putting downward pressure on prices and margins.

- Declining Market Share: The firm might be experiencing a decline in market share, prompting them to consider strategic exits to minimize further losses.

- Technological Advancements: Rapid technological advancements require substantial investment in R&D, which could be straining the firm's resources, making the sale of UTAC a way to free up capital.

The ongoing technological race in the semiconductor industry demands significant investment in cutting-edge equipment and research, making it a challenging environment for companies lacking sufficient resources.

Potential Implications of the UTAC Sale

The potential sale of UTAC has wide-ranging implications for both the Chinese semiconductor industry and the global market.

Impact on the Chinese Semiconductor Industry

The sale could have significant repercussions for China's ambitions in the semiconductor sector.

- Loss of Technological Expertise: The sale might lead to a loss of valuable technological expertise and intellectual property within China, potentially hindering its ability to develop its own advanced chip testing capabilities.

- Potential National Security Concerns: The transfer of sensitive technology to a foreign entity could raise national security concerns for the Chinese government.

- Impact on Domestic Chip Manufacturing: The sale could disrupt the domestic chip manufacturing ecosystem, affecting the supply chain and potentially delaying the development of advanced chips.

The Chinese government has made significant investments in fostering domestic semiconductor development, and the sale of UTAC could be a setback to those ambitions.

Global Semiconductor Market Dynamics

The acquisition of UTAC could dramatically alter the global semiconductor landscape.

- Changes in Market Share: The acquiring company will likely experience a significant boost in its market share, potentially impacting the competitive dynamics of the chip testing market.

- Shifts in Technological Leadership: The sale could shift the balance of technological leadership in chip testing, depending on the identity of the acquirer.

- Impact on Pricing and Supply Chains: The acquisition could affect pricing strategies and potentially disrupt existing supply chains.

The global semiconductor industry is heavily interconnected, making this sale a significant event with far-reaching consequences.

Attractiveness of UTAC as an Acquisition Target

UTAC’s advanced capabilities make it a highly attractive acquisition target.

- Foreign Competitors: Major international semiconductor companies are likely to be interested in acquiring UTAC to strengthen their market position and gain access to advanced technology.

- Other Chinese Firms: Domestic Chinese companies might also be interested in acquiring UTAC to consolidate their market share and prevent the technology from falling into foreign hands.

- Private Equity Firms: Private equity firms might see UTAC as a lucrative investment opportunity, aiming to capitalize on its technological capabilities and market potential.

The bidding process for UTAC is likely to be highly competitive, with various players vying for control of this valuable asset.

Conclusion: The Future of UTAC and the Implications of this Potential Sale

The potential sale of the UTAC chip tester stems from a combination of financial pressures, strategic restructuring needs, and intense market competition. The implications are substantial, potentially impacting China’s semiconductor industry ambitions and reshaping the global chip testing market. The acquisition will likely influence market share, technological leadership, and pricing strategies, creating ripple effects across the global semiconductor supply chain. Stay tuned for updates on the sale of the UTAC chip tester and its impact on the semiconductor industry. Follow us for more insights into Chinese firm acquisitions and chip testing technology.

