Climate-Related Financial Risks For Homebuyers

Table of Contents

Assessing Flood Risk and its Financial Impact

Flood risk assessment is paramount when considering a property purchase. Checking FEMA (Federal Emergency Management Agency) flood maps is the first step. These maps identify floodplains, areas with a high probability of flooding. Properties located within floodplains often face significantly increased flood insurance costs, and obtaining coverage can be difficult or even impossible. Mortgage lenders also require flood insurance for properties in high-risk areas. Ignoring flood risk can lead to devastating financial consequences.

- How floodplains affect property values: Properties in floodplains typically have lower resale values compared to similar properties outside these areas. This can significantly impact your investment.

- The financial burden of flood damage repairs: Flood damage can be extensive and incredibly expensive to repair, often exceeding the value of the property itself. This can leave homeowners financially devastated.

- The importance of researching historical flood data for the property: FEMA maps provide valuable information, but researching historical flood data for a specific property can reveal past flooding events not reflected in the maps.

- Options for mitigating flood risk: Elevating the house, installing flood barriers, or implementing other mitigation measures can reduce the risk and potentially lower insurance premiums.

Wildfire Risk and its Impact on Property Value

Wildfires are becoming increasingly frequent and intense, posing a substantial threat to property value and safety. The proximity of a property to wildlands significantly impacts its wildfire risk. This, in turn, affects insurance premiums, often leading to higher costs or even difficulties securing coverage. In areas prone to wildfires, defensible space—the area around a home that's cleared of flammable materials—is crucial for mitigating risk.

- The effect of proximity to wildlands on insurance premiums: Insurance companies carefully assess wildfire risk, leading to higher premiums for homes near forested areas or wildlands.

- The cost of rebuilding after a wildfire: Rebuilding after a wildfire can be an incredibly expensive undertaking, requiring significant financial resources and often involving long delays.

- Strategies for mitigating wildfire risk: Creating defensible space by clearing brush, using fire-resistant landscaping, and installing ember-resistant vents can significantly reduce the risk.

- Understanding evacuation plans and associated costs: Having a well-defined evacuation plan, including associated costs such as temporary housing and transportation, is essential for wildfire preparedness.

The Impact of Extreme Weather Events on Home Insurance Costs

The increased frequency and intensity of extreme weather events—hurricanes, heatwaves, droughts, severe storms—are driving up home insurance premiums dramatically. Insurance companies are factoring climate change impacts into their risk assessments, leading to higher costs in areas prone to such events. In some high-risk zones, securing affordable insurance can be exceptionally challenging, potentially even resulting in insurance denials.

- How different types of extreme weather affect insurance rates: Hurricane-prone regions will experience higher premiums than areas with lower risk of such severe weather. Similarly, drought-prone areas may face higher premiums due to increased wildfire risk.

- The potential for insurance denials in high-risk zones: In areas deemed too risky, insurers may refuse to provide coverage, leaving homeowners vulnerable.

- Strategies for reducing insurance costs: Making home improvements, implementing mitigation measures, and joining community risk-reduction programs may help lower insurance costs.

Investing in Climate-Resilient Homes

Investing in a climate-resilient home offers long-term financial benefits. These homes incorporate sustainable building materials and energy-efficient features, reducing utility costs and increasing property value. This is a proactive approach to managing climate-related financial risks.

- The financial benefits of energy-efficient appliances and insulation: Energy-efficient appliances and insulation significantly lower utility bills, resulting in long-term cost savings.

- The long-term value of sustainable building materials: Sustainable materials are often more durable and require less maintenance, adding to the property’s long-term value.

- Government incentives and rebates for green building practices: Many governments offer financial incentives and rebates for adopting green building practices, making climate-resilient homes more affordable.

Conclusion

Climate-related financial risks for homebuyers are undeniable and growing. Understanding and mitigating these risks—from assessing flood and wildfire risks to considering the impact of extreme weather on insurance costs—is crucial for making informed and financially sound decisions. Investing in climate-resilient homes is a smart strategy to protect your investment and reduce long-term expenses. Don't let climate-related financial risks jeopardize your home purchase. Conduct thorough research, understand the potential risks associated with your chosen property, and invest wisely to protect your future. Learn more about mitigating climate-related financial risks for homebuyers today!