Featured Posts

-

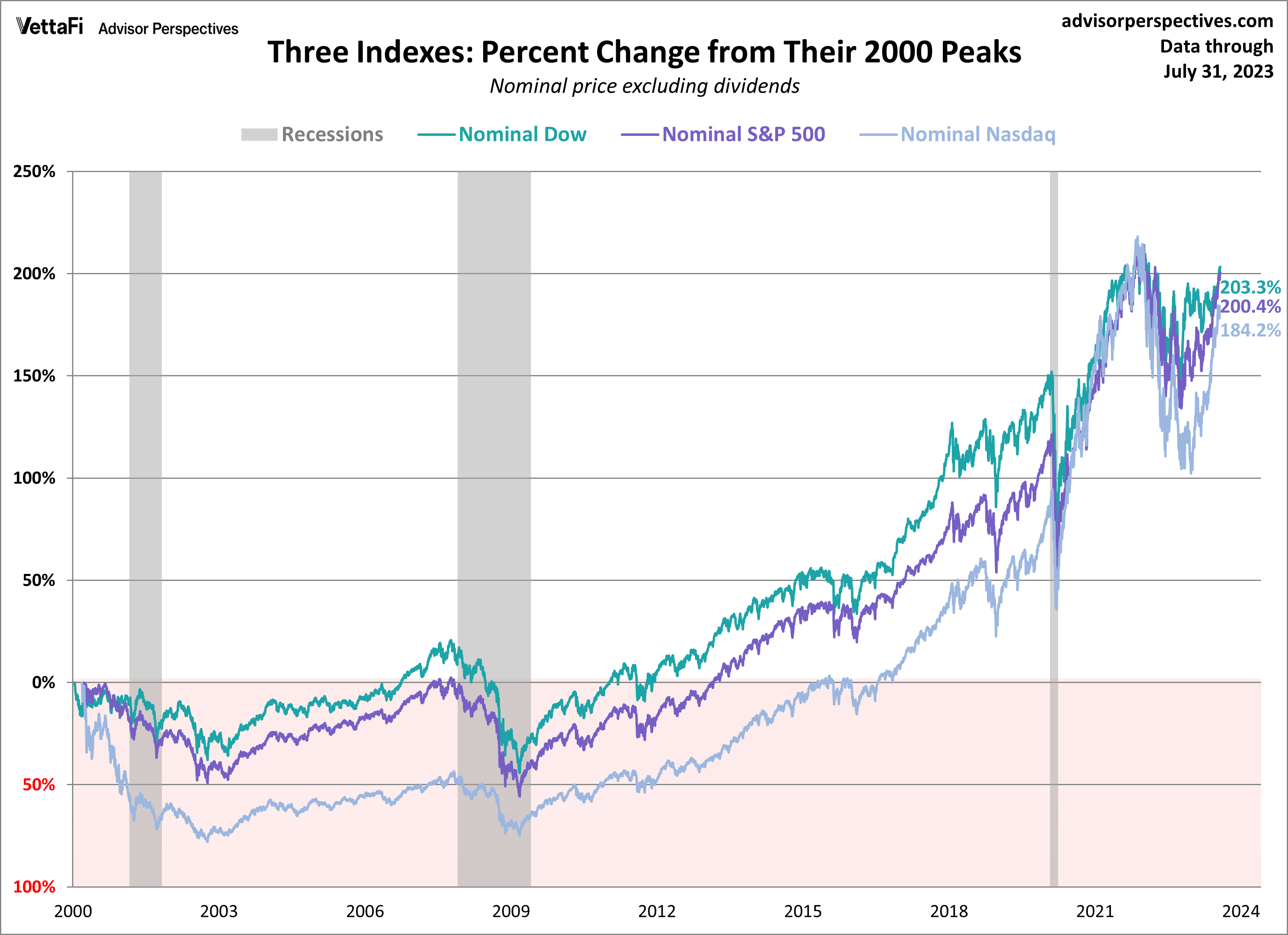

Dow Jones S And P 500 Stock Market Report April 23rd

Apr 24, 2025

Dow Jones S And P 500 Stock Market Report April 23rd

Apr 24, 2025 -

Market Surge Dow Jumps 1000 Points S And P 500 And Nasdaq Gains

Apr 24, 2025

Market Surge Dow Jumps 1000 Points S And P 500 And Nasdaq Gains