Featured Posts

-

Agatha Christies Poirot A Comprehensive Guide To The Detective Novels

May 20, 2025

Agatha Christies Poirot A Comprehensive Guide To The Detective Novels

May 20, 2025 -

Prezzo Shock Gioco Hercule Poirot Ps 5 Sotto I 10 Euro Su Amazon

May 20, 2025

Prezzo Shock Gioco Hercule Poirot Ps 5 Sotto I 10 Euro Su Amazon

May 20, 2025 -

The Bust After The Boom Economic Consequences Of Falling College Enrollment

May 20, 2025

The Bust After The Boom Economic Consequences Of Falling College Enrollment

May 20, 2025 -

Tonci Tadic O Pregovorima Putinov Plan I Njegovi Ciljevi

May 20, 2025

Tonci Tadic O Pregovorima Putinov Plan I Njegovi Ciljevi

May 20, 2025 -

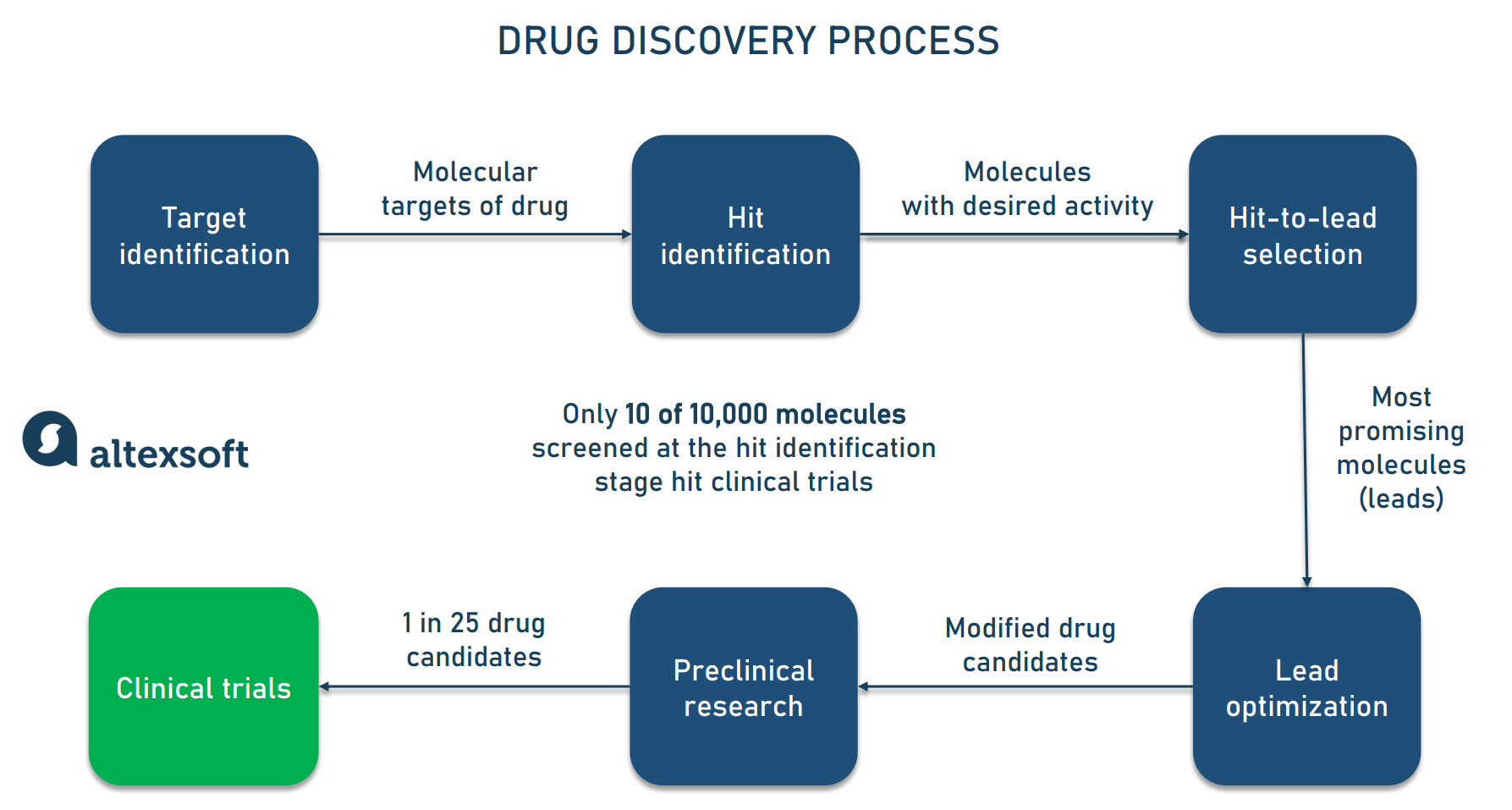

D Waves Qbts Advancing Drug Discovery Through Quantum Ai

May 20, 2025

D Waves Qbts Advancing Drug Discovery Through Quantum Ai

May 20, 2025

Latest Posts

-

Jalkapallo Friisin Avauskokoonpano Kamara Ja Pukki Vaihtopenkillae

May 20, 2025

Jalkapallo Friisin Avauskokoonpano Kamara Ja Pukki Vaihtopenkillae

May 20, 2025 -

Avauskokoonpano Julkistettu Kamaran Ja Pukin Tilanne Selvisi

May 20, 2025

Avauskokoonpano Julkistettu Kamaran Ja Pukin Tilanne Selvisi

May 20, 2025 -

Kaellman Ja Hoskonen Palaavat Suomesta Puolasta

May 20, 2025

Kaellman Ja Hoskonen Palaavat Suomesta Puolasta

May 20, 2025 -

Festlegung Der Endgueltigen Form Durch Die Architektin

May 20, 2025

Festlegung Der Endgueltigen Form Durch Die Architektin

May 20, 2025 -

Huuhkajat Kaellmanin Maalivireen Merkitys

May 20, 2025

Huuhkajat Kaellmanin Maalivireen Merkitys

May 20, 2025