Apr 24, 2025 -

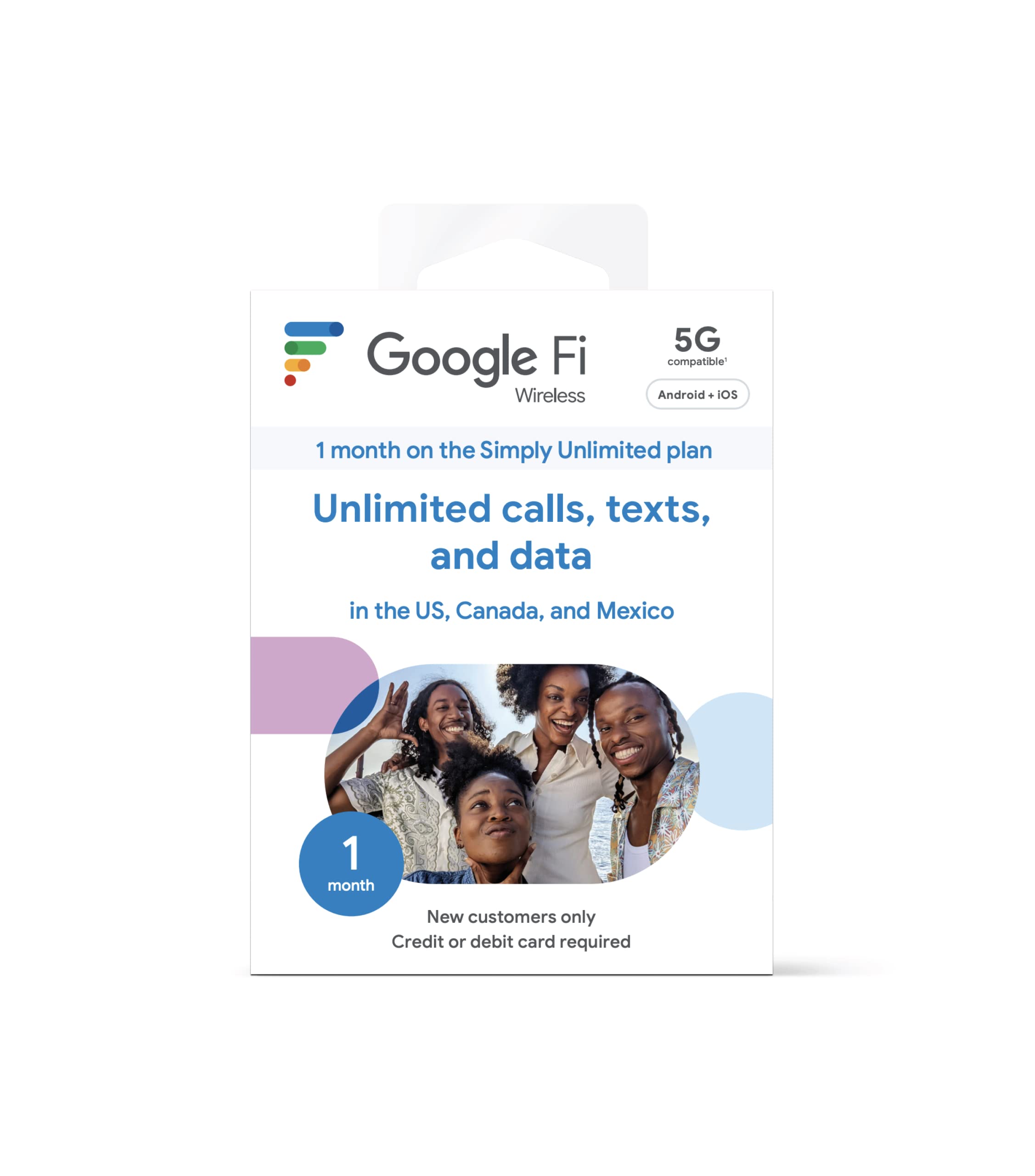

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025 -

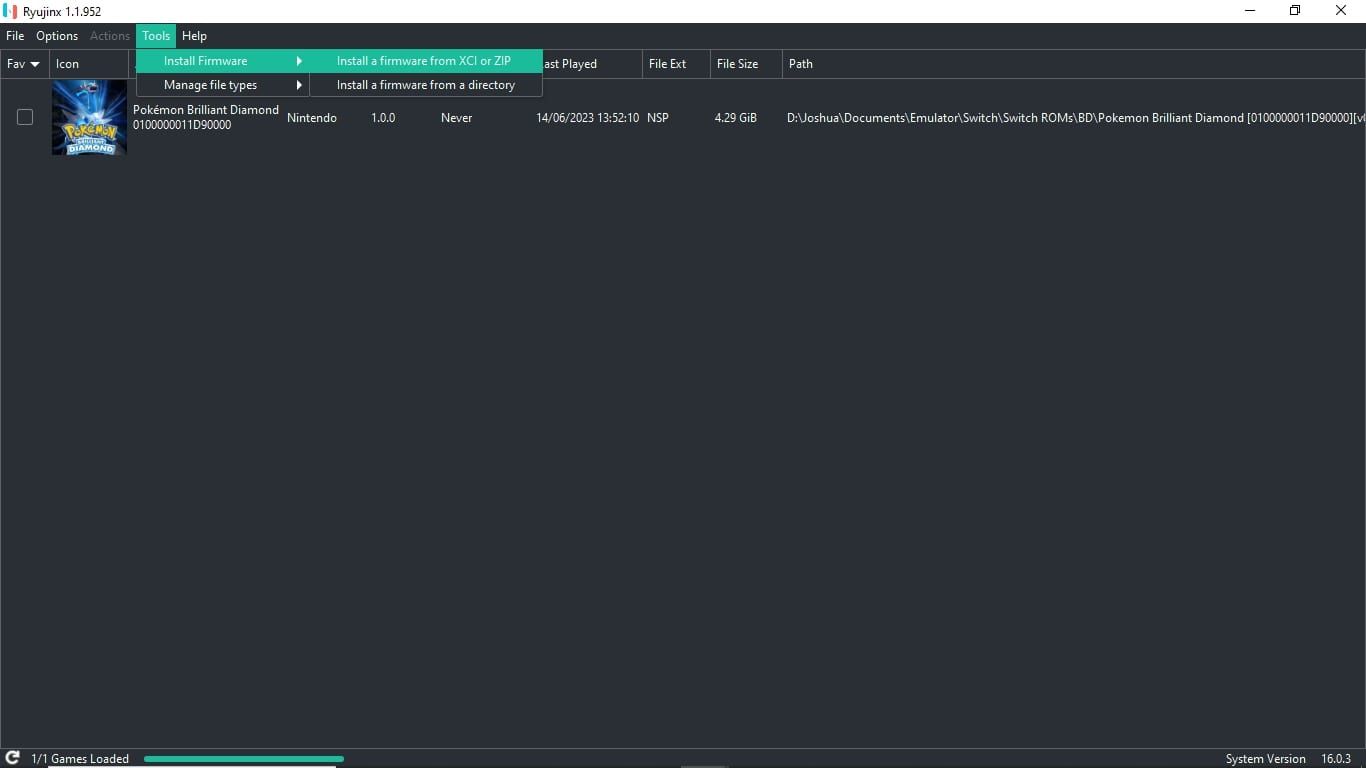

The Ryujinx Switch Emulator Development Officially Stopped

Apr 24, 2025

The Ryujinx Switch Emulator Development Officially Stopped

Apr 24, 2025 -

Apr 24, 2025

Apr 24, 2025